eBay Xero Integration: How to Set it Up

Setting up an integration between eBay and Xero is a great way to improve accounting and bookkeeping accuracy and efficiency.

If you’re an eBay seller who’s trying to keep your books up to date, or an accountant or bookkeeper who works with eBay sellers, then you’ll understand some of the complexities that come along with getting eBay transactions to reconcile with payouts in Xero.

The good news is that integrating eBay and Xero with the right tool can eliminate many of the headaches that come along with eBay bookkeeping.

In this article, we’ll cover how to integrate eBay and Xero with A2X.

Key takeaways

- Integrating eBay and Xero means using a tool to establish a connection that enables your eBay data to flow seamlessly into Xero for easy eBay accounting and bookkeeping.

- Xero does not support a direct integration with eBay, so you can use A2X to set up the integration.

- Setting up an eBay-Xero integration with A2X is easy and just takes a few steps (outlined below).

Table of Contents

Integrate eBay and Xero for accurate accounting

A2X auto-categorizes your eBay sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today

Can Xero integrate with eBay?

Xero does not support a direct integration with eBay, so you’ll need a third-party tool to integrate the two tools together.

Integrating eBay and Xero simply means connecting these two tools together, so that the accounting and bookkeeping data you need from eBay can flow into Xero.

Think of a third-party integration tool as a sort of “bridge” that can be established between eBay and Xero.

We’ll cover some of the benefits and challenges of a couple of different integration tool options below, so you can choose the solution that’s best for your business.

What are the benefits of integrating Xero with eBay?

Before diving into the benefits of integrating eBay and Xero, it might be helpful to outline some of the specific accounting and bookkeeping challenges that you’ll likely run into with eBay bookkeeping (if you don’t use an integration and try to manually enter the data):

- Correctly coding eBay payouts – it may be tempting to code the whole payout to sales; however, eBay payouts are not entirely made up of sales. They actually include a combination of fees, refunds, tax, and other transactions that need to be coded to Xero correctly.

- Managing sales tax – eBay may collect and remit sales tax on a seller’s behalf as part of their Marketplace Facilitator Tax obligations. However, sellers are still responsible for reporting on tax and making sure that they are managing tax correctly. (A2X does not provide tax advice. Consult an expert to better understand your tax obligations.)

- Split month payouts – eBay payouts can occur daily, weekly, fortnightly, or monthly. If you’re practicing monthly bookkeeping, this can be a challenge when a payout spans two months – e.g., a payout that covers the period from February 25 - March 10.

Using an integration tool like A2X can help overcome these challenges, and help you experience the following benefits:

- Time savings – Automate the process of breaking down and coding payout data so you can reconcile payouts in Xero in just a few clicks. No more manually reviewing eBay reports and entering data into Xero!

- Increased accuracy – By introducing an automated integration, you eliminate the risk of human error for data entry, which ultimately means you’ll get more accurate numbers. Accuracy is particularly important for your ecommerce P&L and Balance Sheet (especially if you’re seeking a loan or investment for your ecommerce store).

How to integrate eBay with Xero

As mentioned, Xero does not support a direct integration with eBay, so you need a third-party app to connect these two tools together.

There are a couple of options: 1) using a generic data syncing app, or 2) using a specialized ecommerce accounting integration app, like A2X.

Using a data syncing app

One way to link eBay with Xero is by using a basic app for syncing data. You can find a few options for these types of apps in the Xero App Store.

Data syncing apps work well for small businesses, but might not be the best for larger businesses.

They may send orders individually, which might be too much for your accounting software. They also usually don’t offer many options to customize and it can be tough to choose which data gets synced.

Similarly, these apps might not handle all kinds of transactions, might not have the features needed for dealing with taxes, and could make it hard to reconcile your accounts.

Data syncing apps also usually don’t let you control much about what data you sync. Think about this before you start using the app, because it can be difficult to change things once it’s set up.

Using A2X to integrate eBay and Xero

A2X is an ecommerce accounting automation tool that can integrate eBay and Xero in just a few steps.

