Income Tax Report: Minimize Your Audit Risk With These Insights

All businesses can be subject to an income tax audit.

And if you’re in the under $25,000 and over $500,000 revenue brackets, listen up, because in recent years the IRS has audited those businesses more than most.

And it’s not just the IRS that can audit you. States can audit for income tax, just like they can with sales tax.

We recently published a report on sales tax audits and how ecommerce businesses experience them. After great feedback, we decided to partner with EcomCPA, an expert in the field, to conduct similar research into income tax audits.

We asked 791 ecommerce businesses to answer a few questions about their experience and then sat down with EcomCPA’s Jeremy Allen, an ecommerce accounting and income tax expert, to discuss the findings and what businesses should do with this information.

We wanted to find out:

- What the common triggers are for income tax audits

- Which states audited more than others

- Whether certain tax entities are more likely to be audited than others

- What percentage of businesses file their own returns or work with a tax professional

- Whether the IRS audits more than individual states (or vice versa)

Our findings at a glance:

- After random audits, the top trigger is under-reported income

- California audits most, followed by Alaska and Alabama

- LLCs are audited most often, but this isn’t the whole story

- Around half of respondents used a professional for their return

- States appear to audit more than the IRS

We have prepared this report to help ecommerce sellers better manage their tax planning.

NB: The information below is based on answers from close to 800 survey respondents. Whilst we hope they prove useful insights, do not use them in place of tailored advice from a tax specialist or accountant like EcomCPA.

All quotes are from EcomCPA’s Jeremy Allen unless otherwise stated.

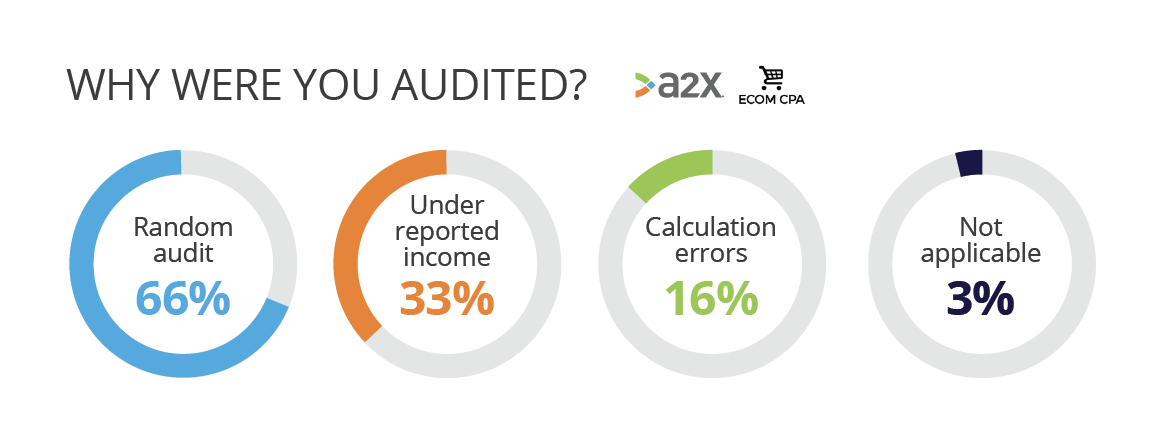

Why were they audited?

Let’s kick off with the all-important question first.

Most audits happen at random. And while you can’t do much about those, there are many other audits triggered by factors that you can influence.

Here are the top three reasons that respondents shared for why they received an income tax audit:

*please note that survey respondents were able to select multiple answers to this question

1. Random audit

According to professionals like Jeremy, it appears that random audits truly are exactly as described.

With no discernible pattern, it’s luck of the draw.

The key message

After reading the rest of this article, you’ll see that the best way to avoid a federal audit is to keep clean, tidy books throughout the year.

Balance your accounts and file on time.

Need a hand with that? Our ecommerce bookkeeping checklist makes things easy!

Download the Essential Ecommerce Bookkeeping Checklist.

2. Under-reporting income

“Under-reported income is probably the most common thing that we see. This is usually because the IRS will use the 1099-K that Amazon and other processors send them to quantify your revenue.

But that amount can include returned sales and other deductions, skewing the numbers.”

The background

Marketplace facilitators are required to send 1099-k forms to the IRS by law.

(This is a federal requirement, not a state requirement. The states may, however, have access to the information for audit purposes.)

