What Does Automated Ecommerce Accounting Look Like?

May 29, 2025 • 27 min read

Hey everyone, my name's Geoff and I'm the Head of Marketing here at A2X—ecommerce accounting‑automation software for the world's leading Shopify, Amazon, eBay, Etsy, and Walmart sellers, as well as their accounting partners. And speaking of partners, I'm joined here today by Scott Scharf from Scharf Consulting. Scott is an expert in helping e‑commerce sellers streamline and optimize their back office. He helps businesses with their accounting processes and tech stack, which is going to be a lot of the focus of what we're going to be talking about today. He also helps folks select the right inventory‑management solutions—which can get really hairy. He provides entrepreneurial coaching and a ton more.

And if Scott looks familiar to many of you, there's a reason for that: it's because Scott has been in the e‑commerce‑accounting space for well over a decade. He was actually the co‑founder of Catching Clouds, one of the first—if not the first—specialized ecommerce‑accounting practices in the United States.

So, just to kind of TL;DR this, if you're an e‑commerce business owner and you want help optimizing your back‑office administration, Scott is your go‑to resource, and we've included a link in the description below to his website. So if you want to get in touch, please do so there. Scott, thank you so much for joining us on today's video and for sharing your expertise.

Scott Scharf (01:25)

Thank you, Geoff. It's always fun collaborating—both with you and the whole team at A2X.

Geoffrey From A2X (01:30)

Okay, so in this video we're going to talk about what automated accounting actually looks like for ecommerce sellers in 2025. Most sellers that are watching this probably didn't start an online store to do the accounting or get caught up in the back‑office administration of it all, so the idea of automated accounting is really appealing because, in theory, you get the benefits of accurate numbers to help you make informed decisions, and you don't have to deal with the admin headaches.

But the challenge with e‑commerce‑accounting automation is that it lives on a spectrum. Every single person probably has a different definition depending on the tools and technologies they're using. Some solutions deliver a part of the process; others make bold claims that they can do all of it but don't necessarily deliver. And with the proliferation of AI, things are getting even a little bit more confusing.

So Scott, I'm going to start off the video with this question for you: What does automated e‑commerce accounting mean to you, and how much of the process can we actually truly automate?

Scott Scharf (02:31)

Yeah, so when it comes to e‑commerce accounting, it really means that the data is flowing in automatically—that either you or your accountants aren't waiting until the end of the month and downloading data and pivoting data or making guesses or doing other things.

There's still a need for actual bookkeepers, accountants, and especially controllers, who are going to make sure that all the numbers come together and tie together—and then can tell you a story about what happened in the current month based on this accurate data. But you're not paying for as many humans to do data entry or to double‑check things where things aren't accurate because somebody broke your spreadsheet and the calculation's wrong and all of that other stuff.

What it means to me is: You have a consistent way—where there's daily, weekly, monthly processes—for you to run your business and for the data to flow cleanly, consistently, in an integrated way into your general ledger, and that you can trust it.

Geoffrey From A2X (03:30)

Love that. And I know that you have a very clear view of what this actually looks like in practice. So I'd love for my next question to be: Could you show us that view? What does your ideal automated e‑commerce‑accounting setup look like, and can you walk us through the process?

Scott Scharf (03:49)

Sounds great—let's do it.

So, there are a number of key functions on top of just the regular accounting when it comes to e‑commerce. The first is: How are you going to post your income so you know if you sold 100 items, did you get paid for all those 100 items—and reconcile to cash? And that's really where A2X comes in and, depending on how you look at it, that's probably the first third of e‑commerce accounting on top of all the regular accounting.

The next key function is: How are you going to post your cost of goods sold? Okay, so I sold 100 widgets at $10; I need to reduce my inventory by $1,000 so I know—if I sold X amount—how profitable I am.

Then the next piece, that more than likely probably starts first, is: When you purchase products, how do you account for them properly?

And then the last little piece is any inventory adjustments and some very specific month‑end closes that have to be done—by the accountants—to make sure the balance sheet balances, vendor deposits are accurate, inbound inventory is accurate, and a number of these other details.

