From Boom to Sustainability: Why Effective Cash Flow Practices are Critical for Ecommerce Businesses

The global ecommerce industry has experienced an unprecedented boom over the past decade, driven by technological advancements and changing consumer behavior. However, as the initial hype begins to settle, competition intensifies, customer acquisition costs rise, and market saturation sets in, ecommerce businesses must adopt a strategic approach to sustain their growth.

In today’s uncertain economic climate, effective cash flow management and forecasting emerge as critical elements that determine the long-term success and stability of ecommerce ventures. Knowing this, this article explores how effective cash flow practices can help ecommerce businesses navigate the changing landscape and position themselves for long-term success.

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

Cash flow: the lifeblood of ecommerce businesses

Cash flow management is the process of tracking, analyzing, and optimizing the flow of cash in and out of a business. Efficient cash flow management ensures that a company has enough liquidity to meet its short-term obligations, such as paying suppliers, employees, and operating expenses. It also reduces the risk of late payments and bad debt, and helps to identify areas where cash can be saved or reinvested.

In the ecommerce industry, where revenue streams can be unpredictable, cash flow management is crucial. By keeping a close eye on cash flow, businesses can make informed decisions about when to invest in growth initiatives and when to hold back. This is particularly important for ecommerce businesses that often have to deal with fluctuating demand levels and changing consumer trends.

Cash flow forecasting: a tool for strategic planning

Cash flow forecasting is the process of estimating future cash inflows and outflows, providing ecommerce businesses with crucial insights for strategic planning and decision-making. It helps businesses anticipate potential shortfalls, plan for seasonal variations, and identify opportunities to optimize cash utilization.

Ecommerce businesses in particular need to be proactive in their cash flow forecasting. With competition growing and margins becoming tighter, it’s essential to have a clear picture of future cash flow to stay ahead of the game.

5 Examples of Effective Cash Flow Practices

Effective cash flow management and forecasting can deliver a range of benefits to ecommerce businesses, including improved financial stability and security. Here are a few ways ecommerce businesses can optimize their working capital:

1. Inventory Management

Cash flow management enables ecommerce businesses to strike a balance between maintaining adequate inventory levels and avoiding excess stock. By forecasting sales and monitoring cash flow, businesses can minimize the risk of overstocking or running out of stock, optimizing their inventory turnover ratio and reducing storage costs.

2. Seasonal and Cyclical Sales

Ecommerce businesses often experience fluctuations in sales due to seasonal or cyclical trends. By accurately forecasting cash flow, businesses can plan ahead for lean periods and allocate resources efficiently during peak sales periods. This ensures smooth operations and prevents cash flow crunches during slow periods.

Let’s think of a digital marketplace that observes sales of electronics and gadgets typically spiking during the end-of-year holiday season or major promotional events like Black Friday. By accurately forecasting cash flow, they can anticipate this surge in demand and plan by partnering with suppliers to secure bulk purchases at discounted rates. This proactive approach also enables them to ensure smooth operations during peak sales periods and prevent any cash flow crunches during slower months following the promotional events.

3. Cost Control

Cash flow management allows ecommerce businesses to identify and control unnecessary expenses. By closely monitoring cash inflows and outflows, businesses can make informed decisions about cost-cutting measures, thereby improving profitability.

Identifying areas where unnecessary expenses can be reduced can look like negotiating better deals with shipping providers or optimizing pricing strategies based on demand. This can also range from focusing more on cost-effective digital marketing channels and reducing expenditure on less effective platforms to negotiating better deals with suppliers and sourcing inventory at lower costs.

You could even implement energy-saving measures to reduce utility costs! But remember, while cost-cutting strategies are valuable, it’s important to strike a balance and ensure that cost-cutting measures do not compromise the quality of your products or services or negatively impact customer experience.

