eBay Bookkeeping [Beginner's Guide]

Written by: Elspeth Cordray

Updated on February 28, 2025.

Bookkeeping for an eBay store is challenging.

Once a place for hobby selling, eBay is now a bustling marketplace for ambitious sellers that need to manage their money properly – and that requires accurate accounting and bookkeeping.

Our guide is here to help! Whether you’re a scaling eBay seller looking to understand how to manage your books, a savvy ecommerce seller looking to sell on eBay as an additional channel, or an accountant seeking to accurately record eBay sales in QuickBooks or Xero, you’ll find the information you need in this guide.

Key takeaways:

- Accurate bookkeeping for your eBay store is crucial for tax compliance and profitability. Keeping detailed records of eBay sales, fees, shipping costs, and inventory purchases is essential for financial visibility. Proper bookkeeping ensures accurate tax reporting (sales tax, VAT, GST) and helps eBay sellers track profitability through financial statements like Profit & Loss and Balance Sheets.

- eBay’s lump-sum payouts aren’t just sales and require careful reconciliation. eBay deposits payments as lump sums that include multiple components (sales, fees, shipping charges, tax withholdings), which need to be properly categorized. Accrual accounting provides a more accurate picture of financial health by recording sales and expenses when they occur. Automating reconciliation with tools like A2X helps integrate eBay transactions into accounting software like QuickBooks, Xero, or Sage.

- Automation and professional support simplify bookkeeping and tax compliance. Manual tracking can be time-consuming and error-prone, especially with multi-channel sales, tax obligations, and marketplace facilitator rules. Using accounting software integrated with eBay streamlines financial management, while working with an ecommerce accountant ensures accurate reporting, compliance, and better financial decision-making.

Still have questions about eBay accounting? You can always reach out to the A2X team at contact@a2xaccounting.com.

Getting started with eBay accounting and bookkeeping

Not sure where to start with accounting and bookkeeping for your eBay store? No worries! We’ll begin with the basics.

Watch this video to get started.

We cover even more basics below. If you already have basic accounting and bookkeeping knowledge, scroll down to better understand the challenges with eBay accounting and bookkeeping.

What’s the difference between accounting and bookkeeping?

Bookkeeping involves the detailed recording of all business transactions, such as sales, expenses, and payments. For an eBay store, this includes capturing sales data from the platform, documenting eBay fees, shipping charges, and keeping track of inventory purchases and product returns. The goal is to ensure your financial records are well-organized and consistently updated.

Accounting, on the other hand, takes this financial data and uses it to generate important reports like Profit and Loss statements, Balance Sheets, and tax filings. For an eBay business, accounting also involves analyzing sales patterns, calculating the Cost of Goods Sold (COGS), and assessing how eBay fees affect your overall profitability. It’s about using the financial information to gauge the business’s performance and make informed strategic decisions.

In essence, while bookkeeping focuses on the accurate recording of transactions, accounting centers on interpreting those numbers to guide financial decision-making, particularly within the eBay marketplace context.

Why am I required to do accounting and bookkeeping for my eBay store?

Accounting and bookkeeping are essential for running a successful eBay store, helping you stay organized and compliant. Here are the key reasons why they are necessary:

- Tax compliance – You need detailed records to calculate and file taxes correctly, including VAT or sales tax.

- Sales and expense tracking – Accurate records of transactions allow you to see how much money is coming in and going out, ensuring you know where your business stands.

- Understanding profitability – By analyzing sales, fees, and costs, you can understand your true profits and adjust pricing or strategies accordingly.

- Inventory management – Tracking inventory purchases and returns is vital to maintaining accurate stock levels and Cost of Goods Sold (COGS).

- Informed decision-making – Financial reports help you assess performance, cash flow, and guide future business choices.

It’s also important to note that your specific accounting and bookkeeping obligations will depend on factors such as your location, business type (sole proprietorship, partnership, LLC, or corporation), and whether you are registered for sales tax, VAT, GST, etc.

We strongly recommend consulting with an accounting or bookkeeping professional who specializes in working with eBay sellers to understand your tax requirements.

Regardless of your eBay business classification or tax registration status, it’s a good idea to start with fundamental accounting and bookkeeping practices.

For bookkeeping, this includes:

- Keeping your business and personal finances separate.

- Recording and maintaining detailed, accurate records of all financial transactions, including income, expenses, and payments.

- Regularly reconciling bank transactions with eBay transactions to ensure accurate financial records.

For accounting, this includes:

- Creating essential financial statements, such as Profit and Loss Statements, Balance Sheets, and Cash Flow Statements.

