Amazon Seller Fees & Transactions: A Comprehensive List

Written by: Allanah Faherty

Updated on August 6, 2024

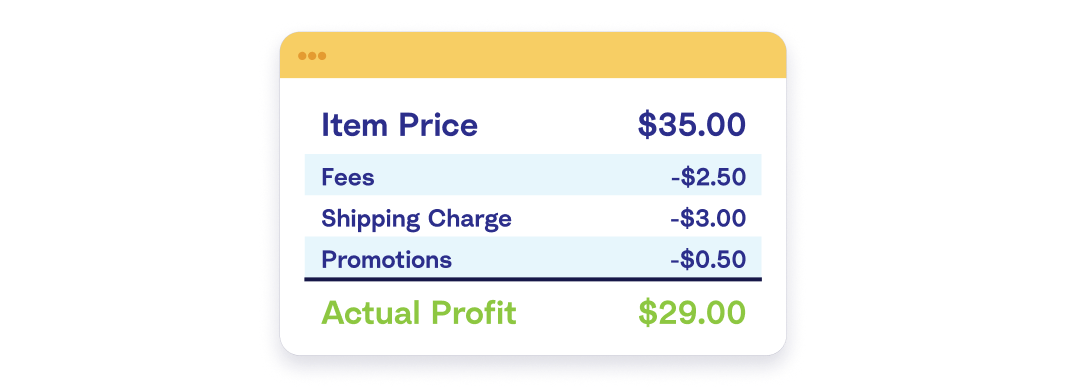

Amazon sellers might be aware that Amazon settlements aren’t made up of just sales – they’re actually a combination of sales, fees, and other transactions.

Understanding the Amazon seller fees you can expect to pay on Seller Central is crucial to your bottom line. You don’t want to be paying more in fees than you’re making in profit!

It’s equally as important to understand all of the other transactions that make up your settlement so that you can account for them correctly, ensure you’re compliant with applicable taxes, and achieve accurate financial reporting (which can help you get a loan or investment and enable you to get better business insights).

In this guide, we break down the fees and transactions that make up your Seller statement. You’ll find the Amazon seller fee and transaction structure by category, complete with the name of each fee or transaction, and a description of what it is.

Bookmark this list to anticipate your fees, interpret your statements, and raise any queries with Amazon if you suspect there has been a mistake.

Important note: Be sure to check Amazon Seller Central for further details and information about fees and transactions, and how they might be applicable to your store and the region(s) you sell in.

Need help keeping track of your Amazon fees? Skip to the bottom to see how A2X for Amazon & QuickBooks Online or Xero can make sense of all these transactions for you. Having trouble estimating your fees before you sell? Try our Amazon fee calculator guide for the tools you need to plan for your Amazon seller fees. |

Amazon fee & transaction categories

We’ve sorted our list into the following categories to help you better understand each fee/transaction and how to potentially manage them:

- Adjustments

- Delivery & Transport Fees

- Commissions & Selling Fees

- Fulfillment & Storage Fees

- Gift Wrap Fees

- Sales, Refunds, Promotions and Shipping

- Reserve Balances

- Payable to Amazon

- Other Fees

- Reimbursements

- Shipping Fees

- Subscription Fees

- Taxes

Terminology

Item Price and Item Price Principal

In Amazon Seller Central reports, you will likely see the term “Item Price”. “Item Price” refers to the price at which an item is listed for sale before any additional fees, shipping charges, or promotions are applied – i.e., the base price that a buyer sees for the product on its listing page.

When referring to financial transactions, the term “Principal” often denotes the primary or original amount. So, “Item Price Principal” also indicates the original price of an item sold on Amazon.

When reviewing sales reports or transaction details, the “Item Price” can help sellers understand the gross revenue from the sale of their products before accounting for Amazon’s fees and other associated costs.

Other Transaction

Many transactions are labeled as “Other Transaction”. This typically refers to a variety of financial activities that don’t fall under standard transaction categories like sales, refunds, or reimbursements. Note that Amazon Pay transactions are usually also categorized as “Other”.

Reach out to Amazon Seller Support to better understand transactions that apply to your specific marketplace.

Amazon Seller Marketplace and FBA Fees & Transactions Breakdown

Adjustments

Changes to the original transaction amounts, often due to errors or discrepancies.

Learn more about Amazon adjustments and how to account for them.

