![Avoid Ecommerce Sales Tax Audits With These Insights [Original Research]](/img/content/guide.jpg)

Avoid Ecommerce Sales Tax Audits With These Insights [Original Research]

The US sales tax landscape was turned upside down by the “ Wayfair decision” in 2018.

Everything changed for ecommerce sellers. And these changes have resulted in costly audits across the country.

In collaboration with our friends at TaxValet, we wanted to dig deeper into these audits and look for emerging patterns that could inform how sellers manage their sales tax.

Over the last few months, we have been collecting responses to a survey of ecommerce business owners that have undergone the audit process.

We wanted to find out:

- What triggered their audit.

- How much it cost them.

- Which states audited them the most, and whether it was their home state or another. We then sat down with TaxValet’s Alex Oxford to discuss the findings. Below are his expert takeaways and advice for managing sales tax.

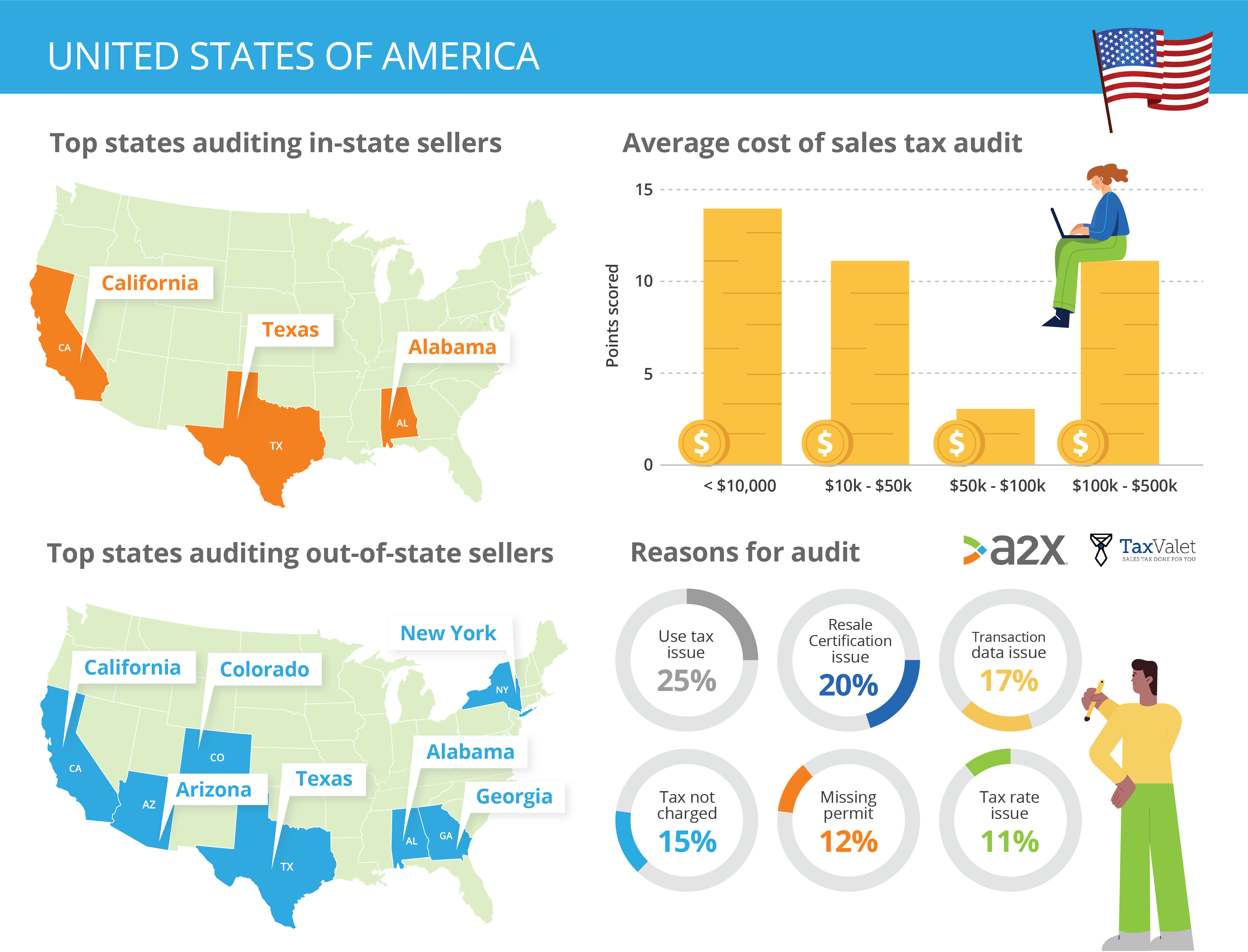

Our findings at a glance:

- The top reason for an audit was use tax not being self-accrued or remitted.

- The close second was missing exemption certifications.

- Most audits cost sellers less than $10k, but a significant chunk were over $100k.

- Out-of-state audits were more prevalent than in-state audits.Let’s dive a little deeper into what these mean and what can be learned from them.

NB: The following insights are based on data provided by 66 respondents. Whilst they should prove useful, they should be applied only in conjunction with tailored advice unique to your business from an expert tax professional. Check out TaxValet if you’re looking for quality sales tax advice. All quotes are from Alex Oxford unless otherwise stated.

Why Were They Audited?

First up, let’s take a look at the key reasons why our respondents were audited, why these can be an issue, and how to manage them.

1. Use tax was not self-accrued or remitted

“Often in the sales tax world we hear the terms “sales and use tax” used interchangeably. It’s one of the most nuanced and confusing aspects of our system in the US.”

Use tax and sales tax are very similar, but they are not the same thing. And since use tax non-compliance has come out on top for reasons why our respondents were audited, it seems there’s been a mix-up.

Either businesses are unaware of their obligations, or confused by them.

The background

Use tax is a tax type that is complementary to sales tax, applicable on some business purchases if sales tax was not collected.

