![[Webinar] Avoid These 3 Ecommerce Accounting Mistakes](/img/blog/webinar-top-3-accounting-mistakes-costing-your-ecommerce-business.png)

[Webinar] Avoid These 3 Ecommerce Accounting Mistakes

With every transaction made and every dollar earned, keeping a precise record is imperative for accounting and tax purposes. This holds true whether you’re an experienced ecommerce merchant or a novice starting your journey. Unfortunately, it’s all too easy to stumble into expensive accounting blunders.

In this insightful webinar, A2X’s product marketing manager, Amy Crooymans, and OFX’s Oliver Budniak unravel the complex world of ecommerce accounting. Read on to hear Amy highlight how to sidestep some of the most frequent errors made by ecommerce businesses in their accounting practices. In addition, the pair provides valuable guidance on better understanding your financials and efficiently managing your numbers. The webinar also delves into how to effectively channel summarized payout data, including sales, fees, taxes, and more, into accounting platforms like QuickBooks Online or Xero, for effortless reconciliation.

Table of Contents

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there

Amy: Welcome to today’s webinar where we’ll be discussing the top three accounting mistakes that could be costing your ecommerce business. My name is Amy, and I’m a Product Marketing Manager at A2X. Also joining us today is Oliver.

Oliver: Good morning, everyone. Looking forward to today. I am Oliver. I head up the ecommerce partnerships at OFX, based out of Sydney. I’m excited about today’s session and I hope it will be beneficial for all of you.

Amy: Thanks for the introduction, Oliver. Today I will start with a discussion with some context on the challenges faced in ecommerce accounting. And then I’ll dive into three common accounting mistakes we see all the time.

The ecommerce accounting challenge

Amy: Getting into today’s topic, I’ll begin by discussing the challenges that come with reporting your net deposits and tax as income. Then, Oliver will cover the issue of not accounting for currency exchange rates, after which I’ll resume with a discussion on improperly handling COGs.

After that, I will quickly overview how A2X and OFX can help you prevent these mistakes. We’ll conclude with a question-and-answer session, so feel free to drop your queries in the question box within Zoom throughout the webinar.

Let’s start with some initial context.

Most businesses have joined this webinar because they aim to grow a profitable business and better understand their numbers. But flipping the coin over, it’s essential to understand why some businesses aren’t successful and fail.

Here’s some key facts, did you know statistics show:

- 32% of ecommerce businesses fail because they run out of cash

- 29% fail because of cost and pricing and balances

- Many other businesses fail because they try to scale too quickly

I think the saddest part about many of these situations is that many of the businesses don’t actually see it coming and are blindsided because they don’t know their numbers.

So why is this?

Ecommerce account is incredibly challenging

Simply put, ecommerce accounting is more complex than accounting for a regular retail store—and it grows in complexity the more your sales volume increases.

I’ve actually spoken with accountants about this before and they’ve admitted that they’ll sometimes try and avoid ecommerce clients entirely because it is so complicated and there are so many things to know.

So with that in mind, let’s learn why ecommerce accounting is complicated:

1. Payout source

If you’re selling on Amazon, Amazon sellers only get paid every two weeks. That could mean if you got paid in May, it would cover sales that happened in April and it would also include sales that happened in May.

This scenario creates a whole lot of accounting complications when you’re trying to do accrual accounting, which is essential for making sure your transactions are recorded in the period they occurred. It can be really difficult to try and then split out from that settlement what transactions occurred in April and which transactions occurred in May. And because Amazon payments cover a two week period, this is a really common issue.

Here’s another example: if you’re selling on Shopify, you might have multiple different payment sources. You might be receiving payouts from Shopify payments, which come directly into your bank account, but then you likely have other payment gateways on your website too, like PayPal or Afterpay. All those payment gateways add another level of complication because there are so many different payment sources.

2. Different transaction types that you need to account for

When you receive that big deposit in your bank account from Amazon, it’s tempting to assume the total value is sales, but it’s not.

In the case of Amazon, that bulk deposit could include up to 400 different transaction types. Obviously a big portion of the deposit includes sales, but there’s likely shipping, discounts, refunds as well. And another big one is tax, which is our third point.

3. Complicated tax

Depending on which products you’re selling, the platform you’re using, and which countries or states you’re selling on, tax can get really complicated to deal with and calculate in your accounting software.

For example, if you need to do your tax return in Xero, then you need to be making sure that you’re calculating tax on the right transactions. You want to be sure you aren’t recalculating tax on a transaction that has already been taxed.

So as you can see, it starts to get really complicated and there’s a lot to a lot to your accounting. Understanding these complications and accurately recording them is crucial to avoiding the pitfalls we’ll be discussing today.

