How To Sell Your Amazon FBA Business - 2022 Guide

Estimated reading time: 50 minutes, 30 seconds.

Amazon marketplace is a powerful tool.

That goes for both the convenience-loving consumer and the ambitious entrepreneur wanting a piece of the trillion-dollar pie.

In less than 30 years, Amazon has gone from small online bookseller to an entire ecosystem, redefining what's possible in the retail and fulfillment worlds and beyond.

But if you’ve been selling on Amazon for a while, you probably know this already. If you’re here, you’re looking to move onto pastures new - and this guide is here to help.

Whether you’re selling your Amazon business to start another one, or leaving the platform altogether, everything you need to know is right here.

You’ll also find plenty more help and resources throughout, including where to get input from the experts.

In this guide to selling your Amazon FBA business:

- An Introduction to Selling Your Amazon FBA Business

- How Sellable Is Your Amazon FBA Business?

- How To Value Your Amazon FBA Business

- How To Increase The Value Of Your Amazon FBA Business

- Preparing To Sell Your Amazon FBA Business

- Ways To Sell Your Amazon FBA Business

- The Sales Process of Your Amazon FBA Business

- The transition phase

"Do you know how ready your Amazon FBA business is for sale, and if now is the right time to exit? You can find out how with our free assessment tool. Keep an eye out for prompts throughout this guide to download your free copy."

If you’ve never sold a business before, as you might expect, there’s quite a lot involved.

To attract a serious buyer, you’ll need an attractive offering. Of course, what’s “attractive” to one may not be to another.

But there are some baselines that most looking to buy an Amazon business will be looking for.

The basic requirements of a sellable business:

- It’s performing well. This either means stable or growing.

- It’s at least a year old, ideally three or more.

- It has a unique offering with limited competition.

- It’s got a good base of existing customers and decent reviews.

- It’s consistently compliant with Amazon’s policies.

- The books and accounts are in proper order.

- Its processes are thoroughly documented.

- Supplier relationships are productive and positive.

- The seller (you) knows the business and industry inside and out.

And yes, they’re just the “basic” requirements. Buyers might still be interested, but you may not get as much money.

Packed with expert advice and actionable insights, this guide will work through what it takes to sell an Amazon business at the best price.

And if yours can’t meet the criteria above yet, what to do to turn things around.

So let’s start at the beginning. Is it even the right time to sell? How long could selling take, and what might it cost you?

Is now the best time to sell your Amazon FBA business?

How attractive would your business be to buyers? Are there things you could do to increase its value? Find out with our free assessment tool.

Download our free guide

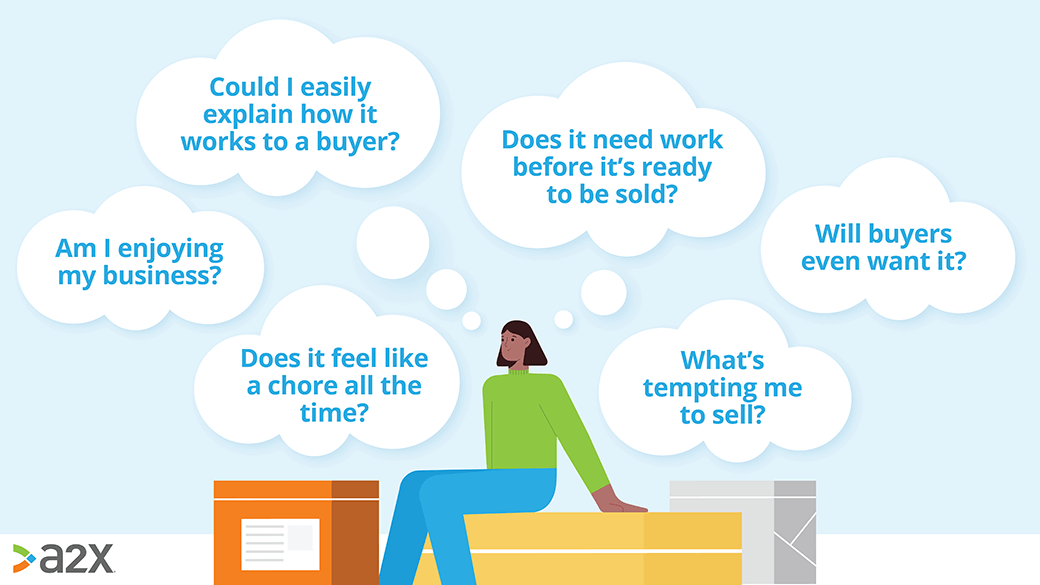

Knowing when the time is right to sell is tough. A lot of factors go into the decision, so make sure you’re asking yourself the right questions.

We asked some of our expert ecommerce accounting partners what they would tell business owners thinking of selling up in the next 6-12 months.

Interestingly, Matt Botha from Elevate Brands, a leading Amazon business buyer, said that many sellers go into the process lacking vital information.

They don’t understand their numbers and sometimes, their business is making a lot more than they realise. And they might not want to sell! This makes life harder for everyone involved.

To make sure you’re prepared and ready to sell, check out these tips from the pros.

Catching Clouds’ Scott Scharf recommends:

- Thinking about exit and succession plans as early as possible.

- Checking out The Exitpreneur’s Playbook

- Talking to an Amazon business broker.

- Asking other Amazon business owners who have sold up what they wish they’d known before starting the process.

- Talking to an Amazon business broker.

bookskeep’s Cyndi Thomason recommends:

- Going through the bookskeep SmartSell program. It ensures clients’ books are ready and they can answer any potential buyer’s questions with confidence. They also identify addbacks and restructure financial reports to include these.

- Get educated about the process. Read about it, listen to podcasts - however you like to consume your information. (Being here is a great start!)

Seller Accountant’s Tyler Jefcoat recommends:

- Solidifying your bookkeeping. It needs to be accrual-based for the greatest valuation.

- Start a Google Drive or Dropbox now to store and organize your records so that they are ready for potential buyer.

- Cut all your unnecessary expenses. That might be software, travel - anything that won’t compromise your profitability. The least number of addbacks you have to fight for later on, the better!

- Don’t look to launch a new sales channel 6-12mo out from selling. These can take some time to perform so you aren’t likely to add value to your business this way. Equally, if you have a bad sales channel, consider killing it to simplify your offering.

- Start building your compelling growth story for your business.

SellerX’s Daniela Heil recommends:

- That you don’t stop ordering inventory just because you’re going to sell soon. No buyer wants to buy a company that will run into stock-outs as soon as they get it. Purchase price will take inventory costs into account.

- Make sure you are accurately tracking your COGS. Sellers often find they’re not doing this well enough when the sale process has already started, which can lead to unpleasant surprises.

- Do an honest sweep of your reviews. Is every one of them legit? If not, it could come back to bite you.

- Understand future growth levers and the preparation that might be required. For example, trademark rights or competitive landscapes in new areas the business could expand into. Paint a compelling growth story with the facts to back it up.

Cap Hill Brands’ Bryana Aguilar recommends:

- Focus on getting all your financial ducks in a row (this is where A2X comes in) because if you have clean financials, it makes the buying process go much smoother and faster.

Selling your Amazon FBA business could take weeks, months, or years. It all depends how you go about it, and how attractive your business is to buyers.

The typical timelines for an Amazon business sale by method:

- Selling via a marketplace: 6-9 months+

- Selling via an auction: 1-4 weeks+

- Selling via a broker: 1-2 months+

- Managing everything yourself: 3-24 months+

The typical timelines for an Amazon business sale by value:

- Less than $100,000: 66 days

- $100,000 - $500,000: 118 days

- $500,000 - $1 million: 151 days

- $1 million - $2 million: 128 days

- $2 million - $5 million: 146 days

- More than $5 million: 170 days

Speed isn’t everything. Getting the maximum bang for your business’ buck, whilst paving the way for a smooth transition to a new owner, will take time.

Whichever route you choose to take, great preparation will help you get the results you want faster.

Each

business

sales

journey

will

encounter

different

costs.

But

usually,

there

are

three

main

types:

- Legal fees

- Taxes

- Sales method fees

Let’s dig deeper.

Legal fees

It’s up to you how much legal input you get in the sale of your Amazon FBA business. The more you get, the better protected you’ll be. The purchase agreement should be checked by a lawyer regardless of how else you might consult them (we’ll discuss these later on).

You may be looking at a bill of $5,000-$15,000 depending on your business size and what you need, but this buys you peace of mind and a smooth transaction process.

Taxes

When it comes to taxes, the sell price isn’t as important as the amount that goes into your pocket. A business sale may be subject to capital gains tax. You may need to pay tax both at the state and federal level, each worth anything from 0-13%+.

And then there’s income tax - depending on your location, you may need to take this into account too. A million dollar sale could actually translate to less than $700,000 in your pocket after fees and taxes.

Method fees

This refers to how you go about selling your business - DIY, via marketplace, or via a broker. Each of these brings different costs. Some brokers are success-based which means they won’t charge unless they sell your business, and then they’ll take a commission.

Commissions are often percentages and range from anything up to and over 10%. Check out the Ways to sell section to learn more about methods and their associated fees.

You might know and love your business, but will buyers be as enthusiastic?

Before leaping into selling your Amazon store, you need to consider just how attractive it is likely to be. This will help you with every other step in the process.