*“Let’s say that your business is purchasing something *for use in your home state. If you don’t pay sales tax to the business you’re buying from, and it’s taxable, then you (as the business) need to remit use tax to the state.

We’re not talking about purchases for resale (your inventory). We’re talking about things that are being bought and used in the order of business, where sales tax was not paid.”

Examples of purchases that may be subject to use tax:

- Software

- Cleaning products

- Officeware

- Storage equipmentBasically, any time you purchase something for use in your business, you’ll need to self-accrue and pay use tax to the state if you don’t pay sales tax.

The key messages

“It should be calculated and handled very similarly to sales tax. And it’s really on the business to keep track of what they’re purchasing and using that they’re not paying sales tax on, so they remit use tax correctly.”

Business owners may have use tax obligations as well as sales tax obligations. And just like with sales tax, there are variations with use tax too.

“There are some things you might buy and use as a business that aren’t subject to use tax, even if you didn’t pay sales tax. Some items are exempt depending on their use.

A common example for ecommerce businesses of items purchased that may be exempt is packaging materials as long as they’re being used to ship items directly to customers. But items like pallets used inside the warehouse may be taxable.”

We wanted to know whether Alex and his team see recurring, easy-to-avoid missteps by sellers when it comes to use tax.

“Something we commonly see people trip up with when it comes to use tax is promotional giveaways. The language you use on your website can sometimes come back to haunt you.

For example, giving away free samples is very different to giving a discount on first orders. The latter may not sound as sexy, but it won’t catch the attention of auditors like the former.

Any time you are giving away free samples, you won’t be charging sales tax to your customer, so an auditor may interpret the item as being ‘used’ in the sense that it is being used to market the business.”

2. Certificates for exempt sales were missing or not acceptable

Not every item or service is taxable, and not every business is required to collect sales tax.

Exemption certificates exist to sort the compliant from the non-compliant.

The background

“When it comes to exemption certificates, you either need to provide them to your supplier or ask for them from your wholesale customers. This is so if you’re audited, you can prove that a purchase or sale was legally tax exempt.”

