Shopify Xero Integration: How to Set it Up for Accounting

Written by: Amy Crooymans

November 17, 2025

Setting up an integration between Shopify and Xero is an excellent way to save time on accounting and get more accurate financials.

Whether you’re a Shopify merchant managing your own books, or an accountant or bookkeeper who works with Shopify merchants, you’ll likely be familiar with the fact that getting your Shopify payouts to reconcile in Xero is challenging. Factors such as multiple payout sources, Shopify fees, different transaction types, third-party apps, and more make accounting confusing and time-consuming.

The good news? An integration between Shopify and Xero (set up with the right tool) can help make Shopify bookkeeping seamless.

This article gives you comprehensive instructions for how to set up a Shopify integration with Xero.

Key takeaways:

- Integrating Shopify with Xero means setting up a connection between these two tools so Shopify data can flow seamlessly into Xero for quicker and easier accounting and bookkeeping.

- There are three ways to integrate Shopify and Xero: 1) via an ecommerce accounting automation app like A2X, 2) data syncing apps, and 3) manual data entry.

- Choose the integration method that works best for your business now and what may be the best choice as your business grows. Overall, you’ll gain confidence and skills to make the accounting processes for your Shopify store even more efficient and help your business gain financial visibility.

Can Xero integrate with Shopify?

Xero can integrate with Shopify via an app or tool. This simply means that Xero can connect with Shopify so that Shopify accounting data will flow seamlessly into Xero.

It’s a great idea to set up an integration between Shopify and Xero for a couple of key reasons:

- You can complete your monthly accounting quickly and easily – no more sifting through Shopify reports and trying to get them to balance with payouts in Xero.

- Your business numbers will be accurate – by having transaction data flow from Shopify to Xero automatically, you reduce the chance for human error and you can ensure your numbers are correct. This is particularly important for Shopify businesses seeking investments or loans.

Xero currently does not directly integrate with Shopify, meaning that you need to either use an additional app or tool to set up the integration, or enter data manually.

How to integrate Shopify with Xero

Shopify merchants have three options when it comes to setting up a Shopify Xero integration:

- Best method: A Shopify-Xero integration with an ecommerce accounting automation tool like A2X that will categorize and reconcile your payout data.

- Integrate Shopify and Xero with a data-syncing app that puts individual orders into your accounting software for manual categorization.

- Manually enter data from Shopify reports into Xero.

Read on for comprehensive instructions on how to set up each of these options.

Shopify Xero integration using a reconciliation tool like A2X

A2X is an ecommerce accounting app for businesses selling on Shopify and other popular ecommerce platforms.

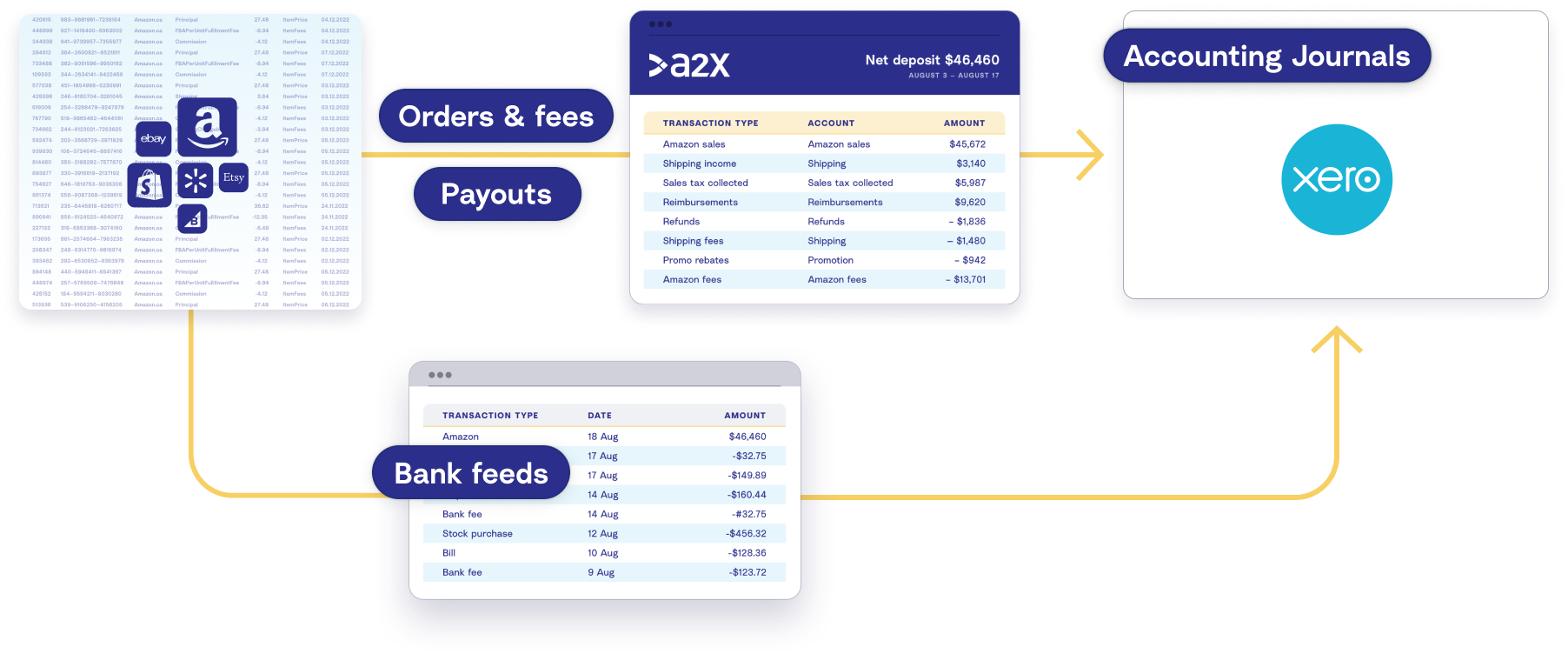

Unlike more general syncing apps used for Xero Shopify integrations, A2X is purpose built for accounting and bookkeeping, so it summarizes Shopify transaction data and passes that on to Xero as invoices.