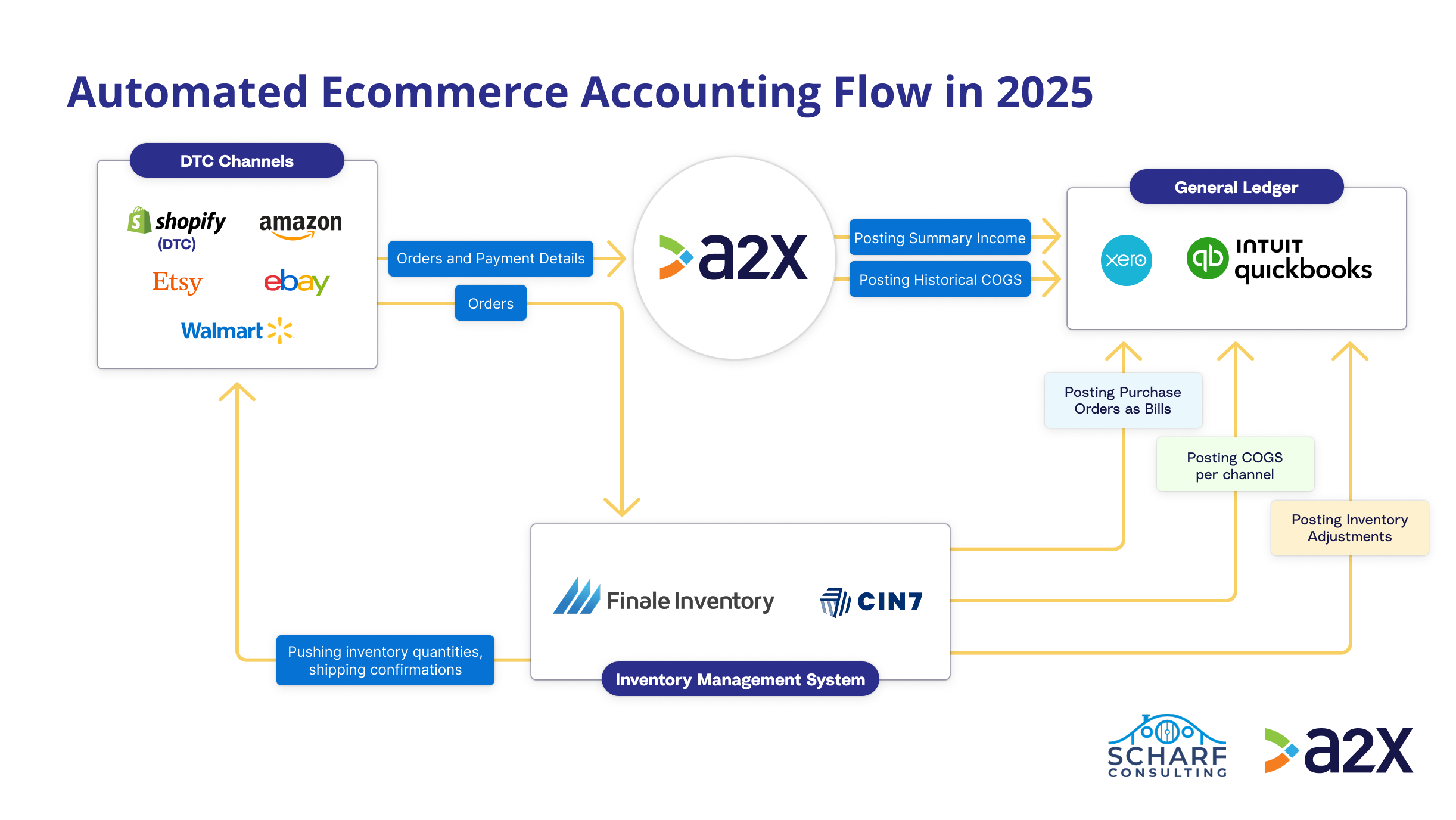

Looking at this image: In the top left you've got your channels. So this first one is specifically for a direct‑to‑consumer only, and then we'll talk about if you're also doing wholesale as well on the next slide. So what it's going to do is A2X is going to pull in all of that income for Shopify, Amazon, eBay, Walmart, and Etsy, and it's going to post it into a summary invoice—either per day or a couple of invoices per month—following accrual rules.

In my opinion, instead of posting every single invoice where you have to apply a payment and track every single invoice in your accounting, this is about 5% of the work: having A2X post this in a summary fashion, especially because both Xero and QuickBooks Online aren't set up to accept thousands or tens of thousands of orders—it's just noise. What you care about is: sold 10 units, did I get paid for 10 units? And A2X specifically does that very well; I've been working with them for over a decade.