There’s one type in particular that crops up most for ecommerce sellers: the resale exemption certificate.

“If your customer is a wholesaler buying 10,000 units from you, and they’re going to resell them, then you do not need to collect sales tax so long as you have a valid resale certificate on file. Even if you have nexus with their home state.

They will be charging their customers, the end users, the tax.

This is as long as you’re collecting a valid resale certificate. If you don’t have a certificate on file and are audited, you’ll need to pay for the tax out-of-pocket. Good luck collecting the tax after-the-fact from your customers!”

The key messages

Alex warns that not collecting a certificate leaves you vulnerable in an audit. You will be liable for that tax if you can’t prove the transaction was legally exempt.

And the resale certificate isn’t the only kind you might need.

“You might also sell to entities like universities, hospitals, or schools which are tax exempt. But they need to provide you with an exemption certificate.”

By collecting the certificates, not only will you protect yourself in an audit, but you could save money.

“This is a potential cost-saver, because otherwise the business owner may end up paying sales tax twice. Without providing a resale certificate to a supplier, the business owner may need to pay tax when purchasing inventory.

If they don’t collect the resale certificate from a customer and don’t collect tax, they may also need to pay that sales tax out-of-pocket.”

Registering for exemption certificates

When it comes to exemption certificates, like most other sales tax regulations, each state is different.

The Multistate Tax Commission (MTC) created the Uniform Sales and Use Tax Resale Certificate to try to simplify the process. 36 states currently accept this document, instructions for which can be found on the form itself.

The Streamlined Sales Tax exemption certificate is also a resource you can use that is accepted by all 24 member states.

For the states that do not accept this document, you’ll need to consult their official government website to create a state-specific exemption certificate.

3. Transaction data was inaccurate

Apps and integrations are great for ecommerce businesses. They automate a lot of the time-consuming transaction data movement and interpretation.

But it’s not foolproof. Mistakes can still happen.

And undetected, they can add up quickly.

The background

“You might say, what’s the big deal? Why is this so complicated? Well, so many ecommerce businesses are selling on multiple channels. These might be marketplaces, direct to consumers, in-person markets, trade shows, etc.

We see a few common issues crop up with the technology used to connect all of this moving data. It might be duplicates, problems with connections that users don’t know about, accidental data loss - any number of things.”

The key messages

So how does Alex and his team manage these challenges?

“Every month, we check our clients’ data. Does it match reality? Is it what they were expecting? We frequently catch things that aren’t quite right, and those problems would have compounded over time.

This issue can be easily mitigated by ensuring that whoever is managing your sales tax obligations is kept fully informed of any changes. Especially if there’s a new sales channel or integration. For some clients, we actually create a flowchart to depict how the data is moving.”

API tools and apps like A2X Multi are designed to smooth the process too.

And by adding new integrations in a stair-step approach, you can minimize risk and identify problems faster.

4. Tax was not charged on items where it should have been

“Often what happens here is the ecommerce business owner is selling a product they thought was exempt from sales tax, but this wasn’t in fact the case.”

The background

“In other countries, almost everything is taxed. But in the US, we have a real patchwork of regulations. Software may be subject to tax in some states and not others for example.”

Unfortunately, product taxability isn’t as cut and dry as you might think. What’s taxable in one state may not be somewhere else. And definitions come into play too.

Alex explains why it’s easy for business owners to get it wrong, even when they’re trying to do the right thing.

“It’s really when we get into the definitions of these things that we find difficulties.

If we’re talking about food, what is a ‘food’? Does a dietary supplement count? If not, what is ‘whey protein powder’ - a food or dietary supplement? Perhaps food isn’t taxable but candy is. So what’s considered ‘candy’?”

The key messages

“We have to be so careful about the definitions of the products we’re selling.”

And like most aspects of sales tax, these nuanced differences vary across state borders.

“It all depends on the state. How is the state defining it? Sometimes it’s clear, sometimes it’s not. This is where product taxability research is key, and working with a sales tax expert can be very helpful.”