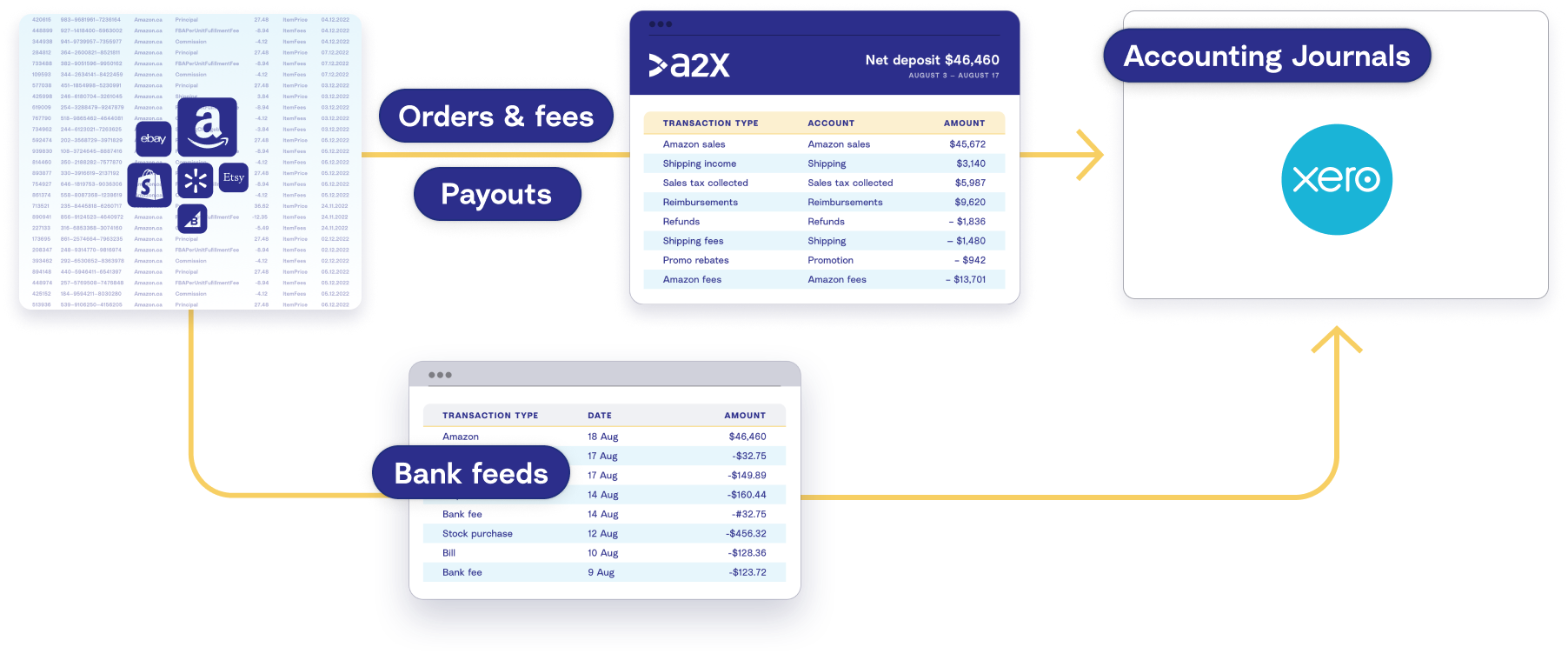

A2X imports your eBay transactions and automatically summarizes them, according to your instructions, for Xero.

A2X makes eBay bookkeeping accurate and easy in a few different ways. Watch the video below and read on to learn more.

Understand critical details

Without A2X, figuring out the transactions that make up an eBay payout can be challenging. Were eBay fees taken? Sales tax collected? Reimbursements applied?

A2X captures this detail and organizes it into tidy summaries for Xero. That way, when you need to calculate profit margins, check how much you’re paying in fees, or that you have collected sales tax, A2X has done that work for you.