- Filing accurate and timely tax returns based on your business’s legal structure, ensuring compliance with tax laws and regulations, including Marketplace Facilitator Tax obligations.

Cash vs. accrual accounting for eBay

When managing your eBay store’s accounting, you can choose between two methods: cash accounting and accrual accounting.

With cash accounting, transactions are recorded when money is actually received or spent. For eBay sellers, this means recording sales when payment is received from eBay and expenses when they’re paid out. This method is ideal for small businesses with simpler transactions, as it provides an immediate view of cash flow. However, it may not fully represent your business’s financial standing if there are unpaid invoices or pending payments.

Accrual accounting, by contrast, is usually the preferred method for ecommerce businesses. In this approach, transactions are recorded when they occur, regardless of when cash changes hands. For eBay sellers, this means recording sales when the order is placed, not when payment arrives, and expenses when incurred, not when paid.

Accrual accounting provides a clearer picture of your overall profitability and financial health by aligning revenues with the costs associated with generating them. With the right accounting tools, accrual accounting is easy.

Can eBay manage the accounting/bookkeeping for me?

While eBay offers tools to track sales, fees, and some expenses, it does not manage your accounting or bookkeeping for you.

eBay provides transaction reports and summaries, but these need to be organized and entered into your accounting system. You’ll still need to handle bookkeeping tasks like tracking expenses, reconciling transactions, managing inventory, and preparing financial reports.

To streamline the process, many eBay sellers use accounting software, such as QuickBooks Online or Xero, integrated with tools like A2X, to automatically sync data from eBay and help to ensure accurate financial management and tax compliance for their business.

Do I still need to manage tax/VAT if my store’s transactions fall under Marketplace Facilitator rules?

Yes, even if your eBay store’s transactions fall under Marketplace Facilitator rules, you still need to manage certain aspects of tax and VAT. (Note that not all transactions will fall under Marketplace Facilitator rules.)

Under these rules, eBay is responsible for collecting and remitting sales tax or VAT on qualifying transactions. However, as a seller, you remain responsible for reporting your total sales and ensuring compliance with your tax obligations.

For example, you may need to file tax returns that reflect the sales handled by eBay, even though the platform collected the taxes on your behalf. Additionally, for non-marketplace transactions (such as direct sales through other platforms or channels), you are responsible for collecting and remitting taxes.

Keep accurate records, understand how taxes are applied to your sales, and work with accounting tools and accounting professionals to stay compliant with local tax laws and VAT regulations.

Do I need accounting software for my eBay store?

If you’re running a small eBay store with a low transaction volume, you might opt to manage your accounting and bookkeeping with a spreadsheet. However, spreadsheets require manual input, which increases the risk of errors and can be time-consuming.

Using accounting software is a better option for your eBay store, as it automates much of the process. With just a few clicks, you can generate important financial reports such as Profit and Loss Statements, Balance Sheets, and Cash Flow Statements.

What’s the best accounting software for eBay sellers? The right choice will depend on your unique requirements, but popular options include QuickBooks Online, Xero, Sage, and NetSuite. When selecting a platform, consider factors like your business size, location, and the specific features you need.

Keep in mind – many accounting systems don’t have direct integration with eBay. You may need a tool like A2X to sync your eBay data with your accounting software, ensuring accurate and efficient financial management.

Do I need an eBay accountant or bookkeeper?

We strongly recommend using accounting software to manage eBay accounting/bookkeeping, and we also strongly recommend that eBay sellers work with a professional accountant or bookkeeper who specializes in ecommerce businesses.

Handling eBay accounting and bookkeeping is more complicated than managing finances for a traditional brick-and-mortar store. Having a knowledgeable professional ensures compliance with tax laws and helps you gain an accurate understanding of your profit margins.