The challenges don’t stop there. Some sales channels don’t actually support compliant tax collection without extra apps.

“If you’re on a basic Shopify account for example, you’re limited in the way you can set up tax rates. This is where a third-party tax app like Avatax by Avalara can be helpful, with thousands of product types you can apply.”

5. Sales tax permits were missing

“What we mean here is that the business had nexus in the state - say by crossing the economic nexus thresholds or having physical presence in the state - and they didn’t have a sales tax permit at all.”

The background

Businesses are required by law to collect and remit sales tax to a state when they are deemed to have nexus there.

Nexus is a link - or business relationship to a state.

It might be physical, like having a storefront or occupying space in a storage facility. Or it could be economic, like getting a certain number or value of orders from customers in that location.

Each state decides how the nexus is determined. Generally, a physical presence in a state automatically qualifies your business for nexus. Otherwise, there’s usually a revenue threshold.

Surprise again: these vary.

At the time of writing, Alabama’s revenue threshold is $250,000. For Alaska, it’s $100,000 or 200 transactions - whichever comes first.

Arizona’s threshold has reduced each year from 2019-2021.

The key messages

“What this tells me is that out-of-state audit departments are looking more at enforcement within businesses that do have permits relative to finding those that don’t have permits at all.

However, this shouldn’t make sellers scared of getting permits because the longer your business waits, the bigger the problem would be if you were audited. Even with the statute of limitations, five years of sales could still rack up hundreds of thousands of dollars.”

What does this tell you? At least two things:

- To keep a strict overview of where you’re doing business, and how much, so you’re immediately aware of exceeding a nexus threshold.

- Not to rely on last year’s information (or worse, further back).The states are checking.

“What we have seen recently is an increase in states asking questions about ‘start dates’. They might look deeper into when a business says it crossed a nexus threshold to verify whether this was truly the case.

We have even seen states, like Utah, ask business owners to sign affidavits testifying that the dates are accurate.

It’s really important for the longevity of your business that you do not put this off.”

How to register for sales tax permits

If outsourcing your sales tax isn’t an option, then you’ll need to make time to educate and update yourself regularly.

There are two main ways you can register for a sales tax permit: the first is through SST registration, and the second is by registering for each state’s permit individually.

The Streamlined Sales Tax (SST) system was created back in 2000 to try to simplify some of the sales tax permit registration processes. Whether it does this successfully is unclear.

At the time of writing, 25 states participate in SST. Registering for sales tax permits through SST may have more negatives than positives. It can take longer to access your sales tax account, and sometimes you don’t actually get the right permit you need.

If you decide to register for each state sales tax permit individually (TaxValet’s strong preference) then you’ll need to take some time to read up on the registration requirements in each state, and perhaps consider getting professional help just at the beginning so you are on the right track. Registration is a lot of work, and it really pays off to be organized.

“Only register for a sales tax permit if you are 100% certain that you need a permit in the state. It costs businesses a ton of money to have issues cleaned up when they register for a sales tax permit accidentally. This is where hiring a sales tax expert can really pay off.”

6. The wrong sales tax rate was calculated

“The wrong tax rate is just a failure of either tax calculation technology, or no tech used at all.”

The background

The complications with sales tax don’t end after determining product taxability, or even after establishing nexus.

Knowing how much to collect can be just as taxing (pun intended).

“In the United States, we need to know exactly where every transaction is taking place to determine the correct sales tax rate. We need to know the rate of the state, the county, the city, the special district, sometimes a special tax or enterprise zone. Some states have more of these defined areas than others.

It’s estimated that there are over 12,000 different state/country/district/local tax jurisdictions in the US. Changes happen all the time, so there’s no definitive number. And in every jurisdiction, the rate will be a little different.”

The key messages

Back in 2014, Avalara and Wakefield did some research into sales tax rates and how sellers were calculating them.

The results were worrying:

“There were close to 14,000 changes to rates and jurisdictions to occur this year [2014] in the U.S. alone, (up by nearly 40%) from the previous year, yet 40% of [respondents] rely on “existing knowledge” to determine their tax liabilities.

