![Shopify VAT: How To Do It Right [Guide]](/img/content/shopify.jpg)

Shopify VAT: How To Do It Right [Guide]

Updates: Changes were made to VAT for Shopify sellers in the UK and EU from July 2021 and again in April 2022. Any seller with business in the EU is likely to be required to collect VAT, with some exceptions. They can now do this for multiple countries all in one place. For the UK, though thresholds haven’t changed, import requirements have, and as a non-EU member state, sellers will need a separate VAT number to remit tax there. Keep reading for all the details.

Selling on Shopify?

Do you have EU sales or EU customers ordering from your store?

Then you’re probably eligible to collect and remit VAT.

(This goes for UK customers and sales too.)

Unfortunately, Shopify doesn’t deal with taxes on your behalf. You might be wondering why, when other marketplaces collect and remit sales tax in some locations.

Well, Shopify is not a marketplace facilitator. It is not legally obliged to handle any taxes for you.

So, strap in! Collecting VAT is all on you but luckily, it just got easier.

This Shopify VAT guide is part of the wider A2X Ecommerce Accounting Hub.

In this guide to Shopify VAT:

Table of Contents

Learn how to manage your Shopify accounting the right way

If you want to scale up your Shopify business, you need reliable accounting. Discover the best tools, key tax information and how to ensure that your Shopify accounting is set up for success.

Download our free guide

Disclaimer: Before we get started, it’s important to note that this guide is merely that: A guide. Getting taxes wrong can be detrimental for any business, so it is always best to seek professional advice and get tailored support for your unique circumstances. Find a Shopify accountant by checking out our trusted accountant directory for help here.

What is VAT?

VAT stands for value-added tax.

VAT is applied at each stage of the manufacturing journey as an item gains value.

Similar to sales tax, VAT is added to the cost of an item and is a pass-through tax, meaning that whoever collects it (you, in the case of your ecommerce business), must remit it to the relevant tax authorities.

