eBay Sage Integration: How to Set it Up for Accounting

Written by: Amy Crooymans

November 17, 2025 • 11 min read

Integrating eBay with Sage cloud accounting software is a great way to save time on bookkeeping and get accurate business numbers.

If you’re an eBay seller and you’re doing your own bookkeeping, or if you’re an accountant or bookkeeper who works with eBay sellers, then you’ll understand some of the complexities that come along with eBay bookkeeping.

Getting eBay payouts to reconcile with bank deposits, understanding eBay fees and transactions, managing payouts that span across two months… the list of challenges goes on.

Fortunately, integrating eBay and Sage with the right tool can help you overcome many of the challenges that come along with eBay bookkeeping – and even help you experience the benefits of time saved and accurate business financials.

In this guide, we’ll cover how to integrate eBay and Sage.

Key takeaways

- Integrating eBay and Sage means establishing a connection that enables your eBay data to flow seamlessly into Sage for easy accounting and bookkeeping.

- Sage does not support a direct integration with eBay, so you can use a third-party app like A2X to set up the integration.

- Setting up an eBay-Sage integration with A2X is easy and just takes a few steps (outlined below).

Can Sage integrate with eBay?

Yes, Sage can integrate with eBay using an app or tool. Integrating eBay and Sage is a great way to get the eBay financial data you need into Sage for faster, easier bookkeeping.

Sage does not support a direct integration with eBay, which simply means that you need a third-party tool to establish a connection and push the right data from eBay to Sage.

We’ll walk you through a couple of options below.

Why should I integrate eBay with Sage?

The settlement statements you receive from eBay which summarize your orders are only so helpful. Each payout consists of a number of line items that you need to know, but are not separated out for you.

The payouts that arrive in your bank are not just the prices of your products sold. Fees were taken out, reimbursements were perhaps added in – and you need to understand these details.

Some eBay reports might provide this detail, but combing through these reports can take a lot of time (plus, manually entering eBay data into Sage can also be time-consuming and error prone).

Using the right tool to set up an integration can automate this entire process – helping you save time, improve accuracy, and experience a number of other benefits.

Save time with automation

Whether you’re an eBay seller or an accountant or bookkeeper who works with eBay sellers, your time would likely be better spent on business activities that don’t include manual data entry.

That’s exactly what integrating eBay with Sage will allow, because it will automate the process of getting all your eBay sales, fees, refunds, and other transactions coded to the Chart of Accounts in Sage.

Get accurate books

Accuracy is incredibly important for ecommerce sellers. There can be major consequences if you incorrectly record transactions, such as inflating your sales numbers or misreporting on sales tax.

Using a tool to integrate eBay and Sage can help you get accurate numbers – and even help you achieve “investor-ready” financials.

How to integrate eBay with Sage

There are a couple of different tools that you can use to integrate eBay with Sage:

- A generic data syncing app

- An accounting automation tool designed specifically to assist with eBay accounting in Sage, such as A2X

Use a data syncing app

Generic data syncing apps (e.g., Zapier) can often be used to send eBay data into Sage.

While these apps might be inexpensive or free to use, there are some caveats to keep in mind before you set an integration up this way:

- Usually, they can only be set up to send data from individual orders – which might be okay for smaller sellers, but can clog Sage if you’re an eBay seller with high sales volume.

- They might not identify all transaction types.

- They’re not designed specifically for accounting and bookkeeping purposes, which means their support might not be able to assist with accounting/bookkeeping-specific inquiries.

- They’re often difficult to reverse once they’ve been set up, which can create a data mess.

Use A2X to integrate eBay and Sage

A2X captures the data in your eBay settlement statements, organizes it into neat journal summaries, and feeds them into Sage. All of that detail is laid out for you, eliminating the need for manual number-crunching.

A2X also splits settlement statements that span months and organizes your books via the accrual method. These two things allow you to more accurately forecast your business’ peaks and troughs, and effectively give you books that are organized by the GAAP-approved industry standard.