Adjustment Item Price Restocking Fee | Amazon sellers can charge a restocking fee when a buyer returns an item. For example, the adjustment item price restocking fee may occur when a buyer changes their mind about a purchase outside of the return window, or if the item has been taken out of its original packaging. The fee varies depending on the condition in which the product is returned, the circumstances, and the item type. Once you have figured out your restocking fee and have subtracted it from the refund total, this will provide you with your partial refund total to the customer. Full guidelines here. |

Other Transaction Balance Adjustment | A balance adjustment can be made when an inventory reimbursement is reversed. This might occur when a customer does not return a unit, and then Amazon finds the unit (or it is finally returned by the customer). Amazon will reverse the initial reimbursement and file it under Other > Balance adjustment. |

Liquidations Adjustments Item Price Principal | An adjustment related to the primary price of an item that's being liquidated or sold off at a discount on Amazon. You will still be paid out for the sale of this item, but the item is being sold at a lower rate. |

Other Transaction Misc Adjustment | A miscellaneous adjustment that that may not qualify to be associated with any other existing adjustment items and could be due to a number of reasons, including but not limited to: transaction corrections made by Amazon, adjustments based on specific issues, circumstances or agreements between the seller and Amazon, certain promotional rebates or discounts, and corrections for previous billing or transactional errors. |

Delivery & Transport Fees

Costs related to the shipping of products, either to Amazon fulfillment centers or directly to customers if not using FBA. Many of the fees within this category might sound similar, but can differ based on specific types of transportation or other scenarios.

Learn more about Amazon delivery and transport fees and how to account for them.

Non-Amazon Order Shipping Fees | Refers to the fees associated with using Amazon's Multi-Channel Fulfillment (MCF) service. MCF allows sellers to store their products in Amazon's fulfillment centers, and when orders are received on other sales channels outside of Amazon (like a seller's own website or other marketplaces), Amazon will pick, pack, and ship the products on behalf of the seller. The fees for this service are typically higher than standard FBA fees because it's designed for orders not originating from the Amazon marketplace. |

Other Transaction Inbound Transportation Charge | This fee is associated with the cost of shipping items to Amazon’s fulfillment centers and includes the broader expenses related to getting your products into Amazon’s network. ‘Inbound’ refers to the shipment that you send to Amazon. This could be coming from you, as an Amazon Seller directly, or from your manufacturer. |

Other Transaction Inbound Transportation Fee | Refers to the costs associated with shipping inventory to Amazon's Fulfillment Centers using Amazon's partnered carriers under the Fulfillment by Amazon (FBA) program. Unlike the “Other Transaction Inbound Transportation Charge,” it specifically refers to the cost incurred when you use Amazon’s shipping label service to send your items to their fulfillment centers. This service often offers discounted rates compared to standard carrier rates because of Amazon's bulk shipping agreements. |

FBA Transportation Fee | Historically, this term was used to describe the fee associated with using Amazon’s shipping services to send items to their fulfillment centers (similar to “Other Transaction Inbound Transportation Fee”). This transaction can still appear and likely relates to other various transportation costs under the FBA program. |

Other Transaction FBA Inbound Transportation Program Fee | Pertains to the fees or charges associated with the Amazon FBA Inbound Transportation Program (which offers discounted shipping options with partnered carriers for sellers to send inventory to their warehouses). This fee covers the negotiated carrier costs and any additional service fees for using the program. |

Commissions & Selling Fees

Referral fees that Amazon charges sellers for each sale, which can vary by product category.

Learn more about Amazon commission and selling fees and how to account for them.

Adjustment Item Fees Commission | Usually a reversal of a commission fee. Adjustment item fees are categorized by type and reason code. The code shows whether the adjustment to your item is an increase or decrease to your inventory, and whether it’s related to product changes, misplacement, ownership corrections, or found inventory. |

Adjustment Item Fees Refund Commission | A retained fee Amazon charges to sellers on refunds. This amount is held back as a refund administration fee. |

Refund Item Fees Commission | A fee charged by Amazon on refunded items. |

Order Item Fees Commission | A fee charged by Amazon for ordered items sold on their platform. |

Order Item Fees Gift Wrap Commission | If you’re an FBA seller and have enabled gift wrapping on your account as an option for your customers, Amazon will collect this fee and present it as your revenue. However, since Amazon does the gift wrapping service, they will receive a chargeback from you. |

