Reporting Rules for Digital Platforms: New UK Policy Affects Ecommerce Sellers (and How A2X Can Help)

The UK’s HM Revenue & Customs (HMRC) is set to enforce new regulations from January 1st, 2024 that will impact reporting requirements for ecommerce sellers. This move aims to tighten scrutiny on income earned through digital platforms including ecommerce channels eBay, Amazon, Shopify, Etsy, BigCommerce, and others – ensuring tax compliance and transparency.

Please refer to the HMRC’s Policy paper here for more details about the changes.

The regulation mandates digital platforms to collect detailed information on their users’ earnings and share this with the HMRC. This development is likely to impact all ecommerce sellers, but in particular, those who have not declared their income or have been inconsistent in their tax submissions.

Impact on ecommerce sellers

The new law introduces a dual challenge for ecommerce sellers:

- For smaller sellers: Individuals generating over £85,000 annually through online sales, who have not registered for VAT or declared self-employed income, will now fall within HMRC’s radar. This threshold, set intentionally low, captures even occasional sellers, pushing them towards formal tax declaration and potentially, tax liability.

- For those with inaccurate reporting: Sellers who report differing income amounts on their company submissions to ecommerce platforms, due to incomplete accounting processes, face a risk of audit, penalties, or even criminal prosecution. This discrepancy can arise from poor tracking of sales, VAT, and other taxes across multiple channels.

How can A2X assist?

A2X is now a crucial solution for ecommerce sellers navigating these new regulations. It offers automated, accurate accounting, addressing the core issues highlighted by the upcoming law:

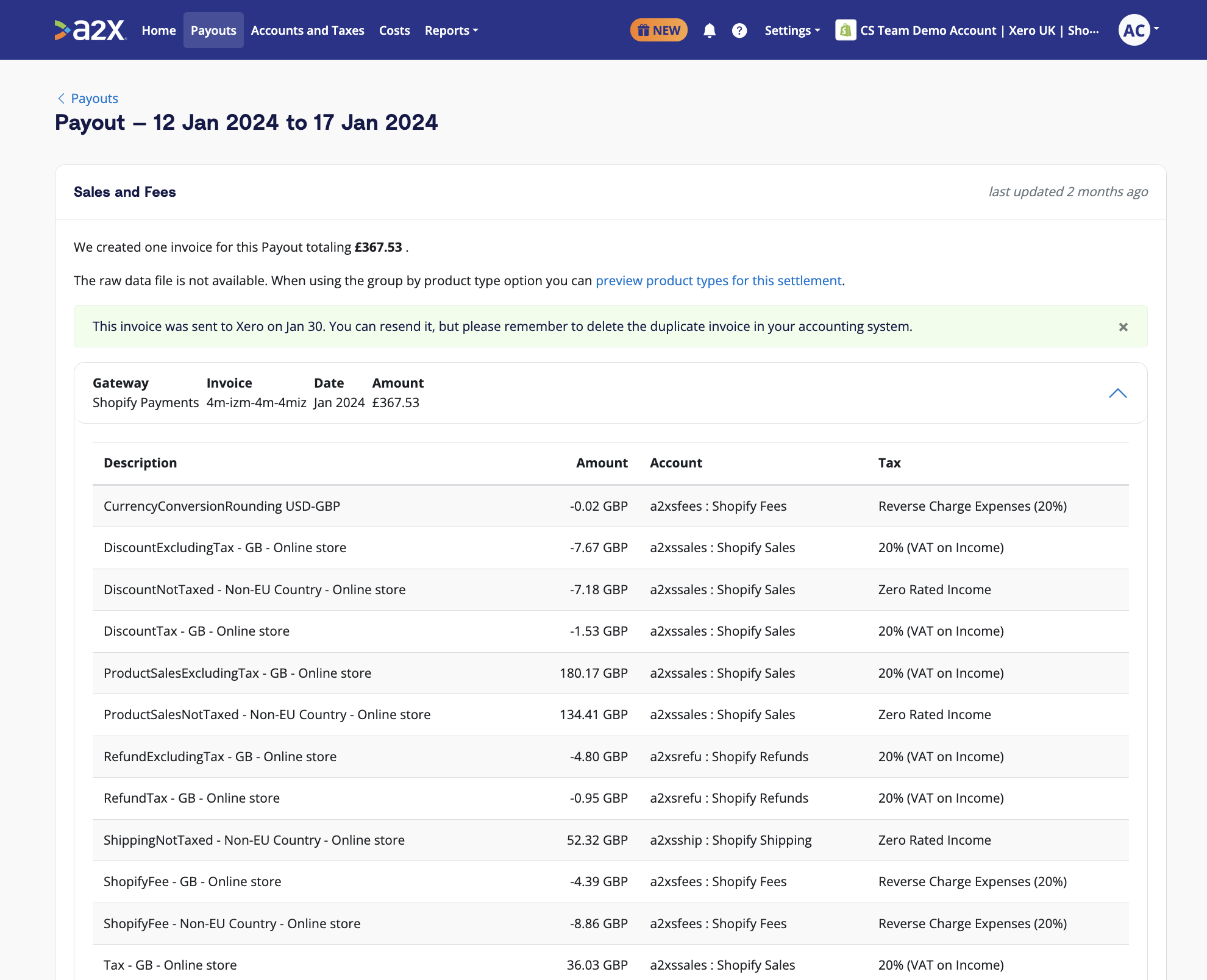

- Automated accounting: A2X automates the accounting process, ensuring that income from online sales is accurately recorded. This automation helps sellers maintain consistent records, aligning their reported income with actual earnings.

- VAT and tax compliance: A2X simplifies the complexity of VAT and other taxes by accurately splitting sales (taxed and untaxed) and tracking marketplace facilitator taxes collected and remitted. This feature is invaluable for sellers needing to demonstrate compliance with tax regulations.

- Integration with sales channels: A2X’s ability to tie back to sales channels ensures that sellers can reconcile their reported income with the data collected by digital platforms. This integration is critical for verifying the accuracy of the information shared with HMRC and avoiding discrepancies.

The new regulations from HMRC signify a substantial shift in how income from online sales is monitored and taxed in the UK. While this development poses challenges for ecommerce sellers, particularly in terms of compliance and reporting, solutions like A2X offer a way forward.

By leveraging automated accounting and ensuring accurate tracking of sales and taxes, A2X helps sellers navigate the complexities of the new law, ensuring compliance and peace of mind in their online ventures.

Sign up for a free trial to see how A2X can automate your ecommerce accounting.

Save hours on your ecommerce accounting

A2X connects your sales channels and accounting software for fast and accurate monthly bookkeeping.

Try A2X today