What Is Modified Cash Basis Accounting and Is It Right for My Ecommerce Business?

This article has been written for US-based businesses. Businesses based in other locations may be required to use a specific method. If in doubt, please consult an accounting professional.

If you’re doing accounting for an ecommerce business, you’re probably familiar with cash basis and accrual basis accounting methods—but what about modified cash basis accounting?

An accounting method significantly impacts how a business is run. It affects how a business appears to be performing, how cash is managed, where investments are made, and ultimately, how much it’s worth. For all these reasons, it’s important to assess the merits of each method to make an informed decision.

To help you decide which accounting method is suitable for a particular ecommerce business, we teamed up with the ecommerce accounting experts at Bookskeep to produce this guide. Read on to learn about modified cash basis accounting, how the three accounting methods compare against each other, and how to choose the best method for your ecommerce business.

At a glance:

- What is modified cash basis accounting? Modified cash basis accounting lets bookkeepers combine elements of two accounting methods: cash and accrual.

- Modified cash basis accounting allows you to handle your operating expense transactions using the cash basis and your revenue and Cost of Goods Sold (COGS) using the accrual basis.

- Modified cash basis gives you a more accurate view of profitability than cash basis and is less time-consuming and complex than accrual basis.

- The Modified cash basis is only appropriate for some businesses but may suit those in the $1-25 million revenue range.

Table of Contents

Webinar: Which Accounting Method is Best for Ecommerce?

Watch ecommerce expert Cyndi Thomason break down the cash, modified cash, and accrual methods of accounting in this on-demand webinar.

Watch now

The 3 accounting methods

The accounting methods we’ll cover here are:

- Cash basis accounting

- Accrual basis accounting

- Modified cash basis accounting

Each method uses double entry accounting. Each transaction must have at least two general ledger accounts assigned, which balance and offset each other.

The key differentiator between these methods is timing. When do you record a transaction—when cash changes hands or when the order takes place?

The correct method depends on the size and complexity of your business.

What are cash basis and accrual basis accounting?

Cash basis accounting records income and expenses when money changes hands. This means if you receive money from a sale, you count it as income as soon as it’s received, and when you pay for something, you count it as an expense as soon as it’s paid.

The cash basis method leads to sharp peaks and troughs in reported revenue and expenses throughout the year. It can work for some businesses. But for others, it misses important details.

With accrual basis accounting, transactions are recorded when value changes hands, not the cash.

For example, purchasing inventory is not counted as an immediate expense. You have traded one asset (cash) for another (inventory) and only when that inventory sells do you consider the cost of goods sold (COGS) as an expense.

The differences in using cash and accrual accounting appear most obviously in businesses with inventory or companies that pay or receive payments with credit terms.

With the accrual basis, because you record a sale and the cost of the goods at the time the same takes place, your COGS percentage tends to roughly track your revenue from month to month—meanwhile, the peaks and troughs caused by the cash method skew this information.

What is modified cash basis accounting?

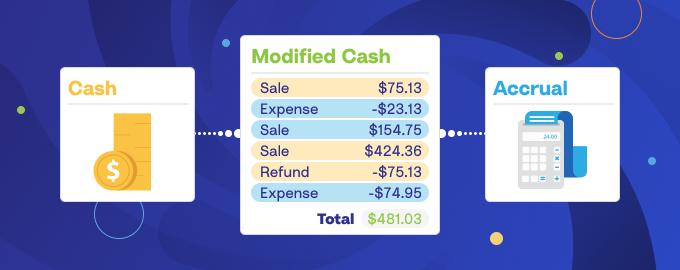

Modified cash basis accounting uses aspects of both cash and accrual basis accounting.

It allows you to handle your operating expense transactions using the cash basis. For example if you pay for insurance for the year, you record the full amount in the month it was paid. For revenue and cost of good sold activity, you would use the accrual basis in order to get a good comparison of the cost incurred for the revenue generated. This allows you to better understand your profitability at the gross margin level.