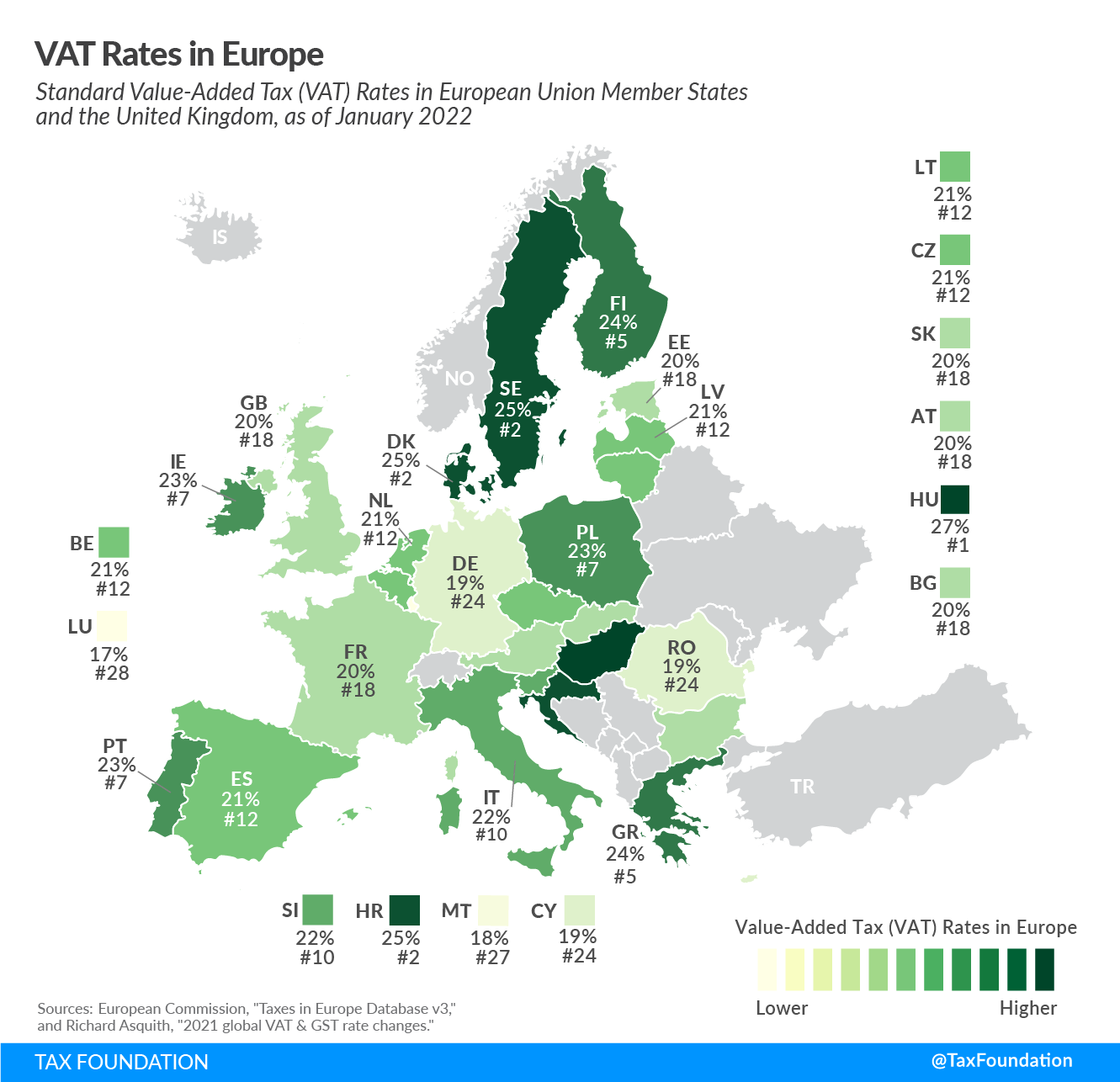

In the European Union, the rates of VAT vary from 17-27% by country. Certain consumables which we need to live and survive are subject to reductions, again based on country. These include select foods, means of transport, fuel, medicines, and other necessities.

This EU VAT guide covers both Europe and the UK.

Does Shopify charge VAT?

Shopify doesn’t charge and collect VAT for you. You’ll need to set this up and manage it in the locations you meet the thresholds to do so.

