![[Webinar] How to Avoid Costly Ecommerce Accounting Pitfalls with A2X](/img/blog/webinar-how-to-avoid-costly-amazon-accounting-pitfalls.png)

[Webinar] How to Avoid Costly Ecommerce Accounting Pitfalls with A2X

If you have money coming in and money going out, you need to keep track of it for accounting and tax purposes. Whether you are a seasoned ecommerce seller or are just learning how to sell on Amazon, it’s easy to make costly accounting mistakes.

In this webinar, A2X product marketing manager Amy Crooymans discusses how to navigate ecommerce accounting and avoid some of the common mistakes ecommerce companies make with their accounting. better understand, and stay on top of your numbers, and get summarized payout data (sales, fees, taxes, and more) into QuickBooks Online or Xero for one-click reconciliation.

Table of Contents

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there

Dominic: Hello and thank you everyone for joining us today for this webinar.

My name is Dominic, and I work with the Amazon Selling Partner App Store which serves as a one-stop shop for sellers, offering over 2500 trusted apps to help you effectively grow and manage your ecommerce businesses. These apps are curated with a focus on helping you grow and manage your ecommerce businesses effectively.

We are proud to continue our ongoing webinar series. We have a presentation from our esteemed software partner, A2X. Today’s discussions will focus on how to circumnavigate costly ecommerce accounting pitfalls.

So, without further ado, I’m pleased to hand over the floor to our guest presenter, Amy.

Amy: Hi, everyone. I will be talking to you about how to avoid costly Amazon accounting pitfalls with A2X. I’m Amy, Product Marketing Manager at A2X. I’ve been at A2X for almost three years, and based in New Zealand, but A2X is actually a global company. So we have team members based all around the world.

What is A2X?

A2X is an ecommerce accounting app that helps businesses, accountants and bookkeepers automatically reconcile their Amazon settlements from the settlements from Amazon marketplace and their accounting software.

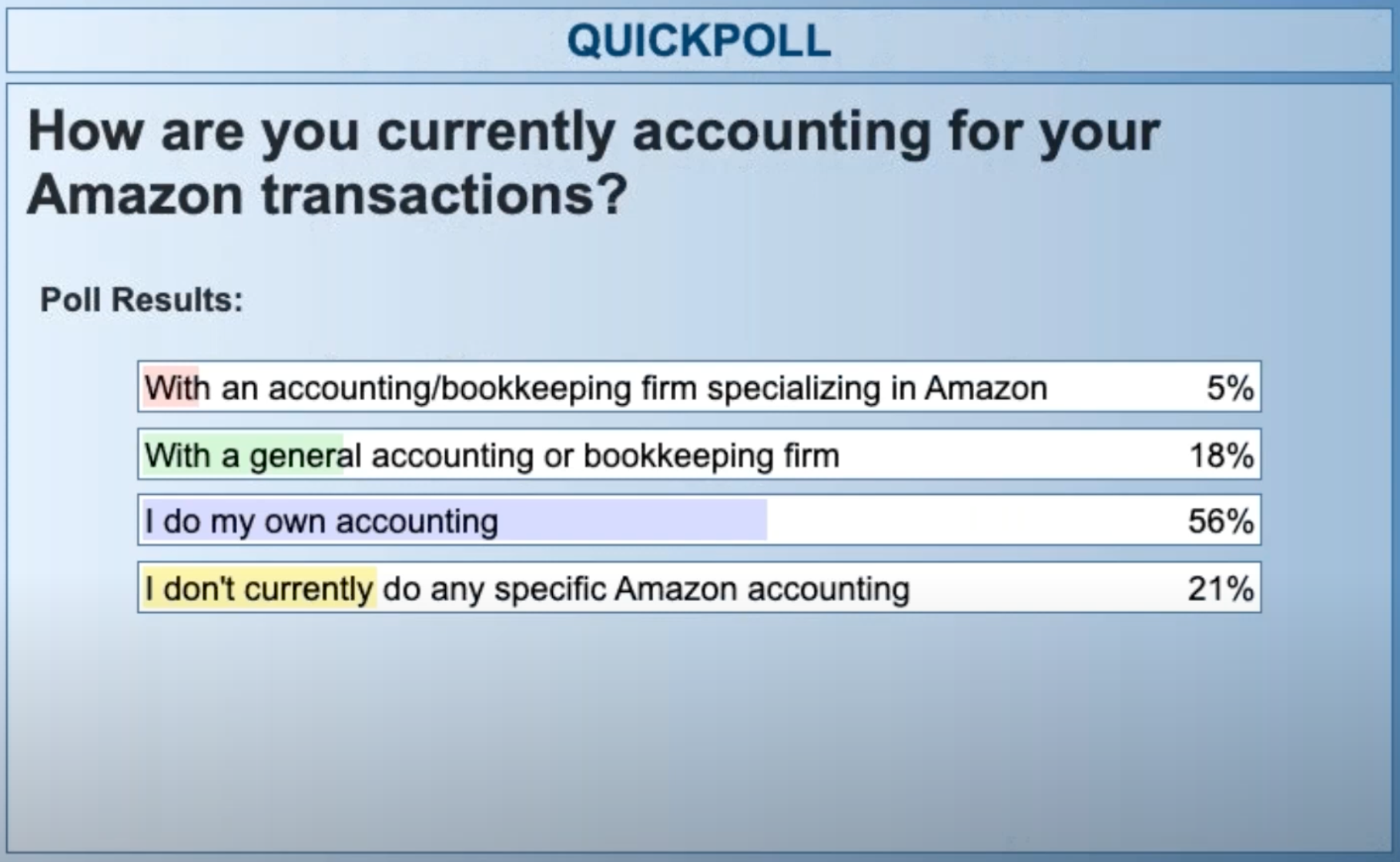

As an Amazon seller, you probably didn’t get into business to spend a lot of time doing your accounting, you may not have even given it much thought when you’re getting started. Or maybe you’re one of the people who are all over it. I will start by running a poll to get a bit of a gauge of where people are at:

Okay, so we can see the results here. They are quite reflective of what we see at A2X:The majority of you are doing your own accounting and some people are not doing any Amazon campaigns. We see this all the time.