4. Capital Allocation

Accurate cash flow forecasting assists ecommerce businesses in determining the optimal allocation of capital. It helps identify surplus cash that can be reinvested into growth initiatives or used to fund strategic acquisitions, product development, marketing campaigns, or expansion into new markets.

Cash flow forecasting is a crucial financial management practice for ecommerce businesses. It involves projecting future cash inflows and outflows based on historical data, market trends, and anticipated business activities.

To start, businesses need to ensure that they have a good estimation of expected cash inflows from various sources, such as sales revenue, seasonal or cyclical trends, investment income, loans, or grants. The next step is to analyze historical data, contractual commitments, upcoming expenses, and expected changes in production or service delivery to forecast cash outflows accurately.

As a result, businesses will be able to identify surplus cash and then be able to make a decision on how to allocate capital in alignment with their growth strategies.

5. Scenario Planning

Cash flow forecasting enables businesses to model different scenarios and assess their potential impact on cash reserves. By analyzing best-case, worst-case, and most likely scenarios, businesses can identify potential risks and opportunities, allowing them to make strategic decisions in advance.

Let’s consider a retail business looking to expand its operations by opening a new store. Using cash flow forecasting, the business models different scenarios to assess the impact on its cash reserves. The best-case scenario assumes high customer demand and increased sales, resulting in positive cash flow.

The worst-case scenario considers factors like lower-than-expected sales, higher operating costs, and increased competition, leading to a potential cash crunch. However, by identifying potential cash shortages, businesses can proactively develop contingency plans, creating a buffer against unexpected events such as economic downturns, supply chain disruptions, or changes in consumer behavior.