In fact, nearly half of the respondents couldn’t remember the last time they updated their sales tax compliance processes.”

So not only are there thousands of different rates within and between states. But there could be thousands of changes to rates and jurisdictions within the space of 12 months.

According to Alex, having the technology to help you is vital:

“This is where tax technology is mandatory now for any ecommerce business. How else are you going to know what the tax rate should be for all the hundreds or thousands of customers that you have?”

How to calculate your rates correctly

“It’s so important to have a tax calculation plugin for your store like Avatax or Taxjar. And these will, in most cases do the following:

- For each product, look up whether that item is taxable in the appropriate jurisdiction.

- *If it is taxable, apply the correct sales tax rate. **There are some free native plugins on some ecommerce sites. But these aren’t always 100% accurate. And the penny differences can add up to dollars.”*

Alex’s team are passionate about simplifying the sales tax compliance process in the US. And they’ve taken it to the courts.

“It’s pretty unfortunate that we have a system in the US that is so complicated that businesses have to spend thousands just to calculate what they owe.

At TaxValet, we’re actually doing a lot of work in the space to try to simplify things for businesses. At the moment we’re working with attorneys in Louisiana because its taxation system is one of the most arduous in the country, to try to change things. If we’re successful, we’re going to repeat the process in some of the other particularly tricky states.

We want a system that works for everyone that’s simple and easy to comply with.”