These forms report the gross sales of all transactions processed by a third-party payment gateway.

Sellers receive the form first so they can check the information is accurate.

But if they don’t know, they can run into problems.

The key messages

Jeremy warns that people often underreport their income because their accounting is sloppy.

“It’s easy to get busy in your business and not pay attention to this.

If sellers aren’t grossing out their sales and pulling all the information they need ( which A2X would pull for them automatically), then although the bottom line appears to be the same, they’ve missed out on deductions. Their Amazon fees are a good example - and we know how many of those there are.”

There’s another issue caused by messy books that can lead to misrepresented income.

“ Misrecording inventory and COGS [cost of goods sold] is another common problem for sellers. These really impact the bottom line.

If your inventory on the books is too high, then your COGS might be understated, which means you’re paying more tax than you should. On the other hand, if you’re underreporting your inventory, then you might not be paying enough tax.

A downstream impact from that is if you want to sell your business, then it’s a whole mess.”

And this is something you need to get on top of quickly if you’re going to grow.

“The bigger the seller, the more problems I see with inventory because there’s more floating around and more chances for loss and mistakes. We try to avoid this at EcomCPA by asking our clients whether they count their inventory at the end of the year and account for shrinkage or spoilage.”

So what’s the answer?

“Have clean books managed properly throughout the year. Ideally, as your business starts to make money, you’ll have a bookkeeper or accountant.

Review your return! Even if you use someone else to prepare your books for you, as many of our survey respondents did. You need to understand what’s on the form and why it’s been reported that way.

If your balance sheet and income statement are reconciled then, to me, there’s nothing to hide or be scared of. It’s just when stuff doesn’t make sense that you might flag yourself to the IRS.”

3. Calculation errors

“Often when people do their own returns, balance sheets don’t balance, and the numbers don’t tie out to their financial statements. Those things will advance their audit risk.”

The background

Filing taxes is complex, particularly when you sell online and qualify for different forms and processes.

Jeremy advises not to do this yourself unless you’re experienced and knowledgeable in what’s involved.

And always ensure that you aren’t relying on Excel spreadsheets.

“Using an accounting system at least gives you a balance sheet (even if it’s not accurate!) If you’re doing it in Excel without a balance sheet there are so many issues that can happen. I’d have no confidence that the P&L [profit and loss statement] would be accurate.”

The key messages

Keep tidy, cloud-based accounts throughout the year.

And if you can afford to work with an accounting professional, get a bookkeeper as early as possible. If you’re looking to find a specialist ecommerce accountant or bookkeeper, find one here.

The best way to avoid an audit? Don’t forget to file income tax returns where you have nexus

There are two different types of income tax audits: federal (the IRS) and state.

Jeremy’s tips above are appropriate across the board, but are particularly important for avoiding or minimizing the impact of federal audits.

When it comes to state audits, it’s more to do with income tax nexus.

If you have met the threshold to file for income tax in a state, you have nexus there. And need to meet those obligations.

“At the state level, it’s key to make sure you file where you have nexus and coordinate your income tax filing strategy with your sales tax filing strategy.”

This is important because:

Income tax thresholds are often higher than sales tax thresholds. Not only that but there are also different criteria and standards for income tax nexus versus sales tax. It’s also worth mentioning that some states are also in the process of adopting economic nexus for income tax

“If you’re going to file income tax in a state because you have nexus there, you’ll probably also have sales tax nexus in that state. This is because the threshold for income tax nexus is usually higher (but not always!).

Like sales tax, income tax is somewhat complicated. Physical presence trumps everything. Generally speaking, if you have $500k in most states, that’s the threshold. In some states it’s lower.

Filing one tax type without filing the other might trigger a notice.”