This process avoids surplus data overloading your Xero account and streamlines the reconciliation process – once A2X has sent the data, your transactions will match your deposits exactly, every time.

The way A2X interprets and summarizes your sales data is especially important because of Shopify’s payout system. Because Shopify payouts contain revenue from multiple sales, it can make it difficult to tie orders back to a single payout, leading to inaccurate books. A2X avoids all of this by condensing transaction data, ensuring the summaries match perfectly with your payouts.

Integrating Shopify and Xero with A2X is easy, and resources are available for assistance if needed. These include a support center, online chat, and a dedicated support team, and free onboarding for subscribers.

How to do integrate Shopify and Xero using A2X

Setting up an A2X account that connects Shopify and Xero is easy and takes just a few minutes.

Watch the video below for a short overview of how it works:

As a Shopify merchant or as an accountant or bookkeeper who works with Shopify merchants, you know that it's important to keep up with your bookkeeping so you can understand your Shopify store's financial performance. But Shopify bookkeeping can be confusing and take up a lot of time. You might already be using Xero accounting software but you're looking for a way to easily get your Shopify sales data into Xero. Up until now you might not have been accounting or bookkeeping through your Shopify store, or maybe you're entering Shopify data into Xero manually, or maybe you've been coding the entire Shopify payout to a sales account. These options might work for you for a short time, but as your Shopify store grows and you transition to accrual accounting you might run into some challenges.

Consider Shopify payouts – they're not just sales. They're actually a combination of sales, fees, refunds and other transactions. Figuring out what transactions make up a payout can be confusing. Shopify provides reports that include this information, but manually reviewing these reports and getting them to balance in Xero can be time consuming. That's why setting up an integration between Shopify and Xero can help. An integration will enable your Shopify transaction data to flow seamlessly into Xero.

There are a couple of ways you could set this up. One way is to use a generic data-syncing app that sends across every individual Shopify order to Xero. This could work for smaller Shopify merchants, but you might run into some issues with this as your store grows – for example, you could overload Xero. A better option is to use A2X. A2X connects Shopify and Xero so all of your Shopify transaction data can flow into Xero. A2X organizes all your Shopify transactions – sales, fees, gift cards, refunds and more – into detailed summaries that reconcile perfectly in Xero.

Integrating Shopify and Xero with A2X is easy – here's how to get set up. First, sign up for an A2X account at a2xaccounting.com. Next, connect A2X to Xero – all you need is your Xero login. Then you'll need to connect A2X to Shopify – again, all you need is your login, or you can request access to the store. Once A2X is connected to Xero and Shopify, it's time to map your Shopify transactions to a Chart of Accounts. Navigate to the Accounts and Taxes page where you can choose how to categorize your Shopify transactions to your Chart of Accounts. A2X can help you automate this.

Once you've completed your accounts and tax mapping, go to the Payouts tab. This is where you can review and post payouts from A2X to Xero. The final step is to reconcile in Xero – A2X will post settlement data as an invoice in Xero. Log in to Xero and navigate to the bank feed. Find the payout from Shopify; next to it you will see the invoice from A2X ready to be reconciled. And there you go – Shopify bookkeeping with Xero can be that easy. Integrating Shopify and Xero with A2X can help save you time on bookkeeping and get you more accurate financials. For more information visit a2xaccounting.com.

1. Sign up for a free A2X trial

Start the process by getting a free trial of A2X for Shopify to Xero. Click the Try A2X for free button, then select the sales channel you’d like to connect to first (i.e., Shopify).

Select your preferred sign in method for your A2X account, then follow the prompts to continue setting up your A2X account.

Once you’re done entering your details, you will land on the A2X dashboard.

Note: You don’t need to provide any credit card information when starting a free trial of A2X (you’ll only need to do so when you decide to subscribe). A2X will be in ‘free trial mode’ until you subscribe, which simply means that some features and functionality will be limited.