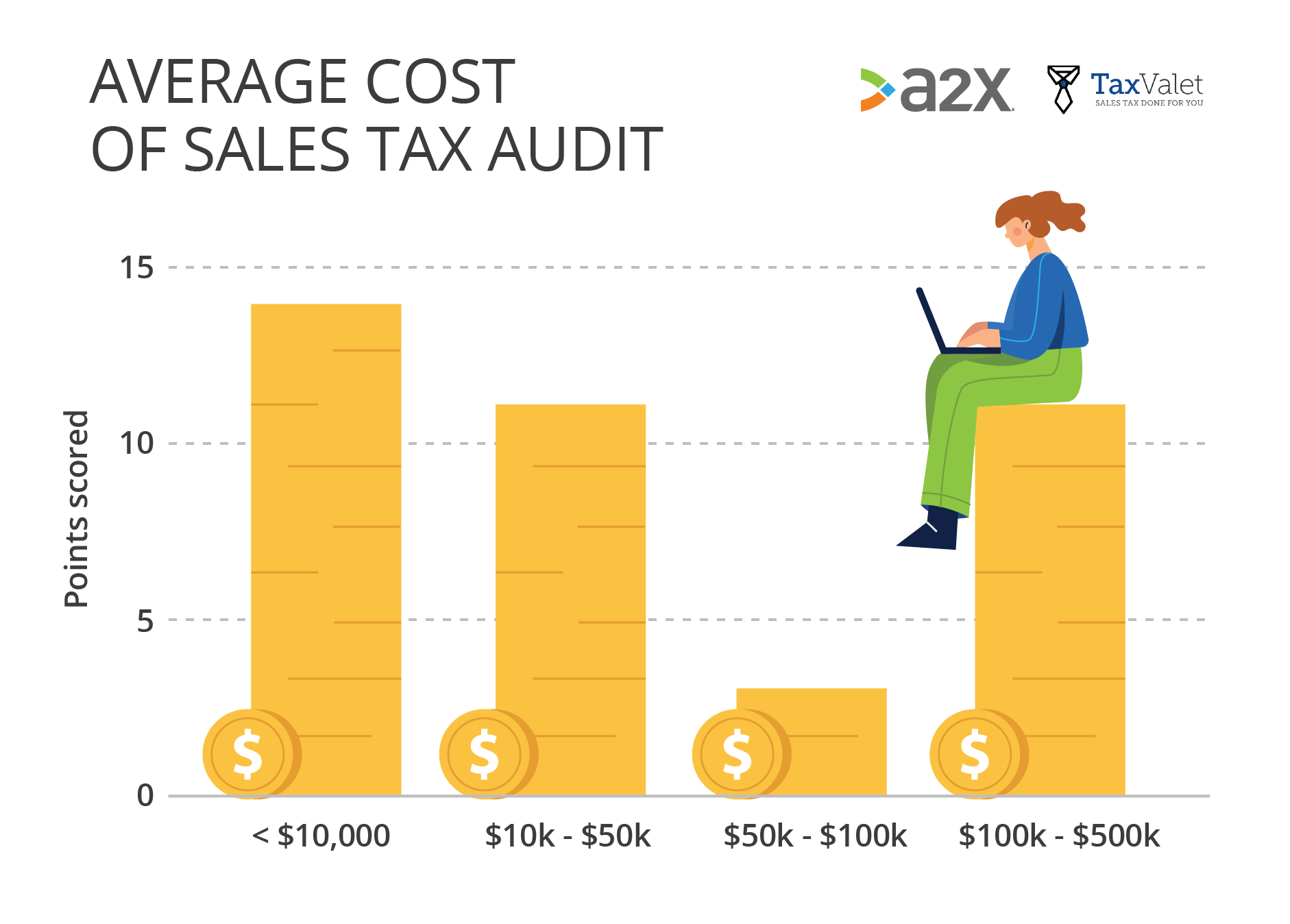

How Much Did The Audit Cost?

So now that we understand the whys, let’s take a peek at the damage in dollars.

Based on our research, most audit bills came back at $10,000 or less, but a significant chunk were between $10-50k, and over $100k:

We surveyed businesses with the following revenue ranges:

- Less than $1million/year

- $1m-$5m/year

- $5m-$10m/year

- $10m-$50m/year

- More than $50m/yearBased on our data alone, we found no meaningful correlation between yearly revenue and the size of the audit bill. There was a relatively broad spread of audit costs against each revenue category.

Where Did Audits Take Place?

Prior to the changes that took place in 2018, out-of-state audits were relatively rare. This is no longer the case.

From our survey, we found that:

- 41% of businesses had an audit from their home state in the last 24 months.

- 45% of businesses had an audit from out-of-state in the last 24 months.

“We’ve seen a pretty dramatic shift in the last few years where out-of-state audits were not that common, and now they’re actually more frequent than in-state audits.”

This shift suggests that states have increased their policing of out-of-state ecommerce sellers.

