Solving Shopify POS Accounting in QuickBooks Online or Xero with A2X

For many retail businesses, managing both online and in-store sales can be challenging, especially when streamlining processes across various channels, locations, staff, and customers.

Shopify, a leader in ecommerce, addresses these challenges by offering functionality for physical retail environments through its Point of Sale (POS) system. This integration provides retailers a seamless experience, combining the ease of online management with the tangibility of brick-and-mortar sales.

While having one source of truth for sales, order management, and inventory is operationally beneficial, it introduces complexities in accounting when trying to reconcile your books in QuickBooks Online, Xero, or NetSuite.

Shopify POS accounting challenges:

- For one, you will receive one daily payout from Shopify Payments, combining all your sales for the day from both your online and physical stores.

- Additionally, you’re likely to receive other payouts, like cash payments in-store, EFTPOS transactions, and payments through Afterpay or PayPal.

- With these diverse payouts hitting your bank account, reconciling payments with orders or locations becomes a daunting task.

- The complexity deepens when considering returns, refunds, discounts, gift card sales and redemptions, tax implications, international sales, and the performance of various locations.

If these Shopify accounting challenges resonate with you or your accountant, there’s good news. A2X is designed to unravel these complexities, providing clear, manageable answers to your accounting challenges.

How does A2X Simplify Shopify POS Accounting for Xero and QuickBooks Online Users?

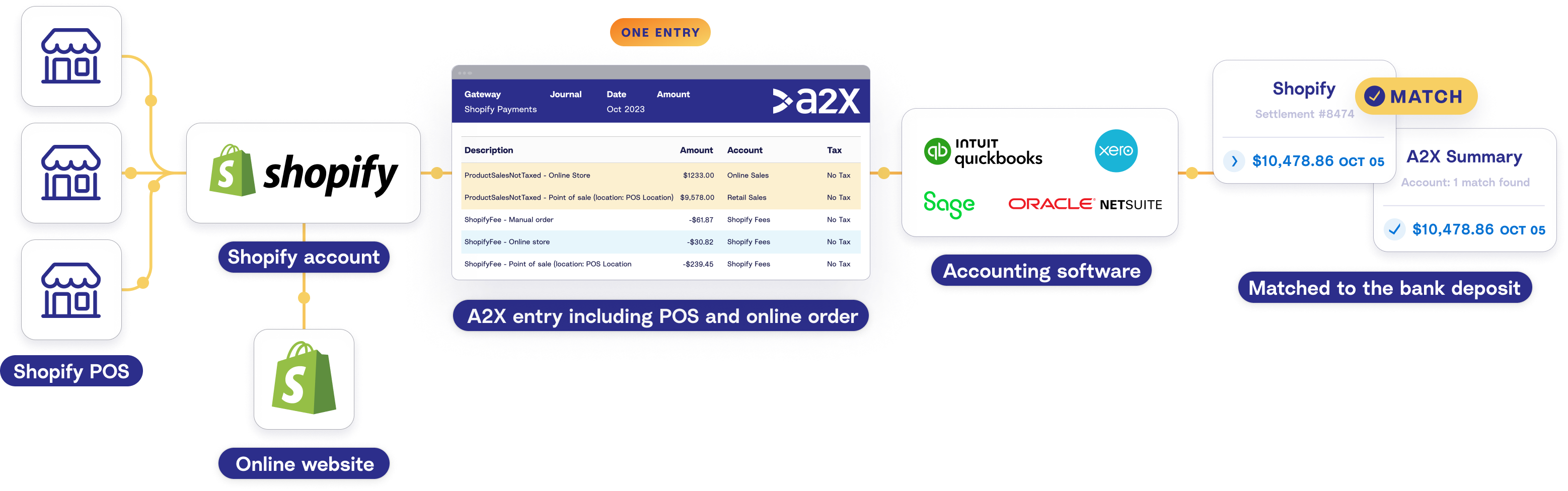

A2X seamlessly integrates with your Shopify store and automatically fetches data from both your online and physical store sales. This integration is particularly beneficial for those utilizing Shopify POS, as it ensures all your data is captured and accurately represented.

One Entry, Comprehensive Data

One of the standout features of A2X is its ability to create a single, consolidated entry that covers both your POS and online transactions. This unified approach not only simplifies your accounting but also provides a holistic view of your business’s financial performance. With A2X, you can see details split between online orders and POS orders, giving you clear insights into each channel’s performance.

Breaking Down the Data

A2X goes beyond just sales numbers. It comprehensively categorizes various aspects of your transactions including sales (both taxable and non-taxable), fees, refunds, discounts, and even complex elements like gift card transactions. This level of detail is crucial for businesses that want to delve deeper into their financials and understand the nuances of each transaction type.

Automated Mapping for Easy Reconciliation

Mapping transactions can be a time-consuming process, especially for businesses with a variety of transaction types. A2X simplifies this through its ‘ Assisted Setup’, which can automate the mapping of your accounts and taxes. This feature is particularly useful for those who use QuickBooks Online or Xero, as it ensures that all sales are appropriately categorized, making reconciliation a breeze.

Location-wise Breakdown for Multi-location Retailers

For businesses with multiple POS locations, A2X’s will break down data by location. This provides valuable insights into the performance of each location, enabling better decision-making and resource allocation.

Enhanced Tracking and Classification

To further refine your accounting process, A2X allows the addition of Tracking Codes in Xero or Classes in QuickBooks Online. This functionality is ideal for businesses that require detailed reporting and analytics, enabling them to filter their data precisely within their accounting software.

Integration with Payment Gateways

In addition to handling Shopify POS transactions, A2X will also capture other payment methods used on your Shopify site, such as various payment gateways. Your payment gateways will be broken down into separate entries. Do keep in mind that you will need to account for the fees charged by payment gateways, as this information does not pass through Shopify.

A2X is a comprehensive solution that addresses the specific needs of retail businesses using Shopify POS. By automating and simplifying the reconciliation process, A2X allows business owners and accountants to focus more on growth and less on the intricacies of accounting. With A2X, the complexities of managing multiple sales channels and locations become manageable, paving the way for a more streamlined and successful retail operation.

Sign up for a free trial of A2X to see how it works for your Shopify Store!

Integrate Shopify and your accounting software for accurate accounting

A2X auto-categorizes your Shopify sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today