For Amazon, eBay, Walmart, and Etsy, they're going to post those based on the settlement statements, match all the pennies, and allow you to map everything—from sales income to shipping income to discounts to refunds and Amazon FBA reimbursements and other items—so all the accounting gets mapped properly and it gets put in the right buckets, in a limited number of buckets, so it's easier to manage.

In the case of Shopify it's going to post a daily invoice that's going to match your Shopify‑Pay payout to the penny—which includes fees and everything else. Any other payment processors are going to be put into a clearing account. So it's going to optimize income getting into your financials with the least amount of data—or invoices or journal entries—so that you have accurate income that you can reconcile and track back to know that's accurate.

If you're wondering, "Well, why don't I do that with another tool or the inventory‑management system? They also have a copy of every order." The difference is that those tools are looking at every order. You want every order in your inventory‑management system, and even if they do a consolidation they're going to consolidate based on a 24‑hour day—or a week or a month—that does not break it into the pieces that accountants need to, as efficiently as possible, make sure the money going in and out of your business is accurate.

With A2X you have the option to upload your costs into A2X if you don't have an inventory‑management system, you currently have spreadsheets, and you don't really trust your spreadsheet calculations to create the number for your cost of goods sold. You can upload those costs into A2X and it'll post the historical COGS for all of your orders—both historically and as you move forward—as long as you keep those costs accurate and up to date.

That's really going to cover about 60% of the e‑commerce accounting; you're most of the way there, and you can continue to work off spreadsheets. But, as we were talking before, there's a point where you need that automation to make sure you're managing how you're purchasing inventory and that you have a trusted source.

An inventory‑management tool is going to do a few key things. It's going to be the trusted source for purchase orders—where you purchase all your products. Every purchase order (even if you make a phone call to somebody and they're sending it to you and you don't email them anything) should be created in the system so you're tracking: I've requested this inventory; it's showing up at some point in time—a thousand widgets or whatever else.

The next critical thing is knowing your costs, and this is the foundation of having accurate numbers. This is the most common thing that goes out of control: when people switch from buy cost ("I spend $10 for a widget") to landed cost ("it actually costs me $30 after it ships from Vietnam or Japan or wherever"). Coming back over, that's your landed cost, where you take the buy cost and you add in any inbound shipping, insurance, customs, tariffs, and duties (which are a big deal now) to make sure you know the total cost of that product when it's sitting in your warehouse so you don't sell it for less than it cost you to make it live and available.

The inventory‑management system is going to allow you to know the vendor, the buy cost, the quantity, the SKUs, and you'll be able to add those additional costs and be the trusted source for costs. The next thing is: it's going to be the trusted source for your inventory quantities. When you receive inventory or you sell inventory, it's the one that's going to keep track of that. Anybody that's on spreadsheets—and if you're working with a third‑party 3PL warehouse—can't just trust their numbers. Sometimes it's not trust but verify; it's trust but ... or don't trust and say, "Wait, there should be another 100 units. Where are they?"

This is a big deal. Many people move off of spreadsheets to an inventory‑management system because they're working with a 3PL and they have no other way to validate their numbers. I had a seller with $50,000 of inventory just disappear because the warehouse mis‑reported it. We looked and it just disappeared financially because it wasn't reported to us that it had disappeared. It took four months until the 3PL did an audit and found a cage full of his product—he had already bought another year's worth of product.

So these are key things, but once it does that, then you can have the accounting. To take a step back: the inventory‑management tool is going to pull in every order; it's going to push inventory quantities up, as well as shipping confirmations, and manage that portion of it.

So, you're going to buy product, you're going to receive product, it's going to update your inventory, it'll update what you're selling, and you'll be able to track those things and generate those things. Now, when it comes to the accounting—when you're working with A2X—what you want your inventory‑management system to do is: when it creates a purchase order, it's going to create a bill in Xero or QuickBooks Online. That's going to tell your accountants that you've spent some money. Otherwise, they have to wait until you either make a payment (which could be a pre‑payment for 25% of the overall order) or until you randomly get an invoice. So they can't track your outstanding accounts payable and what commitments you've made.

You're spending $100,000—you can't project cash‑flow; you can't make financial decisions if those things aren't there. So, what you should do is: when you issue a purchase order—even if you do it by phone—you should always create it in your inventory‑management system and it should create that bill. So that is a key piece of the puzzle.