Everything is Possible with the Right Tool

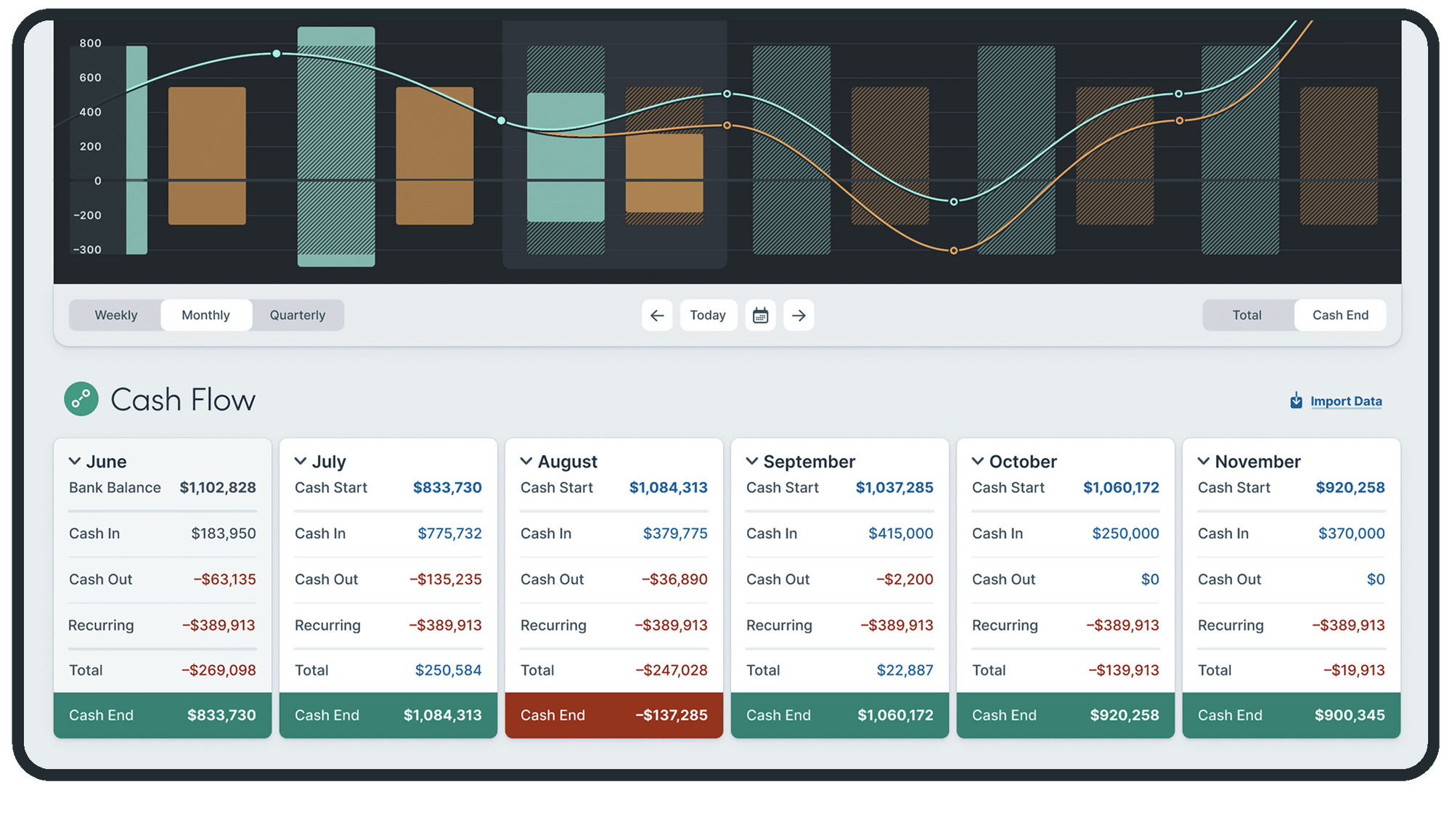

A software tool to manage and forecast cash flow can immensely benefit ecommerce businesses. Not only does a cash flow management tool provide real-time visibility into the financial health of a business, but it also leverages historical data to generate accurate forecasts of future cash flow.

By efficiently creating detailed cash flow projections based on historical data, current financial information, and future sales projections, businesses can anticipate and plan for potential cash shortfalls or surpluses, aiding in better financial planning and resource allocation.

Additionally, a software tool can help identify areas where cash flow can be optimized. For instance, it can track and analyze payment delays, late customer payments, or inefficient expense management. By identifying these bottlenecks, businesses can take proactive measures to streamline processes, negotiate better terms with suppliers, incentivize early customer payments, or implement effective collection strategies.

Another benefit of cash flow tools, especially ones that integrate with existing accounting software, is the ability to import transactional data and automate cash flow tracking. By eliminating manual data entry and the risk of human error, businesses can save time and effort while ensuring accuracy.

If you are looking for an example of a powerful tool designed to help businesses manage and forecast their cash flow effectively, Dryrun is the gold standard. With its user-friendly interface and comprehensive features, Dryrun enables businesses to gain real-time visibility into their financial health, make informed decisions, and confidently plan for the future.

By integrating with your accounting software, Dryrun allows you to effortlessly manage your inflows and outflows of cash while automatically forecasting your direct costs. By effortlessly adding your sales forecast, you can identify ways to increase your revenue and maximize your profit. Furthermore, with its collaborative features, Dryrun enables team members to work together on cash flow forecasts and scenario planning, fostering alignment and ensuring everyone is on the same page.

Conclusion

In conclusion, cash flow management and forecasting are essential for ecommerce businesses looking to achieve sustained growth in today’s ever-evolving business landscape. By maintaining a healthy cash flow, businesses can seize opportunities to evolve their offerings, diversify their revenue streams, and respond effectively to changing market dynamics.

As the ecommerce boom gradually slows down, cash flow emerges as a crucial factor for sustained business growth, and tools such as Dryrun will make the job a lot easier. By prioritizing cash flow, businesses can ensure their long-term viability and position themselves for continued success in the post-boom era of ecommerce.

If you are interested in learning more about what Dryrun can do for you and your business, visit Dryrun.

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here