Newsflash: selling your Amazon business isn’t all about you. In fact, it’s all about buyers and what they’re looking for at the time you want to sell.

They will be weighing up what they want and what you’re offering. To fully gauge whether your business is a good investment, they’ll want to dig deep.

“[Buyers

are]

all

concerned

with

growth,

risks,

transferability,

and

documentation.

They

want

to

see

a

proven

track

record

of

results,

as

well

as

room

to

grow

within

the

business's

market.”

Ian Drogin, QuietLight Brokerage.

Amazon brokers QuietLight have pooled years of experience to articulate the following areas of focus they see buyers return to time and time again:

“A

valuation

can

reveal

how

your

business

stacks

up

in

regard

to

each

pillar,

providing

insight

about

how

you

should

focus

your

efforts

in

order

to

improve

your

business

and

prepare

for

a

successful

exit.

Always

seek

to

increase

growth,

reduce

risk,

and

systematize

all

business

operations

and

documentation

practices.”

Ian Drogin, QuietLight Brokerage.

Buying an Amazon store is a big commitment.

What kind of impression do you want to give them? Professional or sloppy? Organized or muddled? How can your behavior turn them on or off your business?

As you move through this guide, keep these things top of mind. They will be particularly useful when it comes time to create your marketing prospectus.

Business models also play an important part in how sellable your Amazon FBA business is. Let’s take a look at these next.

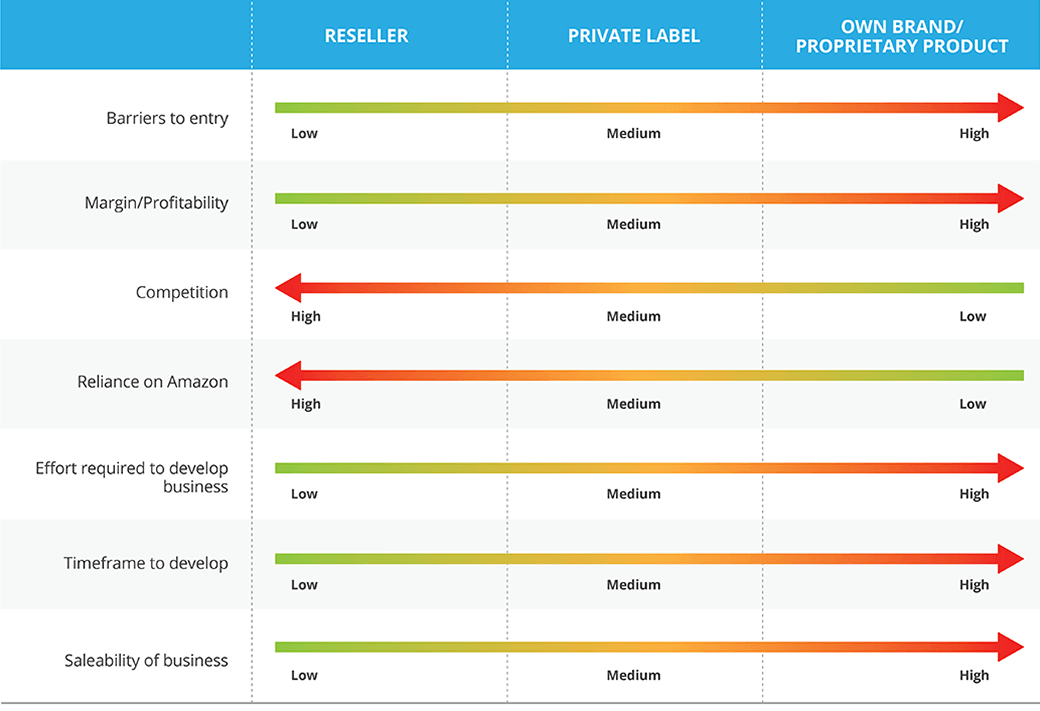

There are three broad categories that FBA businesses tend to fall into: reseller (or retail arbitrage), private label, and own brand/proprietary product.

Here’s an overview of how they compare as models on Amazon:

Let’s dig a little deeper into the pros and cons of each type. Use those most similar to your business to influence how you approach the sales process.

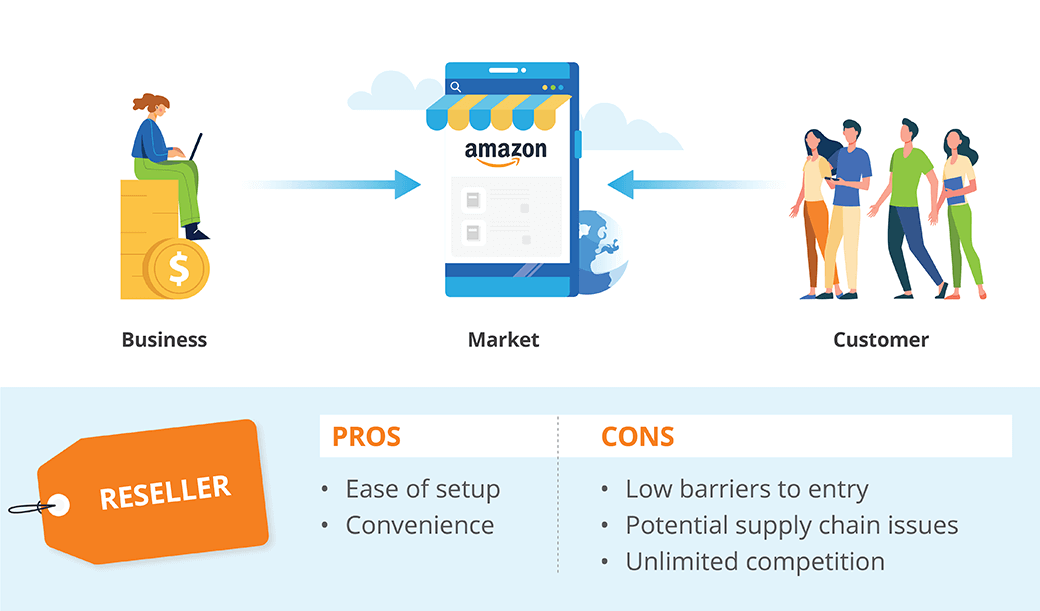

Reseller

Reselling involves finding products (online or in person) that you can sell on Amazon for a profit. This is the simplest type of FBA business to set up.

It’s basically trading: buy wholesale, sell retail.

| Pros of this model | Cons of this model |

|---|---|

| Easy to develop with low start-up costs | Very low barriers to entry can mean huge competition - people could ‘copy’ you |

| You can gauge how well products sell before you invest in them | High competition could turn profitable products into slow-moving stock |

| Great for dipping your toes in the FBA waters and learning the ropes | Amazon has a lot of control - if you accidentally list something you shouldn’t, your entire business is at risk |

| This business type adds little value to the market, so it can be hard to sell | |

| Reliable supply can be a problem |

So, how sellable is this type of Amazon business?

This type of business tends to be very hard to sell, even if you are making substantial profits.

The true value added (for the consumer) is convenience. You are essentially competing for the buy box.

Due to the issues listed above, buyers may be taking on a lot of risk when purchasing a reseller business.

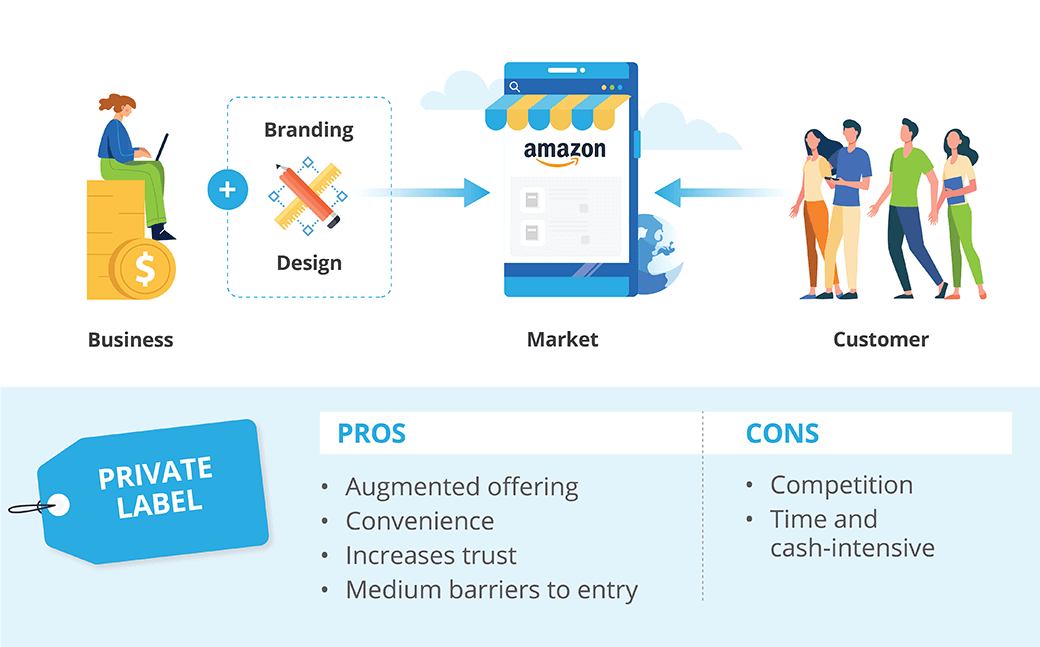

Private Label

A private label model consists of rebranding existing products.