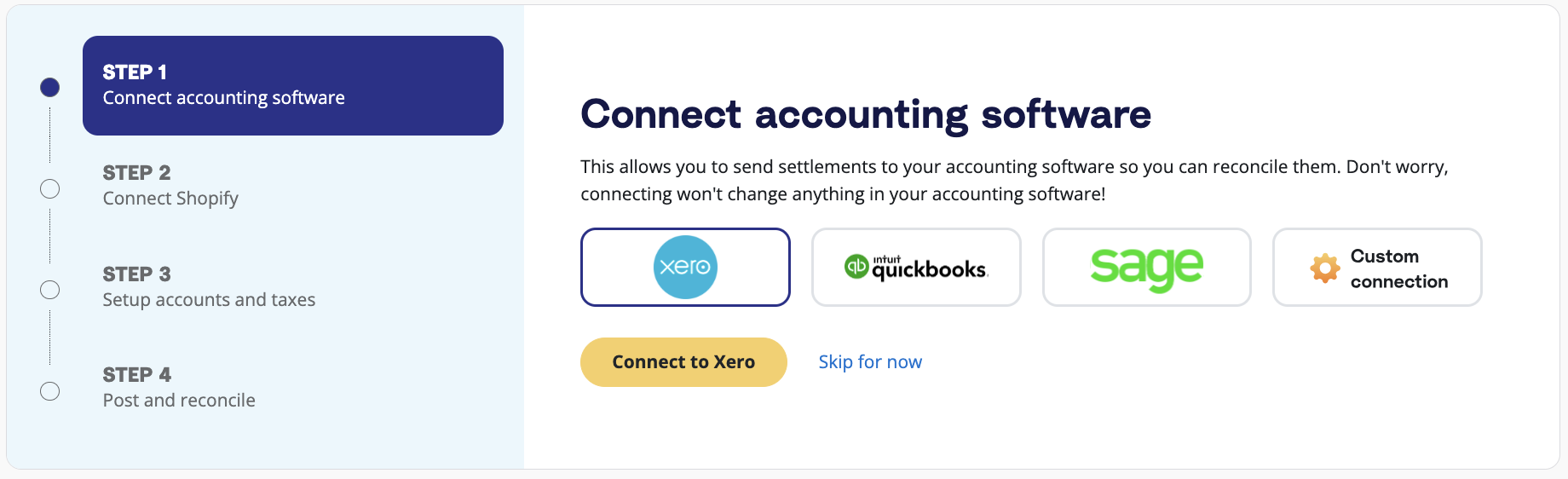

2. Connect to Xero

On the A2X dashboard, you’ll be prompted to connect to your accounting software. Select the Xero logo, then click the ‘Connect to Xero’ button.

You will be redirected to your Xero account to grant permission for access by A2X. Then, A2X will return you to the dashboard.

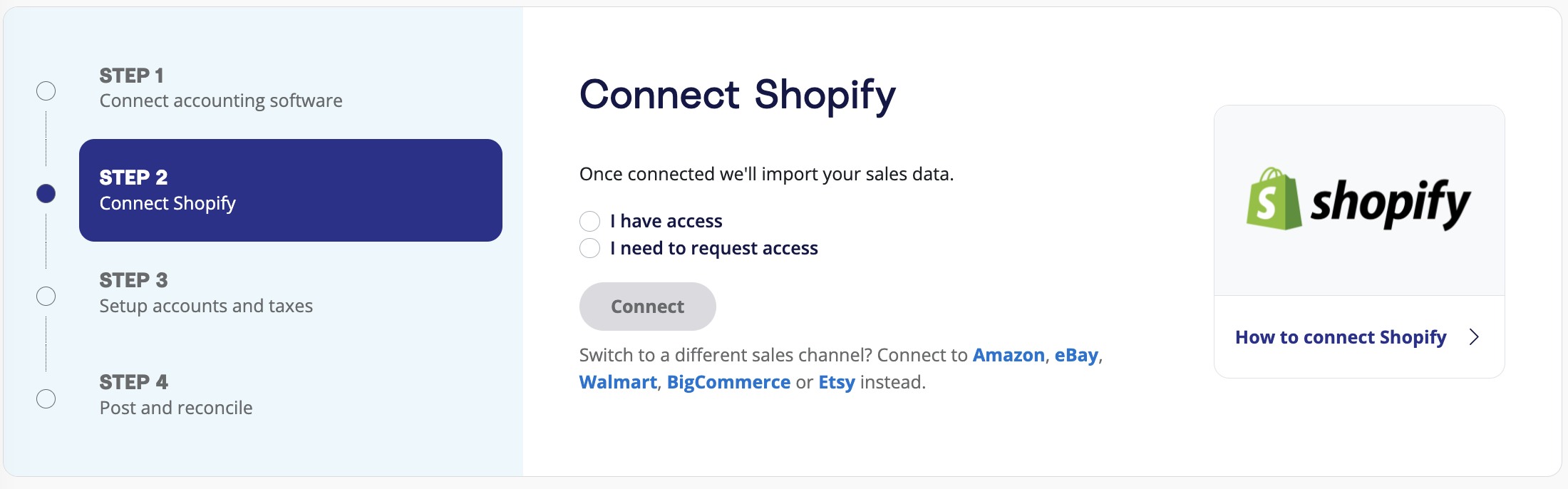

3. Connect to Shopify

Once you’re connected to Xero, it’s time to connect to Shopify.

If you have access to the store, select ‘I have access’ and then click ‘Connect’.

- Enter your store’s name and click ‘Connect’.

- You will be redirected to your Shopify store, and it will ask for permission to allow A2X access.

- After granting permission, A2X will return you to your A2X dashboard, and your first payouts will automatically begin populating (in the ‘Payouts’ tab). This could take as little as 10-20 minutes for smaller stores and a few hours for larger ones.

If you do not have access to the Shopify store (e.g., you are an external accountant or bookkeeper), click ‘I need to request access’, then ‘Connect’, then follow the prompts to have the store owner/manager provide A2X with access.

4. Map accounts and taxes

This is the process of selecting which General Ledger account you want each transaction type to be posted to in Xero. For example, you’ll likely want to code sales to a Shopify Sales account. A2X can automate this whole process for you or you can map it yourself.

Important note: We strongly recommend working with an accountant or bookkeeper with ecommerce experience for this step to make sure you have everything coded according to your store’s needs.

Click on the ‘Setup Accounts and Taxes’ button or click on the ‘Accounts and Taxes’ tab on your A2X dashboard.

The first time you visit the accounts and taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options, Assisted Setup or Custom Setup:

- Assisted setup: A2X will automatically apply best practice and create all of the accounts you need directly in your Xero and map each transaction type to the corresponding account. A2X can also apply a tax rate to be used in Xero if this is applicable to your location and tax settings.

- Custom setup:If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default accounts. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

Once you’ve finished the process or made any other changes, click the ‘Save Mapping’ button at the bottom of the page.

Watch this video for more detail on the Accounts and Taxes page in A2X:

Once you’ve completed accounts and tax mapping, most of your A2X setup tasks are done, and you can move on to routine bookkeeping!