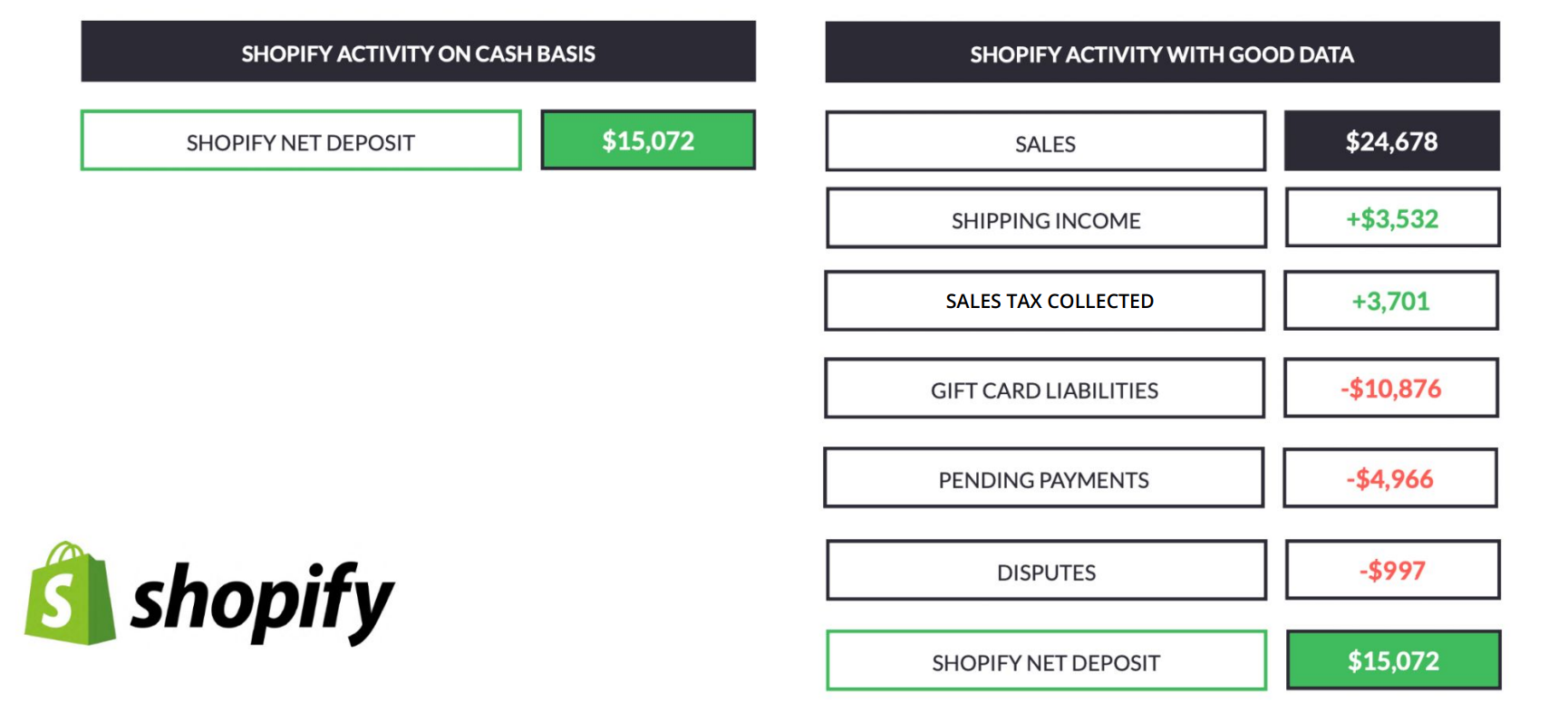

Here’s an example of what I’ve just discussed, using a Shopify seller:

Shopify activity with good data

Let’s look at this Shopify example. In the left column, you’ll see a net deposit of $15,072. This figure is the payout that will hit the seller’s bank account from Shopify. It’s tempting to code this whole deposit as sales revenue but this is a common mistake.

When sellers see such a deposit in their bank accounts, particularly if they have a Xero or QuickBooks Online system set up, they may code the whole amount to a sales or ecommerce account. However, as shown on the right side of the same table, this is not the actual sales value. It’s just the net deposit—the money received. The actual sales figure is considerably higher than the $15,072 deposited into their bank account. This deposit also includes shipping costs, sales tax collected, gift card liabilities, pending payments, and disputes.