Lots of manufacturers offer “white label” products that you can add your own look and feel to.

| Pros of this model | Cons of this model |

|---|---|

| Rather than solely competing on price, your products have something unique | Amazon has a lot of control. Unless you also sell off the platform too, any mistakes could jeopardize your entire business |

| It’s relatively easy to offer a whole range of products under your own branding - you can spread risk | The probability of purchasing stock that takes a while to sell is high - although you can mitigate this with stringent research, it could be risky if you have low start-up capital |

| There’s a clear path to growth if managed well - each successful new product compounds your income | Others may see the opportunity in what you’re selling and do the same |

| The unique branding makes this model more attractive to buyers than reselling the same products as others | It’s cash intensive to stock lots of products and generate prototypes for new ones |

| It’s time intensive to deal with all aspects of the business operations as well as product research and development on top |

So, how sellable is this type of Amazon business?

In many ways, the saleability of a private label business depends on the goodwill of the brand.

If there are lots of great reviews, the business has a strong Best Seller Rank (discussed in the next section) and repeat customers, this will naturally increase the attractiveness of the brand.

Some key factors influencing the saleability of a private label business include:

- How long the account has been in existence.

- How diversified the product mix is (and how concentrated revenues are towards specific products).

- Level of owner involvement.

- Growth trends for sales and profit.

You can improve these things to boost the value of your business. We’ll be exploring this further in later chapters.

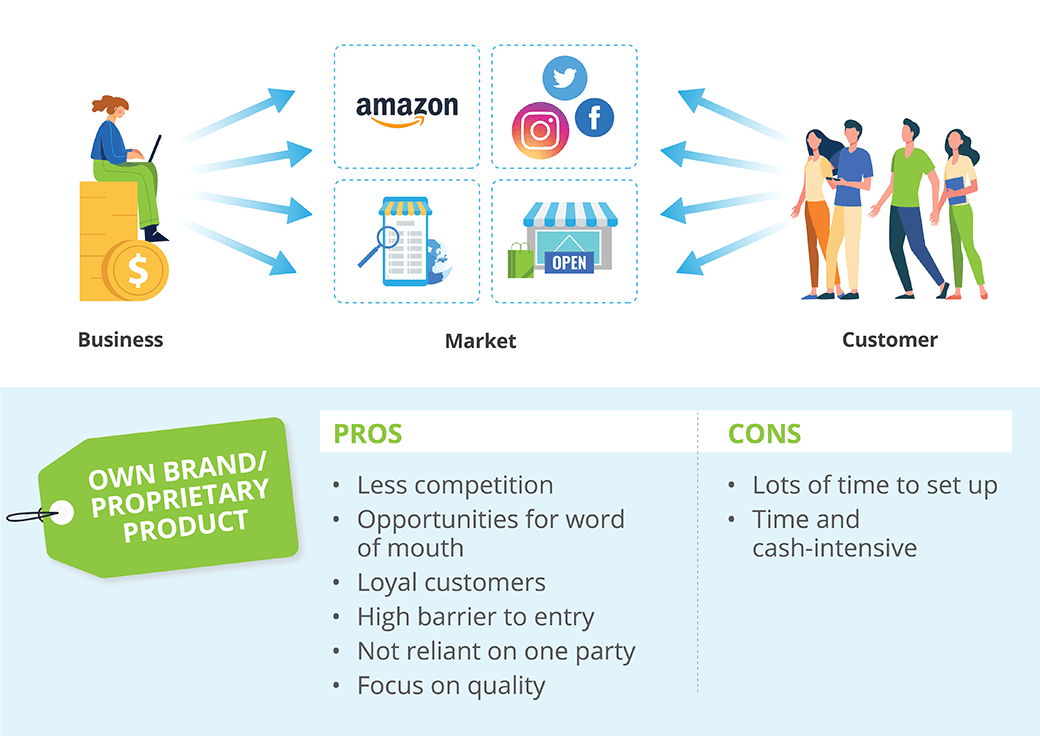

Own brand/proprietary product

As far as FBA businesses go, this is the holy grail.

Having your own products involves selling something new. It might be a product you have designed and developed from scratch, or a new version of an existing product that addresses different needs.

You might notice recurring customer feedback and create a product to suit.

It’s not simply a case of rebranding. You’re adding something original to the market.

This model is more difficult than being a reseller or private label, but can generate much more value in the long run with less competition.

| Pros of this model | Cons of this model |

|---|---|

| Less susceptible to competition because your brand and product is unique. People aren’t just buying for the price | It’s time-intensive to develop a trusted brand and not something you can speed up |

| Easier to maintain margins with less competition | Bad reviews early on could cause real problems getting started and growing |

| Your brand is independent of Amazon so if you’re shut down, you can move it elsewhere | Product sourcing is crucial - you need to find something high quality that will address the needs of your customers |

| Potential for numerous revenue streams | Once you’ve chosen a niche it’s hard to change focus, so you’ll need to do plenty of research up front to make the right choice |

| Loyal customers can become brand advocates and promote you via word of mouth | |

| You may not need to hold as many stock lines as other models so operations may be more simple and cost-effective | |

| You’ll need stronger relationships with suppliers which should earn you leverage |

So, how sellable is this type of Amazon business?

Established, recognized brands and proprietary products add far more value to a marketplace than reselling or private labeling.

They can be more resilient and develop loyal customer bases.

From the perspective of a potential buyer, this is highly valuable and can demand a significant premium.

Factors that affect the saleability of this type of business:

- How established the business is, and,

- How much the earnings of the business are directly influenced by the owner, margins, market share, web traffic, and digital assets outside of Amazon (like social media accounts).

Now that you have some idea of where your business sits in terms of saleability, let’s dig deeper into what might entice someone to buy an Amazon business.

“A common mistake for sellers is not understanding that their business is worth what someone is willing to pay, not a seller’s idea of the value.”

Scott Scharf, Catching Clouds, an Acuity company.

Amazon business valuation isn’t the most straightforward. And a buyer will check your calculations before closing a deal.

So we’ll take it one step at a time, covering:

- Seller Discretionary Earnings (SDE) value - what is it, and why does it matter?

- Addbacks - how to include them and why you would want to.

- Bringing it all together in your calculation.

The good news is that, in general, FBA business values are on the rise.

“Multiples have

increased. Investors

have gained confidence

in the viability and

stability of FBA

businesses. Also, there

have been a lot of

private equity firms

(aggregators) that are

heavily funded and

intent on purchasing

Amazon businesses.

This has further

increased the demand for

FBA businesses, and in

turn, their value in the

acquisition

marketplace.”

Ian Drogin, QuietLight Brokerage.

Amazon businesses tend to be valued according to a multiple of gross earnings before tax plus the cost of any stock traveling to, or stored in, Amazon warehouses.

Here’s how it works

The first value you need to work out is your SDE.

“Seller’s

discretionary

earnings

is

a

cash-flow

based

measure

of

business

earnings

in

an

owner-operated

business.

It

comprises

the

profit

before

tax

and

interest

of

a

business

before

the

owner’s

benefits,

non-cash

expenses,

extraordinary

one-time

investments,

and

other

non-related

business

incomes

and

expenses.

This

metric

is

used

to

measure

the

value

of

an

organization

in

order

to

provide

potential

buyers

with

a

better

picture

of

their

expected

return

on

investment.”

In most cases, valuation multiples are calculated based on annual SDE. But for businesses in a rapid growth phase, or those that have been declining in value for the past three-six months, monthly SDE can be useful.

Annual SDE takes more data into account.

It provides a better picture of how the business is performing now and how it might in the future. As a result, older businesses that use annual SDE tend to generate higher valuation multiples than newer businesses using monthly SDE.

You know how, at tax season, it’s in your best interests to declare business expenses? You might be able to save some money.

Well, the opposite is true here.

Not everyone looking to buy an Amazon business will have the same circumstances as you. They may not want or need to spend money on salaries, offices, storage, insurances, or vehicles. These types of costs should not be included in SDE calculation.

What you’re really interested in when it comes to SDE are the expenses that are absolutely required for the business to continue operating:

- COGS (cost of goods sold), and,

- Cost of business operations.

Any additional expenses that you want to account for can be through addbacks.

From a high-level perspective, SDE can be calculated as follows:

Revenue

-

expenses*

+

addbacks

*COGS

and

essential

operating

expenses

only.

