How to Integrate Walmart Seller Center with QuickBooks Online

Integrating Walmart Seller Center with QuickBooks Online is a great way to manage Walmart seller bookkeeping efficiently and accurately.

Walmart marketplace sellers and accountants and bookkeepers who work with Walmart sellers will understand that bookkeeping for Walmart can be complicated due to the fact that Walmart settlements are not just made up of sales – they’re actually a combination of sales, fees, refunds, and other transactions.

Simply coding a Walmart settlement to a ‘Sales’ account is incorrect, and can lead to a number of issues.

That’s how setting up an integration between Walmart and QuickBooks Online (QBO) can help. An integration will allow Walmart data to be summarized and categorized accurately to your Chart of Accounts in QBO.

In this article, we’ll cover how to integrate Walmart Seller Center with QuickBooks Online.

Key takeaways

- Setting up an integration between Walmart and QuickBooks simply means connecting these two tools so that your Walmart transaction data can flow automatically into QBO.

- There are a couple of options available for integrating Walmart with QBO (outlined below). The option you choose should ensure you get the most accurate data into QuickBooks.

- Setting up an integration between Walmart and QuickBooks with A2X is easy and takes just a few steps.

Table of Contents

Integrate Walmart and QuickBooks Online for accurate accounting

A2X auto-categorizes your Walmart sales, fees, taxes, and more into accurate summaries that make reconciliation in QuickBooks Online a breeze.

Try A2X today

Does QuickBooks integrate with Walmart?

QuickBooks can integrate with Walmart Seller Center using an app or a tool.

Integrating Walmart with QuickBooks means setting up a connection between these two tools so that Walmart transaction data can be quickly, easily, and accurately reconciled in QuickBooks.

How to integrate Walmart with QuickBooks

There are a couple of different tools that you can use to establish a connection between Walmart and QuickBooks.

The one you choose will depend on your Walmart business’s volume of orders and unique needs.

Perhaps one of the most important considerations when choosing an integration tool is accuracy.

Focus on accuracy when choosing a solution

As mentioned, bookkeeping for Walmart can be complicated.

Walmart settlements are made up of a combination of fees, refunds, taxes, and other transactions. Recording them properly – and catching every type of transaction – is critical.

Accurate accounting and bookkeeping can help Walmart sellers:

- Maintain tax compliance: Accurate financial records are necessary for reporting income and expenses on tax returns.

- Understand business performance: By accurately tracking revenues, costs, and profits via bookkeeping, Walmart sellers can understand which products are most profitable, seasonal trends, and other significant numbers.

- Plan and budget: Accurate records can allow Walmart sellers to forecast future revenues and expenses, aiding in budgeting and financial planning. This is essential for sustainable business growth and for making informed business decisions.

- Access to financing: If a Walmart seller seeks financing or investment, accurate financial records are critical. Banks and investors will require detailed financial statements to assess the health and viability of the business.

- Identify risks: Reliable financial information will help you understand if something seems unusual and you need to take action.

Manual data entry or choosing the wrong integration tool can make it difficult to get the accurate numbers you need to accomplish all of the items listed above.

With this in mind, Walmart sellers will likely want to prioritize accuracy when choosing an integration tool to connect with QuickBooks.

Integration tools

There are two primary options when it comes to tools that can integrate Walmart with QBO:

- Data syncing apps

- An accounting automation tool designed specifically to reconcile your Walmart payouts in QuickBooks Online, such as A2X

You only need to choose one option, and the one you choose should best fit your unique business requirements. Read on for more details about each option below.

Use a data syncing app

Data syncing apps are tools that are designed to bring data from one platform into another. When considering Walmart and QuickBooks, for example, you could set up a workflow where every time an order goes through, a journal entry or sales receipt is generated in QuickBooks.

They are often a low-cost option for businesses with a low volume of sales. However, you might run into some challenges – particularly with accuracy and reconciliation – if your order volume begins to increase.

For example:

- They might only post data for individual orders, which could overwhelm your accounting system.

- They might not identify every kind of transaction, which can make it challenging to achieve accurate financials and get a clear picture of your income or expenses.

- Sometimes, they’re not designed specifically for accounting and bookkeeping, so reconciliation can become time-consuming.