Don’t worry; A2X can help. We also provide services for general bookkeepers, specialized accounting, and bookkeeping firms for ecommerce. Hopefully, this presentation will give all of you something to take away.

Ecommerce accounting pitfalls

Your numbers are important, and they deserve your attention.

A common misconception is that if you have more money coming into your bank account than going out, your business is growing. However, statistics show:

- 32% of ecommerce businesses fail because they ran out of cash.

- 29% fail because of cost and pricing imbalances.

- And many others fail because they try to scale too quickly.

Profitable Amazon businesses know the numbers inside and out and they use them to successfully grow the business. And for businesses to survive, they need numbers that they can rely on.

One of the scary things is most of these businesses don’t even see the crisis coming because they don’t know their numbers. So why is this the case?

Why is ecommerce accounting hard and time consuming?

1. Settlement period

Amazon sellers are paid every two weeks. This means settlement can cross over months – making it difficult to determine which transactions occurred in which month. For example, if I received a payment recently, I might have covered transactions from both December and January. It’s very important to split out these transactions into the period they occur. It’s crucial for not only month-end reporting, but also year-end reporting too.

2. Hundreds of Transaction Types

Amazon settlements involve hundreds of different transaction types, which change constantly. Your deposit is going to include sales. But there are also things like adjustments commissions, reimbursements, returns, and a bunch of different fee types that can all go into that settlement.

3. Complicated Tax

Tax is further complicated as you need to account for where you sell and where you’re registered. Although Amazon may collect your tax for you, under the marketplace facilitator legislation, you are responsible for tracking and reporting your tax and correcting any differences. Getting all this information from Seller Central might also seem obvious, but it can be difficult to line up what you’re paid with the numbers you see in Seller Central. This involves going through thousands of lines of data in spreadsheets, and even then, you’ll need to manually input these transactions into your QuickBooks Online or Xero account. This process is laborious, time-consuming, and prone to errors.

These tax implications also relate back to our earlier poll. If you find it hard to relate, you might have been neglecting your bookkeeping, or you haven’t got around to it yet. If you find this easy or believe it’s simple, there’s a high likelihood that you might be doing something incorrectly or not accounting for all types of transactions. Moreover, if you’re spending hours manually handling this, it’s important to know that more efficient methods are available.

Given these complications, it’s unsurprising that many sellers we’ve spoken to either avoid accounting tasks or take shortcuts. However, this approach carries significant risks.

The difference between good data and bad data

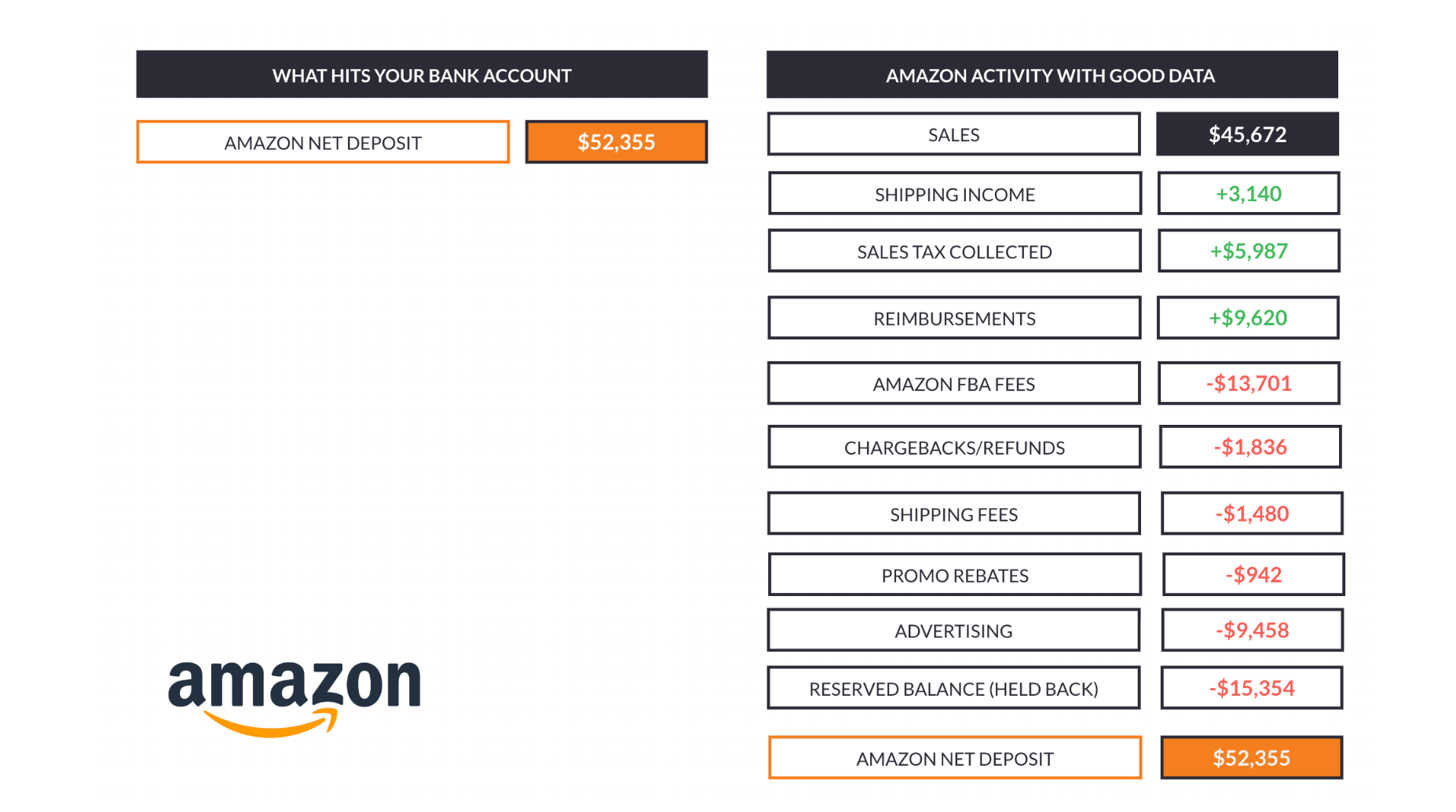

Here’s the difference in simple terms: Your bank account or settlement statement doesn’t provide a comprehensive view. A2X, on the other hand, delivers detailed and categorized data for informed decision-making.