The modified cash basis is often considered a best-of-both-worlds scenario. It gives business owners a clear idea of gross margin profitability during a month without creating more work

How do the three accounting methods compare?

Let’s compare modified cash basis vs. accrual basis vs. cash basis accounting to find the key differences between the three, who each type is best for, and the challenges and benefits of all three.

| Cash | Modified cash | Accrual | |

| Summary | Money is recorded when it changes hands. | Some transactions are dealt with via cash basis and some via accrual. | Money is recorded at the time of a sale and/or purchase, regardless of whether cash changing hands yet |

| How it differs | The simplest and quickest method but can misrepresent profit in the short term. | The operating expenses can be dealt with one way, and the revenue and COGS another. It gives you the benefits of accrual without a complete switch in one go. | More time-consuming but more complete picture of overall profitability. Can be more costly. |

| Who it’s best for | Early-stage businesses or ones with little delay between income and expenses, e.g., restaurants. | Early-stage and growing ecommerce businesses. | Growing and large ecommerce businesses that have investors reviewing their books and as required by the IRS. |

Key challenges

| Revenue and inventory/Cost of Goods Sold do not match in the period they occurred making profitability information harder to understand. Frowned upon by future buyers (for the above reasons). Not allowed by IRS for larger businesses. | Not allowed by the IRS for larger businesses and does not reflect net margin profitability as clearly.

| Complex and time-consuming.

|

| Key benefits | Simple Quick Easy | Quality, actionable information about a business without the huge time investment in bookkeeping. A good mid-point as a business grows. | Greater visibility into profitability at the net margin level. Reassures future investors or buyers. |

Why do ecommerce businesses choose the modified cash basis?

Modified cash basis accounting is the sweet spot between cash and accrual. It uses the cash method when needed except when making accrual entries where they give us important information. For example, recording your operating expenses using the cash method, and revenue and COGS using modified cash basis.

This hybrid method provides more in-depth and relevant financial information than cash basis alone. It can be perfect for businesses that hold inventory, as the cash basis doesn’t reflect the value of inventory that has been purchased and not yet sold.

The modified cash basis also has the advantage of not being as labor-intensive, complicated, and costly as full accrual basis accounting.

What does a modified cash basis financial statements example look like?

If you sell on Amazon and receive payouts every two weeks and if you carry inventory, your financial statements will look very different if you use cash basis vs. modified cash basis accounting.

