The Best Accounting Software for Amazon Sellers in 2025

Written by: Geoffrey Gualano

You’ve got a good handle on Amazon, your sales are growing, and your ecommerce business seems to be thriving… but how can you know for sure?

The simple answer: Accurate accounting.

That’s why you’re searching for “the best accounting software for Amazon sellers”, or some version thereof. You’re ready to arm yourself with an accurate Profit and Loss Statement (P&L), and better visibility into your financial performance. That, or your CPA informed you that you need to get your books in order to file your taxes, and that spreadsheets at your scale won’t cut it.

No matter the reason for your search, you’re in the right place. This blog post will provide you with an overview of the best accounting software for Amazon sellers. We’ve even interviewed specialized ecommerce accountants and bookkeepers to get their opinions on the matter. You can almost say that these applications are “accountant approved”.

Key takeaways:

- Popular accounting software options among Amazon sellers include:

- QuickBooks Online

- Xero

- Sage

- NetSuite

- The best accounting software for Amazon sellers depends on factors like business size, location, growth potential, multi-currency support, integrations, and ease of use.

- Consider how you will get your Amazon financial data into your accounting software – Amazon’s sales data can be complex, and manually entering transactions can be time-consuming and error-prone. Using an integration tool like A2X automates the process by accurately categorizing and reconciling sales, fees, refunds, and taxes in your accounting software, ensuring financial accuracy and efficiency.

What is the best accounting software for Amazon sellers?

Finding the right accounting software as an Amazon seller can be challenging given the volume of options available to you – and the fact that there’s no “one size fits all” accounting software solution. So… how can you tell which option will best suit your Amazon storefront’s unique needs?

In no particular order, we’ll evaluate the following popular accounting software solutions for Amazon sellers:

- QuickBooks Online

- Xero

- Sage

- NetSuite

When evaluating each solution, consider your Amazon store’s particular needs and how well each solution might suit them – for example:

- The region(s) you operate in

- Your anticipated business growth

- Integrations with other ecommerce apps

- Multi-currency functionality

- Sales tax capabilities

- Ease of use

- Financial reporting

- Customization capabilities

It’s also important to consider how you’ll get Amazon fees and transaction data into your accounting software of choice – which is where A2X can help.

The good news is that A2X integrates with all of the accounting solutions listed in this article. We’ll explain more about how to use A2X with each solution below.

QuickBooks Online for Amazon sellers

If you’re located in North America, you’ve likely heard of QuickBooks Online by Intuit (or have seen their Super Bowl ads).

By the numbers, QuickBooks Online (QBO) is the number one cloud accounting software for small businesses in the United States and Canada. QuickBooks Online was first launched in 2001, and is the evolution of the QuickBooks Desktop product.

Many Amazon sellers and Amazon accountants and bookkeepers trust QuickBooks Online for its robust accounting feature set, security, and ecosystem of third-party applications, such as A2X.

QuickBooks Online top features for Amazon sellers

- Seamless ecommerce integrations: The ability to integrate directly with Amazon and other ecommerce platforms through tools like A2X is a big plus for QuickBooks Online. Using the A2X integration as an example, you can import your Amazon sales, fees, and other transaction data directly into QuickBooks Online for accurate and automated revenue reconciliation, saving you hours and increasing the accuracy of your Amazon bookkeeping. (QuickBooks Online also has its own connector app, but it’s better suited for single channel, single country, low order volume businesses.)

- Inventory management features: QuickBooks Online offers some functionality that provides insights into stock levels, Cost Of Goods Sold (COGS), and inventory valuation.

- Automated sales tax handling: With QuickBooks Online, you can automatically calculate, track, and manage sales tax for various jurisdictions. This is especially helpful for Amazon sellers operating in different states and countries, ensuring compliance and simplifying tax reporting.

- Advanced reporting and analytics: QuickBooks Online provides customized reporting tools that allow sellers to monitor their financial health, analyze sales trends, and more.

- Automatic bank feeds and categorization: Real-time updates from bank and credit card transactions, coupled with the ability to set up rules for automatic categorization, help Amazon sellers streamline the reconciliation process.

“QuickBooks Online is perfectly suited for an Amazon seller… it has the right features, usability, and allows for seamless communication between sellers and their accounting partners.”

– Teresa Slack, founder of Financly, ecommerce bookkeeping experts

QuickBooks Online plan recommendation for ecommerce

QuickBooks Online offers several plans and is available in multiple currencies. Plans may vary by country.

A2X will integrate with any QuickBooks plan, but if you’re planning on using A2X with multiple currencies, then you will need the Essentials plan or above.

For Amazon sellers, the Plus plan is recommended due to its advanced inventory tracking and profitability analysis features. If you’re in the United States and want to get started on QuickBooks Online, take advantage of A2X’s promotional QuickBooks Online pricing.