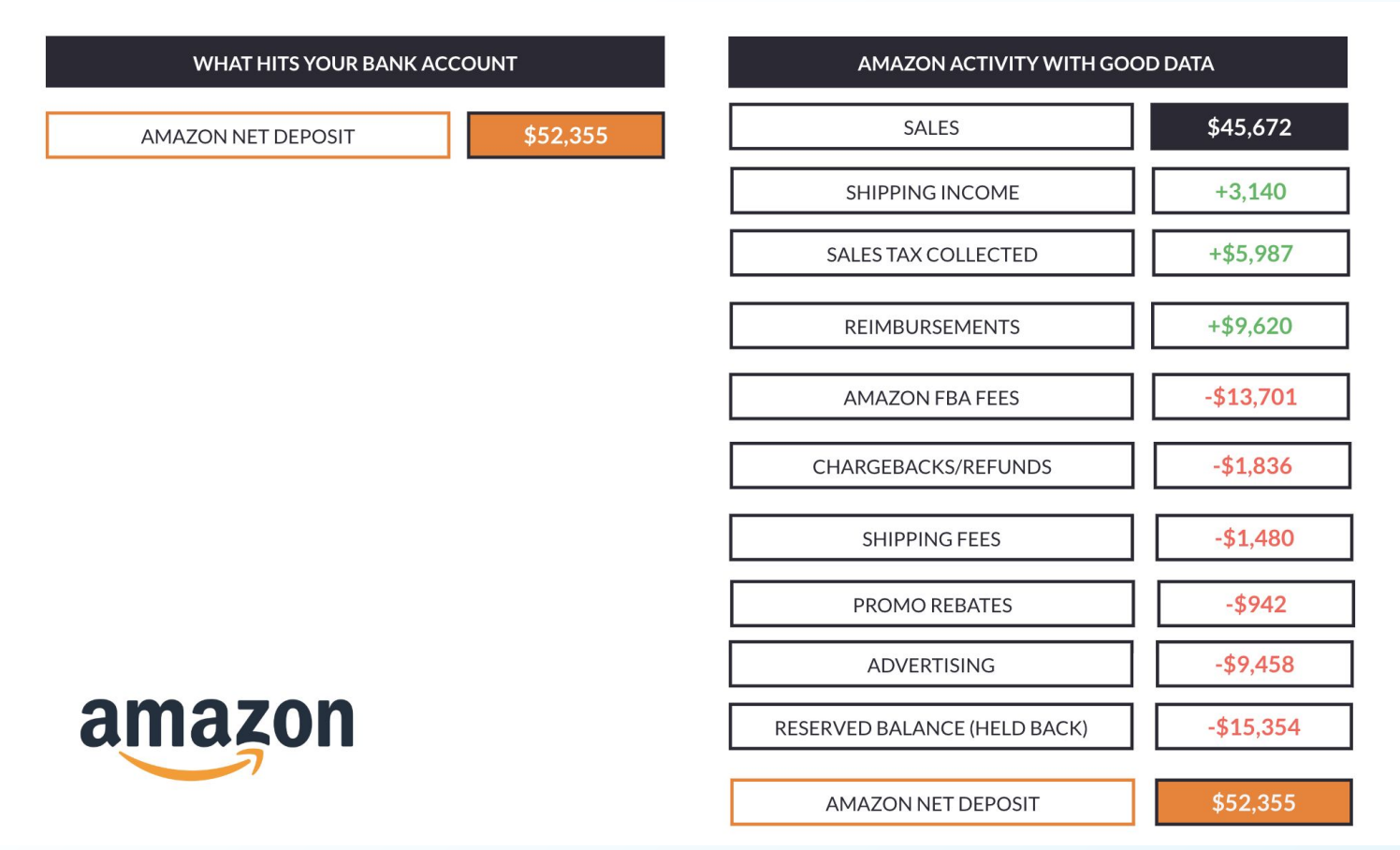

Proper accounting for these transactions is crucial. And if you’re not accounting for these transactions currently, you could get into hot water quickly. The situation becomes even more complex with Amazon, due to the two-week pay period and the many transaction types.

Amazon activity with good data

Amazon sellers may also encounter shipping income fees and other costs. Depending on the Amazon platform where you’re selling—for example, Amazon US—there might be some marketplace facilitator tax, whereby Amazon collects and pays tax on your behalf. Navigating these layers of complexity requires careful accounting, including splitting out various costs.

Ecommerce accounting is hard and many businesses struggle in one of three ways

Because ecommerce accounting is so complicated, we often find sellers do one of three things:

1. They ignore it

We see this frequently: Sellers will reach out to us and they’ll want to do their financials for the last three years. Perhaps they’re looking to sell their business, perhaps they’re getting audited, or perhaps they actually just want some visibility into how their business is going. Either way, they’ve been ignoring their financials and then time comes where they need to start doing something about it.

2. They create best guess entries

We touched on this earlier, but this is what we see when businesses have coded their entire deposit amount as sales, with a sort of “I’ll worry about that later” attitude. Not only is this inaccurate, it’s also a slippery slope because it’s not giving them that visibility.

3. Spend hours doing it manually

In the case of Amazon, accurate reconciliation of payouts could require downloading a massive report from Amazon and using pivot tables and other data tools to determine what the transaction types were. The problem is that it’s really difficult to get it to accurately balance the money you’ve received.