Easy accrual accounting

A2X organizes your transactions via the accrual accounting method. Among other things, this means that your books account for deposits that carry over into different months, which reflects the true nature of your financials. Without A2X, you would need to figure this out manually.

If eBay generates a statement that spans two months, A2X will automatically separate transactions into month-specific summaries so that you are able to monitor and compare your monthly cash flow. This will make analyzing and planning for your business a lot simpler, more efficient and more future-proof.

Automatic and accurate numbers

Your bookkeeping works continuously in the background, updating as soon as new payout information is available.

Once you set up a blueprint for your tax mapping and accounts, A2X will apply it every time, giving you consistent and dependable reports. This is great for you, great for your accountant, and ideal if you ever want to sell your business or ask for investment.

What does this all mean for you? It saves time, money, and stress. By automating your accounting, you’ll give yourself the time to flex your business muscles, and invest your time elsewhere.

Bookkeeping for eBay: How to integrate eBay and Xero with A2X

Watch this video to learn how to integrate eBay and Xero with A2X, then follow the instructions below for more details.

1. Create an A2X account

Start a free trial for A2X for eBay and Xero by clicking ‘Try A2X for free’ in the top right of the A2X website. Select ‘eBay’ as the channel that you’d like to connect to first.

Then, follow the prompts to sign up using your preferred sign in method, and enter the required information.

You’ll end up on the A2X dashboard.

Note – your A2X account will remain in “free trial mode” until you decide to choose a plan and subscribe. In free trial mode, you’ll have access to limited data and A2X functionality.

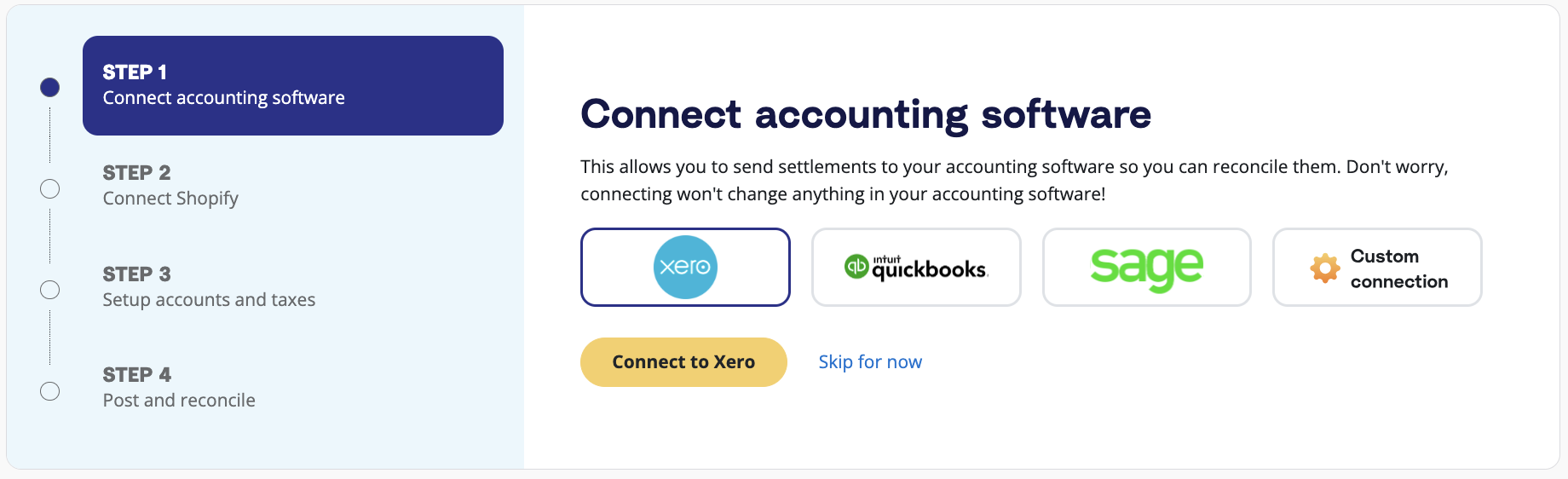

2. Connect to Xero

On the Xero dashboard, you’ll see a prompt to connect to your accounting software.