The next piece is posting cost of goods sold. Yes, you can upload your costs into A2X and choose to post all of your COGS that way. In general, the inventory‑management system is the most accurate place for cost of goods sold because it has all of the ship dates. A2X is focused on income and can post COGS that align with that income, but what you can do is then not have A2X post cost of goods sold and have your inventory system (that has your trusted costs for that day, hour, whatever, and the quantity that's sold for that SKU) post that cost of goods sold on a daily basis into your general ledger, per channel.

So, if you haven't heard this: instead of having a really tall chart of accounts—where you have all the Amazon income, sales income, shipping income, discounts, refunds, then Shopify, then eBay—the idea is to have just those total categories and use what are called tracking categories or classes to create a channel one that's Amazon, Shopify, Walmart, Shopify‑2, Shopify‑3, so you can continue to grow your business.

Where you do your financials horizontally and it allows you to see profitability per channel, because in this model—in your financials—you only want a dollar amount for your inventory. You're not trying to track the quantities and SKUs and per‑SKU costs and any of those details in Xero or QuickBooks Online.

Then the last piece that the inventory system does is when you do a stock change—an adjustment for lost, stolen, damaged, expired, whatever adjustments happen—it's going to post those adjustments. You want limited information flowing in: whenever you create a purchase order, it updates your accounting; when you post COGS, when you sell products and ship them, it's going to update your accounting on a daily basis, typically with a journal entry; and whenever you make adjustments, whether you do a weekly stock‑take or a monthly one, it pulls it together so you're asking A2X to post income, making it as efficient as possible for you or your accountants to reconcile the money going in and out of your business, and then asking the inventory‑management system to do its function to manage your inventory processes and only post the limited information that your financials need to be accurate.

Geoffrey From A2X (14:12)

Scott, you mentioned you or your accountant—one question that we get a lot is: At what point should you consider starting to work with a specialized e‑commerce accountant? And, given the information that you've provided, it feels like if you're kind of going down this route, it would be as soon as possible, right? What are your thoughts on that?

Scott Scharf (14:33)

For an entrepreneur: Is it the best and most useful use of your time? Are you losing weekend time with family or your hobby—whatever else—or stressing doing this? Is it the best and most valuable use of your time? Would your time be better spent either taking time off and relaxing and thinking of new ideas for products, or hiring new team members, or focusing on your marketing or something else, than actually doing the accounting?

As soon as you get to that point—and most people get to it fairly quickly (I happen to have married an accountant and I haven't had to balance a checkbook in over 30 years)—you get there very quickly.

So, in general, it's as soon as you can, but you want to make sure that you're outsourcing it to someone that focuses on an e‑commerce business and understands inventory‑based businesses—preferably somebody that's certified on A2X Accounting and actively focuses on this space—and then deeply understands your business so that you can actually have a conversation with them. Ideally, they're also technical and understand these things.

These slides—I build and share them with sellers and founders so they understand how the data gets into their financials. I explain it just as much to my peers and friends that are accountants and other people that I'm partnering with (where I support their accounts) so they understand: this is the cleanest view of how the data is supposed to flow, so that they can support it; they understand their role, they understand your role. You have responsibilities about creating purchase orders and spending the money, sending payments off to your vendors. They have to record it all. If most of it's recorded, it's not all perfect, and you want those bookkeepers, accountants, controllers double‑checking things and doing controls in case this automation gets a little bit off.

Geoffrey From A2X (16:22)

Yeah, it goes beyond compliance, right? They set up the systems, ensure compliance, but in addition provide added value with the numbers that they're providing and then supplementary insights—like as it relates to your shipping costs, as it relates to profitability by SKU, as it relates to your pricing strategies, and so on and so forth. There's a lot of additional added value beyond compliance when you work with a specialized e‑commerce accountant.

That was awesome—appreciate you walking us through your ideal setup.

Now, Scott, what happens if somebody has direct or wholesale orders?

Scott Scharf (17:00)

Yeah, as soon as you start doing either direct orders or orders on terms. If you just have a handful of those and you're doing those through Shopify draft orders, you can actually continue to use A2X—they have new B2B functionality. But when you start getting serious about it—where you are taking either phone orders or getting purchase orders, you're expanding into wholesale, you're partnering with Faire, or you're doing EDI (which is a data exchange) to connect to Target from an EDI perspective, or to Best Buy, or to Chewy or PetSmart if you're selling pet products along those lines—you'll be having all of those orders come in.