Use A2X to integrate Walmart and QBO

A2X is an accounting automation tool designed specifically for easy and accurate ecommerce reconciliation.

A2X can integrate Walmart with QuickBooks Online. It’s also suitable for multi-channel sellers, with connections available for Amazon, Shopify, Etsy, and eBay.

Here’s how it works:

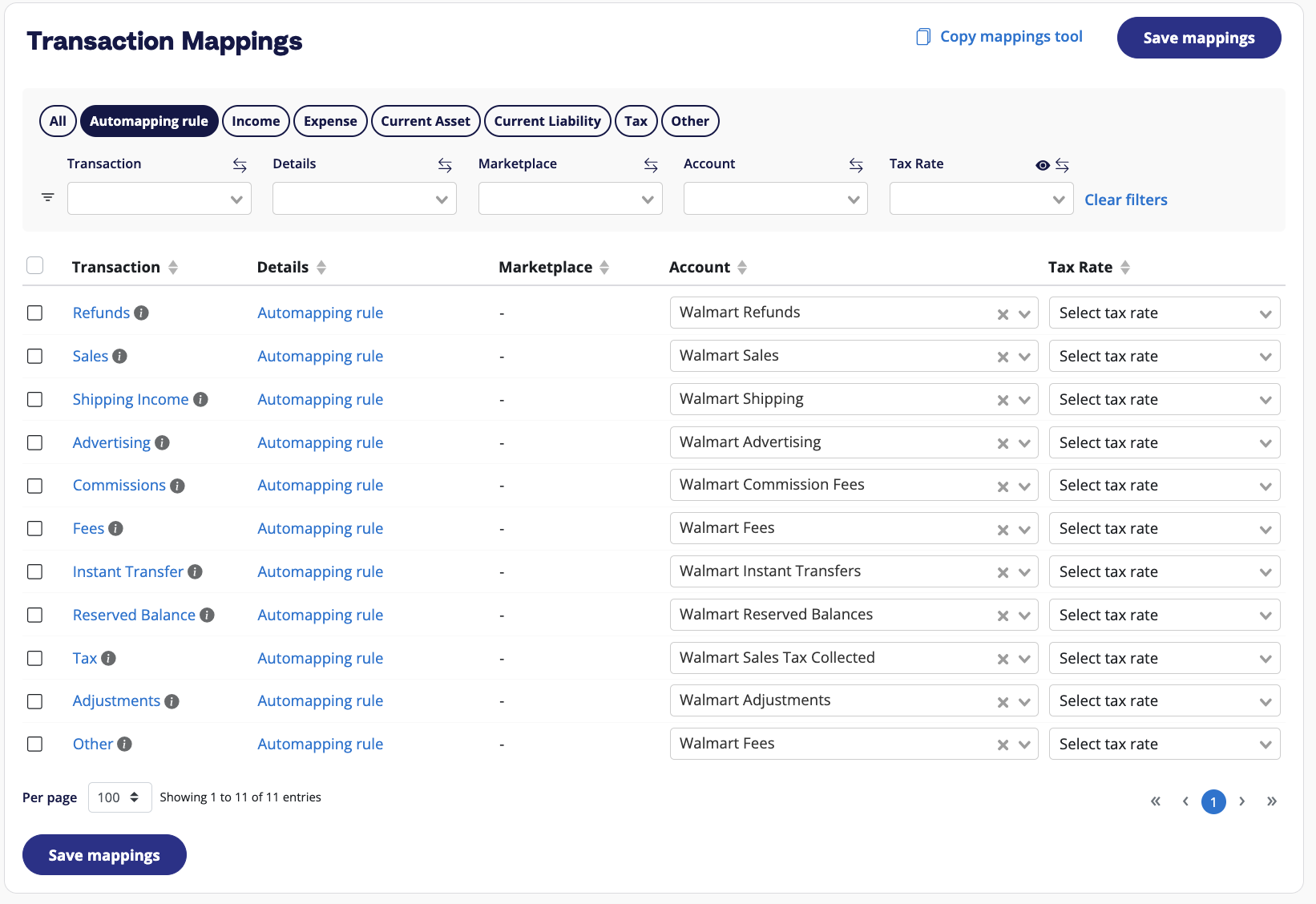

- Once you connect A2X to QuickBooks Online and Walmart, you “map” how you want your Walmart transactions to be coded to your Chart of Accounts in QBO.