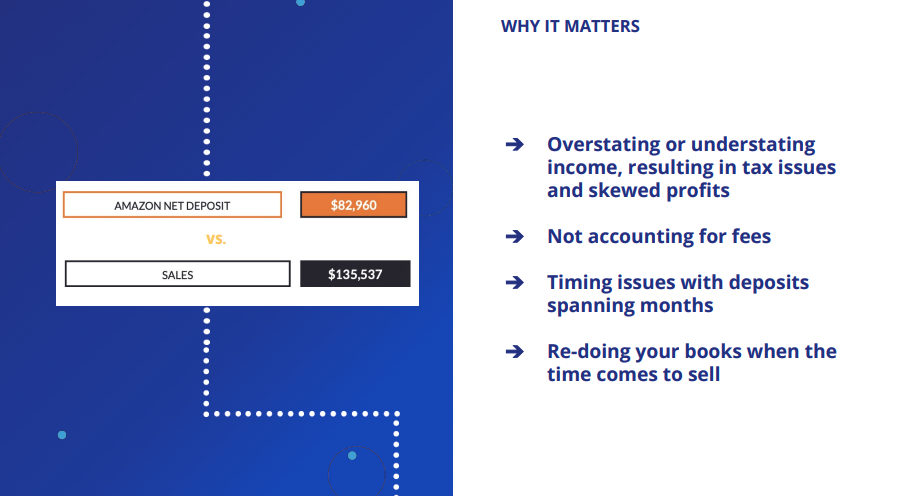

As seen in the previous example, If you’re not accounting accurately, you have limited insight into the profitability of your business and its performance. And, if you don’t know your numbers, it starts to get really difficult to make business decisions. You don’t have confidence in the numbers, which is just something that’s really key for growing your business. Let’s explore the three common mistakes we observe:

The three most common mistakes we observe

Working with ecommerce businesses for so many years, we see and hear of the same mistakes being made over and over again. Here are the three most common mistakes we encounter and why they can be catastrophic for your business.

1. Recording net deposits and tax as income

We see this happen a lot and the problem with this is that it covers a whole bunch of different transaction types, so you’re not getting any visibility into your fees, whether you’re collecting tax, or if your shipping prices have increased, instead you’re just allocated that entire amount as sales.

Why this matters so much

Overstating or understating income, resulting in tax issues and skewed profits

You usually pay tax on an income amount, so if you have the wrong income amount, it’s likely you’re paying the wrong amount in tax.

And, unfortunately this is one of those things that will come up again and when it does come up in the future, it’s likely you will have to pay it back. It’s also possible that it will come up when you’re looking to sell your business or get a loan or funding.

If you’re selling or want a loan, the buyer or lender will want to look at your financial statements. If those are not accurate enough or not correctly accounting for your sales amount, then you’re going to get yourself into trouble.

Not accounting for fees

This is another thing that touches on the visibility issues. For example, if you’re sending out more stock and orders, things might seem to be going really well but that might not be translated through to your bank account. And without proper accounting you won’t necessarily have the visibility into why you’re not getting more money in your bank account.

In this example, the reason could be that while you are doing more sales, you’re also paying more in fees, or your shipping has dramatically increased, or maybe offering free shipping is cutting into your margin. With accurate numbers, you’ll have access to this information, so you can quickly make changes to save your margins.

Timing issues

As talked about earlier, because sales channels pay sellers in bulk deposits, that deposit might cover two months. Accounting for this can become really complicated and it can be a real pain when you’re trying to do monthly reporting and comparing to previous months or years.

For example, if I was an Amazon seller and I was looking at my April numbers, I could have been paid twice by Amazon this April while being paid by them three times last April, due to the payment cycles. So, if I was doing a year-on-year April comparison, my numbers would be way out and you could be stuck looking at the difference thinking “gosh, what did we do last April that was so good? Why were my sales numbers so much higher?”

This is why having all data allocated to the correct month is super important to avoid situations like this.

Re-doing your books when the time comes to sell

Unfortunately it’s not uncommon for ecommerce sellers to ignore their books so they don’t have to deal with them in the moment. This can end up costing you more in the long run.

As an example, if you’re going to sell your business, you’re likely looking for a sales price that is a multiple of your sales. But, if your sales are actually far less than what you believe them to be, then when the time comes to sell the business you’ll have a bleak realization that it’s worth far less than initially anticipated.

Regarding Tax as Income

This example really comes down to which marketplace you’re selling on and whether marketplace facilitator tax has been collected. It also depends if you are calculating tax within Xero or QuickBooks Online. Essentially you need to make sure that you know that tax number and that deposit that you’ve received.

You also need to consider

- Do you need to be calculating the tax?

- Has Amazon already calculated the tax?

- Were there tax exempt transactions?

It’s really important to be able to split all of that information out and most importantly, if you have collected tax, make sure it doesn’t go in a sales account. When tax time comes, if you haven’t set aside the predemand in tax, that will be a pretty scary time.

Spending money that’s not yours

As mentioned, there is a risk of spending money that’s not yours.

Compliance issues

Tax is a significant consideration, and there’s not much leeway when it comes to errors or discrepancies, so you want to make sure that you are fully compliant when it comes to tax.

Skewing your profit margins

Failing to properly account for tax can also skew your profit margins. To avoid this, it’s necessary to account for taxes accurately and set them aside. This will give you confidence that all taxable transactions are correctly accounted for, leading to clear profit margins. The goal is to avoid including tax values in your sales line, as it could distort your financial picture.

2. Not correctly accounting for currency exchange

Amy: I’ll hand it over to Oliver to cover this section.

Oliver: Thank you, Amy. As I mentioned earlier, my name is Oliver, and I head up the ecommerce side of OFX.

A little bit about OFX first, just to paint a picture in terms of who we are. We’re an international money services provider based in Sydney and listed on the Australian ASX.