As you may know, the cash that hits your bank account does not match the sales that you’ve made on Amazon. In the table below, the left side shows you what you see in your bank account, this is the net deposit from Amazon. So, with no visibility, sellers might just code this entire amount to a sales account. This is something that we see and hear from our accounting partners all the time.

On the right side you can see the Amazon activity with good data that shows what actually made up this deposit. We can see that the sales amount was actually $45,672, not the whole $52,355. Therefore, if you’d posted the $52,355 total to your sales account, you would actually be overstating your income. And by doing that, it’s possible you could pay more in tax. And you could also be incorrectly valuing your business.

Amazon activity with good data

You can also see in this table that the shipping income has been split out. This is the shipping income that Amazon has collected on your behalf. You’ll also see the shipping fees—the amount that’s being spent in shipping—so you get both the money that’s been collected, and what has been spent on shipping. In many cases, those will balance out to be the same amount. But if there’s a balance there, it’s important to be tracking them and ensure those numbers will go through into your Profit and Loss statement and your accounting software. You can also see that sales tax collected has been spun out.

As I mentioned earlier, tax is quite complex. If Amazon is collecting your tax as part of their marketplace facilitator scheme, it will also be remitting your tax. A2X will track all of that for you. If you’ve had tax collected and tax remitted, you’ll see those values both included in your entry, and you’ll be able to keep track of all. The tax will also be separately listed for any expenses, which is beneficial for deductions.

For example, if you had tax on gift wrap, or on shippings, or refunds, that can also be split out as well. This seller has received some inventory reimbursements. So if there’s been damaged or lost stock, Amazon will pay reimbursement. You can see that total has been included and this counts as income and also needs to be accounted for.

You will see that these fees have been itemized. A2X provides a detailed breakdown of your fees. Here, we only have the Fulfillment by Amazon (FBA) fees, but we can itemize delivery and transport fees, commission, and selling fees, among others. Any rebates or promotions will also be separately listed. Another important item for Amazon sellers is advertising costs, which are also distinctly shown.

The reserve balance is also very important. If Amazon has held back any money likely to be paid in the next settlement, it will be accounted for in your A2X entry.

As you can see, the table on the right side gives you far more information about what happened on Amazon and what the money received is. This means you can make far more informed decisions about your business. For example, if you see advertising expenses going up but sales aren’t rising up to the same degree, that’s something you should keep a close eye on. This approach is far more effective than relying on assumptions based on your perceived income or expenses.

A good way to think about it is that if a transaction was included in your settlement, then A2X will split it out and identify it for you. This entry boosts your confidence as it presents a balanced account. Here, you can see that the total deposit amount is balanced by all these figures.

You know that these numbers are accurate because they balance perfectly down to the penny with the amount deposited into your bank account from Amazon.

3 most common mistakes we observe

1. Recording your net deposits as income

This means that you could overstate your income. As we saw in the last example, you could be recording sales tax as income too. This can lead to big problems if you’re spending money that doesn’t belong to you.

2. Recording sales tax as income

If you are recording your whole deposit as income, it’s likely that you’re also recording your taxes income. Another thing to be aware of is that if you’re not splitting out that tax, you might be calculating tax on a value that has already been taxed. No one wants to be paying more tax than they need to.

3. Account for COGs only when they are purchased, not as they are sold

A2X is going to allow you to track your COGs as they’re sold. By not doing so you can actually be undervaluing your business with that inventory.

The reality is, if you’re not accounting accurately, you have limited insight into profitability, and it’s highly likely you’re paying the wrong amount of tax.

The good news is it’s not all doom and gloom. A2X has been assisting Amazon sellers delivering accurate automated accounting since 2013. We’ve processed over 1.1 billion orders and earned thousands of five-star reviews.

How A2X works

A2X pulls uncategorized sales, fees, refunds, taxes and more from all the channels you or your clients sell on.

A2X connects to Amazon Marketplace and pulls in uncategorized sales, fees, refunds, taxes, and more. It also connects to any other channels that you sell on and will automatically fetch any new data as it’s available. As you’re paid and you get a settlement from Amazon, that will automatically come into A2X..

A2X can fetch historical data—great news for those among us who have so far been doing their own accounting.

If you need to go back to a certain date, we can help you with that. Once the data is into A2X, A2X will auto-categorize it into accurate summaries that span the right time period.