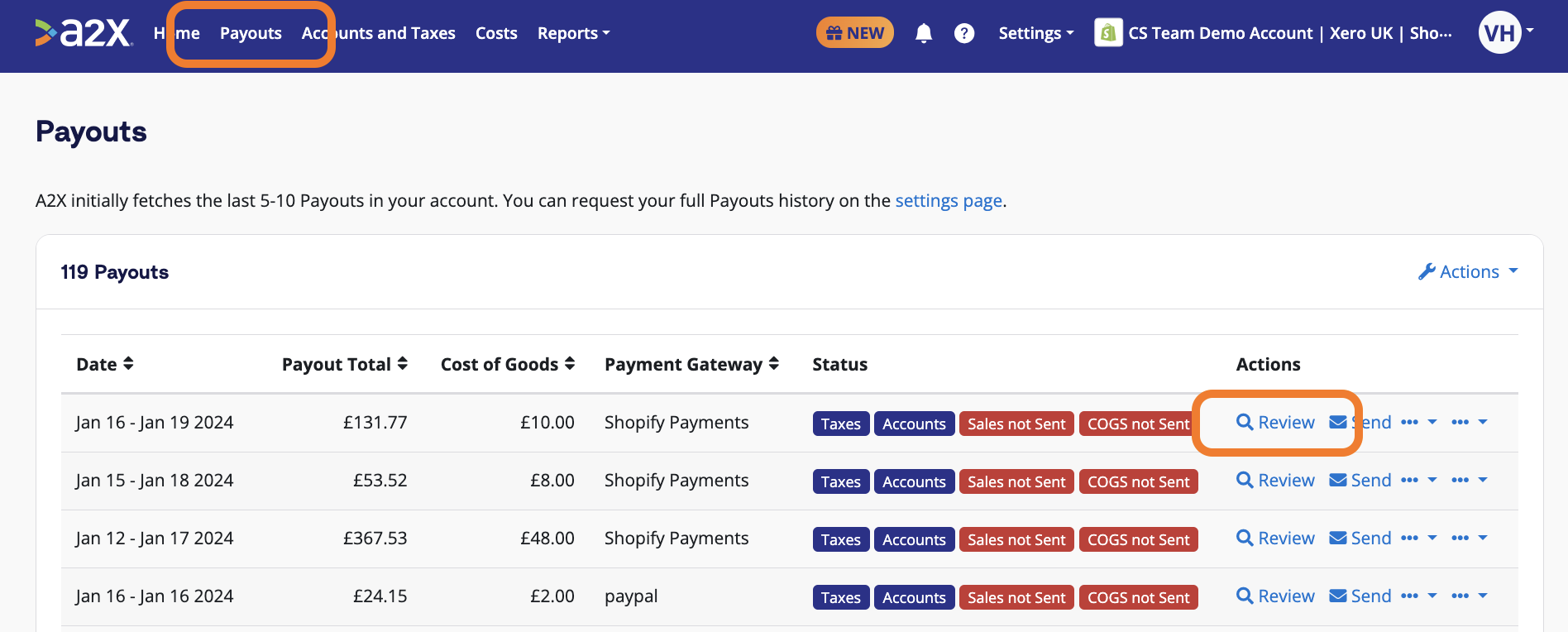

5. Review and post

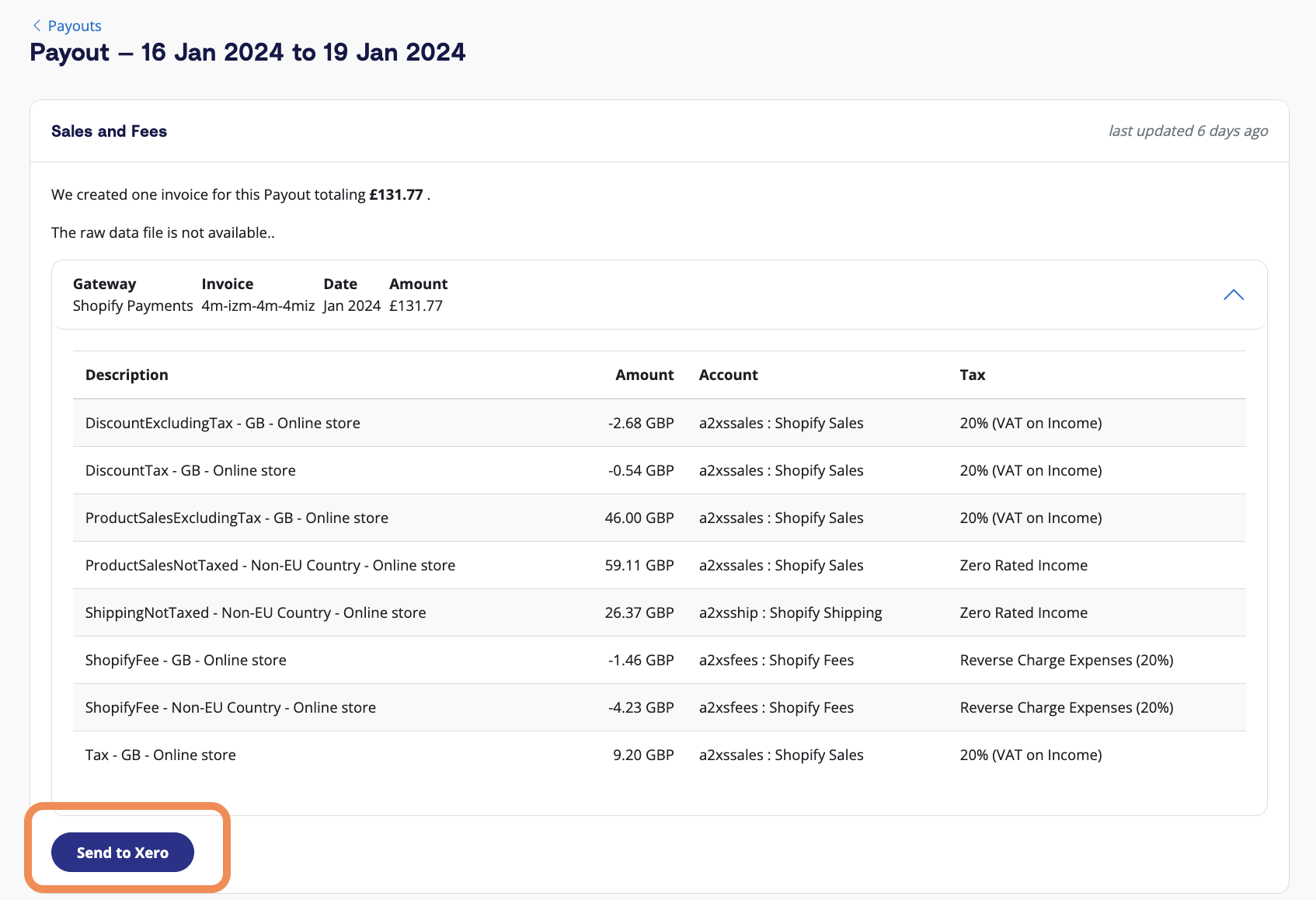

Before sending an entry to Xero, you should review the entry in A2X by going to ‘Payouts’ and clicking ‘Review’.

Use the dropdown to review all information that will be posted to Xero.

You can control when you send the entry to ensure you’re happy with what is being posted to Xero.

When you’re confident in the entry, click ‘Send to Xero’ to post it to Xero as a draft invoice or approved invoice. It can be found under the Invoices tab in Xero.

6. Reconcile in Xero

With the post sent to Xero, you can now reconcile it.

Go to your banking screen in Xero. There will be a green match, and you can reconcile in one click.

If you can’t see your invoice in the banking screen, it will likely be in your draft invoices.

The Shopify Reconciliation Report: A2X’s commitment to accuracy

Shopify accounting can get really complicated, especially when dealing with payment gateways, different transaction types, sales tax, lump sum deposits… the list goes on.

A2X is designed not only to simplify Shopify accounting, but also to help ensure that your numbers are accurate.

Despite A2X’s capabilities, discrepancies can still occur due to:

- Complex orders that don’t follow a “usual pattern” (e.g., partial payments, changes of mind, etc.) that can create an unordinary transaction history

- Third-party apps that can change order timelines

- Changes in the Shopify API that can impact how data is delivered or categorized

If you ever see a discrepancy between A2X’s summaries and Shopify data, you can use the Shopify Reconciliation Report to better understand and account for the difference.

The Shopify Reconciliation Report allows users to drill down into individual orders to identify differences between Shopify data and A2X summaries.

Without the Shopify Reconciliation Report, it could take hours of manual work to identify what might be causing your numbers not to balance.

No integration tool can be 100% accurate, but A2X is as close as it gets. The Shopify Reconciliation Report is a game-changer in Shopify accounting.

Accounting for payment gateways

A2X also accounts for payment gateways, such as PayPal, using a clearing account. You need to manually add the payment gateway fees in Xero to account for these fees. Most sellers choose to do this once a month.

Shopify inventory sync with Xero

A2X has a Cost of Goods Sold (COGS) feature built in, so when you integrate A2X, you’ll also benefit from this inventory tracking system.

COGS will calculate the total cost of your products sold via Shopify as payouts come in, so that you can accurately track your stock levels and the costs associated with your sales. This will help you figure out your gross profitability and margins directly in your financial reports.