In theory, this calculation can be shortened to:

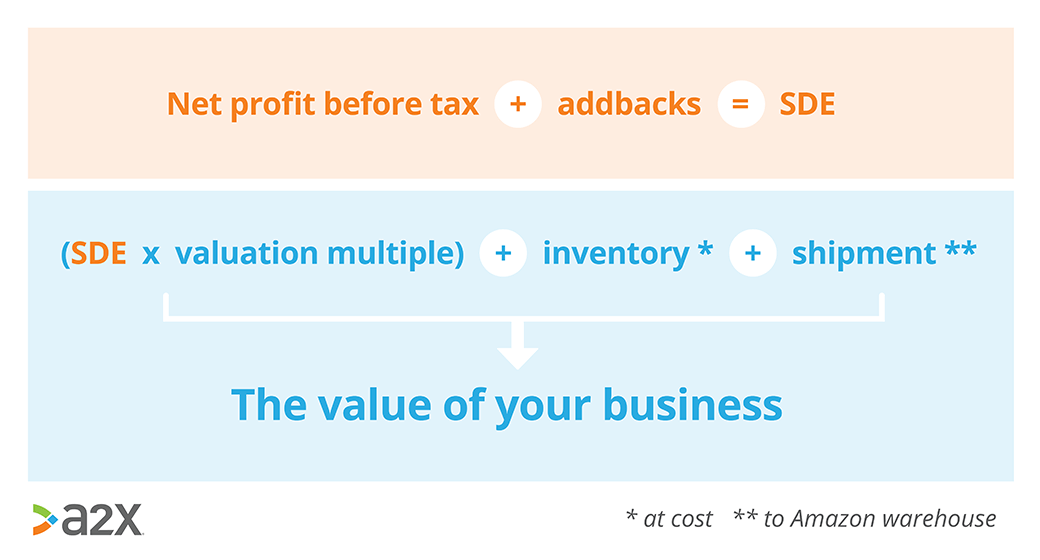

Net profit before tax + addbacks

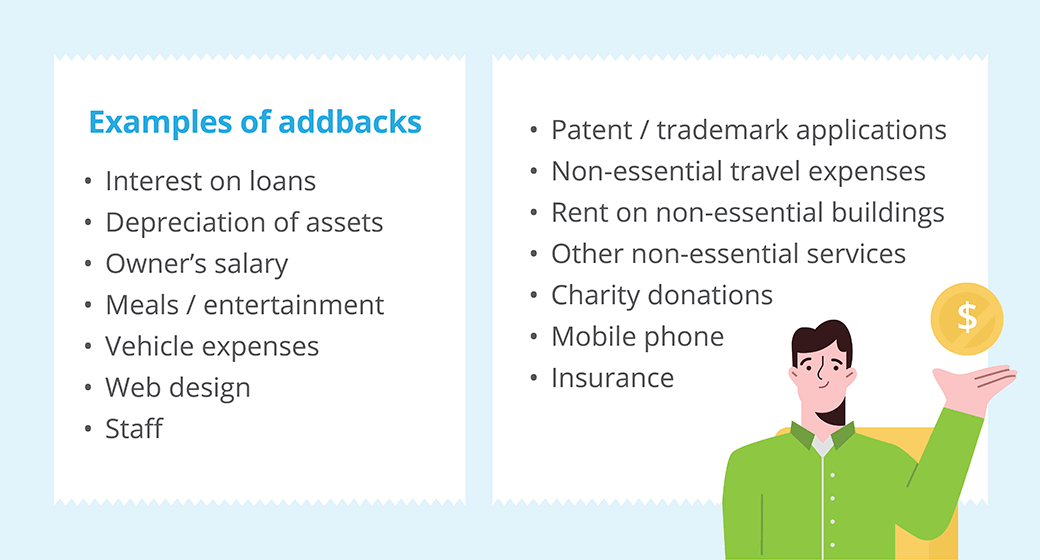

An addback represents an expense that is not integral to your business operations.

It’s an owner benefit and usually a one-time expense that wouldn’t transfer to a new owner.

Here’s a non-exhaustive list of the types of things that, depending on the context, might be eligible as addbacks.

Remember, addbacks are non-essential expenses. The business could be run without them.

We recommend getting tailored advice on what you can include as addbacks from experts like QuietLight.

Calculating your SDE is just the first step in valuing your business. Once you have that, you’ll need to figure out your valuation multiple.

Unfortunately, unless you go through an Amazon business broker, this will have to be educated guesswork. Most Amazon businesses tend to have multiples of 2-5x.

That essentially means your business should sell for 2-5x your SDE figure.

“FBA multiples have definitely increased. They can range quite a bit but I'd say the majority are 2-5x SDE, unless the business is a reseller, in which case perhaps as low as 1/1.5x (but still likely higher). In some cases, they've gone for as high as 7x but those are quite rare”

Ian Drogin, QuietLight Brokerage.

It all depends on your business type and its valuation drivers (which we’ll discuss next).

Luckily though, this multiple doesn’t need to be ‘fixed’. It’s important to go into any negotiation with an open mind, and if your business is particularly attractive to buyers, you may get a better price.

This step is all about getting a feel for where your business sits in the market.

To determine a fair multiple, it’s best to look at other examples. Find out what other businesses like yours sold for, and use the valuation drivers below to compare their strengths and weaknesses against yours.

Where does your business most closely align? This should inform the multiple you use.

Once you have your SDE, addbacks, and valuation multiple, here’s how you use them:

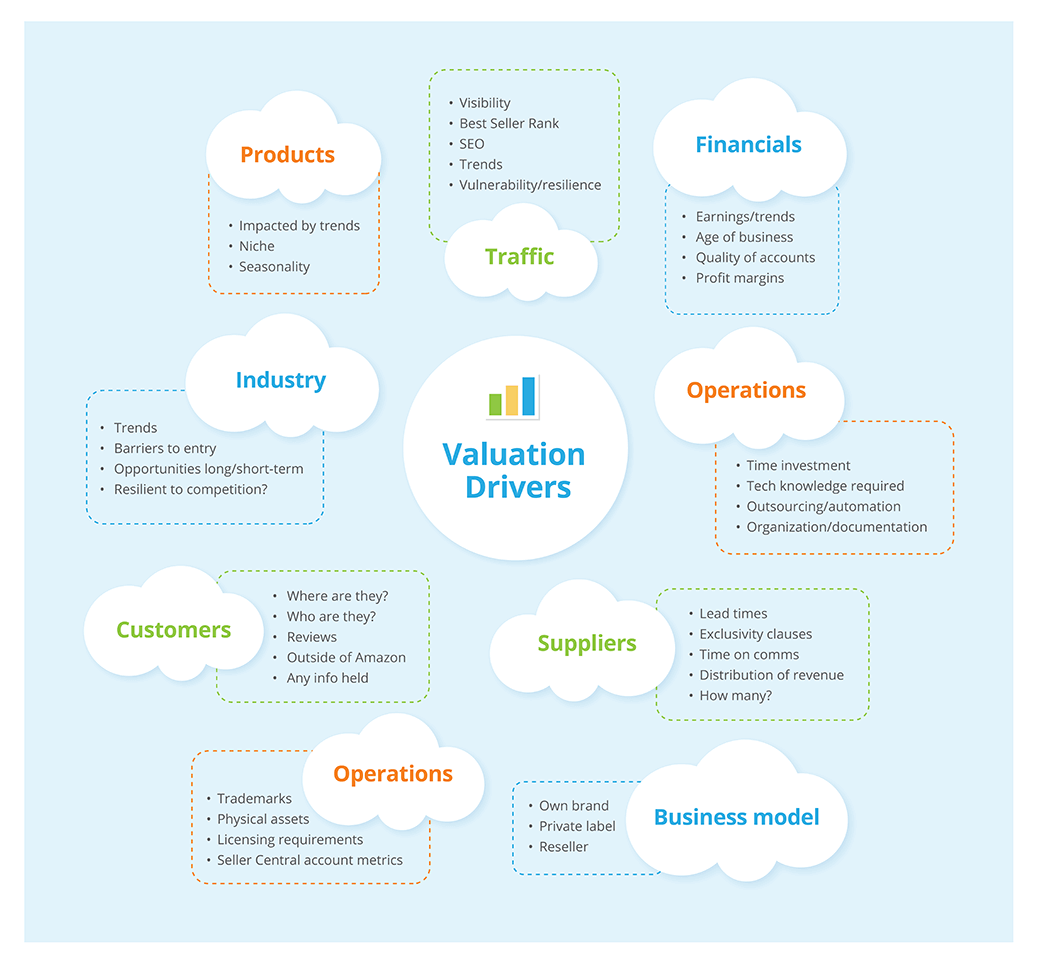

Numerous factors will influence the value of your business for a buyer.

Naturally, if your business is easy to run, making good profit, and resilient, then you’ll be able to attract buyers at a good price.

So, is it? Is your business easy to run, making money, and resilient?

There are a whole host of factors to consider before you can answer this question truthfully - both to yourself, and to your buyers.

Below are the typical value drivers of a business and what potential buyers may want to know.

The icons beside each heading relate to the factors discussed under How sellable is your Amazon FBA business.

Business models

As we discovered in previous chapters, own brand or proprietary product businesses are usually worth more than other models.

More value is added by these businesses with less risk of replication by competing sellers.

Traffic

The Best Seller Rank (BSR) is a metric calculated by Amazon purely based on sales volumes. Products with high BSRs gradually trending upwards indicate popularity with the potential for stable growth (cha-ching).

For businesses that have traffic coming from outside of Amazon, buyers will likely be interested to know:

- Where it’s coming from.

- Whether it’s free (organic) or paid. The latter has an expiration date whereas the former indicates people are looking for the brand.

- Your conversion rates. If you have 10,000 monthly visitors and only a handful of sales, something has gone wrong. You’re getting traffic but it’s the wrong traffic.

- How vulnerable the store is to changes in Google’s algorithms. If traffic is coming from a number of different sources, not just Google, then it may be more resilient.

- Trends in the traffic. Are visitor numbers increasing or decreasing? Are there any patterns from various channels or throughout the year?