OFX has a human and digital business model. Meaning our clients can transfer money online, whereas at the same time we have 24/7 customer support, allowing clients from around the world and speak to one of our OFX experts, regarding overseas payments.

We have offices in Sydney, Auckland, Singapore, and Hong Kong, as well as North America and Europe. And in terms of the numbers above, they might be a little bit bigger now. Our team comprises over 650 employees globally. Recently, we expanded our footprint by acquiring Firma, a Canadian foreign currency business.

What moves the FX market

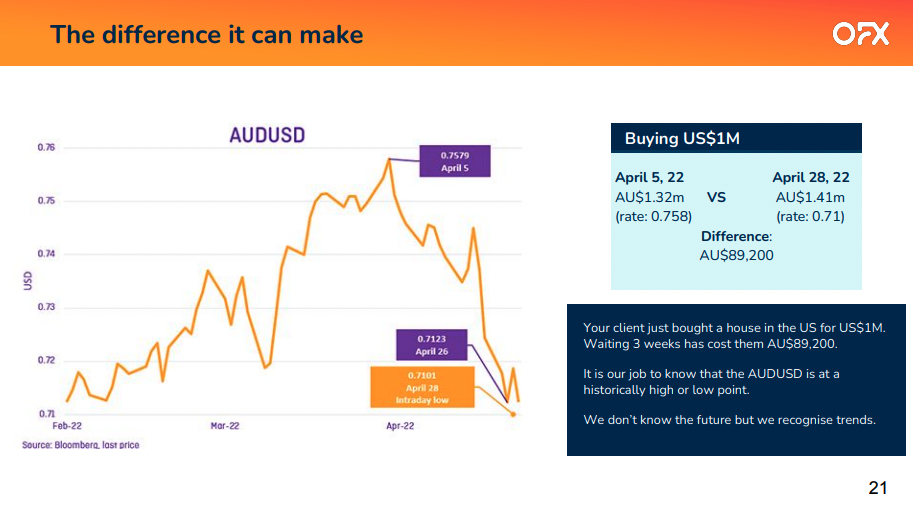

Foreign currency, particularly the Australian vs. the US dollar, significantly impacts ecommerce businesses in Australia. This currency pair tends to be the focus of about 90% of our clients. It fluctuates approximately 18% per annum, which has a direct impact on the profit margins of ecommerce businesses making ad hoc regular monthly payments.

For a small business, it’s crucial to account for this early on. Just this year, we’ve seen highs of around 70-140 and lows around 65-60. That’s a six-cent swing in a five-month period up to May, which could equate to a variation of around $12,000 of your Australian dollars on a purchase of $100,000 US dollars each month. This is something that businesses need to take into account when transacting globally.

The difference it can make

In terms of what I’ve just mentioned, let’s consider a real-life example where a consumer was looking to purchase a property in the US for $1 million USD. Over a three week period, the Australian vs. the US dollar dropped, and the difference potentially cost the client around $90,000 Australian dollars.

One thing I want to make clear is that at OFX, we cannot predict the future. We can’t tell you what rates are going to happen, and where the currency is going to go. However, if you’ve got these kinds of outgoings every month or receivables, you can speak with one of our OFX experts to understand the trend and make an informed decision. They can help you understand historically, what are the highs, what are the lows, and paint a picture around the market within your interest to trade at a given moment.

Limit orders

First and foremost, if you’re a business transacting globally, you’ve more than likely already set a rate that you’re looking to achieve for the year. And you’ll set that against your financials as a worst case scenario. And off that number, you’re going to be working out your profit margins. In the worst case, you’re going to be trying to achieve that rate but looking to exceed it where possible.

And if you’re doing spot payments every month, the market’s really dictating to you what rate you’re going to get. This is especially true if you’re making the same payments every month to your suppliers in China on the same dates, because the market has and will continue to be volatile. With limit orders, you set a desirable rate over a certain period, which helps you secure a more favorable exchange rate even during the peak of volatility, usually outside our time zone.

For example, if you had a payment 30 days from now for $100,000 USD to China, between now and then you could set an order. For example, the rate is 70 cents right now, you could place an order for 71 or 70.5 cents, and if that rate is ever hit, it will purchase those US dollars for you.

The advantage here is that being in Australia and the APAC region, we don’t tend to see the highest period of volatility in our time zone. That period of volatility is normally when we’re asleep. And this is where limit orders work really, really well in trying to just average up your currency exchange rate.

The next OFX solution—and probably the most popular solution—that businesses use in Australia is the forward exchange contract, or FEC for short. This is a zero risk product, here’s what that means:

Say the rate today was 70 cents, and your business has set a worst case rate of 68 cents, and you could achieve 2 cents higher today, you could essentially lock in that rate for up to 12 months. This basically means any upcoming payments due for the next 12 months, no matter if the rate goes up or down, you’re obligated at 70 cents to purchase that currency every month. This completely eliminates the FX risk to your business.

The only potential downside is that you are obligated at the rate you lock in, whether the rate goes up or down. What we find that a lot of clients do is use a percentage of their overall currency exposure to use in a forward exchange contract. For example, you could lock up 75% of your exposure over the next 12 months, and the other 25% you could use with limit orders or the spot market to try and achieve a higher average exchange rate.

