Amazon Shipping Fees (and How to Account for Them)

Written by: Elspeth Cordray

February 28, 2025 • 9 min read

Updated on February 28, 2025.

Amazon seller fees and transactions span the entire selling journey. Given that shipping is an integral part of the selling (and buying) experience on Amazon, a large portion of Amazon fees and transactions are related to shipping.

Shipping-related fees and transactions can fall within a number of categories of Amazon transactions. In this guide, we’ll aim to clarify what they all mean, and how to account for them.

Key takeaways:

- Types of Amazon shipping fees – Amazon shipping-related fees fall into different categories, including delivery and transport fees (inbound shipping costs for FBA sellers), shipping income (revenue sellers earn when customers pay for shipping), and shipping fees (costs deducted from sellers for shipping services). These fees can appear as chargebacks or holdbacks.

- Chargebacks vs. Holdbacks:

- Chargebacks occur when Amazon ships an item on behalf of the seller. The initial shipping fee collected from the customer is recorded as income but then deducted as a chargeback since Amazon is responsible for fulfillment.

- Holdbacks (Shipping Holdback Fees) apply to sellers using the Merchant Fulfilled Network (MFN). This is a referral fee based on the product’s selling price and is not charged when using FBA.

- Accounting for shipping fees – A2X helps automate the accounting of Amazon shipping fees by integrating with accounting software like QuickBooks and Xero. It categorizes shipping-related transactions, assigns appropriate tax rates, and reconciles settlements to keep financial records accurate and up to date. This simplifies bookkeeping and ensures compliance with tax obligations.

What are Amazon shipping fees?

For sellers, Amazon shipping fees are costs related to shipping the product(s) that they sell.

Here’s a high-level overview to illustrate where shipping fees can come into play:

- If using FBA, Amazon sellers can pay for inbound shipping to get their products into Amazon’s warehouses.

- When a product is sold, the Amazon customer pays for shipping, and their shipping costs will vary based on a number of factors (item size and weight, delivery speed, whether or not they are an Amazon Prime member, etc.). This is recognized as shipping income for sellers.

- If using FBA, Amazon will then fulfill the order themselves or via a preferred third-party carrier. If not using FBA, the seller is responsible for shipping the order.

- Amazon will then charge the seller for the actual shipping cost, resulting in a chargeback or holdback fee.

Delivery and transport fees vs. shipping income vs. shipping fees

When it comes to Amazon shipping-related fees and transactions, the definitions and distinctions between different types of fees can get pretty murky.

We’ll aim to clear up some of the differences between three categories of transactions that apply to shipping: delivery and transport fees, shipping income, and shipping fees.

Delivery and transport fees

Delivery and transport fees typically include the fees incurred from shipping inventory inbound to Amazon warehouses, as well as various fees related to fulfillment and storage.

Shipping income

Shipping income-related transactions (e.g., Order Item Price Shipping) usually refer to the income sellers earn from charging shipping fees to customers. These transactions can typically be distinguished by containing the term “Item Price”, which refers to the base price of the item being sold on Amazon.

Shipping fees

These are the core shipping fees that Amazon sellers are charged when their items are shipped. Given that customers pay for shipping – which is “income” for sellers” (see above) – these fees are known as “chargebacks” or “holdbacks” for shipping costs.

The term “chargeback" refers to a fee that Amazon recovers from the seller when Amazon handles shipping on their behalf. When a customer pays for shipping, Amazon initially records this amount as income on the seller’s transaction. However, since Amazon is responsible for the actual shipping, they then apply a “shipping chargeback” on the same transaction. This chargeback is essentially Amazon reclaiming the shipping costs they incurred, balancing the transaction so that the seller does not receive income for a service (shipping) that Amazon provided.

The term “holdback” refers to the Shipping Holdback Fee (or Shipping HB), which is a referral fee charged on the product selling price for shipping that is completed by the seller under the Merchant Fulfilled Network (MFN). This fee is applied when the seller, not Amazon, is responsible for handling the shipping process. If Amazon’s Fulfillment by Amazon (FBA) service is used for shipping, then the Shipping Holdback Fee is not charged. The fee is based on the item type and the use of Amazon as a platform and service.