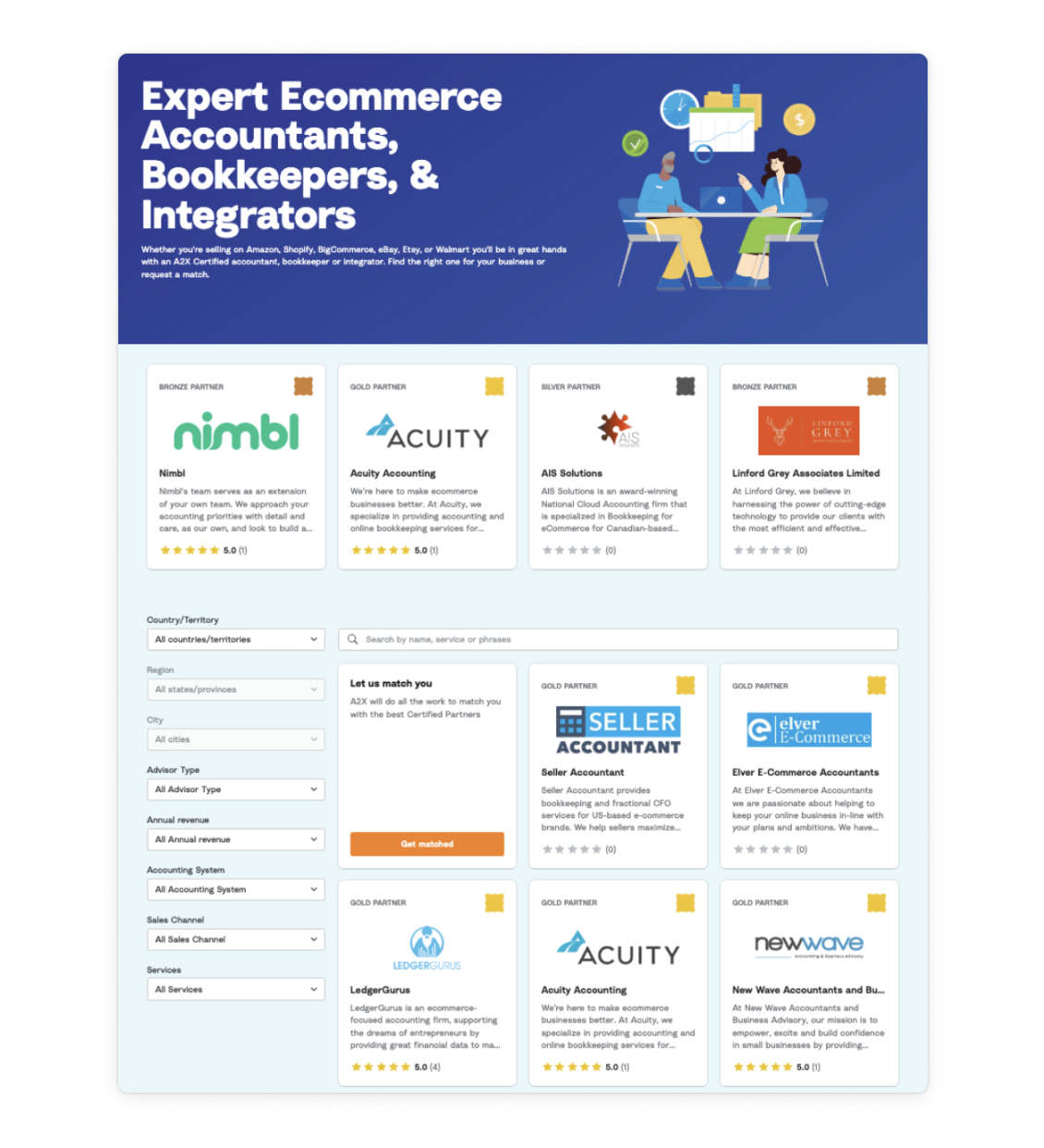

Where can you find an accountant or bookkeeper who has experience working with eBay sellers? A2X’s Ecommerce Accountant Directory is a great place to start. You can either input your business details or choose to “get matched” with a professional tailored to your specific needs.

Adding eBay as an additional sales channel? Here’s what to keep in mind

If you’re already selling on Amazon, Shopify, and/or Etsy, and are thinking about adding eBay as an additional sales channel, here are some accounting and bookkeeping considerations to keep in mind:

- Just like other sales channels, eBay charges various fees, including listing fees, final value fees, and payment processing fees, which need to be tracked separately for accurate expense reporting.

- eBay sales are usually subject to Marketplace Facilitator Tax rules, which means that eBay may collect and remit sales tax or VAT on your behalf, but you are still responsible for maintaining records of these taxes and reporting them properly on your tax filings.

- Ensure your accounting system can track inventory sold across multiple platforms, as eBay sales will affect overall stock levels and cost of goods sold (COGS).

Read on for an in-depth overview of what makes eBay accounting and bookkeeping complicated, and how to overcome some of these complexities.

What makes eBay accounting and bookkeeping complicated

We’ve touched on the fact that eBay accounting and bookkeeping can be challenging, but what exactly makes it so complicated?

Let’s explore some of the key complexities involved, along with practical solutions that can simplify your eBay accounting and bookkeeping processes.

Lump sum payments

One of the most complicated parts of eBay bookkeeping is that eBay payouts are made in lump sum deposits, but this total is not entirely made up of “sales” (and should not be entirely recorded in a “sales” or “income” account).