Click the Xero logo, then click ‘Connect to Xero’.

You’ll be redirected to select the Xero organization you want to connect to. Once you do so, you’ll end up back on the A2X dashboard.

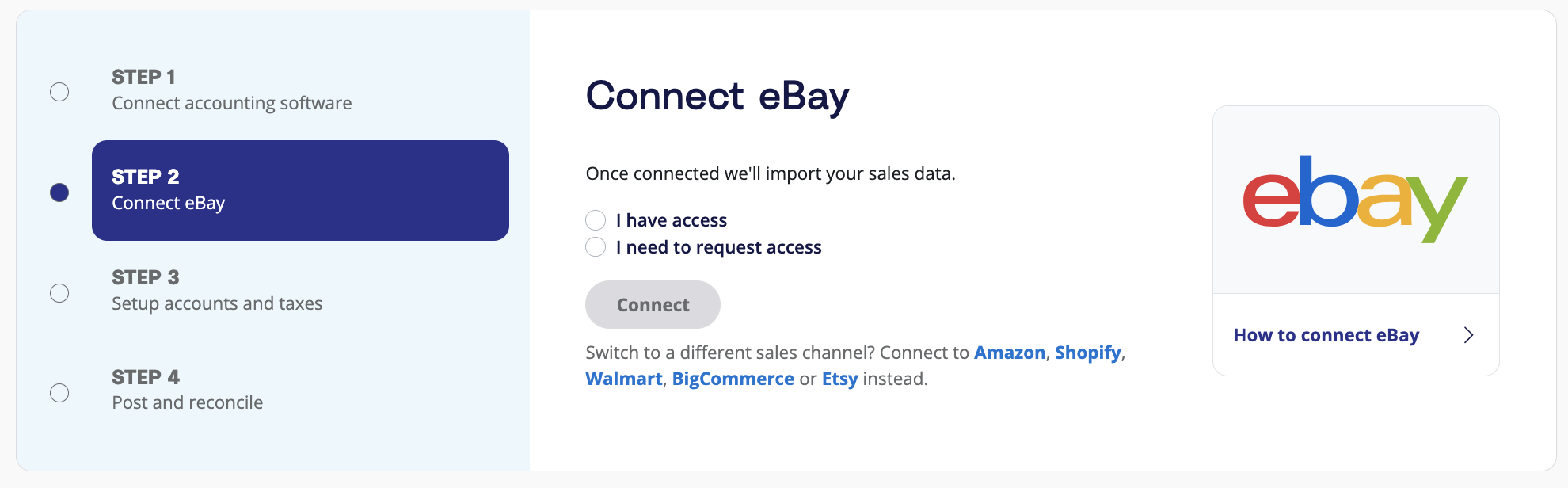

3. Connect to eBay Seller Hub

On the A2X dashboard, you’ll be prompted to connect to eBay.

You have two options:

- Option 1: If you are the store owner or have access to the eBay store you are connecting, select ‘I have access’, then click ‘Connect’. You’ll be redirected to log into your eBay Seller Hub account to grant permission for A2X to connect.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

After permission is granted, A2X will return you to your A2X dashboard, and your first payouts will automatically begin populating. This could take as little as 10-20 minutes for smaller stores and a few hours for larger ones.