Examples of shipping fees

Some examples of how shipping fees could appear on your Amazon seller statement include:

Adjustment Item Fees Shipping Chargeback | Amazon charges a shipping fee to customers. They then deduct this fee from the seller as a "Shipping chargeback" since Amazon handles the shipping. |

Order Item Fees Shipping Chargeback | This fee is deducted from sellers' earnings when Amazon ships their ordered items. Amazon records it as income and then applies a chargeback for the shipping costs. |

Order Item Fees Shipping HB (Holdback) | This referral fee is charged on shipping done by the seller (MFN). It's not applied if you use FBA. |

Refund Item Fees Shipping Chargeback | Amazon adjusts this fee from your account when they handle shipping for refunded items to balance the transaction. |

Refund Item Fees Shipping HB (Holdback) | This fee relates to refunded items. It's a nominal fee based on the refunded item and using Amazon’s services, not applicable if using FBA. |

Other Transaction Shipping Label Purchase | Usually a purchase of a shipping label from a third-party shipping provider, made via Amazon. |

Other Transaction Shipping Label Purchase for Return | Usually a purchase of a return shipping label from a third-party shipping provider, made via Amazon. |

Tax/VAT treatment for shipping fees

A2X does not provide tax advice and the information in this post is meant to be general in nature. Please consult a local tax advisor to better understand your tax responsibilities.

There are a couple of details that you’ll want to check when it comes to understanding tax treatment for shipping-related transactions.

- Shipping income – has Amazon charged tax/VAT?

- On shipping income-related transactions (e.g., Order Item Price Shipping), check to see if Amazon has charged tax/VAT.

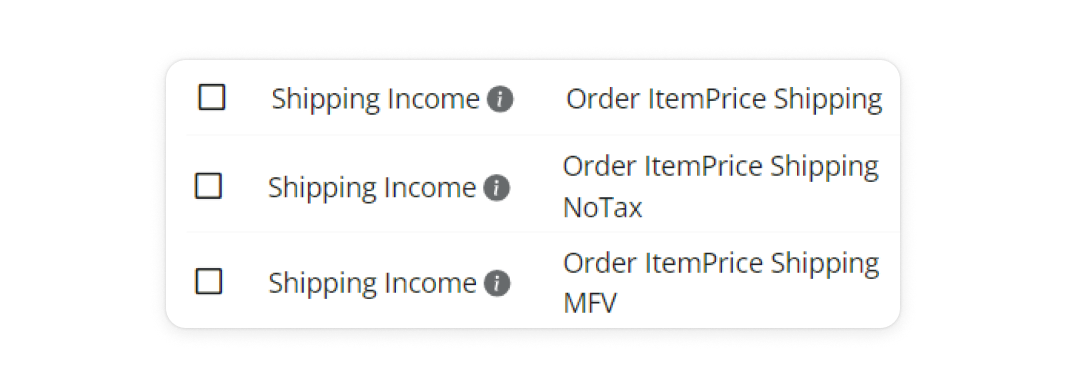

- E.g., Shipping income lines can come into an A2X account differentiated between one where tax has been added, where tax has not been added, or where Amazon Marketplace Facilitator VAT (MFV)/Marketplace Facilitator Tax (MFT) has been collected.

- E.g., Shipping income lines can come into an A2X account differentiated between one where tax has been added, where tax has not been added, or where Amazon Marketplace Facilitator VAT (MFV)/Marketplace Facilitator Tax (MFT) has been collected.

- Work with a tax advisor to determine your tax/VAT obligations on shipping income-related transactions, then use A2X to apply the correct tax rate on these types of transactions automatically so you can code them correctly to your accounting software.

- On shipping income-related transactions (e.g., Order Item Price Shipping), check to see if Amazon has charged tax/VAT.

- Third-party shipping carriers – has tax/VAT been charged?