Integrate A2X with eBay and Sage for:

- Neat, organized books calculated automatically so you have all the details you need.

- Journal summaries sent to Sage so that Sage doesn’t become overwhelmed by individual transactions.

- Statements split by month and accrual-based records for better forecasting.

- Remote access from the cloud anytime, anywhere.

- A scalable solution that can support multiple channels if/when you decide to grow.

- Integrated COGS so that you can keep track of your inventory as you make sales.

- Integrated chart of accounts and tax mappings to Sage. These help save time at the end of the tax year.

“[A2X] saves so much time and removes all those laborious reporting tasks. We don’t have to think about that level of reporting any more, the data goes through seamlessly, and everything gets reconciled correctly. The software saves the need for running loads of separate reports for our accountancy and bookkeeping.”

- Russell S., MD

How to integrate Sage and eBay with A2X: A step-by-step guide

Note: A2X currently integrates with Sage Business Cloud UK (Plus plan), and Sage One UK (Plus plan).

Watch the video for an overview of how to integrate Sage and eBay with A2X, then follow the instructions below for more details.

Running an eBay store means that you also need to do bookkeeping so you can understand how your business is performing, but eBay accounting and bookkeeping can be complicated and time consuming. You might be using Sage Cloud accounting to make bookkeeping faster and easier, but you're looking for a way to easily get your sales data from eBay into Sage.

Up until now, you might not have been accounting for your eBay store, entering your sales data manually, or you've been coding the whole payout to a sales account. These options may work for a short time, but as your eBay store grows, you might run into some challenges. For example, eBay payouts aren't just sales – they're actually made up of a combination of fees, refunds, and other transactions. Identifying the transaction detail you need for accurate bookkeeping can be tricky.

eBay provides reports with this information, but manually reviewing these reports and trying to get them to balance in Sage can take a lot of time. Fortunately, there's an easy solution. Setting up an integration between eBay Seller Hub and Sage will enable your eBay transaction data to flow seamlessly into Sage.

There are a couple of ways you could set this up. One way is to use a generic data syncing app that posts individual orders to Sage. This option might work for smaller sellers, but you might run into some issues if your sales increase. For example, you could clog your accounting system.

A better option is to use A2X. A2X connects eBay and Sage so all your eBay transaction data can flow seamlessly into Sage. A2X organizes all of your eBay sales, fees, refunds, and other transactions into summaries that accurately match your eBay payout and Sage for easy reconciliation.

Integrating eBay and Sage with A2X is easy and just takes a few minutes. Here's how to get set up. First, sign up for an A2X account at a2xaccounting.com. Next, connect A2X to Sage using your Sage login. A2X currently integrates with Sage Business Cloud UK (the Plus plan) and Sage One UK (the Plus plan). Then, connect A2X to eBay using your eBay login.

Once A2X is connected to Sage and eBay, it's time to map your eBay transactions to your chart of accounts. Go to the Accounts and Taxes page, where you can choose how to categorize your eBay transactions to your chart of accounts. A2X can help automate this.

[Music]