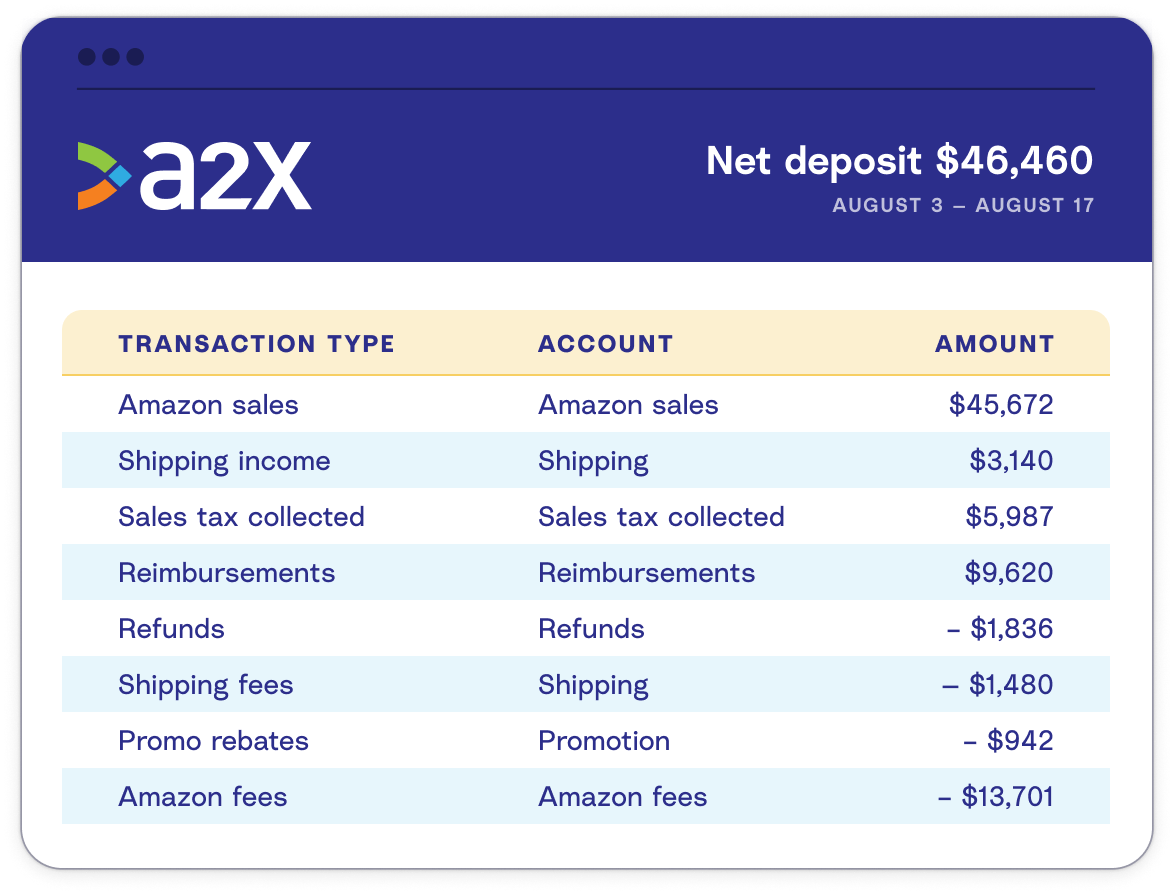

A2X auto-categorizes the data into accurate summaries that span the right periods

You can see above that this payout just covered one month (August), but if a payout covers multiple months, A2X will create two entries. The value you see in this example will be posted to your general ledger account within your accounting software, e.g., QuickBooks Online or Xero. After this information is transmitted to your accounting software, it can be set up to post and sent through automatically. As a result, the summary will perfectly align with the payouts on your banking screen, leading to a quick reconciliation.

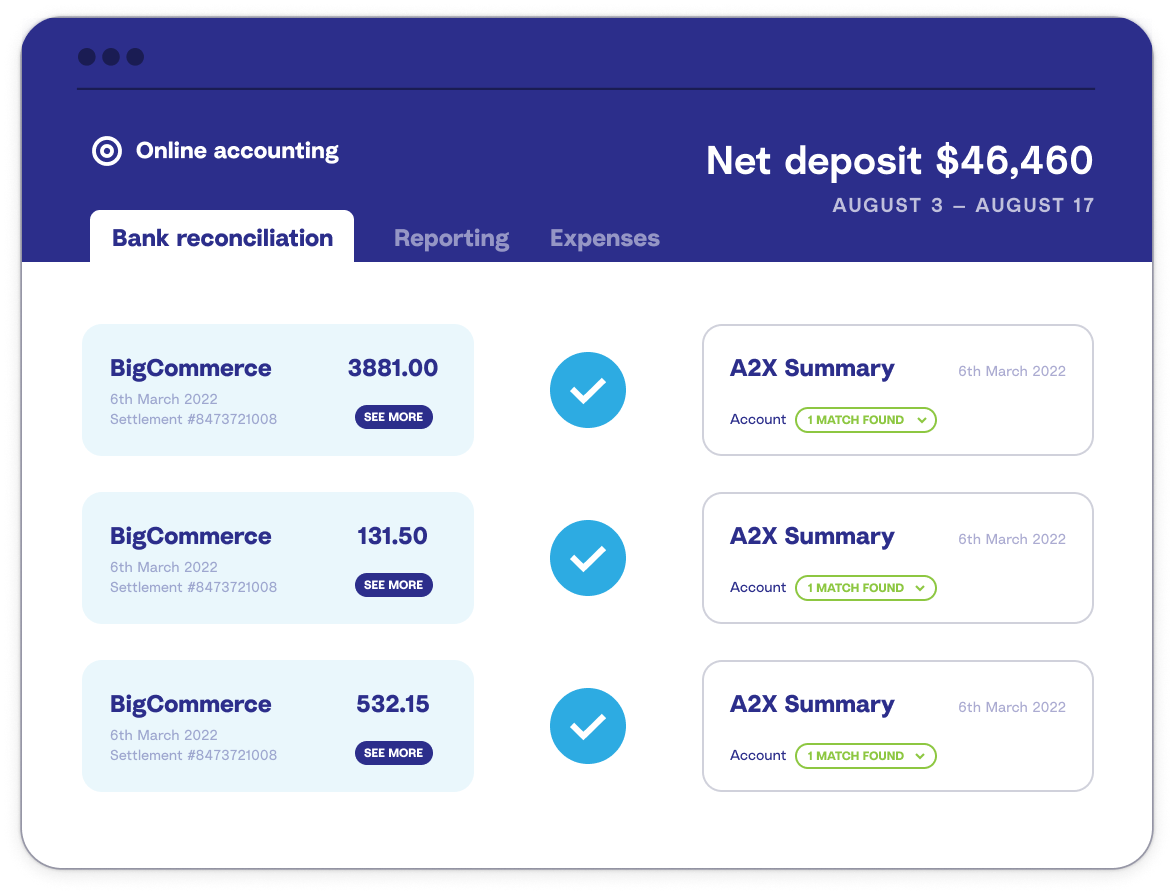

A2X perfectly matches payouts in QuickBooks Online or Xero with A2X summaries for one-click reconciliation

This screenshot shows a banking screen where the A2X summary perfectly matches the information. We’ve also got a little more data, here’s an example within QuickBooks Online’s banking screen:

This is a real-life example from within QuickBooks Online on their banking screen. It shows several deposits received from Amazon.com, and you can see this green box indicating ‘one match.’ This match signifies a journal entry from A2X that aligns with the payment you’ve received from Amazon. By clicking ‘match,’ all the correct values get allocated to the appropriate accounts—sales amounts to a sales account, fees to a fees account. There’s no need for any manual adjustments.

A2X increases visibility with detailed profit & loss statements you can trust.