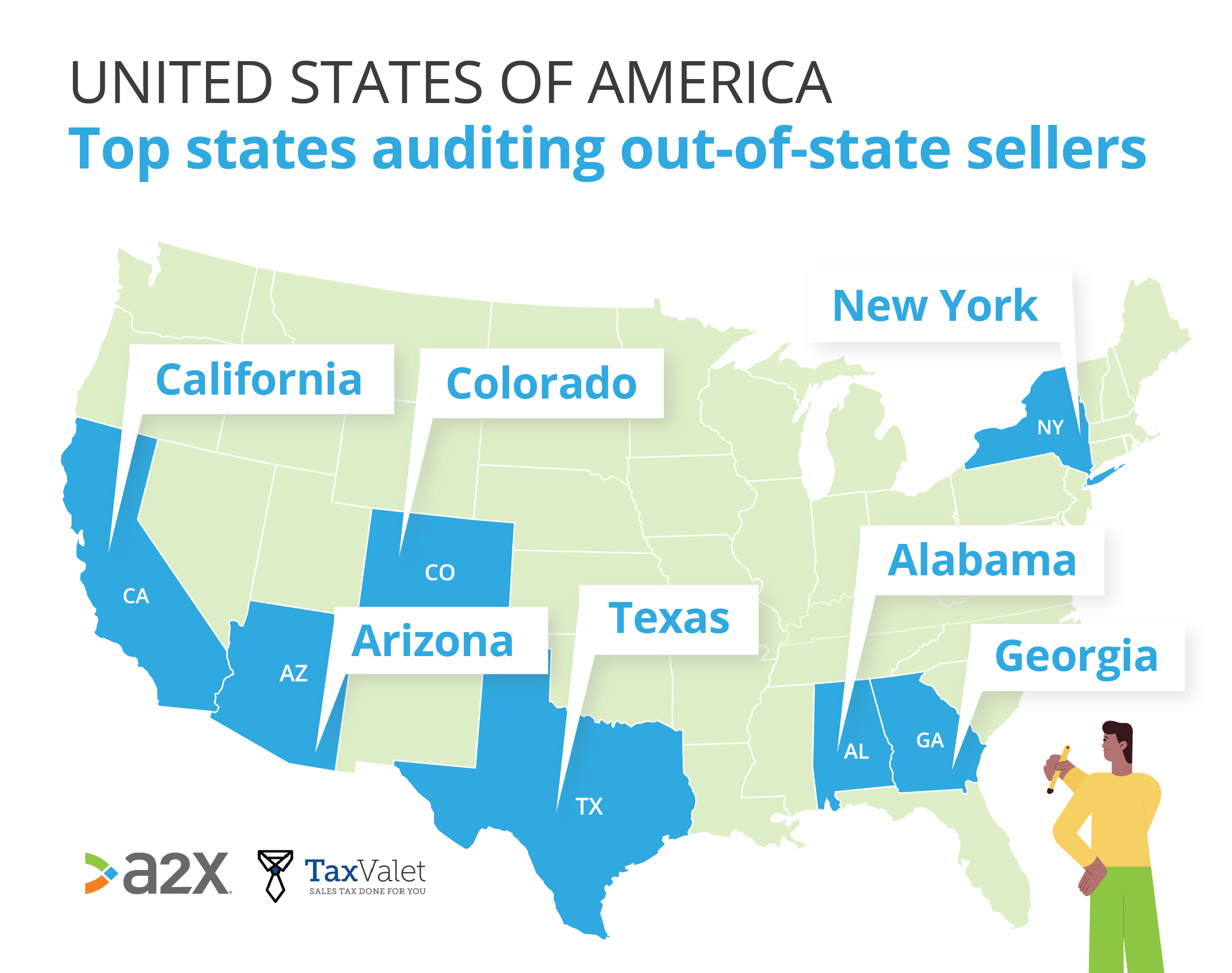

Out-of-state audits

Sellers shouldn’t underestimate their position. This is particularly true of the following states where, according to our research, 60% of the out-of-state audits took place:

- California

- New York

- Alabama

- Arizona

- Colorado

- Georgia

- Texas

If you have nexus with one of these states but are not collecting sales tax there, your business could be at more risk than in other locations.