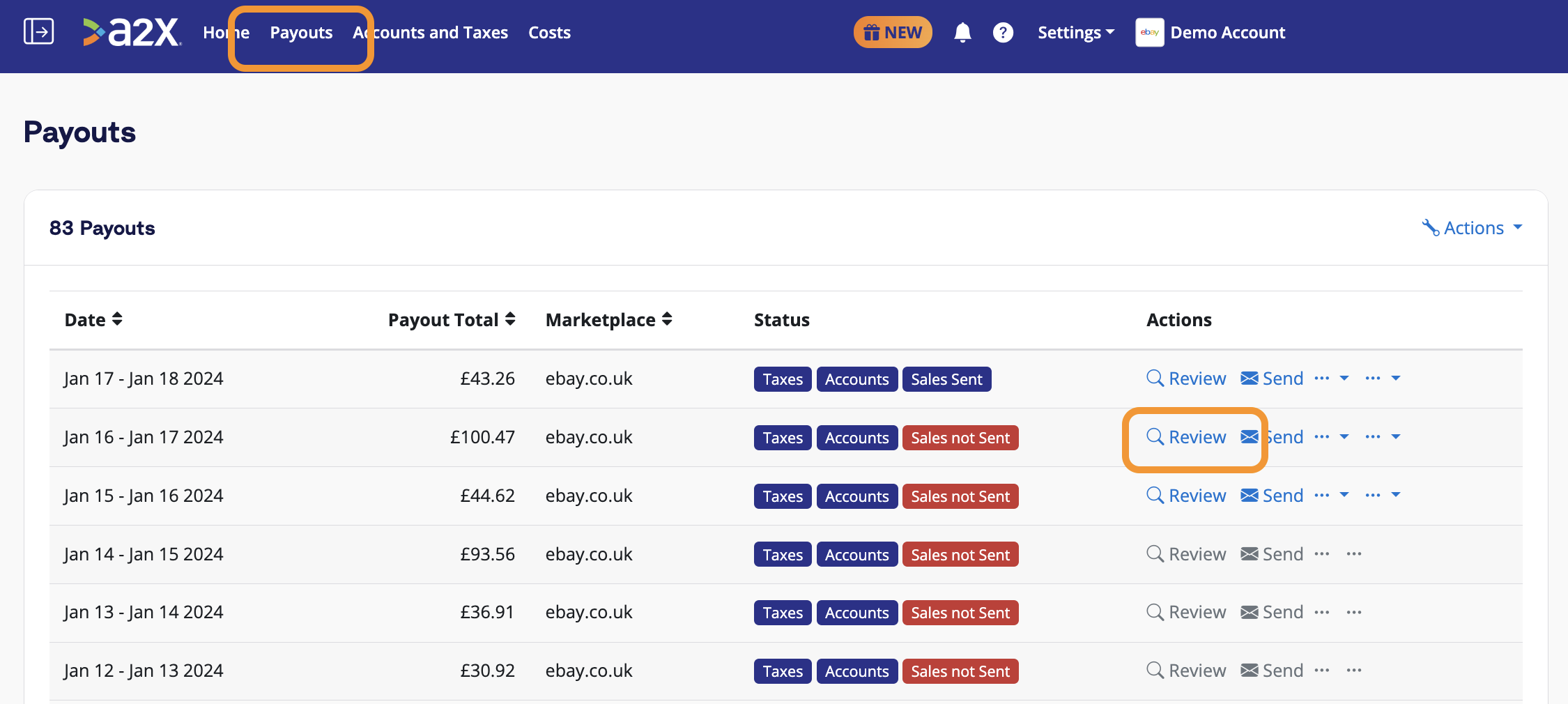

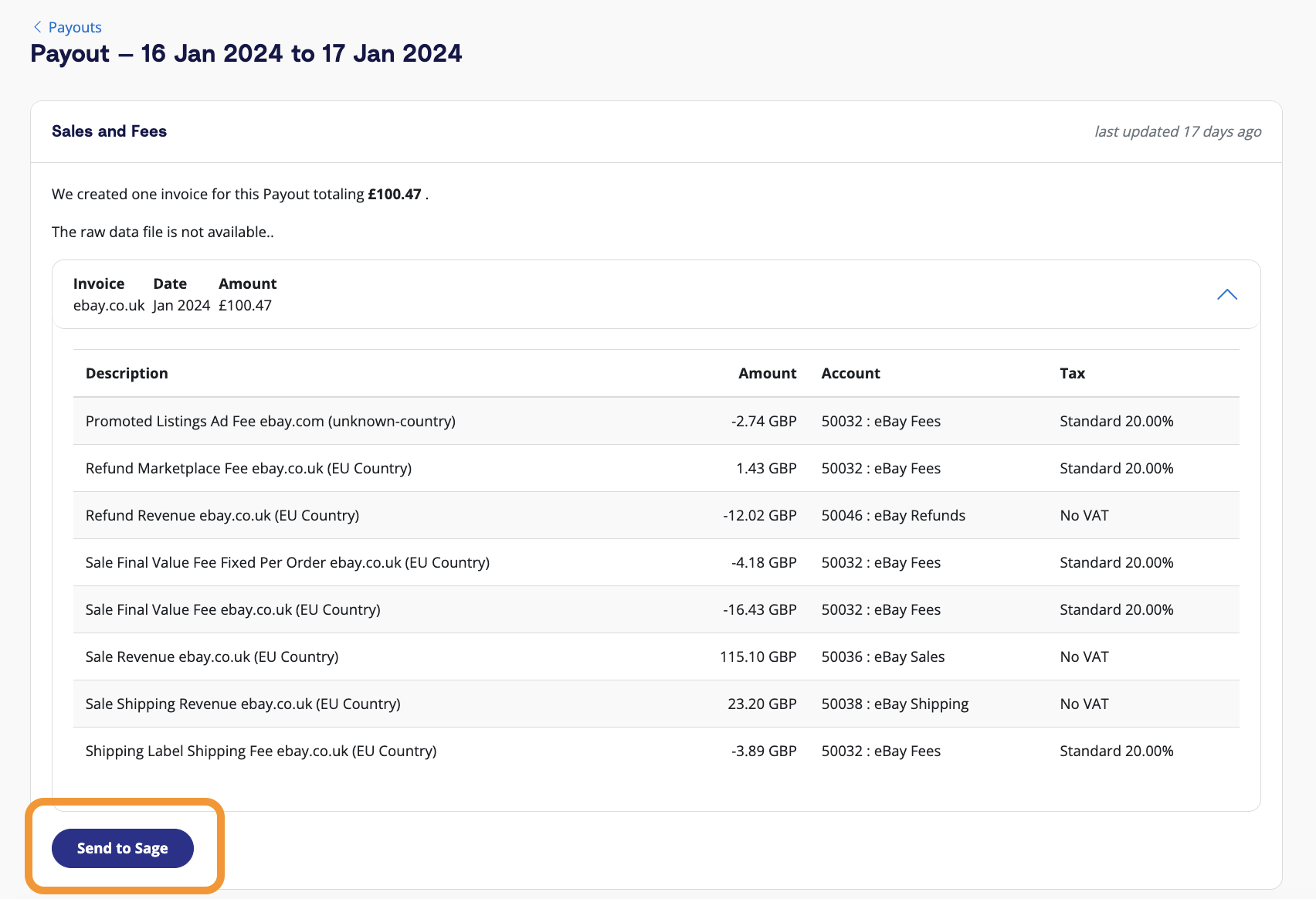

Once you've completed your accounts and tax mapping, go to the Payouts tab. This is where you can review and post payouts from A2X to Sage.

[Music]

The final step is to reconcile in Sage. Log in to Sage, navigate to the bank account you wish to reconcile, and from there click on Imported Transactions. Find the payout from eBay. You'll be able to select the invoice from A2X and click Match to reconcile.

And that's it – bookkeeping for eBay with Sage can be that easy. Integrating eBay and Sage with A2X will help you save time on your bookkeeping and get more accurate financial data. For more information, visit a2xaccounting.com.

Step 1: Create your A2X account.

If you’re completely new to A2X, you can sign up for a free trial (click ‘Try A2X for free’ in the top right).

Follow the prompts to sign up for A2X. You’ll end up on the A2X dashboard.

Note – you don’t need a credit card to sign up, and you’ll be in “free trial mode” until you decide to subscribe. “Free trial mode” means you can use A2X, but you’ll have some limited functionality.