- From there, A2X will code every transaction according to your settings moving forward. A2X can recognize every Walmart transaction type, enabling accurate accounting and bookkeeping.

- A2X organizes settlement data into summaries that are sent to QBO, and perfectly reconcile with the settlement deposits in your bank account.

Accurate Walmart bookkeeping can be completed in just a few steps with A2X. Follow the steps below to set it up!

Step-by-step guide: How to integrate Walmart and QuickBooks Online with A2X

Watch this video to learn how to integrate Walmart and QBO using A2X, then follow the steps below for more details.

Step 1: Sign up for A2X

Sign up for an A2X free trial here – click ‘Try A2X for free’ in the top right corner.

You’ll be prompted to select which sales channel you’d like to connect to first. Select ‘Walmart’.

Sign up via your preferred sign in method (e.g., Gmail or Intuit), then follow the rest of the prompts and provide the necessary information to set up your A2X account.

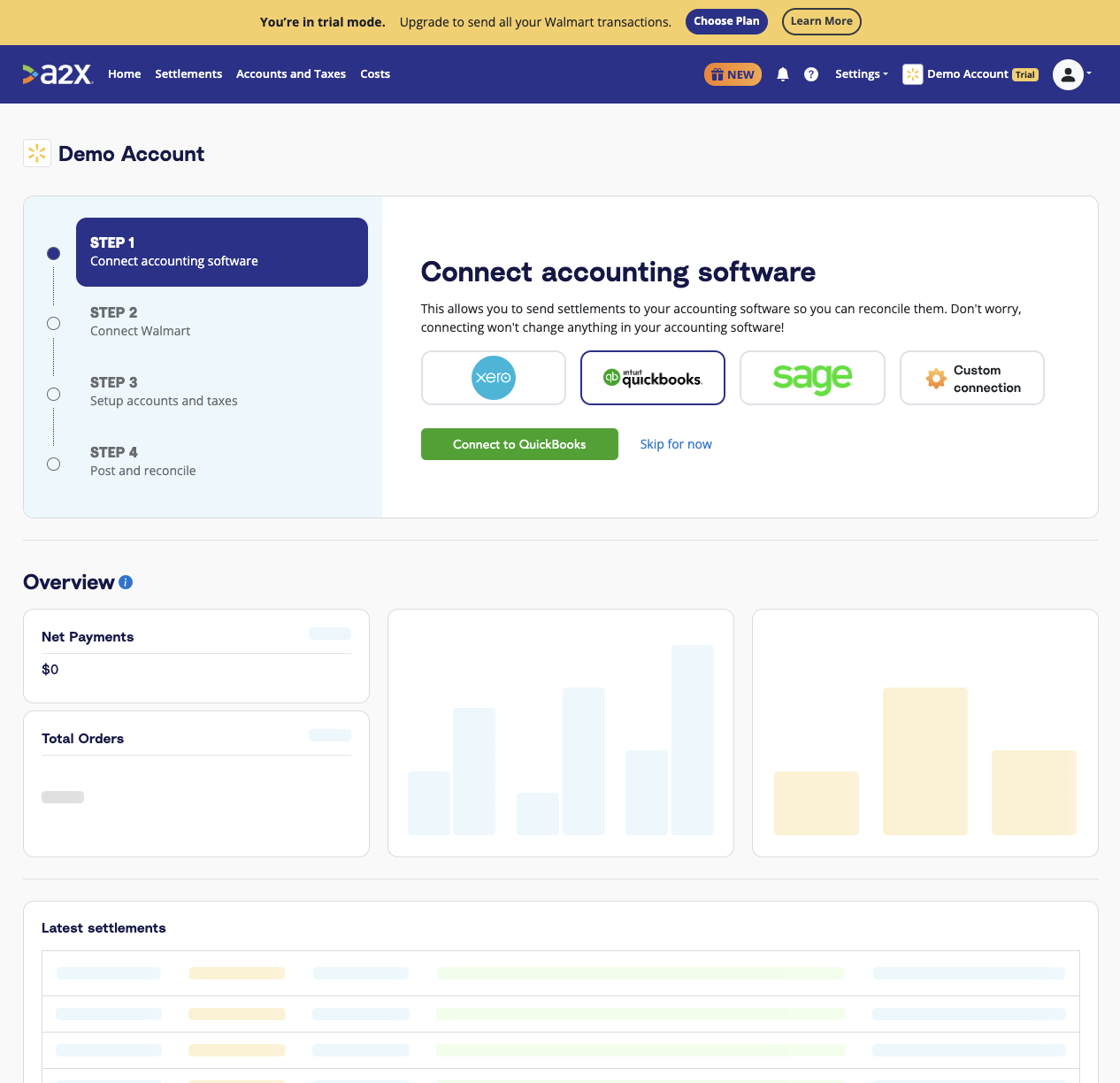

You’ll land on the A2X dashboard.

Note – Your account will be in ‘free trial mode’ until you choose to subscribe. In ‘free trial mode’, you’ll have access to try out most of A2X’s features and functionality, with some limitations.

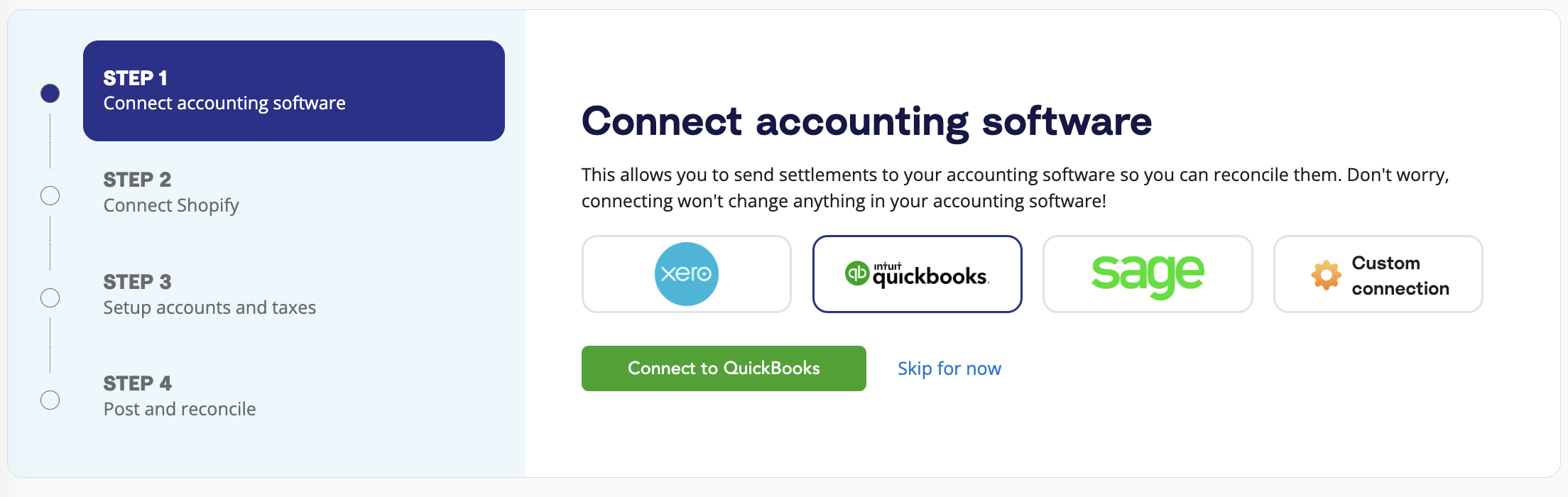

Step 2: Connect to QuickBooks Online

On the A2X dashboard, you’ll see a prompt to connect to your accounting software.

To connect to QuickBooks: Click on the QuickBooks logo, then click ‘Connect to QuickBooks’.

You may be prompted to sign in to QuickBooks and enable permissions for A2X to post to QBO (don’t worry – A2X won’t post anything until you’re ready).

You’ll also be prompted to select the bank/credit card accounts to which you’d like A2X to post journal entries.