Operations

Buyers want to get a feel for the resources it will take to run your business. How much time will they need to spend working on it? Will they need any technical knowledge to hit the ground running?

Perhaps you outsource or automate parts of your operations. Buyers may need to learn new systems or transfer to those of their choosing. If your buyer is an aggregator, they may have staff ready to take over. Either way, operations need to be relatively easy to transition.

Then there’s organization. Have you documented everything it takes to run your business? How accessible is this information? Would a new owner be able to pick up where you left off relatively easily?

Suppliers

A buyer will need to understand the lead times of your suppliers. Do you have stock to transfer? How long does that order process take?

Do you have any exclusivity arrangements with suppliers that can or can’t be transferred to a new owner?

What about the time investment here, how long do you spend communicating with suppliers on a weekly basis? Do you have systems that make this quick and easy? What’s your relationship like with the suppliers?

And finally, how many suppliers does your business have? Too many suppliers could mean overly complex operations. Too little could leave a business vulnerable to service changes.

Products

Consider how many products you sell and their performance. The more diversified your product portfolio is, the better - within reason.

If you have a wide range of SKUs and are considering selling up, it may be worth consolidating stock lines. Analyze which products are selling and which aren’t.

On the other hand, some buyers may be put off by tighter ranges. If the vast majority of your sales come from just one or two products, that’s risky.

Buyers may want to understand trends and seasonality for your products too. Are they particularly popular at certain times of the year? Are they a short-term fad or a long-term success story? What evidence can you provide to back this up?

Customers

Knowing your customers inside and out is crucial. Hopefully this has been a priority from day one since your customers are at the heart of your business.

And buyers will want to get as much insight from you as possible to gauge the feasibility of taking over your business.

-

Who

are

your

customers,

and

where

do

they

come

from?

Are they domestic, international or a combination? Are you able to describe them and the needs your products satisfy in detail? -

Do

you

have

customers

coming

from

outside

Amazon

too?

Or does the platform have full control over your business’ visibility? -

Do

customers

tend

to

come

back

for

more

or

make

one-time

purchases?

Have you ever loved a product so much you’ve raved about it to friends? Perhaps a brand impressed you in its customer service and now you won’t go anywhere else.

It’s cheaper to retain customers than to attract new ones so repeat custom is a great value driver. Pay attention to making every customer as happy as possible. -

Do

you

know

the

average

lifetime

values

of

your

customers?

How about average order values? Do you do anything to improve these things during the buying process? -

What

are

your

reviews

like?

How do you deal with them? -

Do

you

keep

any

customer

information

for

marketing

purposes?

This might include a mailing list or social media presence. These things make retention more viable, and help build a community around your brand for long-term stability.

Industry

Knowing your competitors and the landscape of the industry you’ve chosen is just as important as knowing your customers. The three go hand-in-hand.

A stable business has a steady niche, one that is both long-term and specialized enough that competitors are limited.

A discerning buyer will want to know:

-

How

competitive

is

the

niche?

Where does your business stand with the competition? If you’re in a highly competitive market but dominating, that could be a huge sell. This is particularly true if you have exclusive supplier arrangements in your pocket. -

What

are

the

barriers

to

entry

like?

In other words, how easy or difficult is it for new competitors to shake things up? Would it take much for them to compete with you? -

How

is

the

market

behaving?

Any trends? Is there growth and if so, how steady or reliable is it? In the opposite sense, if there are declines, are there any predictors of how long that will last? -

Are

there

any

immediate,

untapped

opportunities

going?

Any indication of added value and short-term gain by investing in your business will be attractive to a buyer. You could do some research and provide this to them, demonstrating where those opportunities are and how to find them.

Your key concern here is: how defensible is your business?

Will your buyer see the opportunity of investment, or will they be suspicious that you’re trying to offload a sinking ship? Think about what it would take to convince you and get as much evidence as possible.

Financials

“Having accurate numbers doesn’t just aid the sales process, it is vital to successfully managing your business regardless of any intention to sell. There is no doubt that not only to maximize the businesses true worth, but also to make the whole process of selling run smoothly you must have accurate accounts.”

Steve Blackmore, Elver Ecommerce Accountants.

Your finances are arguably the most important part of selling your business. The numbers tell its story, and there’s no hiding them.

They will need to be accurate, neat, and easy to digest. If you can’t understand them, potential buyers won’t - and they won’t stick around long to try.

Are there any gaps? You’d better figure out why.

The key factors to consider with your financials:

-

Your

earnings

How much is your business making (SDE)? Are there any trending or seasonal factors impacting your earnings? Businesses with highly seasonal stock (Christmas ornaments, for example), can be riskier. If stock isn’t sold in the high season, it might need to be cleared - and that’s a loss. -

How

old

is

the

business?

Older businesses that have stood the test of time are perceived to be a more robust investment. -

How

clear

are

your

books?

Is anything missing or out of whack? Are they organized via the accrual method? More on this below. -

What

are

your

profit

margins

like?

Where do they come from? High volume and high margin products are the ideal. But if lower-margin products are responsible for most of your sales, that might put buyers off

When it comes to your financials, the best time to sell is when your business is growing steadily. If you wait until it’s declining in value, buyers will be less likely to pay top dollar.

If your business is growing rapidly, you might be selling up too soon. Timing is everything.

Other

Here’s a quick checklist of other factors to consider when valuing your business:

- Are any elements of your business tied to a specific location? Maybe you have an office or storage facility somewhere? A buyer may need to move or close that property, will that be possible for the business to operate?

- Does your business have any licensing requirements to operate? Certain restricted products might, for example. This could work in your favor because it makes competing with you a little harder.

- Does your business own any trademarks or off-site assets (i.e. not on Amazon)? This is a great sell, because a business with good market share, visibility, and protections for its products is more defensible than a private labeler with their logo on easy-to-replicate products.

- How’s your Seller Central account health? As you probably know, this is a metric Amazon uses to measure how you’re performing against their expectations of sellers. Those with poor levels aren’t likely to attract many buyers. At the very least, you’ll want to be achieving the following levels for these particular metrics:

- Order defect rate: <1%

- Pre-fulfilment cancel rate: <2.5%

- Late shipment rate: <4% (if you’re an FBA business, you shouldn’t be penalized for late shipment rates)

“Our existing clients are on accrual because it’s a best practice and we would be doing our clients a disservice to use the cash method.”

Cyndi Thomason, bookskeep.

The accounting method you use for your business could have an impact on how much it sells for in a big way.

“I

don’t

know

of

any

brokers

or

investment

bankers

who

will

even

take

your

deal

to

market

unless

you

have

accrual

books

and

if

you

try

to

find

a

buyer

on

your

own

you

are

likely

to

get

far

less

than

you

could

get

when

multiple

well-funded

buyers

are

bidding

on

your

business.

For

my

clients

at

Seller

Accountant,

having

great

financials

adds

6-figures

and

sometimes

7-figures

of

value

to

the

deal.”

Tyler Jefcoat, Seller Accountant.

When you sell your online business, the best way to present your profit and loss statement (P&L) is via the accrual method of accounting.

Why?

Cash accounting can under-represent the health of a business.

Any sales made where money hasn’t been received yet aren’t counted. And similarly, upcoming expenses, which the business will need to pay out for in the future, aren’t taken into consideration.

Plus, a lot of your “cash” may be sitting on shelves in the form of already-purchased inventory. By only counting the cash in your accounts, you could be grossly underestimating your net income and SDE.

“Probably

75%

of

the

sellers

I

talk

to

are

using

cash

basis,

usually

with

no

balance

sheet

or

a

balance

sheet

that

can’t

be

trusted.

This

will

lead

to

a

significantly

lower

valuation

if

you

can’t

prove

the

profitability

of

the

business.

The

buyer

will

want

to

drop

the

price

to

protect

themselves.”

Scott Scharf, Catching Clouds, an Acuity company.

Accrual accounting gives you a better overall picture of the value and health of your business by alleviating these problems.

“We find that the majority of businesses making less than about $3m don’t use the accrual method. We always recalculate using accrual. There’s a risk that deals can expire in the time it takes to recalculate this way, but the business is likely to be worth more.”

Matt Botha, Elevate Brands.

A quick recap of the difference between cash and accrual accounting:

Cash accounting involves recording income and expenses when money changes hands. Income is recorded when money is received. Expenses are recorded when bills are paid.

Accrual accounting records transactions when they occur, regardless of whether money has changed hands yet. This takes into account the fact that many debts are settled long after they occur.

If you’re not using A2X for your Amazon store , then working only with Seller Central’s reports is:

“...extremely difficult and time consuming to reconcile accounts month to month whilst also including detail around fees, currency exchange costs, and other expenses.”

Mark Daoust, QuietLight Brokerage.

A2X was designed to make accounting for your Amazon store a breeze - including via the accrual method.

“A2X is such a great tool for making the process a whole lot easier.”

Steve Blackmore, Elver Consultancy.

This is done by importing the correct data from Amazon into your cloud accounting system, allocating income and expenses to the correct period, and automating the process of record keeping.

By removing the potential for human error, buyers can be confident that accounts are more accurate and representative of the true state of the business.

Not using A2X and wish you had been? That’s ok, start today and we’ll be able to help you backdate your books.