A-to-z Guarantee Refund Item Fees Commission | The A-to-z guarantee is offered to customers by Amazon when third party sellers are involved. It’s there to maintain their level of customer service and expectations, and takes into account things like delivery timeframes, the condition of the items, and returns. When the issue cannot be resolved between the third party seller and the customer, Amazon will step in, and will charge a commission to do so. |

A-to-z Guarantee Refund Item Fees Refund Commission | A fee that relates to the reversal of the original referral fee charged to sellers when a buyer's claim under the A-to-z Guarantee is approved. In such cases, Amazon returns the commission to the seller since the sale is effectively nullified. However, other costs or penalties might still apply to the seller due to the claim. |

Liquidations Adjustments Item Fees Liquidations Brokerage Fee | An adjustment or fee related to the handling or brokerage of items sellers are liquidating on Amazon. For example, in cases where your inventory is damaged, lost, or not suitable for liquidations, Amazon might perform a reversal of the initial payment. |

Liquidations Item Fees Liquidations Brokerage Fee | Charges incurred by sellers for using Amazon's platform to liquidate or sell off inventory, with the "brokerage" aspect indicating a fee for facilitating or handling this process. |

Fulfillment & Storage Fees

Charges for using Amazon’s FBA service, which includes storage, packing, and shipping of products to customers.

Learn more about Amazon fulfillment and storage fees and how to account for them.

Order Item Fees FBA Per Order Fulfilment Fee | This Fulfilment by Amazon (FBA) fee is a per order fee, based on the dimensions and weight of your total order. Determine your product categories and size tier to calculate the fulfilment fee. |

Order Item Fees FBA Per Unit Fulfilment Fee | This Fulfillment by Amazon (FBA) fee is a per unit fee, based on the dimensions and weight of each item. Determine your product categories and size tier to calculate the fulfillment fee. |

Order Item Fees FBA Weight Based Fee | This Fulfilment by Amazon (FBA) fee is based on the weight of each order item. |

Non-Amazon Order Item Fees FBA Per Order Fulfilment Fee | This Fulfilment by Amazon (FBA) fee is a per order fee, based on the dimensions and weight of your total order for non-Amazon items. |

Non-Amazon Order Item Fees FBA Per Unit Fulfilment Fee | This Fulfilment by Amazon (FBA) fee is a per unit fee for non-Amazon items. |

Non-Amazon Order Shipment Fees FBA Transportation fee | This Fulfilment by Amazon (FBA) fee is a shipment and transportation fee of your total order for non-Amazon items. |

Other Transaction Storage Fee | A fee covering Amazon storage fees for your products. |

Other Transaction Storage Renewal Billing | A recurring charge for storing items in Amazon's FBA fulfillment centers. It includes monthly storage costs and additional fees for items stored for extended periods. |

Gift Wrap Fees

Refers to charges associated with the gift wrapping service that Amazon offers to customers on eligible products. Sellers are charged this fee when a customer opts for their product to be gift-wrapped before delivery.

Order Item Fees Gift Wrap Chargeback | Gift wrapping is optional for Amazon FBA sellers. If you opt for this, a buyer can select the gift wrap option at the checkout and pay for the additional service. Amazon will take care of the gift wrapping and charge back the cost to you for this. |

Order Item Price Gift Wrap | This is the price of gift wrapping on ordered items. |

Refund Item Fees Gift Wrap Chargeback | This is the gift wrapping charge-back fee on refunded items. |

Refund Item Price Gift Wrap | This is a gift wrapping fee on refunded items. |

Sales, Refunds, Promotions and Shipping

Various revenue transactions and adjustments – e.g., from product sales, refunds issued to customers, promotional discounts, and shipping.

Learn more about Amazon order revenue transactions and how to account for them.

Refund Item Price Goodwill | This is a refund payment given to a customer as a gesture of goodwill. For example, this could include an unhappy buyer with reasons Amazon deems as valid. In this situation, they will deduct the amount from either their own account or the seller’s, depending on the situation. |

Order Promotion Principal and Refund Promotion Principal | "Promotion" (or discounts/refunds given to the customer) can be on “Principal”, otherwise known as the item being sold, or on Shipping. |

Order Item Price Principal | This is the selling price for the ordered item. |

Refund Item Price Principal | This is the refunded selling price of your item. |

A-to-z Guarantee Refund Item Price Principal | This is the selling price amount of the refund to the buyer when the refund is handled by Amazon Pay. |

Order Item Price Shipping | This is a charge for shipping purchased through Amazon’s shipping service. |

Refund Item Price Return Shipping | A compensation to the customer for shipping when a buyer returns a refunded item. |

Refund Item Price Shipping | A compensation to the customer for shipping on a refunded item. |

Refund Promotion Shipping | A refund on the price of a promoted item when it’s returned by the buyer. |

Reserve Balances

Funds that Amazon withholds temporarily from a seller’s payments. These reserves act as a safeguard to cover potential claims, chargebacks, or other liabilities, and are released back to the seller after a specified period or condition is met.