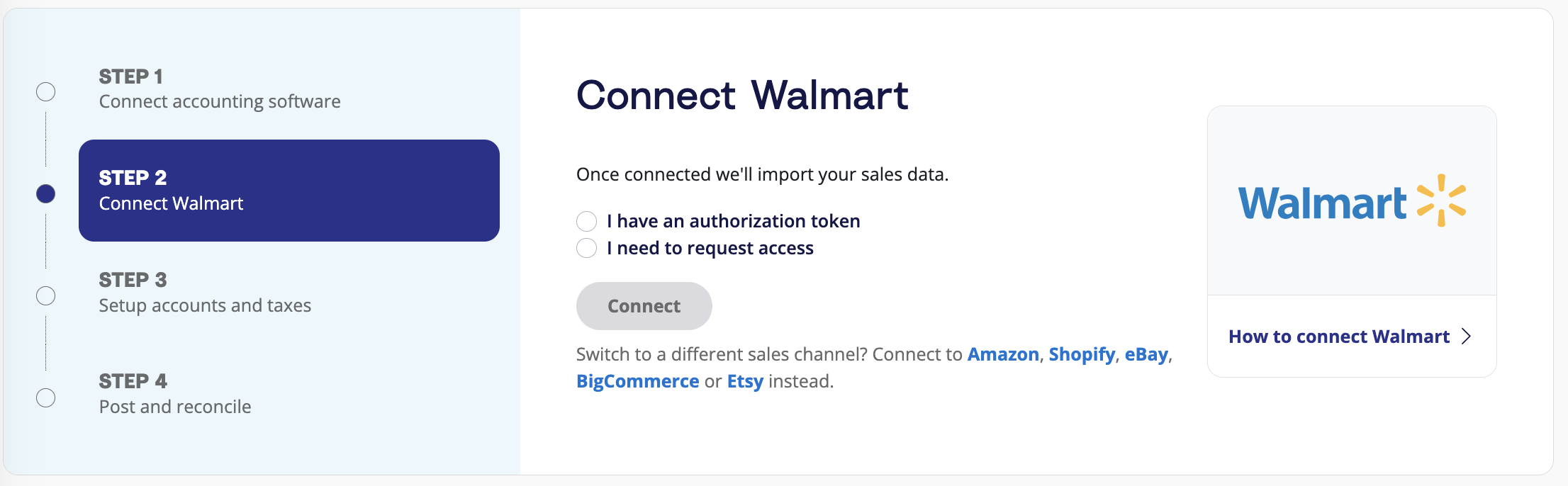

Step 3: Connect to Walmart

Once you’ve connected A2X to QuickBooks, it’s time to connect to Walmart.

You have two options:

- Option 1: If you are the store owner or have access to the Walmart store you are connecting, select ‘I have an authorization token’. Follow the prompts to connect to Walmart. Note – you’ll need your Walmart Client ID and Client Secret to complete this step.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