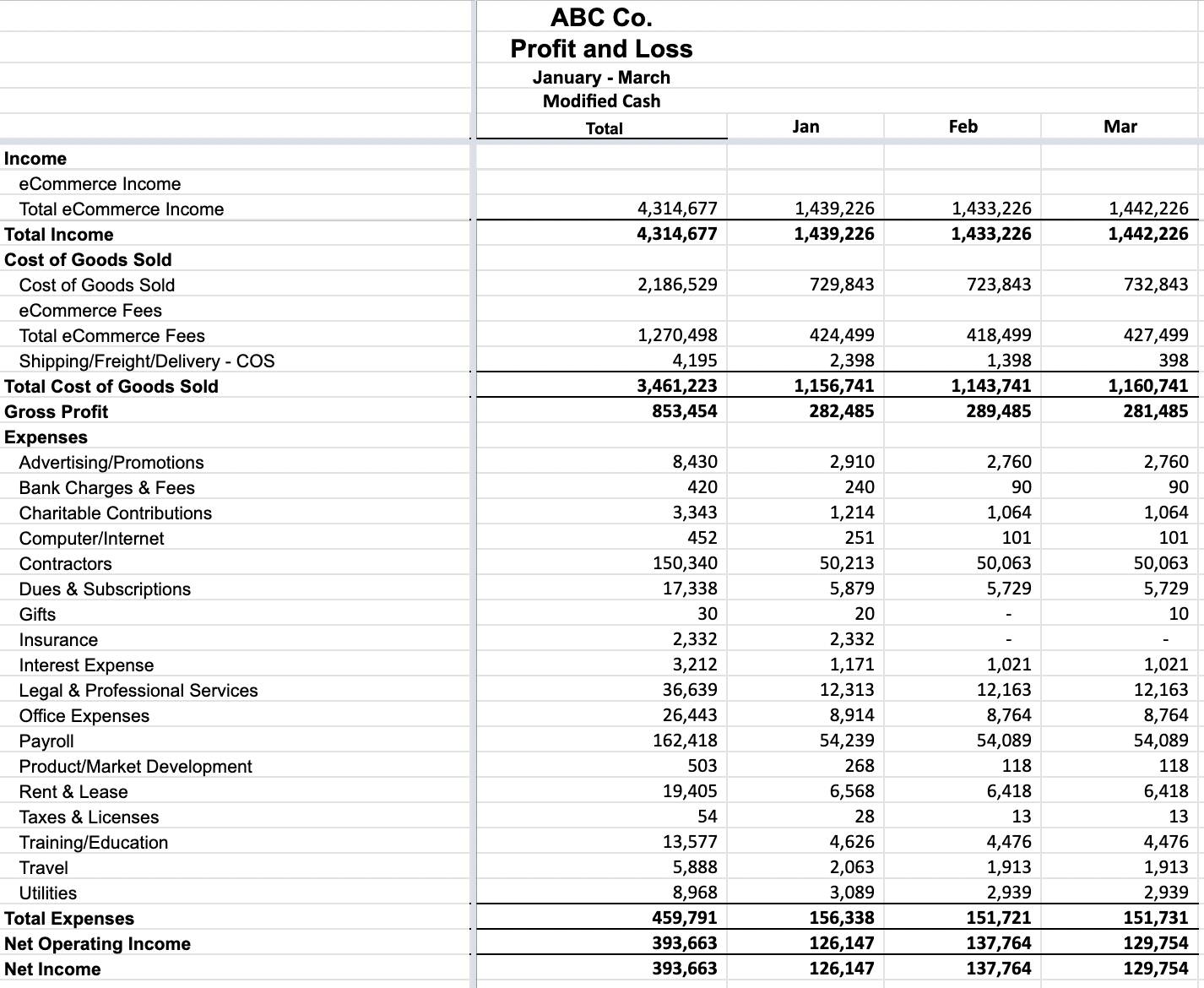

Here’s an example of what an ecommerce business’s financial statements might look like if they use cash basis accounting:

Here you can see the volatility of the cash basis. This statement includes three payouts from Amazon in January and two in February and March. Because Amazon payouts occur every two weeks rather than roughly every 30 days, it means that twice a year, sellers receive a third payout in a month, which can really skew the financials.

Additionally, you see that payment for goods (Cost of Goods Sold) can be very erratic when using the cash basis. This is because the financial statement doesn’t include revenue from the month the sale was made, and the Cost of Goods Sold represents the cash paid for all the inventory the business will ultimately sell.

These two factors combined, a business owner is left with some strange month-to-month profitability swings, which are not representative of the business’s overall profitability.