This information feeds into your profit and loss (P&L) statement, providing increased visibility with data and a detailed statement. Also known as the income statement, the P&L summarizes your sales revenue and expenses, and usually covers a specified period, e.g., annually, monthly, or quarterly. The P&L is really important because it gives you an understanding of how your business is operating, and how profitable it is.

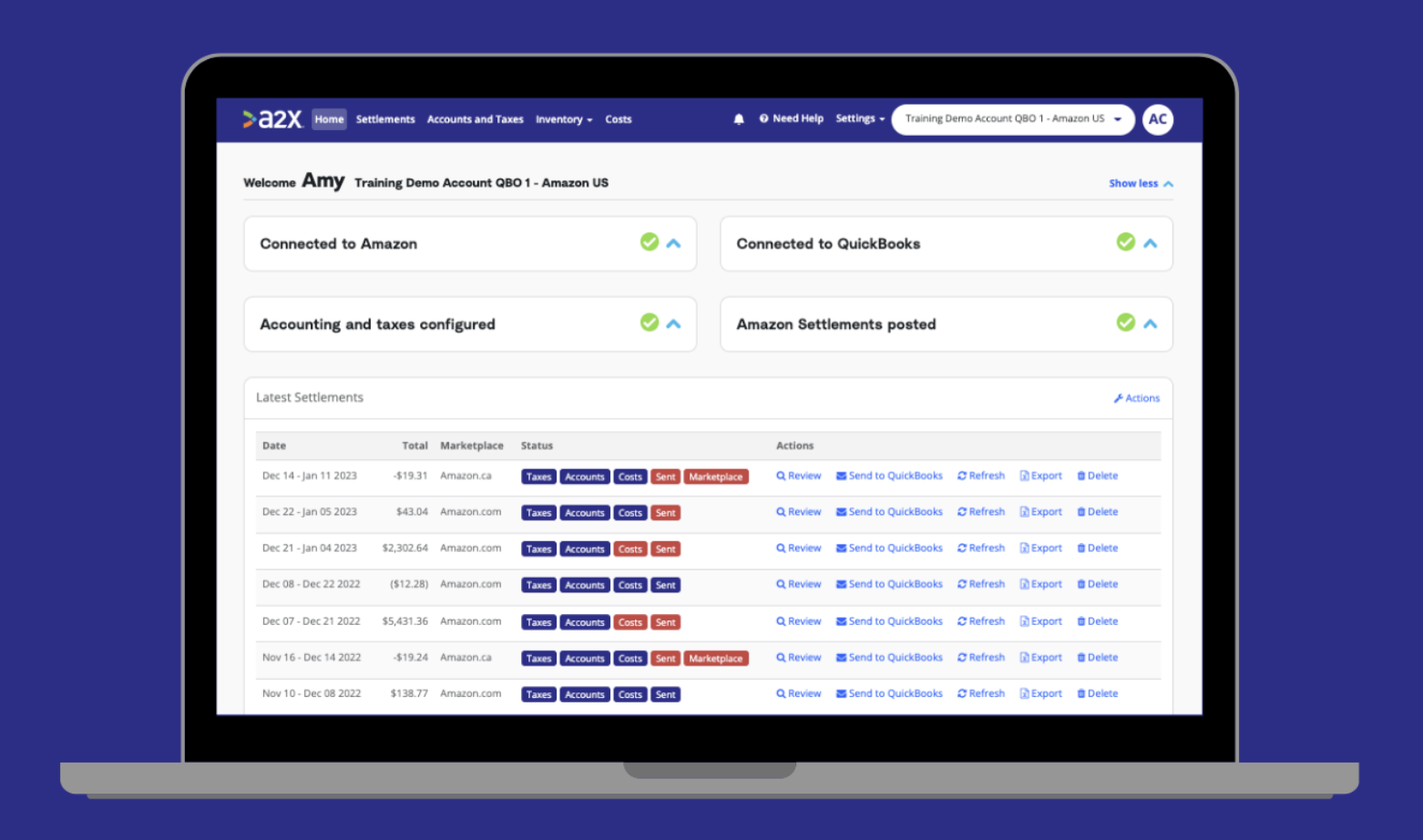

The result is automated, accurate ecommerce accounting. Here is the actual A2X interface:

A2X works with the top ecommerce accounting firms around the world who trust A2X with their clients. I’ve just included a note here, a quote here from Scott Scharf from Catching Clouds and now at Acuity: “A2X is a gold standard in ecommerce accounting.”

We have a bunch of case studies on our website that you can go and take a look at.

Why A2X?

- You automate a time consuming monthly process,

- You’re far more likely to pay the right amount of taxes,

- You’ll know which of your SKUs is the most profitable, and which cost you too much money.

- You know if you’re getting a return on your advertising,

- You’ll get a better view of your financial statements with a far more detailed profit and loss statement and balance sheet.

Most importantly, you’ll have confidence in the accuracy of your books, which, spoiler alert, can lead to a higher exit price if you decide to sell your Amazon businessin the future.

A2X provides accurate solutions that save you time and money.

A2X is the most accurate option. It provides advanced functionality and text granularity for accurate accounting. This is really important if you have specific techniques that you need to be splitting up or if there are different transactions that you want to place that lead out to. It’s customizable to your needs, will save you time and money, and it will help you get a fair valuation when the time comes.

A2X has the largest network of ecommerce accountants and bookkeepers.

The A2X directory is trusted by the leaders in the space.

A2X has the best support team in the industry.

Our support team is focused on your success. We understand ecommerce accounting better than most because many of us have launched our own stores or have bookkeeping expertise. We respond quickly—in hours—with the type of support that you want. And when you’re stuck, and need some help, this is really what A2X provides.

You don’t have to take my word for it. If you look at a lot of the reviews across marketplaces and various review sites, many of them mention the awesome support team.

When it comes to paying tax, making financial decisions, calculating your margins, or even valuing your business, close enough really isn’t good enough. The best thing is you can try A2X for free.

Question & Answer session

Dominic: Thank you so much, Amy, that was really insightful. As a non accountant, a lot of this can be really complex and confusing and so I appreciate the way that you broke it down. We have a lot of questions streaming in. To start:

How does A2X’s pricing work? What should sellers expect there?