Why A2X is a top-rated app for connecting Shopify with Xero

A2X has over 300 five-star reviews on the Shopify App Store, and 97% of reviews on the Xero App Store give A2X five stars.

Here’s what some of our customers have to say:

Excellent app that seamlessly integrates Shopify with Xero.

The support team is outstanding. Special thanks to Renne for resolving two recent issues quickly and efficiently. Highly recommended!

Invaluable time saving link between Shopify and Xero. Saves us days of work reconciling sales to the various sales channels. We couldn’t survive without it now.

A2X made it simple to connect Shopify and Xero with clear, accurate data mapping across multiple stores. The setup was straightforward, and the support team — especially Juliet and Sujay — were excellent to deal with.

After struggling for years with manual spreadsheets and niggly discrepancies to track the costs and revenue accurately on Amazon and Shopify - A2X just works & is saving us massive amounts of time, whilst giving confidence for the audit. Definitely would recommend!

Benefits of using A2X

Understands Shopify’s transaction types (and how to account for them)

A2X is a specialist accounting tool, so unlike data-syncing tools, it can identify and understand Shopify’s different transaction types, for example sales, refunds, shipping fees, etc. On top of this, it will correctly categorize these different transactions so that when it reaches Xero, your books are totally accurate and you’ll have no issue reconciling in one click.

Order details where you need them

Business owners may think their accounting software needs order-level detail to be able to do the books correctly but in reality, this much information will simply overload Xero. A2X follows accountant recommendations by bringing over only the data needed to accurately complete your books, including the number associated with an order. This gives you the information needed to look up an order in Shopify, should you need to, but it doesn’t swamp your accounting system with unnecessary data.

Reduces risk of error and ensures accuracy

Automation via A2X not only interprets and passes on data from Shopify to Xero accurately, but it also significantly reduces the potential for human error. After all, there’s no possibility of A2X losing focus, getting confused, or misreading data. This means you can have absolute confidence in the precision of your books, knowing they perfectly match your sales data to your payout statement every time. And, you’ll always find a flawless green match when you check your accounts.