If you’re an ecommerce business based in Australia and you’re now looking to expand globally, there’s going to be some things you’ll need to take into account very, very quickly and one of them is your receivables in different market places around the world.

One of the main products OFX offers for ecommerce businesses is global currency accounts. This virtual account allows businesses to collect currencies in different marketplaces, helping you avoid unnecessary conversion fees from marketplaces like Amazon, eBay, and Shopify that would be auto-converting the currency back into Australian dollars for you whenever they would be being received and charging you high fees.

By using a virtual account, you can add US account details to your marketplace or sales channel and then any of your customers in those geographies will be able to pay directly into your US dollar account with OFX.

Once that money is there, you can then do with it as you wish. You can leave the US dollars in the US dollar accounts. You could repatriate the money back into Australia and into Australian dollars when the rate was in your favor. Or, if you’re an Australian business importing from China (or anywhere else you need US dollars), you could pay that USD straight to your USD supplier without double dipping or exchanging currency twice to try and reduce the fees.

So there’s a few ideas that I’ve gone over in a very short time frame.

Amy: Thanks for that Oliver. I imagine it’s common to perceive market volatility as a recent phenomenon, when in reality, it’s been a persistent aspect of markets. What’s more surprising is the high fees certain marketplaces charge and the impact of good exchange rates.

3. Incorrectly handling the Cost of Goods Sold (COGS)

The last mistake that ecommerce sellers can make with their accounting is incorrectly handling the Cost of Goods sold (COGS). This is quite a big one because generally for ecommerce sellers, purchasing COGS or inventory will be one of their biggest expenses as a business.

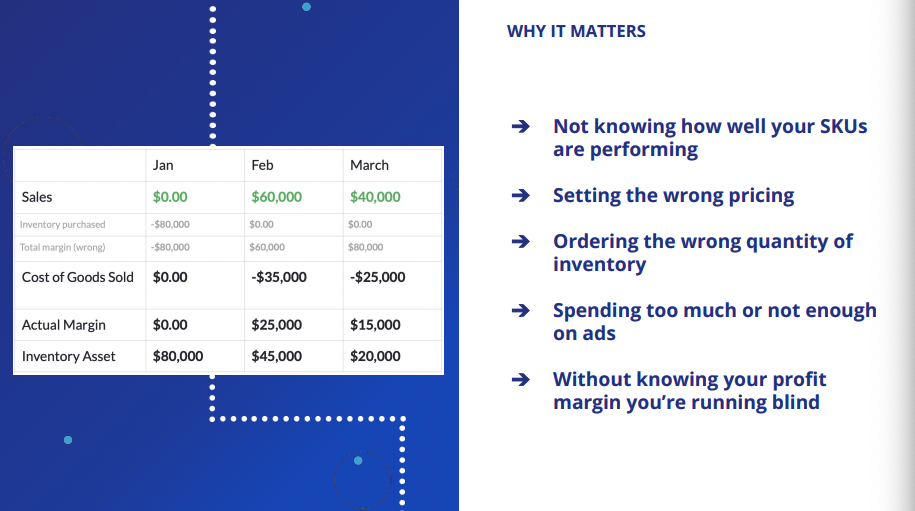

A common case is that sellers will purchase their inventory, as in the example above, in January and month one. Because they didn’t actually do any sales in that month, they will incorrectly say that their margin was negative $80,000. But that doesn’t really paint a very clear picture of what actually happened in that month.

Similarly, in February, they actually did $60,000 in sales, which is awesome. They had all the stock from January, so they didn’t worry about tracking any COGS in that month. And so their margin was $60,000, which looks incredible—especially off the back of the negative $80,000 month in January. The same pattern continues in March with sales and margin both being $40,000.

So if you were looking at this business, it would be pretty hard to figure out what was going on purely from the total margin line. The appropriate way to handle this situation is to account for COGS as they are sold.

This is important because otherwise it leads to you:

- Not knowing how well your SKUs are performing

- Setting the wrong pricing

- Ordering the wrong quantity of inventory

- Spending too much or not enough on ads

- Not knowing your profit margin and running blind

Ideally, the value of COGS or inventory should be retained in an inventory asset account. This is where A2X can assist, and I strongly suggest discussing this with an ecommerce accountant. In this example, you can see that in January, there were no sales.

Even though they purchased the inventory in that period, they didn’t sell any. So it’s sitting in an inventory asset account and their margin was $0. Then in February they did $60,000 in sales, selling $35,000 worth of stock, meaning their margin was $25,000. And there was a similar story there in March but with slightly less in sales. You can see that the margins are pretty consistent.

So if you have a look, it’s giving you a far better idea of how your business is actually performing as opposed to previously where it was just massive fluctuations.

The other benefit is that you’re also tracking your COGS or inventory as an asset, which can be really beneficial for other things like applying for a loan. Understanding your business performance and having accurate insight into your margins is crucial. Otherwise, you might misjudge your SKU performance or set wrong prices, assuming that the income was higher due to unaccounted COGS expenses. Misinterpretations like these could lead to ordering the wrong inventory quantity, overspending on ads, and failing to understand your profit margin.