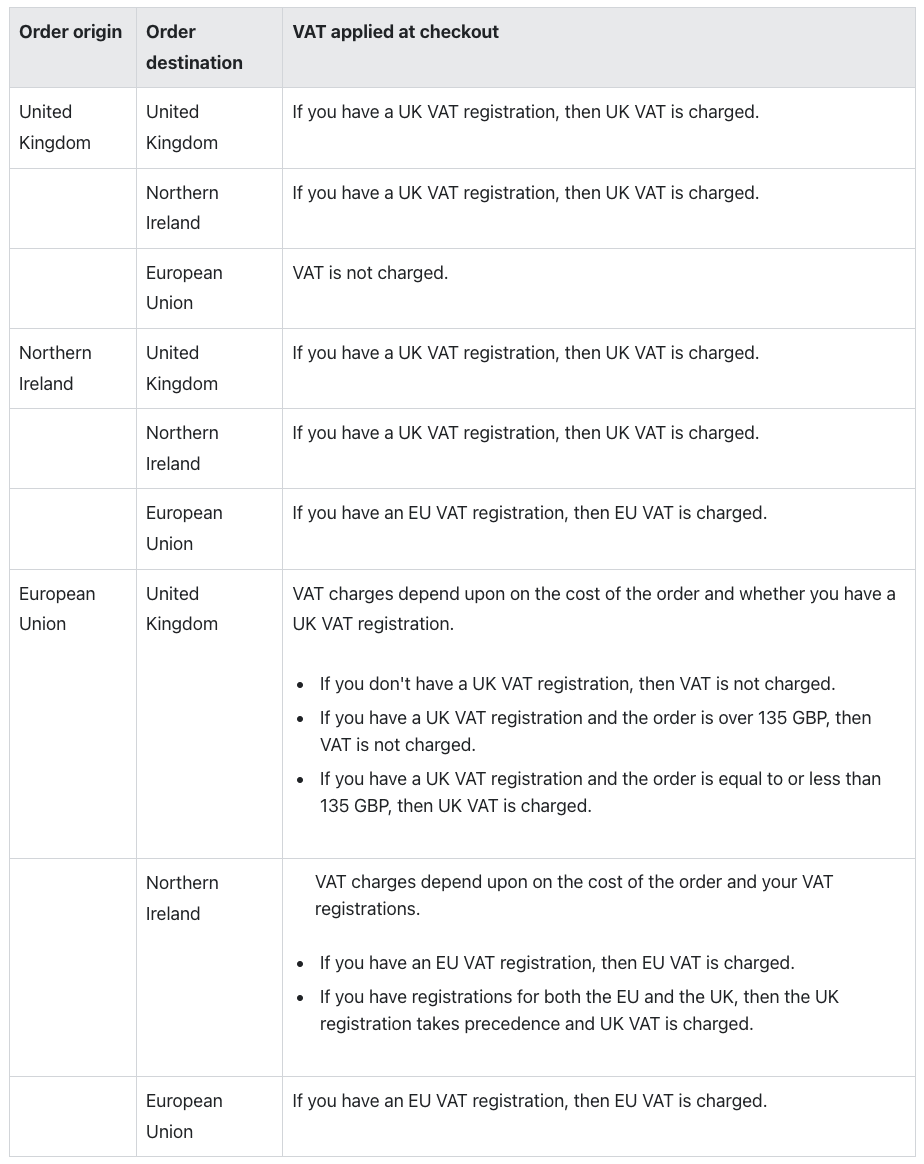

With the UK no longer an EU member state, if you sell both in the UK and other EU member states, the rules may differ.

The EU states have simplified procedures to make things easier, but these procedures are no longer applicable to the UK.

NB: As a result of the 2021 Ecommerce VAT Package, marketplace facilitators are, in some cases, responsible for the remittance of VAT.

Shopify is not a marketplace facilitator, but if you sell on other platforms like Amazon, eBay, Etsy or Walmart, then they may handle VAT for you.

Who pays Shopify VAT?

If VAT is due then your buyers will pay it at checkout.

You will collect the VAT on Shopify and remit it to the appropriate tax authority when it comes time to file, much like with US sales tax.

Fortunately, the EU has simplified this process for businesses that trade with multiple EU countries.

It used to be the case that every EU member state had a revenue threshold that, once crossed, made a business eligible to remit VAT there.

Now, all sellers are required to charge the VAT rate of the buyer’s country from their first sale (unless the micro business exemption rule applies, which we’ll discuss later).

It’s a little different in the UK.

Thresholds still come into play, and these differ based on the format of your business activities. You can find the information on how to determine your status on the HMRC website.

So you need to collect VAT in the EU if:

You sell to EU customers and don’t qualify for the micro-business exemption (explained in the VAT Guide for Shopify Stores in the EU section).

And you need to collect VAT in the UK if:

You are a UK seller turning over more than £85,000/year, or you make more than £70,000/year from customers in Northern Ireland. (There are a few other scenarios to consider here if you don’t meet these but do business in the UK.)

Which countries charge and collect VAT?

More than 170 countries across the world charge VAT. That includes all the EU countries.

As mentioned above, we’ll be focusing on Europe here.

How much is VAT?

The rate of VAT calculations depends upon the country you’re doing business with and what you’re selling.

The EU has a set of core rules that all EU member states must adhere to when it comes to VAT collection.

Rates must be higher than 15%, with up to 2 reduced rates applicable on specific goods and services.

You might find some exceptions, which are usually due to existing measures in place before the member state joined the EU. In these cases, they have slightly different rules to other EU countries.

Aside from that, countries can mostly take their own measures within these parameters. A few updates were made from April 2022 which we discuss in more detail in the section VAT Guide for Shopify Stores in the EU below.