Amy: We have many different pricing options to serve all different types of sellers.

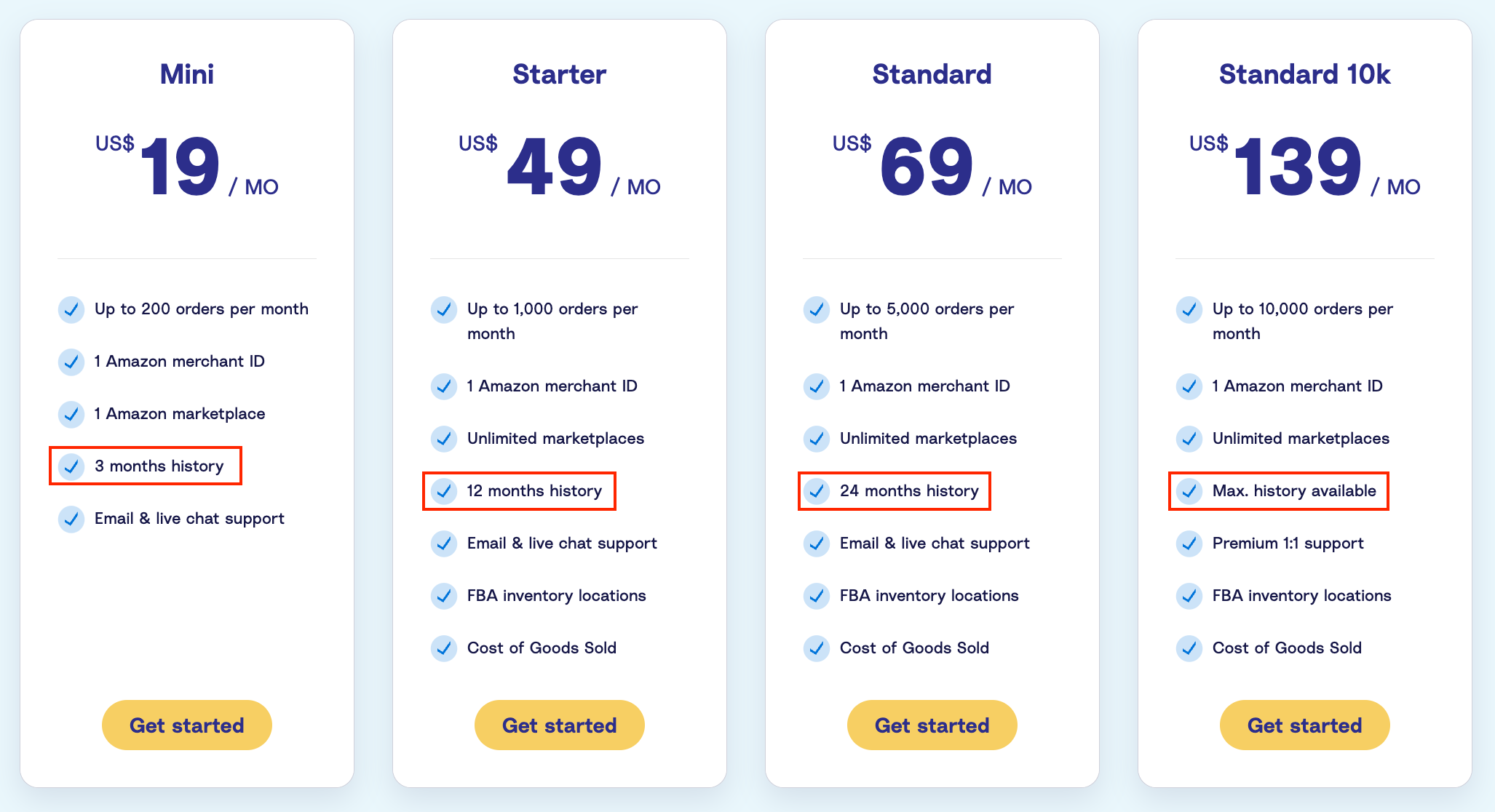

For Amazon sellers, our plans start at $19 a month, and it just depends on how many orders you’re doing. The mini plan starts at $19 a month and allows up to 200 orders with just one Amazon merchant ID. If you’re doing a few more audits per month, and the plans scale, as you grow.

Where can they even find someone to help them with this, either starting up A2X or just doing accounting In general?

Amy: We work with many different ecommerce accounting firms that specialize in ecommerce and are specifically focused on Amazon. We have our awesome A2X directory on our website where you can find ecommerce accountants. .

On the directory there are various selection criteria that you can select depending on your specific needs. For instance, if you’re searching for an accountant specializing in Amazon, you can filter by that and see we have numerous accountants, accounting firms, or bookkeepers available for you to contact.

All the professionals listed there have demonstrated considerable expertise in ecommerce, which as we’ve discussed, can be quite complex.

Data pulled by A2X is based on payout and not monthly transactions. How does that correspond to calendar months and quarters?

Amy: We connect to the settlement, which is similar to a big Excel file that you can pull from. What we will do is we’ll bring in all of the data into A2X and it is then split down into the month that it occurred.

For example, if the settlement period was from 25th of December to the 4th of January, what A2X does is break down the transactions to when they occurred. You’ll see the first entry is for December, and the second entry is for January.

The beauty is that both are sent through to your accounting software, and both are balanced to the total you were paid. That means you can run those reports so you can have monthly profit and losses and monthly reports.

Can A2X be backdated to break down all transactions for the previous year to help with 2022 taxes or will it only start from the time that it is purchased?

Amy: This is something we get asked all the time: yes, we can get historical data.

On the pricing plans, all of them will come with a set amount of data. Even our smallest plan comes with three months-worth of historical data, if you wanted more than that, you could just subscribe to a larger plan, pull out 12 months worth of data and then you could move back down onto a smaller plan if you only had fewer orders.

One thing to note: sometimes Amazon will archive your data. So if you bring it in and you start a history fetch and you’re not seeing some data, then you can reach out to the A2X support team. They’ll give you the steps of how you go into an Amazon seller account and unlock that data.

How far back can A2X pull the data?