It could be tempting to pour a little more into advertising or not necessarily have that visibility into how the month actually went. You could then also be setting your prices wrong. So you might be thinking, “okay, well, we’re making all of this. I don’t necessarily need to put my prices up.” But this is because you’re not actually accounting for the expense of those COGS against the income in that month.

You could be ordering the wrong quantity. It can be really difficult to know how much COGs you have and when you need to be ordering more. And also, it could be very easy to look at the last month and think, “I had a great month, $80,000 in sales, maybe I should order a bit more stock.” However, these scenarios can wreak havoc on your inventory and you’ll likely end up with more inventory than what you potentially need.

And as I mentioned, you might be spending too much on ads. This can happen when you’re seeing a great month and pouring money into advertising without really recognizing that that could have a negative impact. And then you’re also not going to know your profit margin. So you’re running with inaccurate numbers and potentially making decisions that could be really impacting your business.

The good news is that A2X, an ecommerce accounting app compatible with platforms like Amazon, Shopify, eBay, Etsy, Walmart, and BigCommerce, can help automate and accurately manage sales and tax classification and COGS, thereby mitigating these mistakes.

A2X pulls your uncategorized sales, fees, taxes and refunds and more from Shopify. A2X will plug into your Shopify store and pull in all of those individual transactions and categorize them into organized summaries.

Auto-categorize the data into accurate summaries that span the right time periods

So these summaries will cover the right time period and they’ll also be consolidated. So you get one payout in your bank account from Amazon or Shopify and the entry from A2X will cover the exact same period that you’ve been paid for. A2X offers consolidated, accurate entries covering the same transactions.

Perfectly matches payouts in Xero with A2X summaries for one-click reconciliation

One of A2X’s key benefits is its perfect alignment with the amount you receive in your bank account. For example, if you use Xero, you can match payouts from Shopify with the corresponding A2X entry in your bank reconciliation screen. With one click on the green ‘match,’ the reconciliation process is complete.

Furthermore, A2X works seamlessly with tools like OFX. If you receive payments into your overseas Shopify bank account via OFX and transfer it to your Australian bank account, A2X accommodates this situation using a clearing account. This ensures accurate accounting and reconciliation of transactions, providing you with the improved visibility we’ve spoken about today.