“A2X

makes

it

easy

to

go

back

and

pull

the

Amazon

sales

and

cost

data

and

book

it

as

accrual

entries.

This

is

“rework”

and

we

have

to

remove

the

original

entries

and

replace

them

using

entries

generated

by

A2X.

Then

reconciliation

must

be

completed

to

ensure

we

continue

to

balance

with

the

bank.

It’s

time

consuming

but

doable

because

of

A2X.”

Cyndi Thomason, bookskeep.

No gaps, nothing missed - get the maximum value for your business.

“I’ve seen buyers walk away from deals or at the last minute come back with a lower offer because the seller couldn’t adequately explain their numbers.”

Cyndi Thomason, bookskeep.

Don’t make the same mistake.

We’ll talk more about cleaning up your books in later chapters.

That’s right, the valuation stage doesn’t have to mean the end of the road for what your business can fetch.

There are ways to drive that price up.

Let’s look again at the value drivers we explored above and see how each can be optimized.

Business models

Business types in order of most to least valuable (on average):

- A unique product, strong branding, and/or proprietary technology.

- Private label business.

- Reseller business.

If you have the time and inclination to move your business towards that top spot, it could do wonders for your sale price.

Traffic

Increase your traffic both on and off Amazon by:

-

Brushing

up

your

Search

Engine

Optimization

You can do this on Amazon itself, and for any digital assets you have off the site. It takes time and planning, but with sustained effort, can lead to a solid, trusted brand name. -

Adding

links

to

your

products

on

other

websites

Search engines judge the popularity of pages based on a number of factors, but number of links to them is a key one. Not only can you increase your sales but diversifying your income streams is a great way to make your business more resilient. -

Spending

time

on

social

media

You can either set up accounts for your business, or work with influencers that appeal to your target audience. These are both great ways to tap into new customer bases and interact with them too. -

Making

sure

you’re

getting

the

right

traffic

We mentioned above that having thousands of monthly visitors is one thing. Having a decent conversion rate is another. By listening to your customers and designing any messaging around your target audience, you can pick whose attention you get. You want to attract people who need your product. So get to know them, spend time where they are, and advertise to them in those places.

Operations

Any part of your business that can be outsourced or automated should be. Think about the tasks that take up a lot of your time and are easily replicated

By removing yourself from the driver’s seat where possible, you are creating a self-managing asset that is more attractive to buyers.

Our Amazon automation guide delves deeper into the myriad of ways you can optimize your business operations, including:

- Automating your accounting for accurate, organized books in a fraction of the time.

- Outsourcing quality control and correctly packaging FBA products. Remember, incorrect packaging will lead to additional fees.

- Managing more than one sales channel in a centralized space.

The opportunities are endless with apps today. Your key concerns when it comes to automation are:

- Getting the most out of the least apps

- Developing systems and processes that work together seamlessly

- Documenting everything. From the inner workings of these processes to how you work with your suppliers. This will also make things easier from a financial perspective, particularly at tax time.

By documenting everything and mapping out your operations, you can more critically analyze your operations. It will also be easier to transition to the new owner.

Where can you save time, tighten things up, and improve the efficiency of your machine?

It’s easy to see how a buyer would be impressed by this - wouldn’t you?

Suppliers

Exclusivity contracts are a big advantage for a business.

In your mission to make your business as defensible as possible, and raise barriers to entry for your competitors, these can add to your edge.

Although these contracts aren’t always concrete, they do provide extra value to buyers.

If your products are more widely available and difficult to secure exclusivity, try for favorable terms. If you can transfer good deals to buyers with some long-term reassurance, there shouldn’t be too much interruption in the transition phase.

Are lead times a problem for your business? Why not ask suppliers if they can hold stock for you in their warehouses?

The more work you can do before handing over to a buyer, the more they’re likely to pay for the convenience. Using well-documented systems and automation, as discussed above, should also make the transition phase more smooth.

Products

Diversification is important. You know the saying about eggs in baskets…

If you carry just a few products, explore the option of adding more to your portfolio. Test out new suppliers, and analyze how well your current products and suppliers are meeting your business goals.

Are there any opportunities being missed that a buyer might spot? Do you have a good reason for not exploring them?

Perhaps you could lay some of the groundwork for them to capitalize on those opportunities?

Customers

The more information you have about your customers, the better.

They’re the ones with the cash. So it’s their needs, preferences, and decisions that you should be most concerned with

How will you know what they are without interacting with them?

A buyer will also want to know everything about your customers too, and why your products are so irresistible to your target audience. Have you, as a business owner, listened to your customers and evolved with them?

What image of your brand have you put out there so far? Is it one that a buyer would want to invest in?

If you’re only selling on Amazon, you’re limited in your customer relations. So consider developing a presence off the site.

The combination of happy customers and social media can be a goldmine for word of mouth promotion. You can use it to test ideas and new products, gain insights, and learn about customers

It’s worth noting however, that if you feel there are better uses of your time when it comes to growth, then social media may not be the right move for you. Just as it gives a platform and voice to happy customers, the same can be said for disgruntled ones too.

Struggling to get reviews from customers? Tools like Sales Backer and Feedback Express (eDesk) can automate reminders to your customers to review you. By generating more positive reviews, you can trigger a self-fulfilling cycle of more sales, more reviews, more sales = growth.

And what does all that mean? Higher valuation.

Financials

What you want to avoid when it comes to your finances:

- Relying on minimal products to make your money.

- Relying on seasonal fluctuations that could change with time.

- Messy books.

Having a single point of failure is a bad plan for a business.

This is where diversification comes into play again. More eggs, more baskets. Have you got seasonal products? Perhaps explore non-seasonal ones that will pick up the slack in slow periods.

This should spread your risk and ideally make cashflow a little easier to predict and manage.

Gross margins largely determine the sale price of your business.

It can be a good idea to remove any unnecessary overheads at least six months prior to selling.

Expenses such as employees (where tasks can be automated or outsourced), buildings, equipment, vehicles and travel costs should be removed if they aren’t integral to successfully operating the business.

Old stock that is hard to sell is a major obstacle for potential buyers. It may even make more sense for you to clear that stock and not try passing it onto nervous buyers.

And remember the most important part of all: keep your books clean. If they’re disorganized, inaccurate, and confusing to you, that’s a major red flag to a buyer.

Other

Here are a few bonus value drivers to really impress your buyers:

-

Get

clear

on

who

they

are

and

what

they

care

about

Not every potential buyer interested in your business will be the same. They might be individuals, corporates, family offices, or private equity. Each will be weighing up different risk/value factors.

By getting ahead of these and making adequate preparations for each, you’ll be equipped to answer all questions and present your business in the best light regardless of who you’re talking to. -

Leave

them

something

extra

If you can sweeten the deal with some freebies thrown in, this helps you stand out as a seller.

You might be able to offer new products that are fully prototyped, researched and ready to launch. Or maybe preparations to enter new markets following acquisition.

Equally, if you’re struggling to sell, perhaps you should do these things yourself first. Buyers determine the value of your business - not you. So make it as attractive to them as possible -

Register

with

Amazon

Brand

Registry

Registering as a brand on Amazon gives you extra protections. It protects the integrity of your brand, solidifies the value of your digital assets, and helps reduce matching errors when someone looks for your product.

Preparing to sell your Amazon FBA business is every bit as important as the purchase journey itself. You know what they say - failure to plan is a plan to fail.

Is now the best time to sell your Amazon FBA business?

How attractive would your business be to buyers? Are there things you could do to increase its value? Find out with our free assessment tool.

Download our free guide

“Be sure to do your financials on a monthly accrual basis and get a valuation at least 12 months before you want to sell to ensure you have time to prepare for a successful exit.”

Ian Drogin, QuietLight Brokerage.

When it comes to your Amazon accounts, you can run, but you can’t hide.

Unless, of course, they are lying - and that’s just not an option.

The numbers don’t lie.

“Implementing

detailed

and

accurate

bookkeeping

in

your

business

is

like

turning

a

flashlight

on

in

a

dark

jungle

at

night.

The

snakes

might

still

be

there,

but

now

you

can

avoid

them

and

stay

on

the

right

path.

It’s

common

for

a

lot

of

Amazon

sellers

to

ignore

bookkeeping,

at

least

when

they’re

first

getting

started.

However,

the

consequences

of

not

having

an

effective

Amazon

bookkeeping

system

quickly

present

themselves.”

Ian Drogin, QuietLight Brokerage.

We’ve already discussed why the accrual accounting method is best for ecommerce (under How to value your Amazon business). So if your books aren’t organized this way, easily backdate them with A2X for Amazon.

Accounting preparation for selling your Amazon FBA business:

-

Ensure

inventory

is

properly

recorded

Organized books can help you avoid two major pitfalls for Amazon FBA businesses: storing too much stock (triggering extra fees), and running out of stock. If a buyer spots warning signs for this in the future, you could lose them. -

Get

your

balance

sheet

clear

and

accurate

You should be able to forecast your business’ performance in the next few months using your balance sheet. At a glance, you should be able to see a breakdown of revenue and expenses that tell a story, with accessible information. This should allow you to spot opportunities to grow and share these with impressed buyers. -

Audit

your

expenses

and

minimize

them

This should be a regular practice anyway. Are you wasting money anywhere? Can you see ways to save? It’s better to spot them before your buyer does. -

Get

clear

about

disposable

income

Hopefully you haven’t fallen into the trap of spending money as soon as it comes in. A certain amount needs to stay in your business for it to run. Potential buyers will likely ask how much needs to be reinvested and how much can be safely withdrawn. -

Make

sure

you’re

up-to-date

with

your

tax

obligations

Is your business remitting sales tax? If not, are you absolutely sure that you’re not obligated to somewhere? If audited, a state will check when your business crossed its sales tax threshold, so if this was a while ago, you could receive a nasty bill. A discerning buyer won’t take this risk.