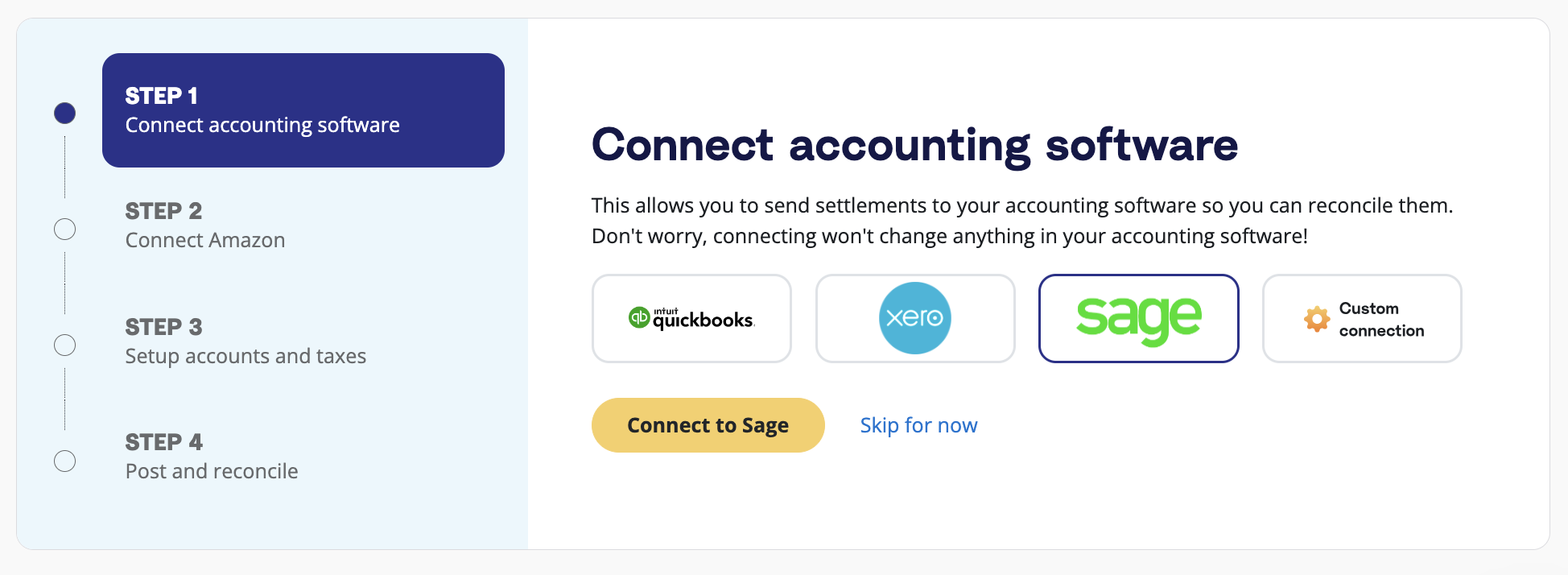

Step 2: Connect to Sage

On the A2X dashboard, you’ll be prompted to connect to your accounting software.

Click on the Sage logo, then click ‘Connect to Sage’. You’ll be prompted to log in to your Sage account.

Follow the prompts, and then you’ll end up back on the A2X dashboard.