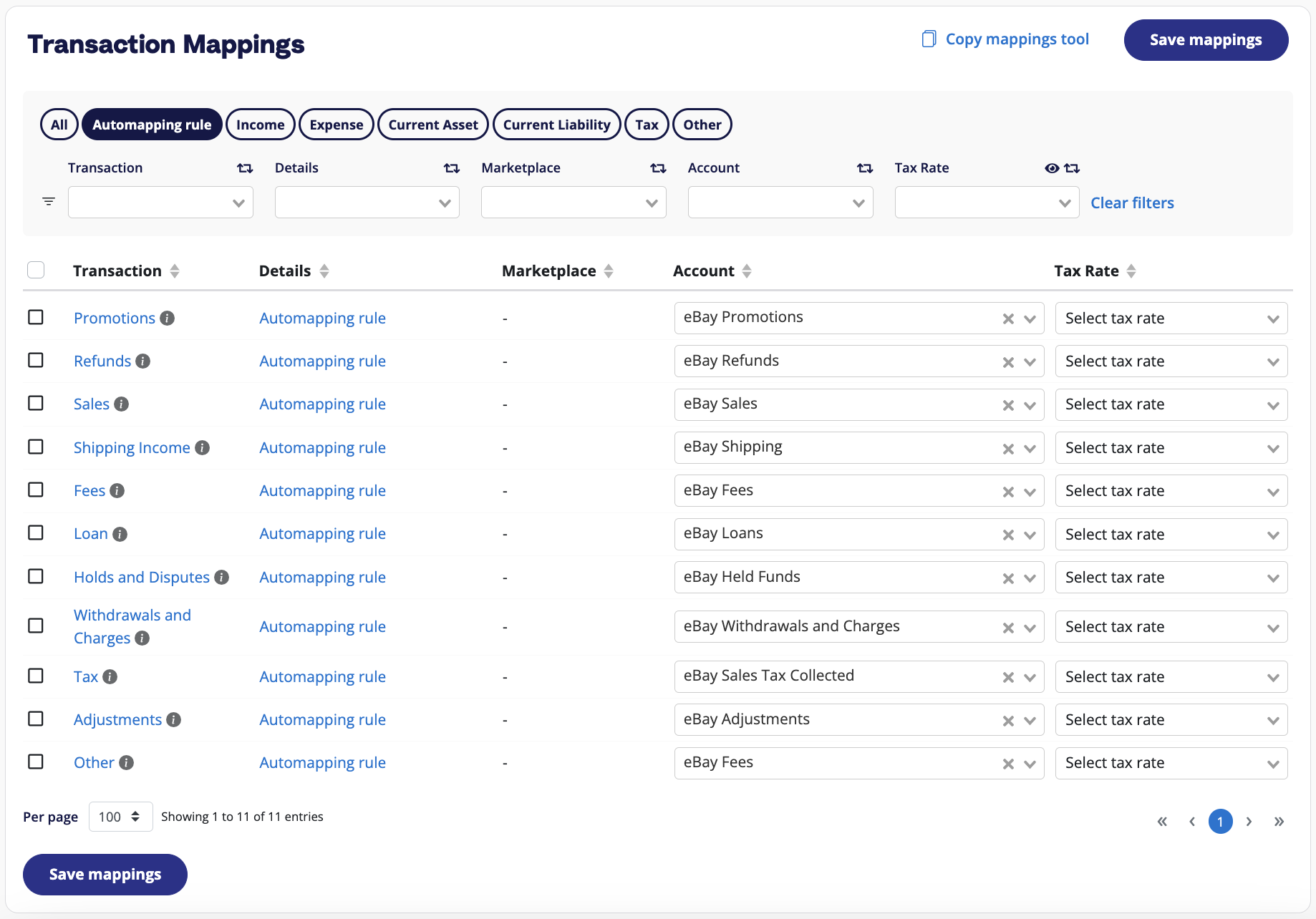

4. Map accounts and taxes

The next step is to map your accounts and taxes.

This is the part where you categorize eBay transactions to the Chart of Accounts in Xero.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get Accounts and Tax mapping correct for your specific business.

- Click ‘Setup Account and Taxes’.