The idea is: you want to flow all of those orders into your inventory‑management system. For those types of orders, you want to track them in a normal sales way. So for every order you want to have an invoice in your accounting that tracks your accounts receivable.

How that would work—and the only difference on this piece—is that the inventory‑management system is going to sync those over as an individual invoice to your general ledger (Xero or QuickBooks Online), and then it's going to sync the status back and forth. So, if you have a large customer that buys $50k at a time and sends you a wire every two weeks, your accountants are going to see the wire; they'll be able to update it in your general ledger, and it'll push that payment status back over to the inventory‑management system so you know where things stand.

It'll also post cost of goods sold for those orders. So as part of that daily piece, the IMS will post the COGS for all of your D2C orders whose income has been posted by A2X—and for all of those other individual orders.

When you get this, you're asking the inventory‑management system to do what it's best at; you're asking the general ledger to absorb the data and allow you to do the accounting; and A2X is doing what it does best: posting that income. By asking everything to do the right steps, everything flows and you can optimize that.

You can decide to do quote‑to‑order‑to‑invoice right out of inventory‑management systems like Cin7 or Finale, which work very well in this model—they support turning off income posting and working properly so it plays nicely with A2X and keeps your financials clean. They aren't trying to do everything; they're trying to do what they're best at. But when you create those orders it's there, and it's a little shift if you've been doing a lot of Shopify draft orders.

Sometimes that's handy, but if you're doing lots of sending stuff to influencers or marketers, or returns or replacements, or things along those lines, an inventory‑management system gives you a way to do that inside their system and—with this integration—will push the appropriate data across so that the accounting stays up to date and flows on at least a daily basis (if not, in some cases, real‑time) as invoices are created.

So it's just a slight tweak on it, but it's really critical that once you have an inventory‑management system, it makes expanding into wholesale/B2B/direct sales—away from just everything flowing through Shopify or Amazon—so much easier, and the accounting can stay up to date as well.

Geoffrey From A2X (20:59)

So Scott, we've known each other for a while now, and I know that for a long time you've had very strong opinions on inventory‑management solutions. In fact, I know that you even had a saying—am I putting you on the spot by asking you to remind me what that was?

Scott Scharf (21:17)

So what I said for probably over a decade—and there are plenty of videos out on YouTube and elsewhere—is: All cloud‑inventory tools suck; some suck less. At Catching Clouds I wouldn't let any of them connect to the general ledger because they pushed too much information—the wrong information—and corrupted the financials to the point where it made it harder to close books so people knew where they stood financially.

Now, they still did some of the other work. Things have changed in the last few years. Basically, for the most part, they've actually done a better job of both controlling their data and generating purchase orders and costs—so that's better; they're collecting better data. But they've also built better integrations to QBO and Xero. So yeah, it's been fun.

Geoffrey From A2X (22:06)

Given your strong opinions, I'd love to hear about your considerations when choosing an IMS while working with one of your e‑commerce clients.

Scott Scharf (22:15)

Yeah, so probably the biggest thing is that when I'm talking to people, I get them at the point where they've demoed 5, 10, 15, 20 solutions; they've talked to a bunch of their peers—whose businesses are all a little different. One person has a warehouse; another has a 3PL; another sells internationally; another manufactures. Everyone's business is a little unique.

Probably the best advice I would have is: document your requirements—just stop and do it. (I did a deeper version of this with one of our peers, another A2X partner, Stephen Brown at LedgerGurus—we'll share the link to our conversation. We geek out over this stuff all the time and go into even more detail.)

The biggest thing is just to write down your requirements. It needs to support bundling and kitting. It needs to support dynamic bundling. It has to integrate with Shopify. It has to support our warehouse‑management system or our barcodes for our warehouse. It has to provide accurate financials. It has to do multi‑currency purchase orders. Whatever it is about your business—you know your business—write those down.

If you've tried another tool in the past and bad things happened and you've killed it off, or you're sort of using a system now and there are five things you hate about it, write those down as things you don't want.

I have a comparison list of over 70 of these solutions—it's 300 fields deep—that I use both to help sellers find the right version and also consult back to these companies, helping them fill gaps in their functionality.