- Amazon often partners with preferred carriers to fulfill orders; however, little information is provided about these third-party shippers. Amazon may send an email with an invoice that details third-party shipping fees.

- Check to see if tax/VAT is charged on the invoice. If it is, consult with your accountant to see if you can claim third-party shipping fees as an expense for your business.

Accounting for Amazon shipping fees using A2X

Understanding all of Amazon’s different fees – especially shipping fees – can be confusing, which can make accounting and bookkeeping frustrating and time-consuming. How do you ensure that you’re coding all the different shipping transactions into the correct accounts? And, how do you do this efficiently?

Fortunately, there’s a simple answer to both questions: use A2X!

A2X is an ecommerce accounting automation tool that integrates with Amazon Seller Central and your accounting software to make ecommerce accounting and bookkeeping easy.

Watch this video to learn more, and follow the steps below to get started.

1. Sign up for A2X and set up integrations

If you haven’t already, sign up for A2X.

In the A2X app homepage, your first step is to connect A2X to your chosen accounting software (like QuickBooks Online or Xero).

Then, connect A2X with Amazon Seller Central.

2. Map Amazon transactions to your Chart of Accounts

Go to the ‘Accounts and Taxes’ page in A2X. This is where you’ll assign (or “map”) Amazon transaction types to specific accounts.

Answer the questionnaire and use the Auto Setup feature in A2X for quick and easy mapping, and select the ‘Default’ setup for an initial configuration. Adjustments to account mappings can be made later as needed.

The chart below illustrates how A2X will map Amazon shipping transactions when using the Default setup.

Note: This is where you can assign a tax rate to your shipping income and shipping expense transactions, as applicable. We recommend working with an ecommerce accounting expert for tailored mapping advice for your business.

Amazon Transaction | A2X Default Account | Account Type |

Adjustment Item Fees Shipping Chargeback | Amazon Shipping Fees | Expense |

Order Item Fees Shipping Chargeback | Amazon Shipping Fees | Expense |

Order Item Fees Shipping HB | Amazon Shipping Fees | Expense |

Refund Item Fees Shipping Chargeback | Amazon Shipping Fees | Expense |

Refund Item Fees Shipping HB | Amazon Shipping Fees | Expense |

Other Transaction Shipping Label Purchase | Amazon Seller Fees and Charges | Expense |

Other Transaction Shipping Label Purchase for Return | Amazon Seller Fees and Charges | Expense |

If you sell on multiple marketplaces in different countries, you might also see a country or marketplace breakdown of your data.

3. Review settlements and post to your accounting software

Visit the ‘Settlements’ page in A2X to view all fetched Amazon settlements.

Select ‘Review’ for each settlement to inspect transaction details, mapped accounts, and assigned tax rates.

Once verified, click ‘Send to [Your Accounting Software]’ post to your bank feed in your accounting software.

4. Reconcile

In your accounting software, locate the newly imported settlement from A2X in your bank feed.

Ensure the transaction amounts are accurate, and then reconcile.

5. Keep up with your bookkeeping

Regularly perform steps 3 and 4 to keep your financial records up-to-date. A good habit is to do this every time you get a new settlement from Amazon.

Consistent accounting and bookkeeping provide valuable, near real-time insights into your Amazon store’s financial status.

Get accurate and automated Amazon accounting with A2X

Accounting for shipping transactions can be confusing for Amazon sellers – but A2X can help you make this easy.

Sign up for a free trial and integrate A2X with QuickBooks Online or A2X with Xero today!

Learn more about Amazon seller fees and transactions and how to account for them:

- Amazon Order Revenue Transactions (and How to Account for Them)

- Amazon Delivery and Transport Fees (and How to Account for Them)

- Amazon Commission and Selling Fees (and How to Account for Them)

- Amazon Fulfillment and Storage Fees (and How to Account for Them)

- Amazon Subscription Fees (and How to Account for Them)

- Amazon Reserve Balances (and How to Account for Them)

- Amazon Reimbursements (and How to Account for Them)

Frequently Asked Questions

FAQs about Amazon Shipping Fees

Integrate Amazon and your accounting software for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today