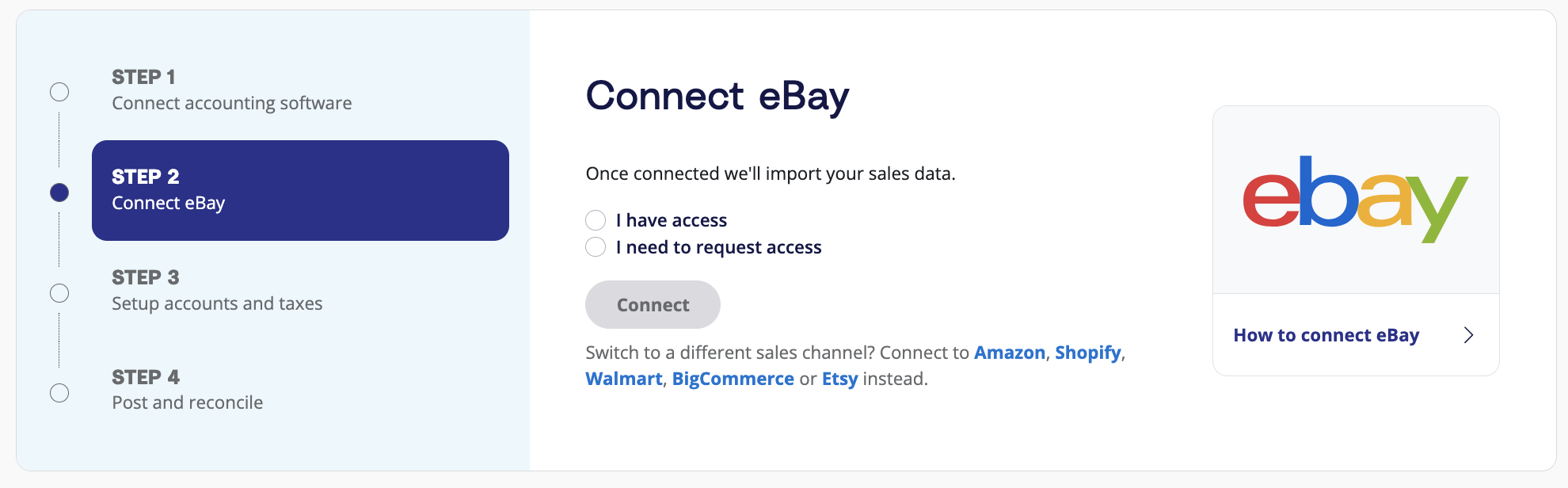

Step 3: Connect to eBay

Next, you’ll be prompted to connect to eBay.

You have two options:

- Option 1: If you are the store owner or have access to the eBay store you are connecting, select ‘I have access’. You’ll be prompted to log in to your eBay account to enable A2X to connect.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

After permission is granted, A2X will return you to your A2X dashboard, and your payout data will automatically start to be fetched by A2X (which you can see in the ‘Payouts’ tab).

