COGS: How the Cost of Goods Sold is Your Key to Profitability

As important as COGS (cost of goods sold) is, it can be a confusing concept to understand. One simple Google search can return a multitude of different definitions. You may be asking yourself: How can this be?! It’s because COGS is calculated differently based on business type.

This article will set the record straight on COGS for ecommerce sellers, walk through similar calculations that often get confused with COGS, and explain how best to analyze the profitability of your business with the help of COGS.

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

What is COGS?

COGS, or

cost of goods sold, is an accounting term that is directly translated to

the calculation of how much your products cost from production through point of sale.

That’s it! Simple, right? As an ecommerce seller, it takes into account all the expenses to receive a finished, sellable product to the door of your warehouse, retail store, or another location of business.

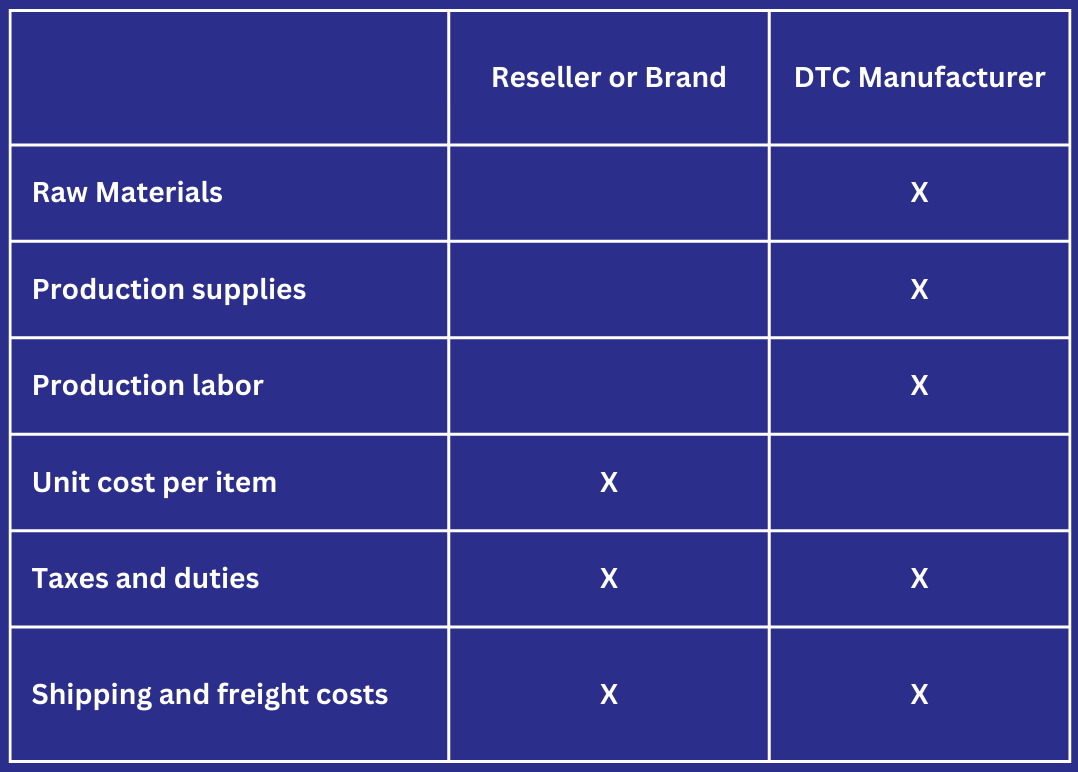

If you’re a DTC manufacturer, you’ll need to layer in other costs, such as raw material and production costs. Again, the goal for COGS is to understand what it takes to create and receive a finished product. So, it would make sense for manufacturers to include production cost in their COGS calculation but not for other brands or resellers where they receive finished goods at their door.

By Finale and A2X’s standards, COGS expenses are all direct costs related to the sale. For example:

How to calculate COGS

The good news is that the COGS formula is extremely simplistic. All you need to do is tally the above mentioned costs for items that have sold. Please note, this normally takes place across a group of products, and reported on at certain time intervals (i.e. at the end of a quarter or season). For the sake of keeping this calculation simple, we’ll look at the COGS for this one item.

Product: 12" x 12" Cleaning Cloth, sold at $13.98 retail and $6.98 wholesale

- Unit cost: $2.22

- Allocated Freight per unit: $0.156

- Allocated Duty: $0.218744

Total COGS: $2.594744

For any Amazon FBA sellers, know that you can also include shipping to the FBA location as the point is to get a look at the costs needed to set up an item for sale. This also applies to products sent to a 3PL.

What is not included in COGS?