Your books tell the story of your business.

They should be easy to read and reassure potential buyers that this business is a well-run, sensible investment.

Disorganized books are a great way to lose buyers, undervalue your business, and walk away with less than you deserve (if you manage to sell at all).

Ecommerce business owners wanting to sell up should seek legal advice as early as possible. This is regardless of whether you choose to sell via an FBA broker or not.

Lawyers protect both sides.

And just like with accountants, it’s always best to use an attorney with experience handling ecommerce businesses specifically.

Legal measures to consider when selling your FBA business:

-

Securing

intellectual

property

If you have a proprietary brand, it is likely the beating heart of your business. Any trademarks, copyrights or patents should be officially registered to be both defensible and transferable to a new owner.

You should also keep records of any challenges made to your intellectual property in the past as this may be requested from buyers during the due diligence process. -

Contract

agreements

If you hire contractors in your business, ensure you have the appropriate agreements in place. Work for hire agreements need to spell out what happens when there is a transfer of ownership -

Non-competes

It’s probable that you’ll need to sign a non-compete on selling your Amazon business. This states any restrictions on the type of subsequent business you can set up that could compete with the new owner. It shouldn’t be too restrictive, but strike a good balance, so make sure you read through this thoroughly. -

Non-disclosure

agreements

NDAs are important when sharing the inner workings of your business with potential buyers. Nothing will have been signed yet, so you don’t want the buyer to use the information you give out. -

Transferable

assets

list

You’ll need to be explicit about the assets up for sale. This can act as a checklist for transferring ownership once the purchase agreements are in place towards the end of the selling process.

These will need to be detailed in that agreement, and would include things like your Amazon account, any other domains, social media accounts, customer databases, payment gateways, and brand assets. -

Escrow

This step allows thorough inspection and verification before funds are released and as such, is an important part of the sales process. But terms of escrow should be agreed between buyer and seller too.

There will be costs involved, and these are usually split 50-50. For businesses worth over $1 million, lawyers tend to handle this process. Having this step in place is optional but will protect you and your buyer.

“Ecommerce businesses are often highly attractive to non-technical buyers, who make up a significant proportion of the market. A recent survey of our buyer network revealed that a substantial majority of buyers classified themselves as non-technical.”

Thomas Smale, CEO of FE International.

Ecommerce businesses are by definition, technology-dependent. Just because you may not have a physical store on the street doesn’t mean there isn’t spring cleaning to do.

You need to make your technical business attractive to non-technical buyers.

You might be using Amazon in a pretty standard way. Perhaps you keep within its structure and haven’t customized much to suit your business.

But you might have developed your own way of doing things and a tech stack to suit.

The options for apps, integrations, and plug-ins are endless. So for business owners that have explored optimizing their stores, it’s time to pick up that pixelated feather duster.

What does that mean? Auditing your apps.

Do you use a lot of automation?

That could be a great thing - as long as you have balance. You want to make sure you’re getting the most out of the least number of apps.

So do an audit and see whether any are made redundant by the features of another.

Buyers come in all shapes and sizes.

They’re concerned with different things and will be looking for their own set of criteria when it comes to judging your business.

In general, the types you’ll come across are: individuals/partnerships, companies, and private equity/investment firms/aggregators.

Here we’ll break down what each is typically after and how to prepare.

Individuals and partnerships

This type of buyer is a private individual or a few people that want to run a business themselves. They might be new to ecommerce, new to Amazon, or seasoned pros after a new venture.

General overview of this buyer type:

- Their primary motivation is to avoid loss.

- They’re generally using their own money, so as well as growth, they’ll want to know how much risk they’re taking on.

- They’re usually looking for an income stream to run themselves.

- They normally have a set budget to spend so they’ll be looking for a deal within that.

- They may consider loans though if they are sold by your business’ potential.

- It’s a good idea to really emphasize how your business is defensible in the market.

- Propriety products/developed brands are likely to be most attractive to these buyers.

Companies

These are likely to be established businesses. They might already be selling on Amazon or looking to explore the platform.

General overview of this buyer type:

- Motivations could include acquiring competitors or strategically adding to their existing portfolio with your business.

- They’ll be looking for where synergies lie and how they can combine resources to expand.

- If you have exclusivity with suppliers or reputable proprietary products, they might be driven to acquire these to level-up their market share.

- They usually have access to credit and can move quickly if a good deal is on the table.

Private equity firms, investment firms, and aggregators

These guys are usually after investments with growth potential for the biggest return.

They’ll be looking to acquire companies fast, and have access to lines of credit if required.

Aggregators in particular have become more popular recently, and provide FBA sellers with a profitable exit strategy.

They can be interested in any business model, though private labelers are still the strongest sell.

General overview of what this buyer type looks for:

- Registered brands

- FBA businesses

- A strong niche

- Loyal customers

- Fewer SKUs with higher margins

- A minimum portion of sales generated through Amazon (if some of yours are off-site)

Hopefully you can see a pattern emerging here.

The criteria of a sellable business doesn’t vary all that much.

“At

SellerX,

we

look

at

virtually

all

categories

in

the

Amazon

FBA

space,

with

a

few

exceptions.

There

are

various

boxes

the

ideal

FBA

player

should

tick

in

multiple

categories:

market

size

and

trends,

competition,

product

quality,

customer

satisfaction,

and

financial

performance.

Naturally,

the

market

or

niche

should

be

attractive

in

future

development

and

ideally

fundamentally

stable

throughout

upcoming

trends

and

market

tendencies

(so-called

evergreen).

The

product(s)

should

be

well

placed

and

in

an

industry/niche

leading

position

in

quality,

pricing,

ratings,

and

reviews.

Lastly,

the

financial

performance

should

depict

an

upward

trend

with

healthy

margins

and

marketing

spending

through

attractive

conversion

rates.”

Daniela Heil, SellerX.

“We look for really high reviews on Amazon, smaller SKU counts and high margins.”

Bryana Aguilar, Cap Hill Brands.

Plenty of things can go wrong when it comes to selling a business.

We asked some of our expert ecommerce accounting partners to share some insights into common mistakes they see sellers make.

Lack of well-managed and valued inventory

“Not

having

good

historical

data

for

their

inventory/COGS

going

back

two

years.

Good

inventory

practices

help

you

manage

your

business

every

day;

don’t

wait

until

it’s

time

to

sell

to

get

your

inventory

working.

Going

back

and

trying

to

“force”

the

numbers

is

time

consuming,

costly

and

sometimes

impossible.”

Cyndi Thomason, bookskeep.

If your inventory records aren’t accurate, you’re unlikely to get the maximum value for them.

“If

you

don’t

have

your

invoices

and

statements

organized

for

review,

you

end

up

getting

surprised

during

due

diligence

and

surprises

during

due

diligence

almost

never

favor

the

seller.

[Create

a

Google

Drive/Dropbox]

“data

room”

that

is

so

beautiful

that

your

due

diligence

team

gets

giddy

when

they

look

at

it.

If

you

can

make

it

easy

to

understand

your

story

you

will

get

paid

more.”

Tyler Jefcoat, Seller Accountant.

Lack of properly reconciled and organized accounts

“Brokers

and

buyers

want

numbers

that

are

defensible

and

tell

a

story.

When

they

don’t

make

sense

it

causes

them

to

get

nervous

and

this

will

impact

their

offer

or

even

cause

them

to

back

away.

Unfortunately,

when

we

take

on

new

accounts

we

sometimes

find

that

bank

accounts

haven’t

been

reconciled,

and

the

balance

sheet

and

P&L

[profit

and

loss

statement]

do

not

reflect

the

activity

that

has

gone

through

the

bank.

This

should

be

a

given

but

some

people

“make

it

work”

which

doesn’t

reflect

reality.

Or

the

business

owner

doesn’t

understand

accounting

and

doesn’t

realize

the

importance

of

the

reconciliation

step.”

Cyndi Thomason, bookskeep.

“When

buyer

anxiety

goes

up,

multiples

go

down.

The

solution

is

to

make

sure

that

you

have

at

least

12

months

and

preferably

24

months

of

solid,

clean,

accrual

financials

to

share

with

the

investors.”

Tyler Jefcoat, Seller Accountant.

Too much time spent on due diligence

“Don’t

get

bogged

down

in

due

diligence.

This

will

take

time,

but

shouldn’t

be

so

onerous

that

the

owner

is

spending

more

time

on

that

than

running

their

business

Assign

someone

(sometimes

the

owner,

usually

the

accountant)

to

support

the

due

diligence

and

set

a

time

limit.

1

to

2

weeks

for

most

sellers,

no

more

than

4

weeks.

We

have

helped

clients

through

3

month

due

diligence

projects.”

Scott Scharf, Catching Clouds, an Acuity company.

Not completing due diligence in a timely way can halt a sale in its tracks.