If you’re ready to get started with QuickBooks Online, watch the video below to learn how to set up your Amazon storefront in QBO.

Xero for Amazon sellers

If you’re located in the United Kingdom, Australia, or New Zealand, you’re likely very familiar with Xero. By the numbers, it’s the top cloud accounting software in those regions.

Xero was founded in 2006 and was purpose-built for the cloud. It boasts hundreds of cloud integrations with third-party applications to make accounting more automated, accurate, and actionable.

Many Amazon sellers and specialized ecommerce accountants and bookkeepers trust Xero for its robust functionality yet seamless user experience, as well as its strong capabilities in handling multiple currencies, making it a top choice for international sellers.

Xero’s top features for Amazon sellers

- Seamless ecommerce platform integrations: Xero’s ability to integrate with Amazon through third-party apps like A2X, streamlines the revenue reconciliation process and provides you with accurate Amazon sales, fees, and other data in your P&L. (A2X won Xero UK’s Practice App of the Year award in 2024!)

- Multi-currency support: For Amazon sellers operating internationally, Xero’s multi-currency handling is incredibly helpful. It automatically updates exchange rates, allowing sellers to manage foreign currency transactions with ease. This is likely one of the reasons Xero is so popular for international Amazon sellers selling into the United States.

- Detailed financial reporting: Xero offers comprehensive reporting tools that give sellers insights into their financial performance, including profit and loss statements, balance sheets, and cash flow analyses.

- Inventory Management: Though more basic than some specialized inventory systems, Xero provides essential inventory tracking features that help sellers manage stock levels, understand product performance, and more.

- Cloud-based accessibility: With Xero, sellers can access their financial data from anywhere, fostering flexibility and timely decision-making.

“In our opinion, Xero is the only general ledger solution that elegantly and efficiently handles the foreign currency issues that you’ll encounter as an international Amazon seller in the US market.”

– Jason Macdonald, Partner at Intrepid Advisory, expert ecommerce accountants supporting international sellers

Xero plan recommendations for ecommerce

Xero has multiple plans and is available in most currencies. Plan types may vary depending on your location.

A2X will integrate with any Xero plan, but if you’re planning on using A2X with multiple currencies, then you’ll need the Comprehensive plan or above.

If you decide to use Xero, here’s a step-by-step guide to monthly bookkeeping for your Amazon store using Xero.

Sage for Amazon sellers

If you’re in the United Kingdom, you’re likely familiar with Sage as it was founded there in 1981 and supports millions of customers worldwide with its desktop and cloud accounting products.

Sage Business Cloud Accounting, specifically, caters to Amazon sellers looking for an all-in-one accounting solution. It’s not as widely used as QuickBooks Online or Xero for Amazon sellers, but it’s still a very capable solution.

Sage features for Amazon sellers

- Amazon accounting integration: Sage Business Cloud Accounting integrates with Amazon Seller Central through tools like A2X, and allows you to accurately reconcile your sales, fees, taxes, and more.

- Inventory management: Sage provides tools to manage stock efficiently, with real-time stock data and inventory reports. You can set minimum reorder levels and receive notifications for products going out of stock.

- Multi-currency support: Sage offers the ability to trade in multiple currencies. This feature is particularly useful for Amazon sellers dealing with international customers or suppliers. You can create invoices, accept payments, import bank transactions, and track expenses in various currencies, giving you the flexibility to expand your business globally.

Sage plan recommendations for ecommerce

A2X connects Amazon and Sage, and specifically supports the Sage Business Cloud UK (Plus plan) and Sage One UK (Plus plan).

Sage Business Cloud Accounting Plus is £36/month for the Accounting plan. For Amazon sellers, the Sage Business Cloud Accounting plan provides a good balance of features and affordability.