The map below shows the standard VAT rates across the EU. The numbers (#1) signify the most expensive to the least.

Source:

TaxFoundation.

Source:

TaxFoundation.

These standard rates are before any reductions which can apply to specific products.

The table below shows the standard rates against the other types of rate you might come across:

Country | Standard rate | Reduced rate | Super reduced rate | Parking rate |

Austria (AT) | 20% | 10 / 13% | - | 13% |

Belgium (BE) | 21% | 6 / 12% | - | 12% |

Bulgaria (BG) | 20% | 9% | - | - |

Croatia (HR) | 25% | 5 / 13% | - | - |

Cyprus (CY) | 19% | 5 / 9% | - | - |

Czech Republic (CZ) | 21% | 10 / 15% | - | - |

Denmark (DK) | 25% | - | - | - |

Estonia (EE) | 20% | 9% | - | - |

Finland (FI) | 24% | 10 / 14% | - | - |

France (FR) | 20% | 5.5 / 10% | 2.1% | - |

Germany (DE) | 19% | 7% | - | - |

Greece (GR) | 24% | 6 / 13% | - | - |

Hungary (HU) | 27% | 5 / 18% | - | - |

Ireland (IE) | 23% | 9 / 13.5% | 4.8% | 13.5% |

Italy (IT) | 22% | 5 / 10% | 4% | - |

Latvia (LV) | 21% | 5 / 12% | - | - |

Lithuania (LT) | 21% | 5 / 9% | - | - |

Luxembourg (LU) | 17% | 8% | 3% | 14% |

Malta (MT) | 18% | 5 / 7% | - | - |

Netherlands (NL) | 21% | 9% | - | - |

Poland (PL) | 23% | 5 / 8% | - | - |

Portugal (PT) | 23% | 6 / 13% | 13% | |

Romania (RO) | 19% | 5 / 9% | - | - |

Slovakia (SK) | 20% | 10% | - | - |

Slovenia (SI) | 22% | 5 / 9.5% | - | - |

Spain (ES) | 21% | 10% | 4% | - |

Sweden (SE) | 25% | 6 / 12% | - | - |

United Kingdom (GB) | 20% | 5% | - | - |

Source: TaxFoundation.

Understanding which VAT rate you need to apply will all depend on which country you’re dealing with and the products you’re selling.

It’s best to get the help of a professional to ensure you’re collecting the correct amount of VAT based on these factors.

How to register for a Shopify VAT number

First up, you’ll need an EU VAT registration number and registration country.

Good news! If you need a local VAT registration within multiple EU countries, you can now do it all in one place with your local tax authority.

Country-specific registration and separate VAT returns are no longer required.

The new One-Stop-Shop (OSS)scheme brings everything under one digital roof. This also makes your local VAT return easier to manage.

To register with the OSS for Shopify VAT:

- If you’re based in the EU, you’ll need to start the registration process with your Member State of identification. In other words, your home country. If you have more than one location, you can choose one, but note that it can’t change for the next three years.

- If you’re not based in the EU, you can start the process with any EU member state.

- You’ll be given a VAT number and will need to record which countries require you to collect VAT. This will be distributed automatically when it comes time to file.

We always recommend getting help from experienced ecommerce accountants when getting set up (or ideally for the long-term). You can find specialists across the world via our directory here.

How to collect Shopify VAT number

After the changes made in July 2021, Shopify automatically updated VAT tax settings for sellers.

So if you’ve been collecting VAT for a while and just wanted to make sure you’re still compliant, this may have been sorted for you.

Otherwise, you’ll need to update your settings manually.

Set up Shopify VAT collection

- From your Shopify admin, head to Settings > Taxes.

- Under Tax Regions, besides EU, select Set up.

- Under VAT Collection, select Collect VAT.

- Select your VAT registered country/countries.

- Enter your VAT number. If you haven’t got it yet, you can update this later.

- Select Collect VAT.

- To add more regions or account numbers, select Start Collecting VAT.