It’s automated and a timesaver

Anyone who does the books for their business knows it sucks up a lot of time sitting down and putting effort into a very repetitive task – and one that needs to be done frequently. A2X takes that weight off your shoulders and gives you your time back. Not only does it automate the task but it takes the time to complete this process from hours to minutes, so you can spend it on other areas of the business.

It all ties back to your Shopify records

When A2X interprets and summarizes your Shopify data, you’ll also receive a finance report. You can then compare this report to Shopify’s finance report to check that all the data processed by A2X matches your Shopify transaction data exactly.

It captures payment gateway data

A2X is built and trusted by ecommerce accountants and bookkeepers who know Shopify stores often use multiple payment gateways. This means the gateways on the Shopify store will be accounted for as the data will flow through to A2X. For gateways that don’t extract their fees on Shopify and do it on their own site, like PayPal, A2X uses a clearing account method so everything is clearly accounted for.

Customizable to your needs

A2X can be changed and altered to fit what your specific business needs. This allows you to really get into the numbers and get the information you need to aid your business’s growth. For example, with A2X you can split your sales by SKU or product type if you need to.

Support when you need it

A2X’s support team all have experience in the bookkeeping or accounting world, so when you need support, not only can they walk you through a solution, they understand exactly what you need and why it’s so important. A2X is particularly well-known for its helpful and knowledgeable support team who don’t follow pre-written scripts but tailor their support to whatever you need help with.

In addition, A2X has a support center filled with articles on your Shopify and Xero integration, as well as a blog and ecommerce accounting hub where you can learn more about ecommerce accounting in general.

A2X challenges

Longer set up time

A2X is purpose-built to integrate Shopify with Xero. Its sole purpose is to transfer, interpret, and accurately match order data to deposits.

Because A2X guarantees your books will be completely accurate, its setup can take a little longer compared to other integration solutions, particularly if you’re using custom mapping. However, A2X does offer assisted setup to help guide users through the process with the support team always available to help.

Ultimately, the longer set up time is offset by the time it saves your business once it starts automating your books.

Start the integration process today by getting a free trial of A2X for Shopify now.

How to integrate Xero and Shopify with a data syncing app

You can also funnel your data from Shopify to Xero using a data-syncing app.

Ecommerce accountants sometimes refer to these as ‘detailed integrations’ because of the high volume of order-level data they transfer to accounting software.

There are many different kinds of these tools, and they’re simply designed to move your transaction data from Shopify to Xero with no interpretation or summarizing of the data, which leaves you with that task before you can reconcile. You can see which data-syncing apps are available on the Xero or Shopify app stores.

These types of integrations may suit new or small businesses with few sales. However, if a business doesn’t review their tools and upgrade as they expand, problems could arise as the app continues to bring data into Xero, eventually overloading the software. Some apps may even post a daily sync, which seems convenient but is not necessary and often doesn’t tie back to what you’ve been paid.

It’s also worth considering that these apps are generally less customizable and may not work for international businesses. They may pick up standard sales transactions but miss other types, such as refunds or fees. As your business grows, you will likely need much deeper financial analysis than these apps can provide. With this in mind, let’s learn more about how to integrate using these apps.

How to integrate Shopify with Xero using a data-syncing app

- Create an account with the data-syncing tool of your choice: There are many different apps available that will sync your data or orders directly to your Xero account. Find them on the Xero app store or Shopify app store (many will use the phrase ‘order syncing’) and choose one that fits your needs and budget.

- Connect Shopify: Select and connect Shopify as the platform that should send data to your data-syncing app.

- Connect Xero: Select and connect Xero as the place where the data should be received. At this stage, double-check that data won’t be automatically synced as soon as you connect Xero. You should have everything set up properly before you switch on the app so you don’t create entries in Xero that you need to delete later.

- Tell the app what data it should transfer: Configure the syncing actions to ensure your sales data is mapped to the correct place in Xero. Depending on the app they may post individual orders or they might do a daily summary.

- Test the action and turn it on: After everything is connected and you have chosen the action, test the action to ensure the data-syncing app is running as expected. These apps can have limited control of what data you sync, so keep this in mind.

- Review and compare data: Once you see data flowing through to Xero, be sure to compare the data you’re receiving with your Shopify finance summary. This will ensure that everything is being accounted for correctly.

Data-syncing app benefits

Low cost (or free)

This can be a very affordable way to do a Shopify to Xero integration. Many of these tools offer a free or cheap plan suitable for smaller businesses that would suit an already-stretched budget. If you continued to use a data-syncing app as the business grew, it would undoubtedly be cheaper than hiring staff to do the books manually.

Can easily find order details in Xero

Data-syncing tools are what’s known as a “detailed integration” due to the fact they bring a lot of data into Xero. In reality, this is far more information than you actually need to do your books correctly. However, it does mean you can find order details within Xero, without having to open and search in Shopify. While this level of detail is not something ecommerce accountants recommend having in your Xero account, it could be convenient.

A decent solution for smaller, less complicated businesses

Even with these integrations bringing so much order-level detail into your Xero, this likely won’t be an issue for smaller, straightforward businesses. It could be a good solution for those who have just started up and those who aren’t sure they want to invest in purpose-built accounting solutions for their Shopify Xero integration. The best way to use these apps would be with regular reviews to ensure they are still serving the business well or if they should be upgraded to something like A2X.