Learn more about Amazon reserve balances and how to account for them.

Other Transaction Current Reserve Amount | This is an accounts receivable amount that is held and then released following action from the seller, on your next statement(s). It should be allocated to the Amazon Reserved Balances asset account in Xero or QuickBooks Online. |

Other Transaction Previous Reserve Amount Balance | This is the reserved amount Amazon eventually releases and it will show on your statement as ‘Previous Reserve Amount Balance’, which can be coded to the Amazon Reserved Balances asset account in Xero or QuickBooks Online. There will be a debit and a credit amount in the suspense account; these will cancel each other out. |

Payable to Amazon

Represents the total amount sellers owe to Amazon, covering a range of fees, charges, and other liabilities.

Learn more about Payable to Amazon transactions and how to account for them.

Other Transaction Payable to Amazon | This is the transaction amount owing to Amazon. If the amount is significant, Amazon will charge your credit card. If the amount is small, they will carry the debt into the next settlement and charge you for the amount you owe from the proceeds of your next settlement. |

Other Transaction Successful Charge | This Amazon charge is made via your credit card and it will be labeled as a 'Successful Charge' transaction. You will see it within a settlement or a single settlement only containing the 'Successful Charge' line. |

Other Transaction Transfer of Funds Unsuccessful | This transaction occurs when a transfer of funds is not successful due to incorrect bank information provided or some other error. |

Other Fees

Miscellaneous fees and transactions related to selling on Amazon.

Other Transaction Inventory Placement Service Fee | Amazon sometimes makes you split your inventory and send it to different fulfillment centers, which can get costly. This often applies when you ship small quantities. By activating the Inventory Placement Service Fee, you can send your shipment to a single designated warehouse, and Amazon will split up your inventory and distribute it accordingly. |

Non-Amazon Order Shipment Fees Brand Neutral Packaging Service Fee | This is a fee you pay to Amazon for providing brand-neutral packaging on your non-Amazon orders when they’re shipped to your customers. |

Non-Amazon Order Shipment Fees Multi Channel Fulfillment Brand Neutral Box Fee | This fee applies where you use Amazon’s logistics system to fulfill non-Amazon orders from other channels, such as your website. This also includes the fee for using a brand-neutral box. |

Other Miscellaneous Event | Miscellaneous Amazon fees. For example, sending inventory to Amazon without proper labeling. If your sold item gets returned to Amazon and it qualifies for free returns, Amazon will charge you a processing fee for that return. If your inventory remains unsold and stored in an Amazon warehouse for longer than six months, you are able to request Amazon to return it and pay the removal orders fee. |

Other Transaction Disposal Complete | This is a fee Amazon charges for the service of disposing of your inventory. You can manually dispose of products yourself if an item does not sell and it’s cheaper to throw it away, or if you sell food products that have expired. |

Other Transaction Removal Complete | Removal complete fees are charged per item removed. Removal completion typically takes 14 business days, and will appear in the ‘Payments’ report. |

Other Transaction Non-Subscription Fee Adjustment (Adj) | This fee could mean that Amazon hasn’t charged you what they should have as an Amazon seller on a non-subscription model. It could also mean they have overpaid you for something, and are now correcting this mistake. |

Other Transaction Warehouse Prep | There are packaging and prep requirements for products you ship to and store in Amazon fulfillment centers. This transaction is for the FBA prep service to have your Amazon items packaged properly for fulfillment. This helps with reducing delays and protecting your product for shipment. |

Liquidations Item Price Principal | A transaction (usually categorized as revenue) that relates to the base price of items sold under Amazon's liquidation program. |

Other Transaction Shipping Label Purchase for Return | Usually a purchase of a shipping label from a third-party shipping provider, made via Amazon. |

Reimbursements

When Amazon compensates sellers for various reasons, such as damaged inventory in their fulfillment center.