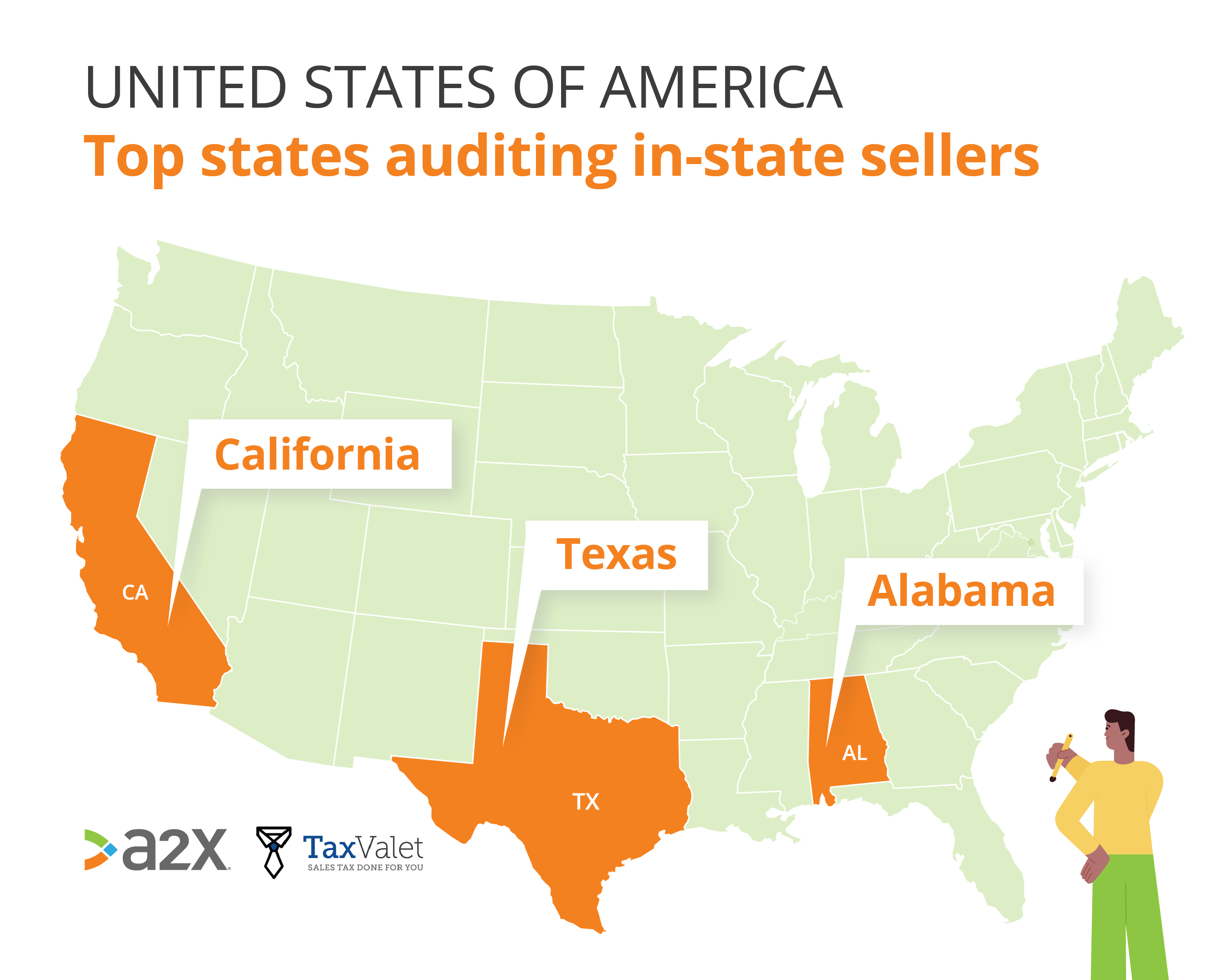

In-state audits

With regards to in-state audits, the top states were:

- California

- Alabama

- TexasWhilst sellers should register for sales tax and collect it wherever they have nexus, for those being more selective, these findings may help manage risk. But these lists can always change.The best way to manage risk and protect your business is to get on-the-pulse help from the experts.

The Lesson? Don’t Ignore Sales Tax

“We know that sales tax enforcement is ramping up and will continue to. States have been devastated by COVID, but we’ve seen dramatic rises in sales tax revenue since the Wayfair case [in 2018].”

Collecting and remitting sales tax is a legal obligation, and sellers that choose not to do this open themselves up to a range of risks.

Even if you’re lucky and aren’t audited, the future of your business is still at stake.

Future buyers will want evidence that you’re tax compliant, and will likely run in the opposite direction if you can’t prove it. Since audits can be backdated 3-5+ years, they could be responsible for your years of infringement.

The best way to ensure you’re compliant with your sales tax is to get professional help.

Failing that, tax apps are a minimum. Apps will save you or your accountant hours of manual rate calculations, and provide the plug-ins you might need to set custom rates at checkout.

Whilst changes may be on the horizon to simplify the system, the experts deem it unlikely that we’ll see anything drastic anytime soon.

To learn more about sales tax, check out the dedicated chapter in our Ecommerce Accounting Hub.

To eliminate your sales tax stress and work with the experts, contact Alex’s team at TaxValet.

Learn how to manage your sales tax obligations like a pro

Sales tax is complex and the costs for getting it wrong can be significant. Discover the key terminology, compliance strategies as you grow, and how to set your business up for success.

Download our free guide