Data-syncing app challenges

It could swamp Xero

When using accounting software for Shopify like Xero, you should be aware that if it’s inundated with information, it will become slow and hard to use. This can be a big problem when using data-syncing apps as they are designed to move data and they don’t necessarily know what data you need, which means they can end up transferring all of it. In worst case scenarios, your Xero account may become so unusable that you may need to start fresh.

It sends more data than needed and doesn’t interpret it

The other downside to transferring all that data is that these apps send far more than is needed for your books and it doesn’t interpret any of it. This means you need to have a clear understanding of what you do and don’t need in order to make sense of it all and enter the right information into your books.

For example, you may think you need to have the order details for each individual sale, but in reality you don’t. What would be better is if the app transferred the sales information and the order number, so you could refer back to it in Shopify if needed, but didn’t have the bulky order details taking up space in Xero.

Functionality may be limited depend on your location

Some data-syncing tools are designed with North American sellers in mind. This could mean that certain marketplaces, countries, or currencies may not be supported. Additionally, these apps often have limited tax functionality, which can compromise the accuracy of your data during tax filing season. For instance, they may not accurately track the tax collected versus tax paid for Marketplace Facilitator Tax.

Varying degrees of support

Using a more generalist tool for your Shopify integration with Xero might be good for your wallet but if something goes wrong, you might pay for it with varying degrees of support you’ll receive. As these apps aren’t accounting-specific tools, it’s unlikely that a member of the support team will fully understand any issues you have and be unlikely to be able to guide you through it beyond simple fixes. If you’re on a free or low-level plan, you might find it hard to receive any individual support at all.

May miss transaction types

Sales aren’t the only transactions you need to account for in your books, Shopify has plenty of other transaction types including refunds, exchanges, taxes, and gift cards. Accounting for these can be difficult even when you do have all the information needed but it can get even harder when using these data-syncing apps because they may miss less frequent transaction types. In these cases, you’ll have to manually enter the data to ensure accurate records.

Doesn’t have the mapping that a purpose-built app does

These tools are not ecommerce-specific apps and therefore will not cover the level of mapping that a more sophisticated app does. This is particularly true when it comes to tax and could result in tax-related issues, including reporting the wrong amount of income and therefore paying an incorrect amount of tax for your Shopify store.

You may still need to do things manually

Even with the app transferring data there’s a high chance you’ll still need to do your books manually as these tools will not interpret your data and also may miss things. So, when it comes to reconciling your payouts, the entries may not match the payout amount exactly and you will need to dig in and account for the difference. This could result in leaving a residual balance in the clearing account.

Manually enter data from Shopify reports into Xero

If you’re a new Shopify merchant or have fairly low sales volumes, you might be curious about how to manually transfer your Shopify data to Xero.

Doing this process by hand replaces the need for any other sort of app. Although the manual process takes more time than using an app, it may suit the needs of your business, especially if you’re a smaller operation with a lean budget.

How to manually record Shopify data in Xero

Manually accounting for Shopify in Xero comes down to selecting and generating the right reports in Shopify and then mapping this correctly in Xero:

- Log into Shopify: Navigate to the ‘Analytics’ section in the sidebar menu and then click Reports.

- Find the report you want: Select which information you want to download. For example, go to the ‘Finances’ section and find the ‘Finances Summary’ report. Another option is to download the ‘Orders Report’.

- Customize the report and download: In the top right corner, adjust the dates you want the report to span and click ‘Apply’.

- Download the report: Click the ‘Export’ button in the top right of the page and select the file format needed, such as Excel, PDF, etc.

- Consolidate: Depending on the data in the export, you may need to do some consolidation, such as grouping sales and fees. Some people choose to use a pivot table to help with this.

- Open Xero: Open your Xero account, click ‘New’ in the top left corner, and then select Invoice.

- Open files and begin invoice: Mapping the data from the report to the corresponding accounts in your invoice in Xero. If you still need to create a Chart of Accounts, do this before making an invoice.

- Attach files, if needed: You can attach a file or report to each entry so you have a record of how you accounted for each order.

- Review and save: Check the data mapping and make any adjustments before importing the data to Xero. Remember that the total value of the entry should balance to the payout. Once everything is correct, click ‘Save’.

- Match your payout to your invoice: After saving the entry, go to your banking screen and find the payout. The last step is to match the payout to the entry you just created.

Repeat for other payment gateways, if needed: This process should be followed for each payment gateway you use, e.g., PayPal. Download the reports from the relevant payment gateway and follow these steps.

Benefits of manual data entry

No cost (except time)

The biggest pro for manually doing your books is that it doesn’t cost anything in addition to your Shopify and Xero plans. All you need is a little time and some know-how and you can do your books. For many new or smaller businesses, this option is definitely a good one. You just need to bear in mind that as your business grows, you might find that your time could be better spent on other tasks, especially if your volume of sales means needing more and more time to do your books properly and without error.

You control what data is entered

As discussed earlier, one of the main problems of using a data-syncing app is that they are what accountants call “detailed integrations.” This means they can bring over a ton of information to your Xero account – far more than you reasonably need to do your books. The benefit of doing your books yourself without a specific Xero and Shopify integration is that you have total control over what data you enter. Although this can make it harder to know if your numbers are correct, it does mean you avoid bringing over details like individual sales data, which isn’t needed and can clog up Xero.

Manual data entry challenges

A lot of data

If you’ve ever downloaded Shopify reports, you’ll know they contain a lot of data. If you’re doing your books manually, you’ll need to dig into all that data to make sure you enter the right information. Once your store reaches a level where it’s doing sales in the hundreds or thousands, the amount of data will certainly become overwhelming to read through and input.

Many different transaction types

Not only do you have to account for sales but you’ll also have to factor in other transaction types into your Shopify accounting, for example, refunds, exchanges, and gift cards. This can be fiddly and hard to keep track of. However, failing to properly account for all of these transaction types will mean inaccurate financial records.