Learn more about Amazon reimbursements and how to account for them.

FBA Inventory Reimbursement Customer Return | This is when Amazon reimburses you for a damaged item in which they take possession of it. Amazon may sell the product for a discounted price. |

Other Transaction FBA Inventory Reimbursement Damaged: Warehouse | This is an amount Amazon will reimburse you for any items damaged at their warehouse. You can also request a reimbursement. |

FBA Inventory Reimbursement Lost: Inbound | This is a reimbursement fee that Amazon will cover if an item you send to them as part of the Fulfilment by Amazon service is lost or damaged by a carrier operated on behalf of Amazon. |

FBA Inventory Reimbursement Lost: Warehouse | This is a reimbursement fee that Amazon will cover if an item you send to the Amazon warehouse gets lost. |

Other Transaction FBA Inventory Reimbursement | This may show up as: “REVERSAL_REIMBURSEMENT”. This happens when Amazon takes back the cash payment for a previous reimbursement and gives you inventory instead. |

Other Transaction FBA Inventory Reimbursement | Appearing as: “WAREHOUSE_DAMAGE”. This is a reimbursement fee Amazon will cover if an item you send to the Amazon warehouse gets damaged. |

Shipping Fees

Shipping holdback and chargeback fees.

Learn more about Amazon seller shipping fees and how to account for them.

Adjustment Item Fees Shipping Chargeback | This is a similar concept to the Gift Wrap Chargeback fee. Amazon will take care of the shipping for you on the adjusted item, and remove the fee from your account with a chargeback to balance out the transaction. |

Order Item Fees Shipping Chargeback | Amazon will take care of the shipping for you on ordered item fees, and remove the fee from your account with a chargeback to balance out the transaction. |

Order Item Fees Shipping HB | This is also known as the Shipping Holdback Fee. You won’t need to cover this holdback if you use FBA (Fulfillment by Amazon) and Amazon is shipping your items. This is a small fee added, based on the type of item and for using Amazon as a platform and service. |

Refund Item Fees Shipping Chargeback | Amazon will take care of the shipping for you on refunded item fees, and will remove the fee from your account with a chargeback to balance out the transaction. |

Refund Item Fees Shipping HB | This is known as the Shipping Holdback Fee on refunded items. You won’t need to cover this holdback if you use FBA (Fulfillment by Amazon) and Amazon is shipping your items. This is a small fee added, based on the refunded item, and for using Amazon’s platform and service(s). |

Subscription Fees

Regular fees for using Amazon’s platform, like the monthly fee for a Professional Seller account.

Learn more about Amazon subscription fees and how to account for them.

Other Transaction Subscription Fee | There are various subscription models depending on what kind of seller you are. Individual sellers who sell under 40 units per month or do not have a monthly subscription fee are charged $1 per unit fee on every sale. Professional sellers pay $40 per month to receive full access to Amazon’s seller platform. The $1 per unit cost is removed in this case. Therefore, if you are selling more than 40 units per month, it makes sense to become a professional seller. |

Other Transaction Subscription Fee Correction | This fee means that Amazon has either not charged you what they should have as an Amazon Seller on a subscription model or that they have overpaid you for something and are now correcting this mistake. |

Taxes

Any tax-related transactions, either collected by Amazon on behalf of the seller, or taxes Amazon charges the seller.

Order Item Price Shipping Tax | A charge for Shipping and Handling tax. |

Refund Item Price Shipping Tax | A charge for Shipping and Handling tax on a refunded item. |

Order Item Price Gift Wrap Tax | Tax charges on gift wrapping on ordered items. |

Order Item Price Tax or Order Retro Charge Item Price Tax | Tax charges on ordered items. |

Refund Item Price Tax or Refund Retro Charge Item Price Tax | Tax charges on refunded items. |

Keep track of your Amazon fees

The number of Amazon seller fees and transaction types can be overwhelming.

And – trying to make sense of them via Amazon’s reports can be confusing and time-consuming.

A2X for Amazon captures each bank deposit and identifies all the fees that were taken before you received your final sum. A2X sends journal summaries of these breakdowns straight to your accounting software for easy reconciliation and reporting.

A2X also organizes your books via the accrual method, splitting statements out by month, so that you can not only report on your data, but forecast cash flow, too.

Feel in control of your Amazon fees from the start with A2X for Amazon.

Integrate Amazon and your accounting software for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today