Amy: In most cases, we can get all of that historical data provided it’s not archived. Even if it is archived, we can give you instructions on how to go in and unlock those. And, if there are any complications, the A2X team will work with you through that. Nine times out of ten, we can get all of that data for you.

To get the data you need, you will need to subscribe to an A2X pricing plan that includes the historical pull you need. For example, if you need five years’ worth of data, you should move on to a plan that comes with unlimited history.

If you need help during this process, you can chat with the support team using the small pop-up in the bottom corner of your A2X screen. They’ll be able to ensure you’re getting the needed history.

Can A2X be integrated into inventory management systems to figure out how quantities and money are moved?

Amy: This is something we get asked about all the time because obviously inventory is a massive part of any ecommerce business. What A2X will do is create a cost of goods sold inventory. Most times this would be used by a business that is not using an inventory system, e.g., a smaller seller.

We’ve got an example here. What A2X does is identify all of the different SKUs that are sold on Amazon, and then you can upload a cost price and it’ll post the total value. So $390 would be posted. The idea is that you’d have your asset account which is the total value of your inventory settlement, and then it would be reduced by $390.

If it’s a larger seller, and they use an inventory management system, A2X works really well alongside a lot of them. The key thing is just working out which data they are posting to your QuickBooks Online. If you haven’t connected and it’s posting data for example, we can’t usually recommend that you set up your inventory system and then see what data they’re posting.

The reason you would need A2X alongside your inventory system is because that inventory management system is probably only capturing some of the picture. For example, it might be doing sales and refunds but it won’t be doing all of the things with the level of detail that A2X will do.

If your inventory system is posting across your sales, the A2X team can help you either remove that line from the entry or post the A2X sales portion to a clearing account, so that you’re not duplicating the sale.

Many of our larger sellers and a lot of our accounting firms work with both A2X and an inventory management system. The key is ensuring we get the configuration right so that you’re getting both up to date inventory numbers from the inventory system and accurate financials that reconcile from A2X.

What’s the relationship between QuickBooks Online and A2X?

Amy: In your A2X account, you’ll connect your Amazon account and then you’ll connect to QuickBooks Online.

Something to note is that even once you’ve connected your QuickBooks Online to A2X, nothing will change until you’re ready to start sending across your data—it’s totally safe to connect your Amazon and QuickBooks Online account

After everything is connected, A2X can see your general ledger or your chart of accounts. A2X can then bring in all of your ledger accounts exactly as you have them set up in QuickBooks Online, or if you don’t have this set up, it can actually create the accounts for you.

There are two scenarios we see:

- You’ve already been doing ecommerce accounting, and you have all the ledger accounts set up in your QuickBooks Online that you want to keep using. In that case, you come into A2X and then the accounts and tax mapping page, you just select from a drop down, “I want my sales to go to my Amazon sales account.”

- You’re brand new and don’t have any accounts within your QuickBooks Online. In that case, A2X can create the accounts you need. You can come in, connect your Amazon and QuickBooks Online, and then in your accounts and tax mapping page you’ll be asked a few questions, and then you just select the option and A2X will create all of the accounts that you need. All of those accounts will be created in your QuickBooks Online and they’ll be the right type for what you need. However, we always recommend that you do get it checked by an accountant to make sure that it’s right for your setup.

Once everything is set up, A2X can then post on an ongoing basis. This means every time you’re paid from Amazon, an entries will be created and it will be automatically sent over to QuickBooks Online. Depending on your setup, you can have it as a draft or as a live journal entry.

At this stage you won’t even need to log into A2X. You could just go into your QuickBooks Online and see the entry. You could just go into the banking screen and see the money from Amazon, you’d see the entry from QuickBooks Online, and you just need to click match. Everything will be taken care of and posted to the correct accounts reconciling.

Does A2X work with QuickBooks Enterprise, QuickBooks Desktop, or QuickBooks Online, or all of the above?

Amy: We predominantly work with QuickBooks Online. However, if sellers are using QuickBooks Desktop, the process works essentially the same—you would just need to export the file and then upload it into QuickBooks Desktop. We also have settings that let you choose the format such as an IIF file for QuickBooks Desktop.

QuickBooks Online is completely seamless and easy. The only consideration with the type of QuickBooks Online subscription you might need would be if you’re selling in multiple countries, so if you needed multicurrency, you might need a higher level of QuickBooks Online subscription—that would be something to have a chat with your accountant about.

In addition, we work with Xero and Sage, the business cloud accounting software.

Does A2X calculate taxes and fees for international marketplaces?

Amy: You can see here in this example, Amazon Canada has been split out and Amazon.com has been split out.

What will happen if you have multiple marketplaces, A2X will connect to a region. We have a lot of sellers in Europe so they would have an EU connection. And that would bring in all of the sales on the UK marketplaces, the German, French, etc, all of those different marketplaces would all come through into the same account. With North America, A2X can do the tax mapping for you. It can suggest the traits. With the European countries, some of the tax will likely be split out for you and the VAT will be done for you on the UK account.

The only thing is that I don’t know whether tax rates would be applied if you were specifically a French seller. The reason for that is because we do tax rates in English-speaking countries.

In a nutshell, yes, the different marketplaces will be there. Yes, the tax will be split out. For the UK and the majority of marketplaces, A2X can recommend a tax rate for you. It would just be for any other marketplace, you may need to select which tax rate should be applied to those transactions.

How does A2X work with international currencies?

Dominic: For example, if a seller is selling in multiple marketplaces, can they all use the same account? Or do they need a different account for instance, for their Canada marketplace, their Mexico marketplace, through the US marketplace and elsewhere?

Amy: The currency conversion is done in your accounting software. For example, there’s payments here that are likely in Canadian dollars and also in US dollars.

What will happen is A2X will bring it through in the home currency. For example, if this was a European seller, you might see euros, and you might also see pounds, then what will happen is you will send it over to your accounting software, provided you have the multi-currency turned on. If you have a bank account that is set up with euros, and you’ve also got a UK bank account, all of that conversion is taken care of on the QuickBooks Online or Xero side. In addition, it should be able to identify the matches there, and you can connect them all up.