Then narrow it down to two and demo those—and take notes. Don't just let them do the standard demo. You can let them do the standard demo for 5, 10, 15 minutes, then say, "Show me how purchase orders work. Show my operations manager how I receive inventory. Show me how landed cost is calculated." Oh—you do it based on quantity, not weight? My stuff's really heavy; your tool won't allocate landed costs based on weight if I bought $100,000 worth of product and three of the items weigh a ton and the others weigh like a feather.

Walk them through how they look at quantities, walk them through the reports—do they do moving‑average cost for your COGS or do they do first‑in, first‑out and track every sale? That's not always a killer piece; you just need to understand what that is.

And then: does it integrate with all of your existing technology—specifically your general ledger and, of course, all of your channels?

You want to make sure you've got those things and then demo two systems, document, compare, and rank them. Get quotes. The cheapest solution isn't always best. You want to make sure it works best.

The next thing is: right now, by the end of this year, every single inventory‑management solution that doesn't have an AI‑based demand‑planning/inventory‑planning solution—one that tells you when you're over‑stocked, gives you three‑day, five‑day, two‑week warnings to place a purchase order for something that takes 62 days to show up at your warehouse—is going to be at a disadvantage. Or they need to work with one of the tools that are out there: Flieber, Prediko, whoever.

The other piece is: it's almost more important who implements it as the tool itself. You want to pick the right tool and go through an actual documented process so you know you're comfortable with the right decision—but implementing these tools is usually a four‑ to eight‑week process. This isn't something that's going to be set up in a day—you can't do it over a weekend. It's just not possible for any business over $3 million.

If you have manufacturing, add another two to four weeks to re‑translate and get everything set up. Then, after those two months, you're going to have a month of going live and training—running your old system and your new system in parallel. After that, you get comfortable for the next couple of months, then you can optimize.

Depending on the inventory‑management system: Finale does their own implementations; they have a phenomenal team and great customer support—you can trust them. Cin7 has an okay implementation team, but their implementations (for a few thousand dollars) are so lightweight that they don't finish everything and you might have to redo everything three or six months later if you don't. I always recommend hiring one of the many great external Cin7 partners who will spend those two months with you—train your team, customize, and adapt the tool to your business—so that it's fully implemented.

Geoffrey From A2X (28:07)

I love how you have such a pulse on each of these inventory‑management solutions. And you didn't mention this, but I'll mention it for you: I know that you work directly with most inventory‑management solutions serving e‑commerce. I know that you're giving them feedback on their roadmap and so on and so forth, so if folks watching this video are looking for somebody to help with implementation—not just selection—I'd definitely recommend reaching out to Scott after this video.

Okay, so we've gone over your considerations for evaluating an inventory‑management solution, but let's talk a little bit about what they are for an accounting solution.

Scott Scharf (28:46)

Yeah. If you don't have one, one of the biggest challenges I'll mention is that you've got Xero and QuickBooks Online—they're Pepsi and Coke; going with either one is fine. There's no reason to change from one to the other and back again, because every time you go through a migration, you usually end up with two or three months where you don't have any financials. You're totally in the dark—just like when you started the business before you did everything else.

So, if you're on one or the other—stay there. Then, if you already have an accounting partner, hold them accountable to do the things they need to do. Now, if they've used a tool that has pushed in 10, 20, 50,000 transactions from your shopping cart and things are out of control, you might have to have them start over with a brand‑new file to get things cleaned up. But, for the most part, hold your accountants accountable; have a weekly meeting with them and hold them to cleaning things up to your satisfaction. If they can't, then you can look for an alternative.

But really, Xero and QuickBooks Online are both solid solutions—there are pros and cons to both. They're different companies; QuickBooks Online tends to be a little more expensive. I have some strong opinions about them, but, for the most part, you need to make sure they integrate with your banks. (In the U.S., that's pretty much a given these days with Plaid integrations.)

They need to support your business from your current currency to multi‑currency—whatever—for at least the next 12 to 24 months, and then integrate with payroll, accounts payable, financial apps, dashboard apps, cash‑flow apps—whatever else you're doing—payment processors, things along those lines.

Another key consideration is that your accountants—your trusted partners—support it. If you haven't decided, you don't really have anything, or you're on one of the low‑cost/free solutions or still on spreadsheets (I run into companies over $10 million that grow really fast and are still on spreadsheets), find your trusted advisor. Any of the A2X partners—e‑commerce accounting firms—are a great choice.

Geoffrey From A2X (31:01)

…desktop.