- The first time you visit the accounts and taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted Setup or Custom Setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in Xero and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

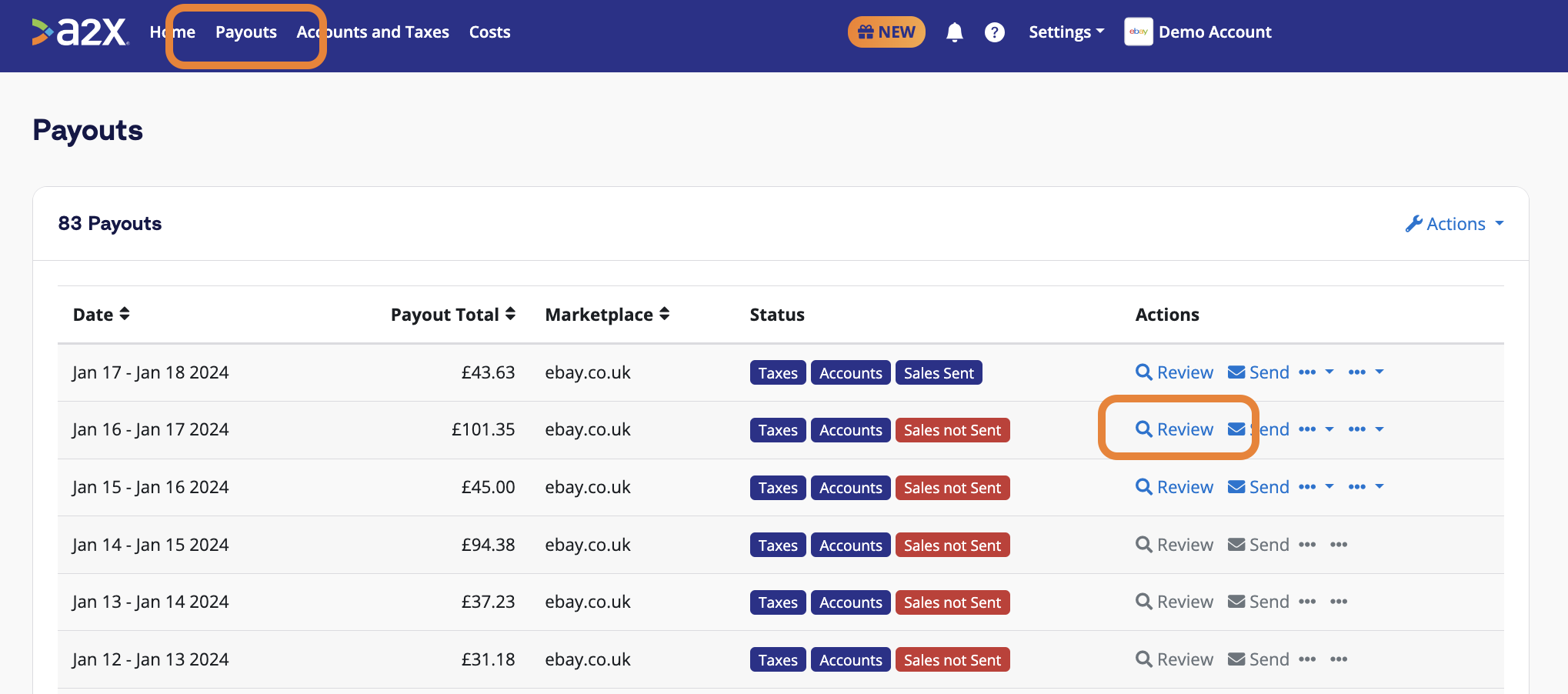

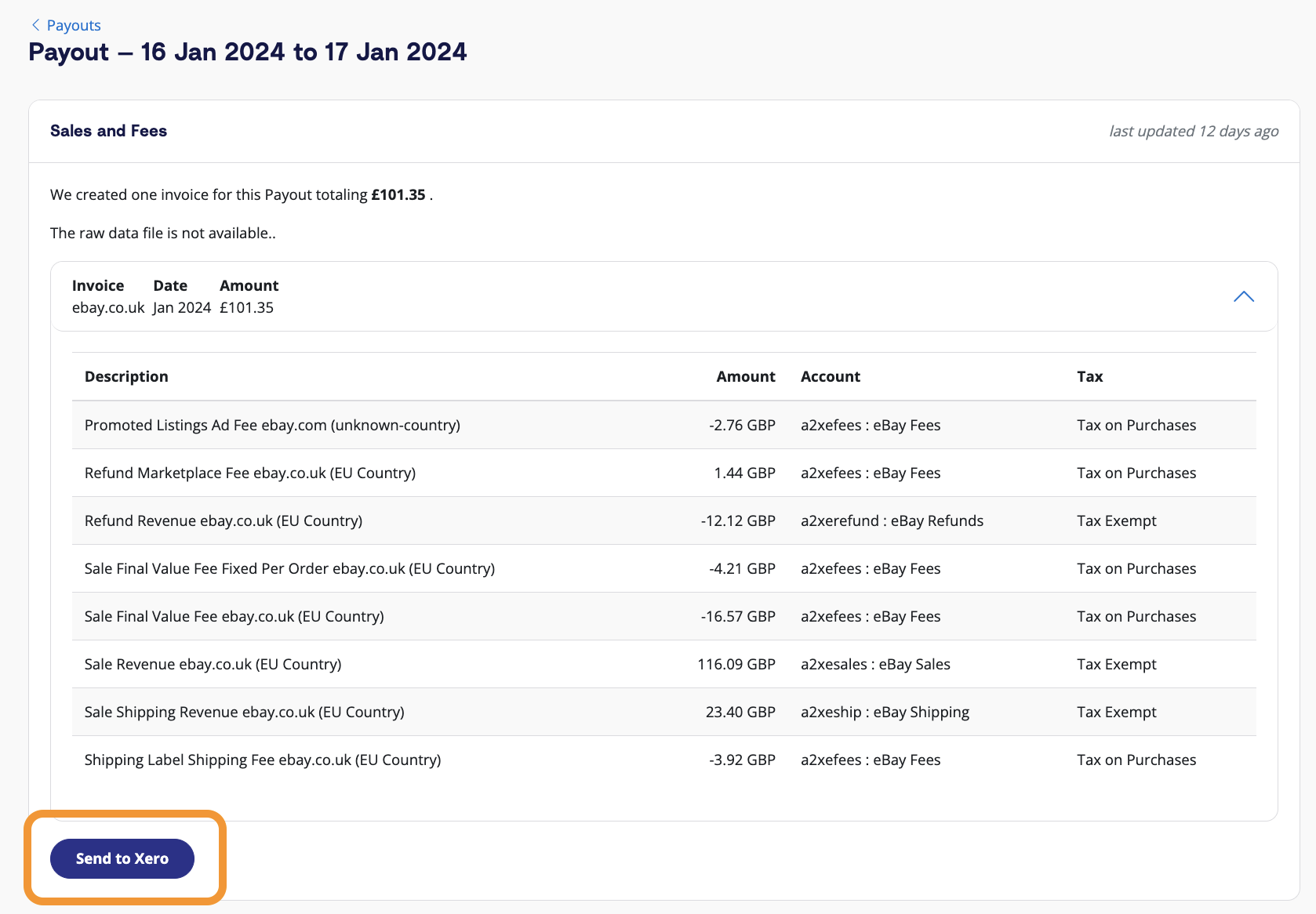

5. Review payout details and send to Xero

Time to get into the routine bookkeeping part of A2X: review eBay payouts in A2X, then post to Xero.

Go to ‘Payouts’, and click ‘Review’ beside the settlement you wish to review and post.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to Xero’ when you’re ready.

Note – auto-posting is available to you when you’re ready to use this.

6. Reconcile in Xero

Log in to Xero, then navigate to the bank feed.

Find the payout from eBay for which you just sent the A2X invoice – you should also see the A2X invoice beside it, ready to be reconciled!

Make it a habit to repeat steps 5 and 6 from this list, and your eBay bookkeeping will be in great shape.

Ready to integrate eBay and Xero with A2X? Start a free trial today!

Integrate eBay and Xero for accurate accounting

A2X auto-categorizes your eBay sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today