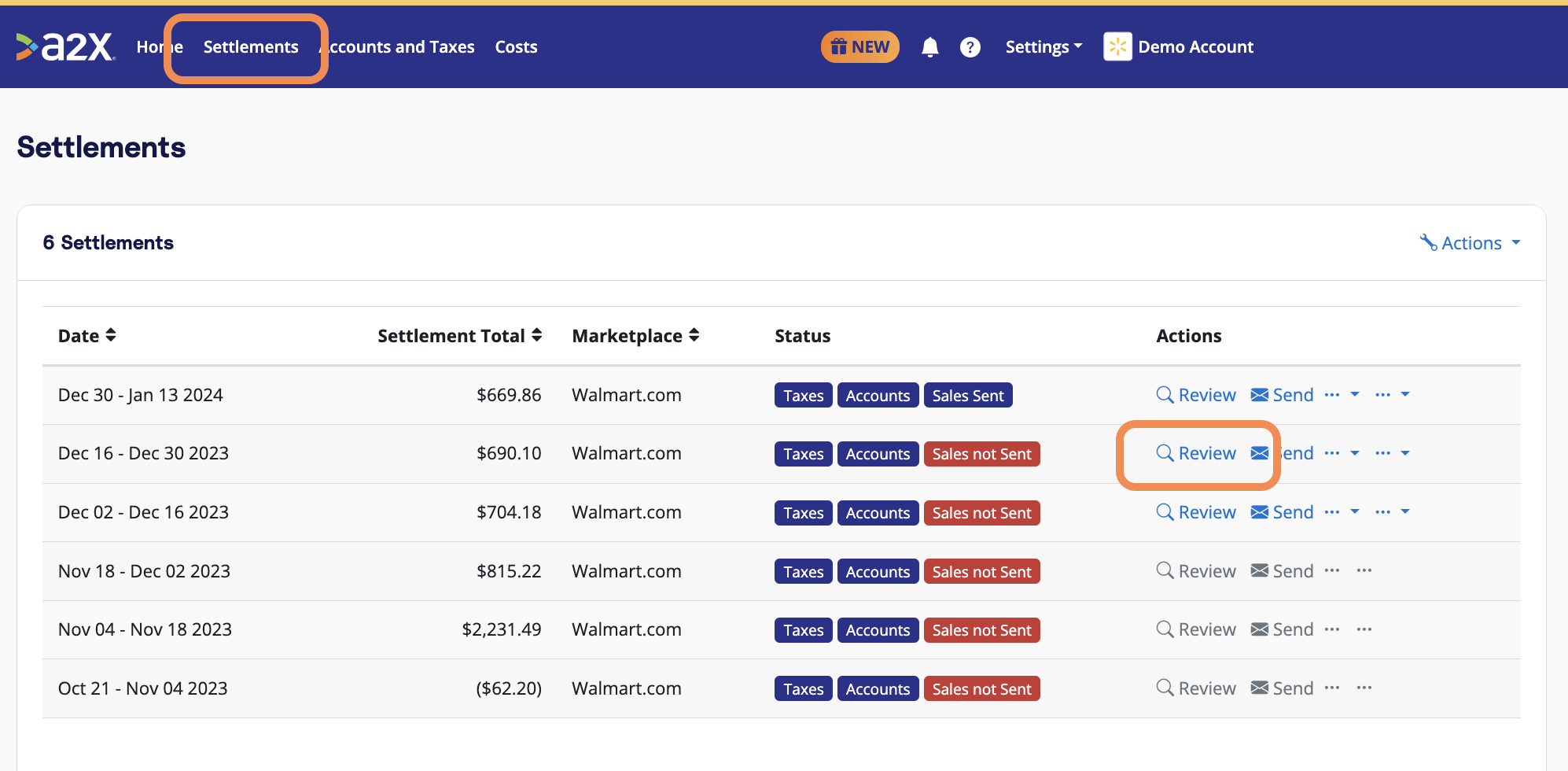

After permission is granted, A2X will return you to your A2X dashboard, and your settlement data will automatically start to be fetched by A2X (which you can see in the ‘Settlements’ tab).

Step 4: Map accounts and taxes

Mapping accounts and taxes is the process of selecting which account in the Chart of Accounts you want each transaction type to be posted to in QuickBooks Online for all settlements moving forward. For example, sales transactions will be posted to an Walmart Sales account.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to correctly map accounts and taxes according to your specific business needs.

A2X can automate this process for you, or you can map it yourself.

- Click ‘Setup Account and Taxes’ on the A2X dashboard.

- The first time you visit the Accounts and Taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted setup or Custom setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in QuickBooks Online and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

Step 5: Review and post to QuickBooks

The good news? You’re done the majority of your A2X setup!

The even better news? You can now move on to routine bookkeeping for Walmart and QuickBooks with A2X.