Scott Scharf (31:17)

They're going to provide the services you need—whether it's bookkeeping, accounting, controller, CFO, or tax services. Don't typically ask somebody that only does income tax to do bookkeeping or client‑accounting services—please don't. They're really good at taxes; they geek out on that stuff, but they're not great at running a daily, weekly, monthly process.

They're all too busy doing taxes right now while we're filming this, so I'm not worried about them seeing it.

Anyway, once you get on one, you're going to stay on it until you either sell the business or grow at $10 or $20 million a year and you outgrow it at $70 million and have to go to something else.

Geoffrey From A2X (32:11)

Yeah, totally agree. And, regarding your mention of A2X's expert e‑commerce‑accounting and bookkeeping directory, we'll make sure to link it in the description below so you can click on it and potentially find an accounting partner that suits your needs.

Scott, I always love chatting with you—whether it's in a recorded format on a YouTube video or just generally speaking (we talk most days). For everyone watching: thank you so much for lending your expertise.

If anybody needs support—whether with e‑commerce accounting and automation, selecting an inventory‑management solution, or any of the other services that Scott and Scharf Consulting provide for e‑commerce businesses—please do reach out. There's a link in the description below.

Scott, thanks again, and we'll see you soon.

“Automated accounting” promises “set-it-and-forget-it” books, yet most ecommerce sellers still end up wrestling with messy marketplace fees, multi-currency payouts, and missing tax data.

In this video, Scott Scharf of Scharf Consulting breaks down what automated ecommerce accounting actually looks like.

00:00 What Does Automated Accounting Look Like for Ecommerce Sellers

03:50 Automated Accounting Setup for DTC

14:17 When to Hire an Accountant

17:00 Automated Accounting Setup for B2B & Wholesale

21:03 Choosing an Inventory Management System (IMS)

28:42 Choosing the Right Accounting Software for Ecommerce

Summary: What Does Automated Ecommerce Accounting Actually Look Like?

Scott Scharf’s Definition of True Automation

- Data flows in daily (not in end-of-month CSV dumps).

- Bookkeepers/controllers still review & “tell the story,” but far fewer humans re-key data.

- Consistent daily → weekly → monthly processes feed a trusted general ledger.

The Ideal 2025 Tech Stack

Function | Tool of Choice | Why It Matters |

Sales & fee summaries | A2X | Posts summary invoices – thousands of orders become a handful of clean entries. |

Inventory & COGS | Cloud Inventory Management System (IMS) | Single source of truth for costs, quantities, landed cost & purchase orders. |

General Ledger | Xero or QuickBooks Online | Holds only the financial view (balances, not SKU-level detail). |

➡️ The result? ~60%+ of accounting is hands-off once A2X + IMS are dialed in.

When to Hire a Specialized Ecommerce Accountant

- The moment bookkeeping steals evenings or family time, outsource.

- Look for A2X-certified firms that understand inventory-based businesses.

- Beyond compliance, pros surface insights on shipping costs, SKU-level profit and pricing strategy.

Selling Wholesale/B2B? Do This…

- Pipe purchase order or phone orders into your IMS.

- IMS pushes individual invoices to Xero/QBO → keeps A/R and COGS accurate.

- Turn off income posting inside the IMS so A2X remains the single income source.

Choosing an Inventory Management System (IMS)

Scott’s long-time mantra was: “All cloud inventory tools suck. Some suck less.”

However, things have changed in recent years – and the right IMS can turn inventory chaos into clean, real-time data that feeds your accounting platform automatically and unlocks SKU-level profitability insights.

Selection checklist:

- Write your requirements first (bundling, multi-currency POs, barcodes, etc.).

- Narrow to two candidates, then force demo teams to show your workflows.

- Budget 4-8 weeks for implementation + one month of parallel running.

- The implementer often matters more than the software – consider certified partners.

Choosing Accounting Software & Partners

- Xero vs. QuickBooks Online = Pepsi vs. Coke. Stick with what’s working.

- Priorities: solid bank feeds, multi-currency support, and integrations with payroll/AP apps.

- Hold your accountant to weekly check-ins until the books are clean.

💡 Key Takeaways

- Automate the data flow**, not the judgment.** Humans still interpret results.

- Use A2X (income) + an IMS (inventory) for a lightweight, scalable ledger.

- Document your needs before demoing tools; cheapest ≠ best.

- Outsource bookkeeping the moment it gets in the way of growth – or your weekends.

Questions? Get in touch with Scharf Consulting.