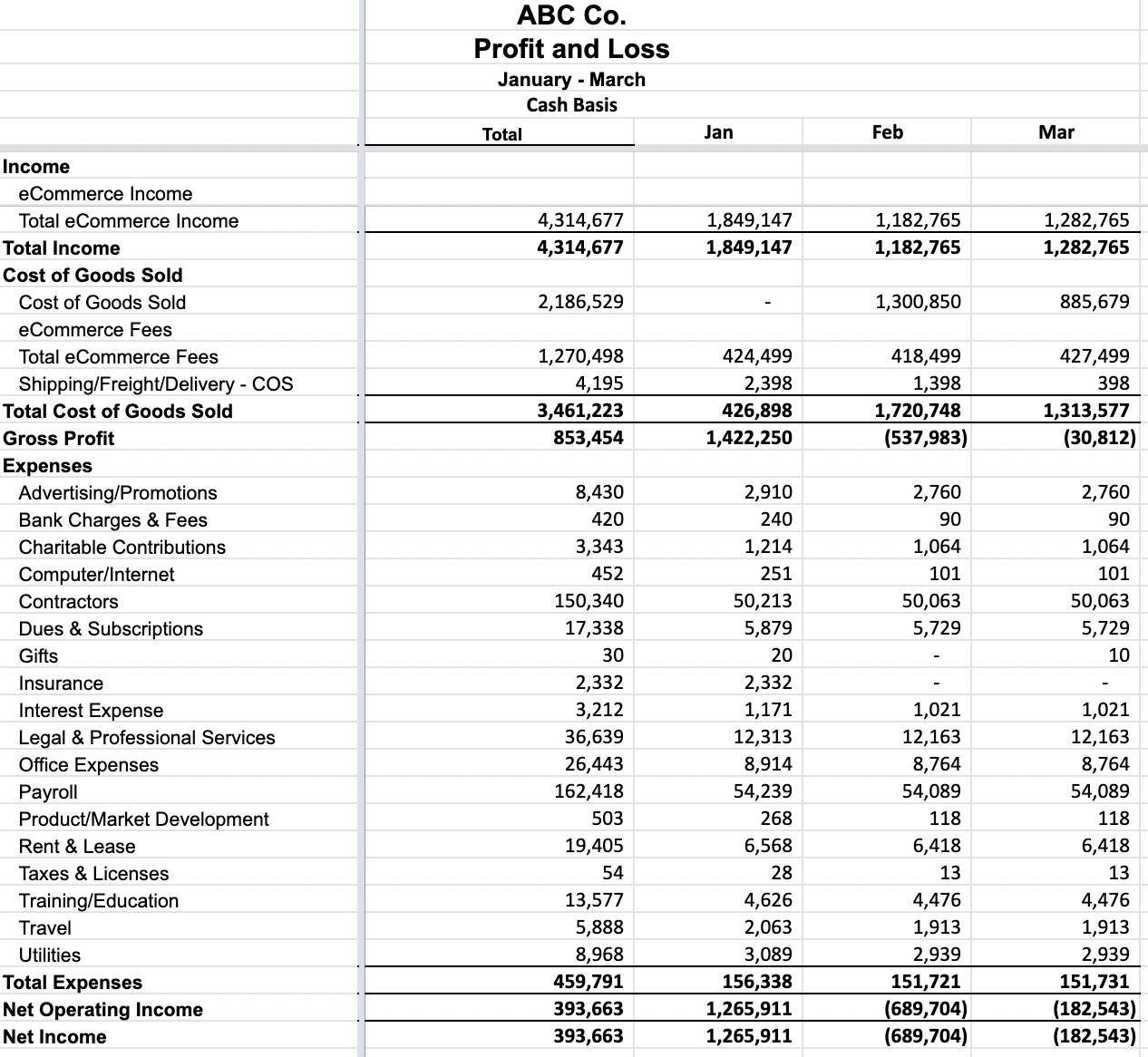

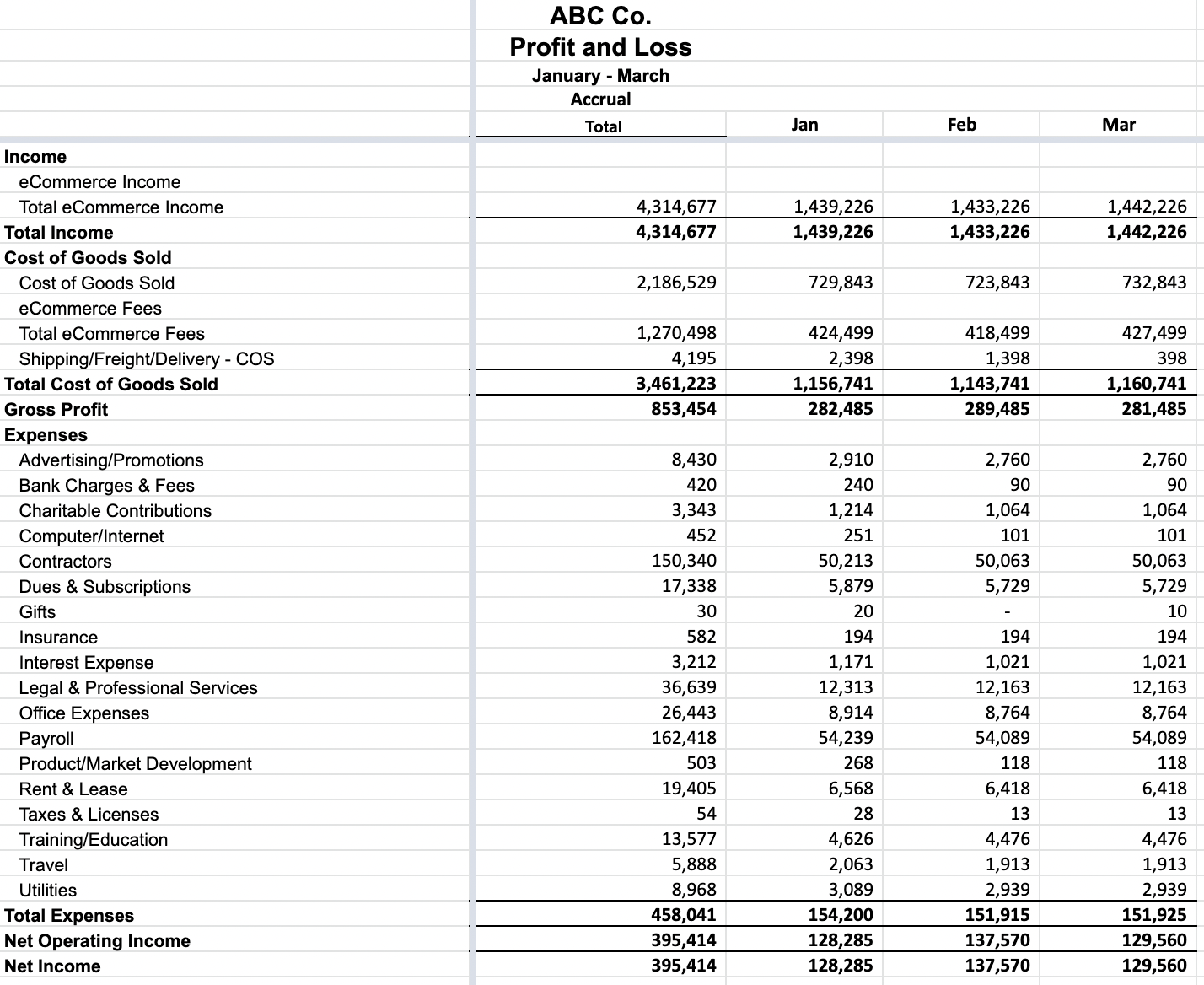

Here’s an example of modified cash basis financial statements for the same company:

The modified cash basis has smoothed out all the issues present in the cash basis statement because income is recorded by the date the product was shipped and the Cost of Goods relates specifically to the revenue received. The numbers now make more sense and you also have a much more well-rounded view of the company’s profitability.

This level of insight allows the business owner to make informed financial decisions more quickly, or should they decide to sell or take on investments or loans, it gives banks, buyers, and lenders the information they need to make their decision.

Finally, here’s an example of accrual basis financial statements for the same company:

The accrual basis goes beyond what the modified cash basis statement does for even better visibility into business performance and profit margins. For example, with the insurance activity, you can see that a little is hitting every month, as opposed to the big payment in January that we saw in the modified cash statement.