Not handling taxes correctly

“If its an asset sale, they need to close down sales tax licenses ASAP. And they also need to file a final income tax return for a business that’s being closed.”

Scott Scharf, Catching Clouds, an Acuity company.

If you don’t complete your tax obligations and are caught, you’ll be fined.

Trying to hide mistakes

“It

can

be

tempting

to

try

to

cover

up

a

bad

decision

that

you

made

last

year

but

even

a

hint

of

shadiness

can

kill

your

deal

very

quickly.

Instead

of

hiding

the

warts,

be

prepared

to

tell

your

story.

“Hey,

I

made

a

mistake

last

June

in

that

I

waited

too

long

before

ordering

inventory.

As

a

result

I

chose

to

pay

the

air

freight

instead

of

sea

shipping

to

ensure

I

didn’t

stock

out.

I

don’t

know

if

that

was

the

right

decision

or

not

but

it

sure

did

crush

my

profitability

in

September!!

Here’s

my

process

going

forward

to

make

sure

that

doesn’t

happen

again…

The

point

is

to

craft

and

control

the

narrative

but

in

a

way

that

discloses

warts

instead

of

hiding

them.”

Tyler Jefcoat, Seller Accountant.

If you’re wondering where to sell your Amazon business, you have a few options. Each comes with its own pros and cons, time investments and costs.

Let’s explore them.

Selling your Amazon FBA business through a broker will ensure you get the best value and the smoothest transition.

But there are a few other options too.

Let’s explore each.

Amazon business broker

| Typical timeframe | Time investment | Costs |

|---|---|---|

| 1-2mo+ | Minimal for you, the broker will handle most elements | 10-15% commission, legal fees* and taxes, sometimes retainers too |

*Brokers can help to reduce legal fees by providing quality legal agreement templates. This saves your lawyer starting from scratch.

Amazon business brokers are the experts you can turn to if your business is worth more than $25,000 and you don’t have the experience, time or patience to get the best deal for it.

They are experienced in the selling process, handle most of it for you, and can guide you through from start to finish. They can help maximize value and get the appropriate legal protections in place.

They’ll also have contacts waiting and ready to buy. So if you’re going to work with a broker, make sure you can give them as much complete information as possible.

Brokers are the more costly option for obvious reasons. But they do know how to get top dollar for your business. If you pay 15% in fees, but they got a 25% higher price, you’ve still won!

Marketplace

| Typical timeframe | Time investment | Costs |

|---|---|---|

| 6-9mo+ | Full responsibility for the sales process | Listing fees, legal fees, taxes |

Just like Amazon, business listing marketplaces can be crowded. It’s hard to stand out.

If you’re comfortable with the business selling process, this can be a good way to get results without shelling out for a broker.

But if you’re new to it and you’re busy, this may not be the best route for the biggest bucks. Brokers can ensure you’ve not only valued your business accurately, but that you follow the correct transition steps and protect yourself and your buyer throughout.

A popular business marketplace is BizBuySell. You’ll need to include a description of your business with some basic financials.

Auction

| Typical timeframe | Time investment | Costs |

|---|---|---|

| 1-4w+ | Full responsibility for the sales process | Listing fees, closing fees, legal fees and taxes |

Auction formats demand a similar amount from you as marketplaces, but with time limits.

This can be good in one respect: buyers may be pushed to bid higher more quickly. But it could also result in getting less than the business is worth.

Auctions can come with a number of fees and after you add these up, they may not be that different from brokers. But with a broker, you do much less heavy lifting.

Remember, buyers come to auctions looking for a deal. You might find earnings multiples much lower than those discussed earlier that brokers might fetch for you (see valuation multiples).

Do it yourself

| Typical timeframe | Time investment | Costs |

|---|---|---|

| 3-24mo+ | Full responsibility for the sales and marketing process | Legal fees and taxes |

If you haven’t got interested buyers already, this process can be time-consuming.

On the surface, it may also seem like the cheapest option. But you risk undervaluing your business and also getting less money for it in the end.

You would probably research potential buyers and cold call them. This is risky if they’re competitors and you divulge sensitive information they can later use against you.

If you’re well established in the industry and have contacts, you might feasibly be able to sell the business yourself.

The DIY method isn’t great for competitive advantage and can have a relatively low success rate. It’s more common for people to go this route if they already have an interested buyer.

You may be hoping for a nice and easy one-time cash payment from your buyer. But this isn’t always realistic.

Buyers are looking to strike a balance between what they can afford and how much risk they’re willing to take on. So to negotiate a win for both sides, more creative financing solutions might be explored.

Here, we’ll explore some of the most common ones.

Financing options for selling ecommerce businesses:

-

Cash.

This typically makes up the largest portion of a sale price. In some cases, buyers may pay in cash outright. If they can’t, they might look to raise more cash through loans, partnerships, or cashing out savings or retirement funds. -

Seller

financing.

This involves securing a portion of the sale price against the business’ future earnings. The outstanding balance will be paid off over a fixed period based on the cash flow of the business. This is a common financing option but poses risks. If the cash can’t be repaid, the original owner may be able to repossess the business without having to return any of the payments received so far. -

Holdback

agreement.

This involves partial transfer of ownership until certain conditions are met. These conditions might involve meeting certain targets within a timeline, verifying costs that are harder to determine in the short-term (like chargebacks or refund rates), and the seller meeting requirements prior to sale. That might include training the new owner, for example. -

Earn-out

agreement.

Similar to seller financing but with more input from the original owner. Earn-outs involve the buyer growing the business with sustained help from the seller, and paying them a portion of the profits or revenue. It’s common to see this structure in newer businesses or ones with less certain futures - and it’s risky. The seller needs to trust that the buyer knows how to grow a business, and can reliably meet the agreed terms.

If you’re at this point, you should have all your Amazon business ducks in an exit strategy row, and be feeling confident.

Don’t crack into these until you are.

Below is a step-by-step demonstration of how selling your Amazon business could go. No two journeys are exactly the same, but these will give you a good overview - both with and without a broker.

Here’s a general overview of the selling process:

- You make the decision to sell.

- You value your business.

- You develop a business prospectus (detail about its finances, operations, market analysis etc.).

- You search for buyers and/or list your business for sale.

- Negotiate a deal with a potential buyer, agreeing on price and terms.

- You complete the transaction and transfer process. Money is usually held in escrow until everything is in order.

- You run the new owner through the business operations and systems ready to hand over.

Below is an example from the experts at QuietLight. Not all brokers follow the same steps but there will be similarities:

- Clean up your finances (A2X makes this a breeze) and determine addbacks so you can value your business.

- Value your business. The broker will help you calculate your SDE range and figure out how much your business should be worth.

- Draw up the costs of selling the business and ensure they are worthwhile. These include the broker’s commission, legal fees, and taxes (generally on the proceeds of the business sale, not on inventory sold at cost).

- Sign an engagement letter with the broker. This includes a period of time the broker has to sell your business exclusively (usually 90 days but they can vary). Some may offer you non-exclusive deals but these can sometimes turn sour if brokers disagree about who gets the commission and can result in less commitment if the broker has other exclusive deals on their plate.

- Develop a business prospectus. This goes into depth about your finances, operations, and market share. Good brokers should conduct detailed interviews to understand the nuances of your business and its industry. Only this way can they produce feasible visions for its future and answer buyer questions accordingly.

- Set up buyer meetings or conference calls. They should sign an NDA before seeing the inner workings of your business. This engagement should aim to help you and the buyer get to know each other and ask questions.

- Draw up a letter of intent. This is the first formal expression of interest from a buyer. It is a non-binding agreement that sets out what the buyer would agree to in a sale, and how each party would move forward. This is the prelude to a legally-binding purchase agreement. A typical timeframe from letter of intent to purchase agreement to closing is 30-40 days.

-

Carry

out

due

diligence.

This

is

the

time

to

verify

through

third

parties

that

everything

is

correct.

The

buyer

may

reproduce

the

P&L

with

raw

data

and

check

other

financial

statements,

vendor

agreements,

business

registrations

and

licenses

etc.

Buyers

may

request

the

following

things

from

you

to

complete

this

step:

- Amazon statements over the last 2+ years

- Bank statements over the last 2+ years

- Vendor invoices and COGS

- Vendor information

- Sign an asset purchase agreement.This is checked by a lawyer and when signed, signals that the business can be transferred. The money stays in escrow in the transition operated either by a lawyer or third-party service.

- The closing and transition phase. Most of this is done between the buyer and seller directly - things like transferring ownership of your Amazon account, social media, and any other digital assets. Sellers generally offer up to 40 hours of hand-over training to buyers in any format that suits both. That number of hours isn’t always required, but it’s a good idea to keep track of the time used to avoid any disputes.

As you can see, while brokers charge commission on sales, they do ensure full compliance at every stage of the selling journey. This protects you and your buyer, and helps keep the experience as smooth and pain-free as possible.

You might be wondering how to actually transfer ownership of an Amazon seller account.

It depends which country you’re in. Luckily, the US is one of the easier locations.

Although Amazon states officially that accounts are not transferable, in practice, this isn’t the case.

All you need to do is change the information in your account to that of your buyer. This information includes:

- Charge method (credit card)

- Deposit method (bank account)

- Tax information

- Account name

- Email address

This way, customer reviews will be transferred to the new owner.