If you’re selling multiple currencies, that’s no problem. You would just need A2X connection for every region. If you’re selling in Europe and North America, you’d need two connections, but the setup is relatively the same and the currency conversion would be taken care of. The same applies to what you’re selling on a website. it will bring it in the home currency, and then, For example, if you had an A2X connection to BigCommerce, for example, the same principle applies. The currency is brought in—the currency that it was sold in—and the conversion happens.

How does A2X record the inventory cost of returned products?

Amy: You’ll see a returns line and what it will do as the total value, so if there’s a return from Amazon, we’ll take that value from Amazon and it will be included in your entry. The other thing to keep in mind is if you’re looking at stock levels, for example, that would need to be managed by a different system as A2X would just look at the value rather than like the units or the SKUs, but there are ways that you can do that.

If you’re getting into that level of granularity, it’s probably worth talking to one of our accounting partners because they can help you either just with the setup to make sure it’s all working as it should be, or they can provide you with some ongoing sort of support on managing that.

Will A2X tell me the value of the remaining inventory at Amazon?

Amy: Our COGS feature is generally used on the smaller end. The whole idea is that you would purchase your COGS, put it in an inventory asset account, and then it just reduces that so that’s kind of as far as it goes.

A2X wouldn’t provide, as far as I’m aware, up to date updates on the value of your stock at Amazon. However, I know that some of our partners have advanced settings within A2X to manage that and they go into a lot more detail. I know a big one for Amazon sellers is inventory in transit. So if you’ve shipped it to Amazon, and it’s in transit, that’d be accounted for. And If there’s breakages or returns, etc. If you’re going into that level of detail, I definitely recommend talking to one of our accounting partners. They will be able to provide you with a lot more detail around that. You wouldn’t get that necessarily directly in the A2X interface but that information is available if you go through one of our expert accounting partners.

Can the VAT (Value Added Tax) be added retrospectively?

Dominic: For example, if a company registers for six months after the transaction, can A2X work out the VAT? Historically?

Amy: Yes, it can. If you’re in the UK, if you’re using Xero, then tax will need to be calculated on the sales amount. So what will happen is you can come in here and say, for example, there’ll be a line that says sales and then you can choose a tax or VAT rate. So you can select that and it will be calculated.

One thing to keep in mind is that these mappings will be applicable from today. For instance, if I said, I need a 20% VAT rate on all of my sales and then updated my data, that will be applied to all of my transactions.

So yes, that could apply if you wanted the VAT to be calculated on all of those transactions, A2X could absolutely do that. If you wanted it from a certain date. So you said “okay, up until the first of January, I wasn’t charging any VAT, so any November or December, sales don’t need VAT but then from January 1 I do need VAT. That would also be doable, you just need to map twice.

So you would come in, do the mapping, send just the first amount of entries over. And then you do the remapping and send the January entry. Again, I would recommend talking to one of our accounting partners. We’ve got some awesome ones in the UK as well that specialize in the complicated VAT on ecommerce transactions.I can’t recommend them highly enough. And if you’re just wanting to get A2X set up, they can probably just go through it with you and get all that historical data done. And then going forward, you might not need a lot of input back but at least you get that confidence that it’s accurate if someone’s helped you go through setup initially.

Does A2X record order level accounting?

Dominic: For example, is each order and invoice is recorded on an individual basis, or is it batched by a reconciliation file?

Amy: We do batch payments, not individual entries. The reason that we don’t do individual orders is because it would create a lot of entries in your accounting system. If you’re doing 100 orders per month, for example, it would create 100 entries into your accounting system.

Most accounting systems have a limitation on invoices. I believe Xero allows up to 1000 invoices and QuickBooks Online probably has similar restrictions. The other thing with it is that it’s really difficult to link it to the payment because what you’d be doing is you’re getting, you’re getting paid for all of the 100 orders in one batch deposit. So you’d be trying to drag in all of these 100 entries in your accounting software to this one deposit. That’s why A2X does a summary entry. It’s also best practice from an accounting perspective too.

We will create one summary entry every time you’re paid, that will cover all of the sales and transactions that were included in that period.

Does A2X work with Sage 100?

Amy: I believe Sage 100 is a desktop product. We work with Sage Cloud Accounting. Essentially, we work with the basic cloud accounting software with Sage. That’s a direct integration.

However, if you’re on Sage desktop, or you’re on a Sage product that we don’t have a direct integration with, it’s possible that the manual export method, a.k.a a non-direct integration, could work. It does still save you so much time and that it creates an entry for you. The only manual part of using A2X with the desktop product is that you have to export the data and upload it and it will still save you a lot of time.

If you go to the A2X support center, it will tell you the exact ones A2X integrates with or if not, you can just reach out to our support team on the website and say “I’m on Sage 100. Can I use the export method? What are my options?”

If you’re selling in multiple countries, will A2X prepare the report for all of those countries or would it convert all the amounts to your currency and break it down that way?

Amy: Essentially what will happen is A2X will bring in the entry into A2X in the currency that it was sold in. If it was sold in euros, for example, it’s going to come into A2X in euros. If it’s in pounds, it will come in pounds. And if it’s Canadian dollars, it will come in Canadian dollars, etc.

Then what happens, we send our entry over to QuickBooks Online, and the currency conversion happens there. All of the data is always going to be in the home currency and then what happens with it beyond that will happen in QuickBooks Online. If you’re getting paid in pounds, and your entry from A2X is in pounds, that’s nice and seamless, that will connect. If there’s a currency conversion that needs to happen, then that can also happen within your accounting software. I think they’ve got a process where they take the currency exchange for the day and they figure it out.

The other thing to keep in mind is that some people will use a currency conversion tool outside of your accounting software. For example, if you’re using a Transferwise or OFX, and you’re getting paid into that, say in euros, and then that’s converting and paying you in pounds, then there is also a workaround for that. There are a few more steps, but we have a good support article explaining how you do that. Essentially, you can still link it back to that payment.

So, regardless of what currency you’re getting paid anymore, and provided you have the multi currency option in your accounting software and you’re prepared to work with us, I’m sure we’ll be able to find solutions.

Dominic: I know we’re quickly out of time but Amy, again, just wanted to give you a sincere thanks for your great presentation today and also answering all of the thoughtful questions from our sellers. I enjoy hearing from you and I know that all of them did as well.

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there