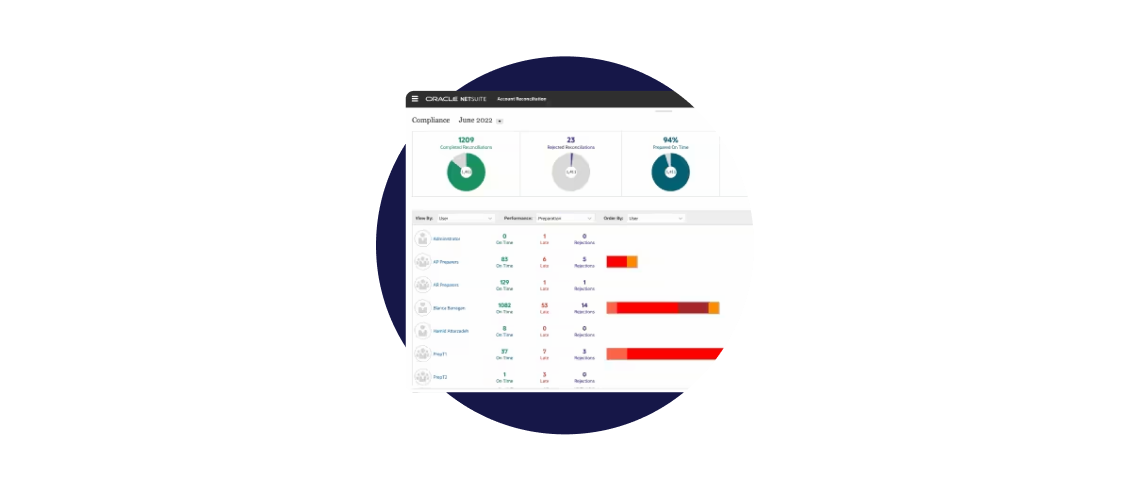

NetSuite for Amazon Sellers

If you’re an Amazon seller or ecommerce business with scale, you’ve likely heard of NetSuite. It’s a comprehensive ERP solution, and is well suited for larger ecommerce businesses seeking accounting, inventory and operations, and complex financial management at scale.

NetSuite features for Amazon sellers

- ERP and CRM solutions: Beyond basic accounting, NetSuite provides extensive ERP and CRM capabilities, supporting larger Amazon sellers in managing their business lifecycle within one solution.

- Advanced inventory management: NetSuite excels in inventory management, offering detailed tracking, multi-location support, and real-time insights into stock levels, essential for sellers with extensive inventory.

- Global business management: For sellers operating on an international scale, NetSuite’s global business management features, including multi-currency, multi-language, and multi-subsidiary support, can be helpful.

- Scalability: As a business grows, NetSuite’s scalable platform can adapt to increased complexity, supporting Amazon sellers through various stages of business growth.

- Comprehensive reporting and analytics: NetSuite’s reporting and analytics tools provide insights into every aspect of a seller’s business, from financial performance to customer interactions.

- Revenue reconciliation with A2X: Amazon sellers adopting NetSuite can still take advantage of A2X for accurate and automated Amazon revenue reconciliation in NetSuite.

NetSuite plan recommendations for ecommerce

NetSuite’s pricing is customized based on business needs, typically starting at a few thousand dollars per year. For large Amazon sellers or those with complex multinational operations, we recommend contacting NetSuite directly to discuss your options.

Accurate and automated Amazon accounting: Integrating Amazon Seller Central and your accounting software with A2X

You might be asking yourself, “If I’m using accounting software for my Amazon business, why would I need an app like A2X?”

Amazon accounting is complex. As Jason Macdonald from Intrepid Advisory puts it, “The sales data you get from Amazon in your accounting software is incredibly unsophisticated. You need an app like A2X to break it down and make sense of it all.”

With A2X, all the transactions that make up your Amazon deposits – sales, fees, refunds, taxes, and more – are accurately categorized into summaries that reconcile perfectly in your accounting software. It’s the most accurate integration solution available today, and is trusted by the world’s leading ecommerce accountants and bookkeepers.

Here’s what leading Amazon accounting and bookkeeping experts have to say about A2X.

“For connecting Amazon seller data with our accounting software, we use A2X. I can never understand why a client would connect a solution that submits individual transactions (that flood the general ledger) or enter data manually. A2X is seamless, allows for accrual accounting, and is incredibly accurate.”

– Chase Insogna, founder of Insogna CPA, expert ecommerce accountants, tax strategy, and CFO advisory services

“Our 7, 8, and 9-figure sellers require investor-ready financials to make better decisions, unlock financing, and satisfy investors. A2X is the only technology we trust to manage their complexity and scale.”

– Sam Hill, founder of Ecom CFO, expert accounting practice for scaled ecommerce businesses

“We love using A2X because they help us reconcile the revenue data and post Cost of Goods Sold cleanly and easily. We’ve been using A2X since 2014. We love their team, they’re super responsive to our needs, and the support is amazing.”

– Patti Scharf, founder of Catching Clouds (now Acuity), first specialized ecommerce accounting practice in the US

After you’ve selected your general ledger, make sure to try A2X for yourself! Click the ‘Try A2X for free button’ in the top right to get started.

Need help selecting the right Amazon accounting software?

Selecting the right accounting software for your ecommerce business is essential if you want accurate books, financial visibility, and tooling to help you pay the right amount in tax. Not to put too much pressure on the decision, but it can impact every facet of your online business, from daily operations to long-term strategic growth.

If you’re struggling to pick the right solution for you, we highly recommend consulting with an expert ecommerce accountant or bookkeeper. They’re well versed in every solution, and can evaluate your needs to help you make the right decision for your business.

Find an expert ecommerce accountant or bookkeeper on the A2X Partner Directory.

Frequently Asked Questions

Integrate Amazon and your accounting software for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today