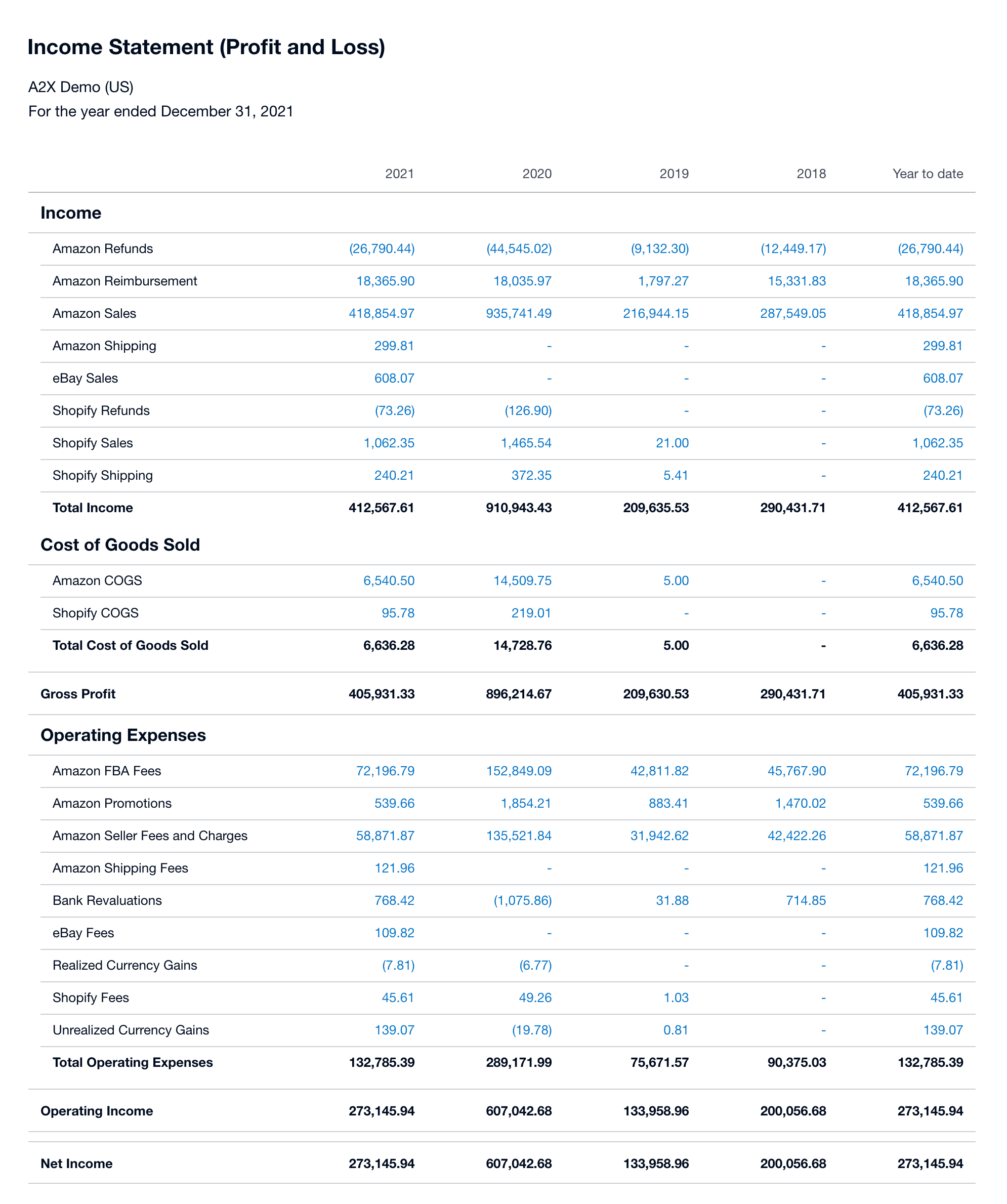

Increase visibility with detailed Profit & Loss Statements you can trust

So all of the numbers that come through from A2X will be posted through into your Profit & Loss statement, and some of them will potentially be in the balance sheet as well.

Below you’ll see what a general Profit & Loss report within Xero looks like. You can see that it’s really nicely broken down. All the numbers from A2X get posted into your P&L statement, with some also showing on your balance sheet. A general Profit & Loss report in Xero provides a comprehensive breakdown

Why use A2X?

As a little bit of a wrap up, let’s explore here why sellers would choose A2X.

Why A2X?

- Automate monthly bookkeeping: A2X automatically sends entries, easing the bookkeeping process.

- Know your profitable SKUs: With better visibility, you can understand how your business and individual SKUs are performing relative to your COGS.

- Visibility on your financials: Access to clear, accurate financial data can inform better business decisions.

- Accurate P&L: Have confidence in your numbers.

- Higher exit price: If you plan to sell your business in the future, accurate financials could help you achieve a better selling price.

The A2X Directory

Additionally, A2X provides an ecommerce accounting directory. If you’re looking for an ecommerce accountant that specializes in Amazon or Shopify and works in your region, this directory is a free-to-use, one-stop-shop that can help. Many of these accountants also use OFX, providing a comprehensive ecommerce accounting solution.

Lastly, you can try A2X for free. We’ve got a free trial available on our website that you can sign up for.

Q&A session

Can you explain a little about the cost of good sold (COGS) tracking?

We covered this with quite a lot of detail within the presentation about how to accurately track your COGS. There’s a whole art to correctly accounting for inventory and COGS and I would definitely recommend that you speak to an ecommerce accountant about this. That said, A2X does have a method where it can send over a COGS entry to your Xero or QuickBooks Online to make sure that you’re accounting for COGS as they’re sold.

What are the fees and transaction costs of setting up a global currency account?

Oliver: There are none! In short, OFX makes its money on the margin and it’s a highly competitive margin. But in terms of transaction fees and set up costs, there’s nothing for setting up a global currency account.

What happens if I book a forward and the rate gets better?

Which is a great question and one that we get a lot. If you book a forward and the rate improves, you still have to use that forward. While it might feel like you’re missing out, consider that if the rate has improved, the next time you book a forward, you’re in a stronger position than you were previously.

Even if the rate goes down and you’re left with a higher forward rate, remember that forwards can be booked for three, six, or 12 months, and obviously we hope your business will last much longer than that. So, if the rate increases and you’ve booked a forward at a lower rate, the next time you book a forward, the rate should be more favorable and you’ll actually be in a better position than you were previously.

I’d argue that if the rate goes down and you use your forward rate, sometimes you can be worse off in the long run. Definitely looking it out over the longer term is a more of an advantage for your business.

I wanted to confirm what happens when a purchase is made on Shopify, but it was paid through PayPal Express checkout.

What happens is A2X is connected to your Shopify store. So any orders that come through and are paid via Shopify, we will reconcile those perfectly down to the cent.

If it comes through another payment gateway—such as PayPal—A2X will still see that transaction and it’ll still see any shipping, Shopify fees, returns, or anything that occurred with that transaction. The only thing it won’t see are any fees that PayPal charges you for that transaction. So for example, the order is placed, then the money goes from Shopify to PayPal, and then PayPal puts that money into the seller’s bank account.

A2X does have a method that picks up all payments made via these payment gateways. So, for transactions via PayPal, A2X will send a PayPal entry to your accounting system, which you can reconcile using a clearing account. The value that A2X sends might be slightly higher than what you actually receive from PayPal, due to PayPal’s fees. So, for this example, A2X might see $500 but you might only receive $475 from PayPal due to them taking $25 in fees, and to fix this, you just need to do a manual entry.

To summarize, A2X can help account for any payment gateway on your website, but you will need to account for those fees manually.

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there