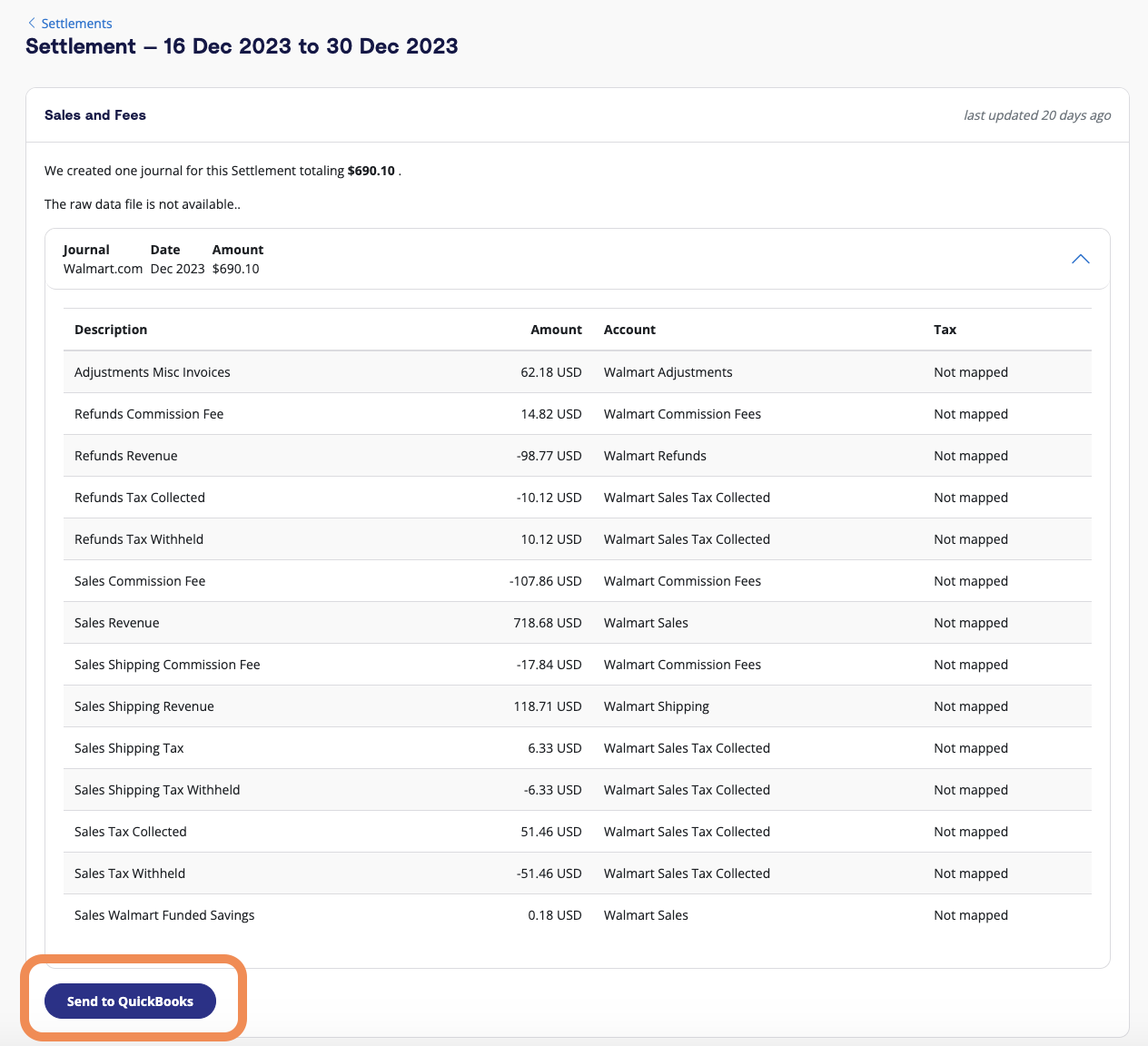

To send your first journal entry from A2X to QuickBooks, go to the ‘Settlements’ tab.

Click ‘Review’ beside the settlement that you wish to review and post to QBO.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to QuickBooks’ when you’re ready.

Note – auto-posting is available when you’re ready to use this feature.

Step 6: Reconcile in QuickBooks

Log in to QuickBooks.

Look for the Walmart deposit in the bank feed. You should also see the journal entry from A2X beside it, ready to be reconciled!

Click ‘Match’, and the transaction will be reconciled.

And you’re done! Walmart bookkeeping really can be that easy.

Ready to integrate Walmart and QuickBooks Online using A2X? Start a free trial!

Integrate Walmart and QuickBooks Online for accurate accounting

A2X auto-categorizes your Walmart sales, fees, taxes, and more into accurate summaries that make reconciliation in QuickBooks Online a breeze.

Try A2X today