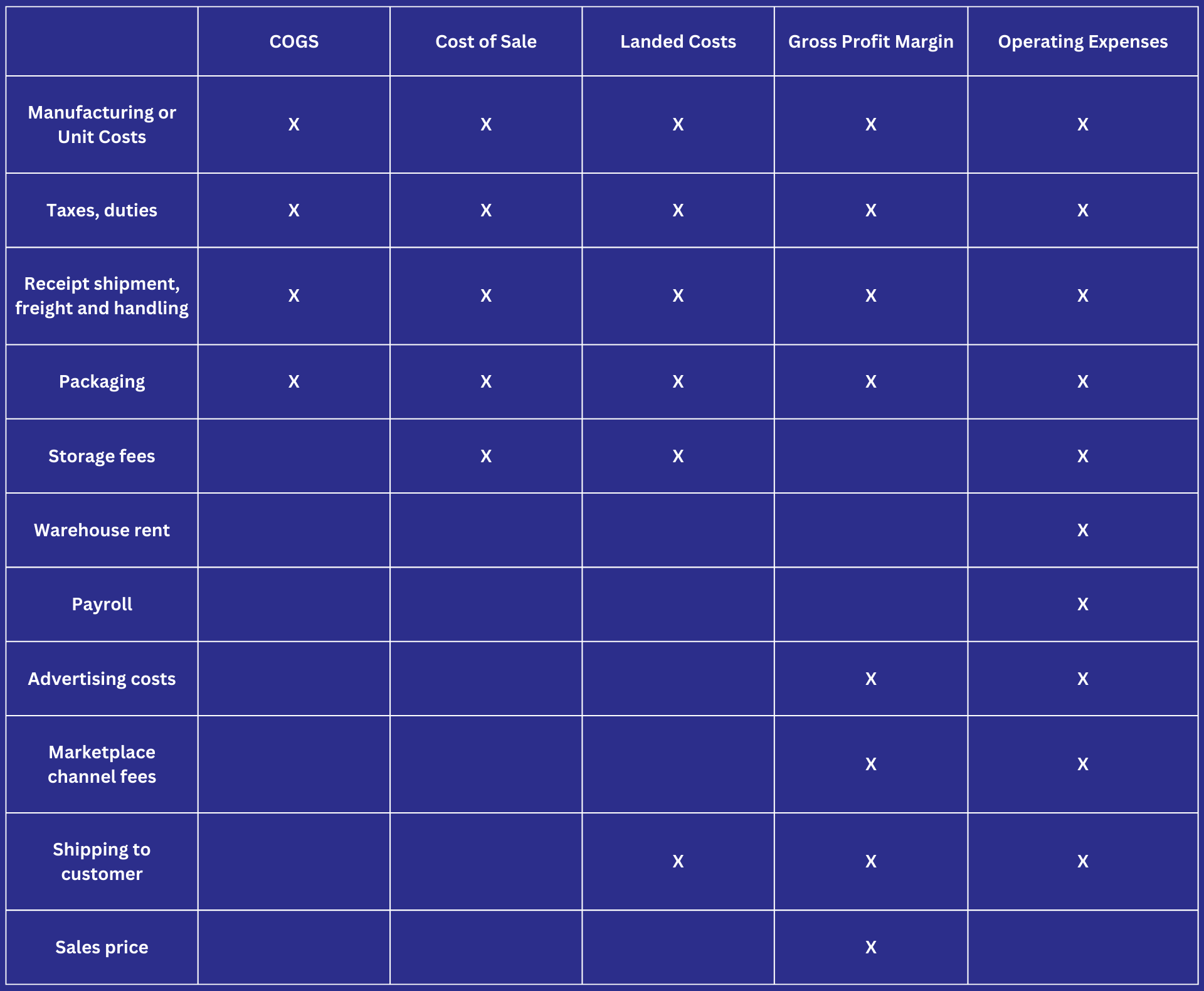

Cost of goods sold can often be intertwined and confused with the cost of sale, landed costs, and larger operating expenses. Let’s quickly look at those definitions:

- Cost of sale: all costs used to create or secure a product or service which has been sold.

- Landed costs: all costs used to create or secure a product or service, which has been sold and has been received by the customer

- Gross profit margin: all costs to sell the product against the cost to obtain it

- Operating expenses: all costs incurred doing normal business operations

As you can see, these definitions each expand upon what it includes. You’re also probably seeing that aspects of COGS overlap and are also taken into consideration when calculating these other costs and profitability measures:

So why is COGS important?

COGS is important to a business to help determine profitability. As COGS is part of your operating expenses and are marked on your balance sheet, COGS are one part in helping determine the profit margin of your business. Often COGS are tracked for possible tax deductions.

Tracking your COGS is important to determine the costs per unit, which allows you to understand which products are worth producing and selling, or if you can justify a price increase on your products. It can also guide you to better vendors with better prices for those products or services.

In addition, it’s important to understand how your business is calculating your COGS. Without the proper technology, your COGS and cost of sale could be inaccurate, which can create an imbalance within your books. With the ability to track supplier purchases, bills and sales transactions, Finale Inventory helps sellers do just this. For the larger gross margin assessment, A2X and Finale can be used to understand profitability.

Best practices for calculating COGS

- Stay on top of your stock takes. Know starting inventory counts, sold product counts and remaining inventory counts. Keeping abreast of this information helps to ensure accuracy of COGs

- Make sure any manual invoices are reflected in your inventory and/or accounting system. Leaving out purchases obviously has a direct impact on your financial analysis.

- Come to a consensus across your team (and your bookkeeper) for how COGS is calculated and how it is used. If stakeholders aren’t on the same page and are interpreting data differently, this can lead to making the wrong business decisions.

Why an inventory management system can help with COGS and profitability

An inventory management system integrated with an accounting solution like A2X and QuickBooks Online can provide your business with the transparency, accuracy, and accountability it needs to reach maximum profitability. These technology systems allow high-volume ecommerce owners the opportunity to frequently check the health of their business with the confidence it is accurate by tracking all expenses like taxes, freight, raw materials, advertising and more.

A perpetual inventory system, like Finale Inventory, can help track each product and update the inventory valuation every time you have a transaction. Since not all inventory management systems are built the same way, it is important to look at your current processes and see which platform can ultimately help you blend your inventory valuation models and make a smooth transition into something that can provide your business with more transparency.

Finale’s reporting is very compatible with A2X and can help gather distinct, comprehensive data. When worked in with A2X’s data and QuickBooks Online, the combination helps your team make smarter, more efficient business decisions while taking the heavy lifting of manual calculations off of them. Schedule a demo with a Finale inventory expert or reach out here.

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here