Using the accrual basis means a business has great visibility into its finances for a better valuation if it was to be sold or acquired. It’s also the IRS’s accepted practice and is mandatory once a company reaches revenue of $26 million. That said, using the accrual basis takes more time and effort than the other two methods, which may not be worth it for businesses earlier in their growth journey, especially if the IRS doesn’t require it.

Choosing the right accounting method for your business

If you’re curious about what accounting method might suit your business, check out the quiz, prepared by A2X partner, Bookskeep ➡️ Take the quiz now.

You can also use the questions below to help you assess each method and whether your business can use them.

NB: This is just a guide to help you make the right decision. It’s always best to get tailored advice unique to your business from an expert ecommerce accountant.

1. How much revenue is your business generating?

$0-1 million: The cash method may suit you in the early stages of your business. The time it takes to use the accrual method likely won’t add value.

$1-25 million: A modified-cash approach works well for this size business. You want to understand the business profitability month by month so you can adjust course and you want to keep the accounting as simple as possible. You can start handling your longer-term transactions via the accrual method and short-term via the cash method.

More than $25 million: Your revenue is significant enough now that the accrual method makes sense, and it will be required by investors and the IRS soon.

2. Does your business deal with inventory?

Yes: The earlier you can use the modified cash or accrual basis, the better. Modified cash basis accounting will be less time intensive and gives you important information about your profitability. As your business takes on investors or gets more complicated, you will consider moving to the accrual method.

No: The cash method might suffice for you, at least for a while. However, inventory isn’t the only factor you should consider when choosing your accounting method.

3. Does your business receive Amazon settlements every two weeks?

Yes / sometimes: Amazon settlements bridge months when they are paid out, so your deposit will have funds from sales in two months. To ensure that the income is reported in the proper month, you will want to use modified cash or accrual.

No: You may be able to use cash because the income will be roughly the same with daily type payouts month over month.

4. Does your business buy inventory on terms?

Yes / sometimes: If you have expenses coming up, you’ll need to know about them to run your business efficiently, and the only methods that give you this visibility are modified cash and accrual.

No: You may be able to use the cash method in the early stages of your business.

5. Are you thinking of selling your business one day?

Yes / maybe / not sure: The modified cash or accrual method is the best in this scenario. Potential buyers of your business will want to see well organized books that reflect the profitability of the company and whether it’s a good investment.

No: If you’re sure you’ll never sell your business, this shouldn’t impact your accounting method decision.

6. Are you thinking of asking for a loan or investment one day?

Yes / maybe / not sure: The modified cash or accrual method is the best in this situation, as investors, buyers, or banks will want evidence of a well-run, profitable business.

No: if you’re sure you’ll never want to take out a loan or investments, this shouldn’t impact your accounting method decision.

7. Do you want to manage your books yourself or get a professional?

Manage them myself: The cash method is the most straightforward starting point. However, as your business and its obligations grow, you’ll likely need to transition to modified cash or accrual basis accounting. It’s possible to manage modified or accrual basis accounting, but it can be time-consuming, and you’ll need cloud-based accounting software and tools such as A2X. You could also consider a program that helps you set up your accounting software and trains you to use it, like SmartStart by Bookskeep.

Hire a bookkeeper and/or accountant: An expert can help guide you from day one and has the expertise to help you should you transition from one method to another.

Ready to learn which accounting method is right for you?

A2Xpert Cyndi Thomason of Bookskeep has created a short quiz to help you choose the right accounting method for your business.

This article was written by our editorial team and edited and fact-checked for accuracy by Cyndi Thomason, a qualified and experienced accounting professional. Cyndi is the founder and President of ecommerce accounting practice, Bookskeep.

Also on the blog

Webinar: Which Accounting Method is Best for Ecommerce?

Watch ecommerce expert Cyndi Thomason break down the cash, modified cash, and accrual methods of accounting in this on-demand webinar.

Watch now