NB: You can override tax rates for specific products if need be. See Shopify’s guide on that here.

Once you’ve completed this process, you’re done - it only needs to be set up once. Charging VAT will now be automatic.

To find out how the latest VAT updates impact ecommerce sellers, check out this guide.

For additional information on managing taxes and making changes, check out Shopify’s guide here.

VAT guide for EU Shopify stores

Now that you’ve got a bit of background on Shopify EU VAT and the VAT implications of doing business there, let’s dig into how it works for sellers on a practical level.

**Note: This section has been added following the changes made to the EU VAT directives in April 2022.

These changes focused on the rates and reduced rates that EU member countries are allowed to set. These are product-specific, so some sellers dealing with Shopify EU VAT will be impacted more than others.

It’s about what you’re selling and where.

( As an interesting example, products that are deemed harmful to the environment will no longer be eligible for reduced rates of VAT.)

The best way to check out what changes are relevant to you is to look at the official pages of the appropriate country.

Key things to know about collecting Shopify EU VAT

-

No more distance-selling thresholds. If you sell to countries in the EU, you’re probably eligible to collect and remit VAT. This is regardless of how much you sell and where.

-

Unless you’re deemed a “micro-business”. If your taxable turnover in the last two years amount to less than €10,000, and you operate in one EU country, you may meet the micro business threshold and be exempt from VAT. This is also known as the micro business exemption.

-

You can file all your returns in one place. The new One-Stop-Shop (OSS) system allows sellers to file a single VAT return even if they sell in other European countries. This is not the case in a seller’s home country or in any location where they hold stock. They will need to register and file separately in these cases.

-

All orders shipped to the EU from outside are subject to VAT. It used to be the case that goods from non eu businesses valued below €22 were exempt from import tax, but this has been scrapped. Sellers can choose whether they manage this VAT themselves, charging their buyers and handling it for them. Or they can leave it for customers to pay the VAT on receipt of the order.

-

You can file your import VAT returns in one place too. Merchants that collect VAT themselves on orders under €150 can use the Import One-Stop-Shop (IOSS) system to file one monthly return for low value exports. Non-EU merchants might need a professional intermediary to use this system.

VAT guide for UK Shopify stores

When it comes to Shopify UK VAT, things are a little different.

If you’re selling to UK customers, or you’re based in the UK but your customer’s country is overseas (including the EU), this section is for you.

This handy table lays out what VAT applies based on your circumstances:

Source:

Shopify.

Source:

Shopify.

Key things to know about collecting Shopify UK VAT

- The threshold for VAT collection is £85,000 annual turnover. Make sure you’re clear on all of HMRC’s eligibility criteria which changes based on your business type, location, and whether you do business with Northern Ireland.

- You’ll need a UK VAT number if you don’t have one already. Although EU sellers can use the simplified OSS to file a single return, this doesn’t apply to the UK. You’ll need to remit VAT to the UK on a quarterly basis.

- VAT must be collected on all low-value consignments that enter the UK. There used to be a relief for consignments under a certain value but this is no longer the case. Any orders valued at less than £135 are eligible for 20% VAT to be added at checkout.

A2X for Shopify taxes

Staying on top of your Shopify VAT is just one small aspect of managing your ecommerce bookkeeping properly, but it’s easier said than done.

A2X automatically calculates every line item that went into a bank deposit from the platform so that in your accounting software, you have journal summaries for each settlement.

Rather than sending individual orders across, A2X organizes your books for you into these summaries, giving you every detail you need without clogging up your system.

A2X organizes your accounts via the accrual method, giving you a better handle on your business performance, peaks, and troughs throughout the year. It also splits statements by month so that you can track and plan on solid, reliable numbers.

Save time, headaches, and money by trialing A2X for Shopify & QuickBooks Online or Xero today!

Also on the blog

Learn how to manage your Shopify accounting the right way

If you want to scale up your Shopify business, you need reliable accounting. Discover the best tools, key tax information and how to ensure that your Shopify accounting is set up for success.

Download our free guide