More payment gateways = more work

As mentioned in the step-by-step guide above, if you use different payment gateways, you’ll need to download separate reports for each gateway and manually enter the transaction data for each. Having multiple payment gateways is great for your customers, as it gives them multiple ways to pay, for example using Shopify Payments or PayPal. But this can also mean extra work in the long run.

Month-end crossover can make it hard to balance books

Shopify merchants do not receive their payouts instantly, instead they get bulk deposits every few days. These deposits contain the revenue from multiple sales across multiple days, and sometimes those days may be across two months. For example, sales made on July 31 and August 1 might be paid out in the same bulk deposit. It’s very important to account for these sales in the month they were made, even if the money was paid in the same deposit. If not, you risk inaccurate books and you’ll find it incredibly hard to get your books to balance.

Time-consuming and error-prone

Running a business is a generally time-consuming undertaking, and manually doing your books is a recurring task that will only take longer the more successful your business becomes. Doing this manually means setting aside dedicated time to input the data from your reports into Xero every month. You also need to maintain focus the entire time due to the whole process being prone to error, misreading a number of making a type can throw your books off and prolong your accounting process as you compare your Shopify reports to the Xero to find the mistake.

Shopify-Xero integration: Regional & tax considerations

When integrating Shopify with Xero, it’s important to account for regional tax requirements (VAT, GST, sales tax, etc.). A2X simplifies this by ensuring accurate tax recording in Xero, separating tax transactions from sales.

Tax recording options in Xero

A2X provides two ways to record taxes:

- Exclude sales and tax transactions from the tax module

- Sales and tax data are recorded without triggering tax reporting.

- Taxes go to a current liability account like “Sales Tax Collected.”

- Best for:

- US & Canadian sellers and those in countries with multiple tax rates.

- Sellers not tax registered or not using Xero’s tax module.

- Include sales and tax transactions in the tax module

- Tax amounts are part of gross sales, and Xero automatically calculates the tax with a selected tax rate.

- Best for:

- Sellers in countries with one tax rate per country (UK, EU, NZ, AU).

- Sellers who are tax registered and using Xero’s tax module.

Tax setup by region

⚠ Note: This content is intended to be general. A2X does not provide tax advice. Consult a tax professional for compliance guidance.

Australia

- Shopify can collect 10% GST on applicable sales (when set up correctly).

- A2X will extract the GST from Shopify sales.

- Recommended A2X setup:

- Include sales and taxes in the tax module.

- Map transactions:

- Taxable Income & Taxes (GST) Collected: “GST on Income”

- Non-Taxable Income: “GST Free Income”

- Expenses: “GST on Expenses”

- Current Assets/Current Liabilities: “BAS Excluded”

- Xero will handle BAS returns accurately.

- Learn more about Australian GST mapping in A2X here.

Canada

- Tax rates vary by province (GST, HST, PST, QST).

- A2X separates and records the total tax collected based on Shopify tax settings by province.

- Recommended A2X setup:

- Exclude sales and taxes from the tax module.

- Map transactions:

- Income & Taxes Collected: “No Tax,” “Tax Exempt”

- GST/HST/PST/QST recorded to a liability account in Xero.

- Use a tool such as Avalara or TaxJar for sales tax tracking by province.

New Zealand

- Shopify can collect 15% GST on taxable sales (when set up correctly).

- A2X extracts GST from Shopify sales**.**

- Recommended A2X setup:

- Include sales and taxes in the tax module.

- Map transactions:

- Taxable Income & Taxes (GST) Collected: “GST on Income”

- Non taxable income: “GST Free Income”

- Expenses: “GST on Expenses”

- Current assets/current liabilities: “GST Excluded”

- Xero will calculate GST for returns.

- Learn more about New Zealand GST mapping in A2X here.

United Kingdom

- VAT can be applied at standard or reduced rates based on products. Learn more about Shopify VAT here.

- A2X categorizes and records VAT amounts.

- Recommended A2X setup:

- Include sales and VAT in the tax module.

- Map transactions:

- Income & Taxes (VAT) collected: “20% VAT on Income,” “Zero-Rated VAT”

- Expenses: “Reverse Charge”

- A2X can then isolate any EU VAT into its own liability or liabilities (by zone) account depending on customer preference.

- Xero will handle VAT returns accurately.

United States

- Sales tax collection varies by state laws and economic nexus. Learn more about US sales tax for Shopify here.

- A2X identifies taxable sales and separately records the total taxes collected.

- Recommended A2X setup:

- Exclude sales and taxes from the tax module.

- Map transactions:

- All transaction lines: “No Tax” or “Tax Exempt”

- Sales tax recorded to a current liability account in Xero.

- Use a tool such as Avalara or TaxJar for tracking sales tax per state.

Rest of world

For sellers outside the listed regions, tax regulations vary widely. Shopify may require you to collect and remit sales tax, VAT, or GST, depending on local laws.

- A2X can still help by categorizing and recording sales tax transactions according to your country’s requirements.

- Recommended A2X setup:

- If your country has a single tax rate, consider including sales and taxes in the tax module.

- If your country has multiple tax rates or complex tax rules, consider excluding sales and taxes from the tax module and mapping taxes to a liability account.

- Consult a local tax professional to ensure compliance with specific tax reporting requirements.

⚠ Note: This content is intended to be general. A2X does not provide tax advice. Always check with a certified tax expert to understand your obligations.

Ready to integrate Shopify and Xero with A2X? Start a free trial today!

Frequently Asked Questions

FAQs about integrating Shopify with Xero

Integrate Shopify with Xero for accurate accounting

A2X auto-categorizes your Shopify sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today