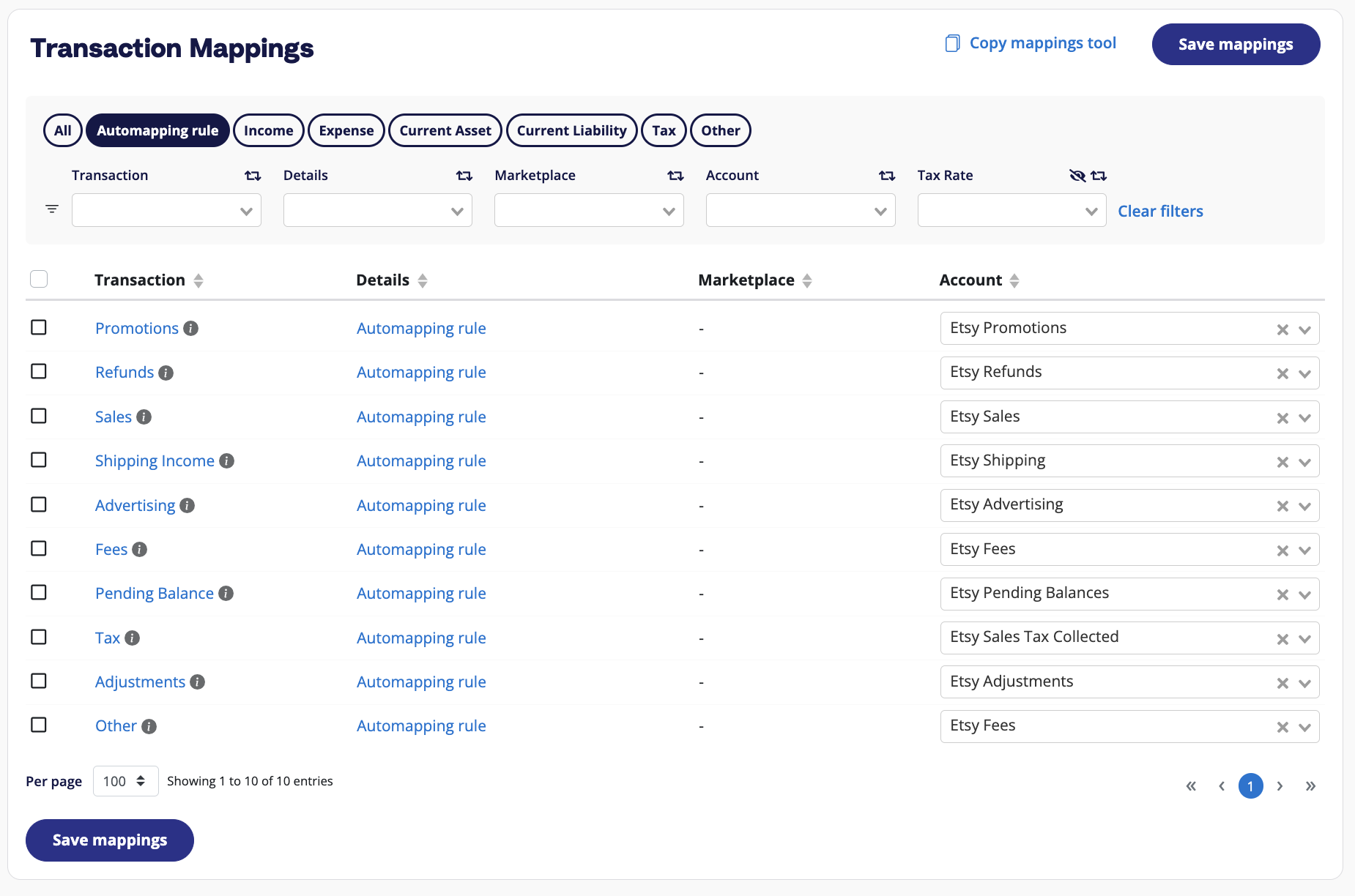

Step 4: Map accounts and taxes

Next, you should take some time to map accounts and taxes.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get it right for your specific business.

Mapping accounts and taxes is the process of selecting which General Ledger account you want each transaction type to be posted to in Sage for all payouts moving forward. For example, sales transactions will be posted to an eBay Sales account.

A2X can automate this whole process for you, or you can map it yourself. Once you set this up, all eBay payouts will be coded according to the settings you’ve selected moving forward.

- Click ‘Setup Account and Taxes’.

- The first time you visit the accounts and taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted Setup or Custom Setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in Sage and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

Step 5. Review and post

Most of your A2X setup tasks are done! You can now start posting A2X payouts for easy reconciliation in Sage.

Go to ‘Payouts’, and click ‘Review’ beside the settlement you wish to review and post.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to Sage’ when you’re ready.

Note – auto-posting is available to you when you’re ready to use this.

Step 6. Reconcile in Sage

In Sage, navigate to the bank account, click ‘Imported Transactions’, and identify the transactions that need to be reconciled.

Click on the payout from eBay. You should be able to see the invoice from A2X, ready to be matched to the transaction.

And there you go! Easy eBay bookkeeping in Sage with A2X.

Ready to integrate eBay and Sage with A2X? Start a free trial today!

Integrate eBay and your accounting software for accurate accounting

A2X auto-categorizes your eBay sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

`Try A2X today