A lump sum payout from eBay may include multiple individual sales, fees, shipping charges, and tax withholdings, all bundled into one deposit. eBay deducts various fees (e.g., final value fees, listing fees, shipping fees) before transferring the lump sum payment to the seller.

As a marketplace facilitator, eBay may also collect and remit sales tax or VAT on your behalf, with taxes typically being split out when they fall under the Marketplace Facilitator Tax (MFT/MFV) rules. However, not all transactions may be covered by these rules. Sellers might also have other sales within the same account that do not qualify under the Marketplace Tax Rules, requiring them to manage VAT or other taxes themselves.

It’s crucial to break down these transactions and record them accurately in your general ledger.

If you report the full lump sum as “sales,” you risk inaccurately representing your revenue, which can lead to paying too much or too little in taxes and provide misleading data about your business’s performance. By correctly categorizing each part of the payout, you can ensure accurate financial reporting, tax compliance, and a clear view of your business’s actual financial condition.

While eBay Seller Hub provides reports to help break down the transactions included in each payout, manually downloading and reviewing these reports, then categorizing each transaction, can be time-consuming and prone to errors.

Solution: Integrate eBay with your accounting software using a tool like A2X. After connecting A2X to eBay and QuickBooks Online, Xero, or Sage, A2X will break down the transactions that make up each payout and send that information over to your general ledger in your accounting software. Then, you can reconcile in just one click. Easy!

A2X can also simplify Marketplace Facilitator Tax transactions with its MFV and MFT tagging system, which can help you distinguish between facilitated transactions and those that require direct tax remittance.

Payout periods

eBay payouts may not always align with your bookkeeping periods, especially when a payout spans across month-end dates (e.g., a payout covering March 28 to April 5).

Accrual accounting requires recognizing revenue when it is earned, not when the payment is received. This means sales from March should be recorded in March, while April sales should be logged in April.

Failing to match revenue with the correct period can lead to inaccurate financial reports. For example, if revenue and Cost of Goods Sold (COGS) aren’t aligned, it could misrepresent your profit margins. Ensuring that both revenue and expenses are recorded in their correct periods helps provide an accurate view of your financial performance.

Solution: A2X automatically separates payout data based on when the sales occurred, making sure that your accounting records accurately reflect transactions in the appropriate month. This improves the accuracy of your financial reporting.

Fees and transaction types

eBay sellers must account for different fees, including final value fees, listing fees, payment processing fees, and promotional fees for activities such as advertising. Additionally, eBay transactions involve a variety of activities such as sales, refunds, promotional discounts, shipping costs, and sales tax that eBay collects on behalf of the seller.

Each type of transaction must be accurately categorized and recorded to ensure precise financial reporting. Mismanagement can lead to incorrect financial records, affecting profitability and tax compliance. The complexity of these transactions means that sellers need to pay close attention to detail and may benefit from using specialized accounting software or working with a professional.

Solution: First, make sure all eBay transactions, including different fees and sales tax collected by eBay, are captured in your accounting system. Then, each transaction type must be treated accordingly to ensure it’s recorded correctly. A2X can automate this process, capturing all eBay transaction types and ensuring your books stay accurate and up to date.

Marketplace Facilitator Tax/VAT

Marketplace Facilitator Tax and VAT rules introduce added complexity to eBay accounting and bookkeeping. Under these rules, eBay collects and remits sales tax or VAT on behalf of sellers for certain transactions, shifting the burden of tax collection.

However, sellers still retain responsibilities that complicate their accounting:

- Sellers must maintain detailed records of all transactions, even those where eBay collects the tax. This includes documenting the tax amounts collected and remitted.

- Sellers are still required to report eBay sales in tax filings, depending on local tax regulations.

- Different regions have varying marketplace tax rules, and sellers must ensure compliance across all jurisdictions where they sell.

- Sellers also need to handle tax collection for sales through other channels (e.g., their own website), requiring reconciliation across platforms.

- Handling the tax implications for returns and refunds adds another layer of complexity.

Solution: Sellers can use tools like A2X to automate transaction tracking and help to ensure accurate tax reporting. We also strongly recommend working with a tax/VAT professional to make sure you’re compliant with applicable tax/VAT laws.

Need help with eBay accounting and bookkeeping?

Whether you’re new to selling on eBay, or are an experienced multi-channel ecommerce business, you can find the professional accounting and bookkeeping assistance you need – in the A2X Ecommerce Accountant Directory.

Frequently Asked Questions

Integrate eBay and your accounting software for accurate accounting

A2X auto-categorizes your eBay sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

`Try A2X today