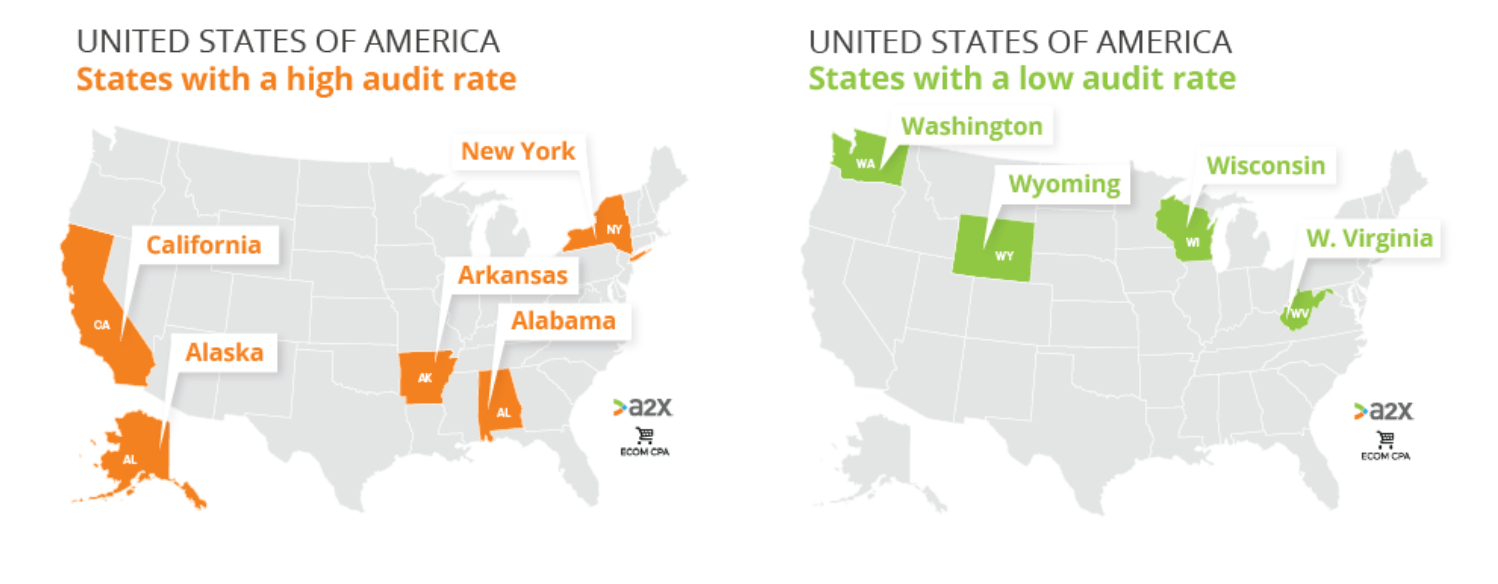

Where were they audited and by whom?

“California and Texas are the most popular states for ecommerce. California is the most aggressive with enforcement of their tax laws, so I would say they’re the most unfavorable but it’s a great place to live! So you pay the price.”

California audited the most of our survey respondents (10.6%).

Next came:

- Alaska (9.2%)

- Alabama (9%)

- Arkansas (6.4%)

- New York (6.4%)

It’s difficult to know why some states audit more than others. California is a larger state with more businesses and complex tax laws, so this may be part of the reason.

“California is aggressive on their interpretation of doing business.”

At the opposite end of the spectrum, the states that audited our survey respondents least were:

- Washington (3.9%)

- West Virginia (0.4%)

- Wisconsin (0.3%)

- Wyoming (0.1%)

State vs. federal auditors

It might be stressful to think of the possibility that you can be audited by the IRS and a particular state over your income tax.

Knowing that ecommerce businesses might be concerned about this, we asked Jeremy whether there are ever any conflicts between what these two bodies might want.

And if so, what businesses can do about it.

“Yes! As well as IRS requirements, states all have their own tax laws [and rates] as well. So something might be deductible for IRS but not at the state level.

You have all these federal to state differences you have to think about. Then different states also have different incentives and credits, so there’s a whole world of stuff in it!

This is another reason why you should engage a professional, either when you hit about $1m in revenue or just start making money.”

Which tax entities were audited most?

“As far as entity types go, most people will set up an LLC because it provides some asset protection. But this should be a decision you make with the help of an attorney and/or accountant. You can change it later.”

The entity you choose has a lasting impact on your business’s obligations in a number of ways, tax being one of them.

LLCs were the most audited entity in our survey, but this doesn’t mean much in practice.

In fact, sole proprietorships are the most likely to be audited.

Here’s why.

“An LLC is not a recognized tax form, so you can be one for legal purposes but not for tax purposes. You have to fit into one of the other “buckets” [i.e. sole proprietorship or another entity type].

Historically speaking, sole proprietors were audited five times more than any other entity type.

This is probably because tax returns for corporations, S-corporations and partnerships are far more detailed. More information is required in these filings, including the balance sheet.

This is not the case on Schedule C forms (those used by sole proprietors). For this reason, it’s easy to misrepresent financials, triggering an audit.”

The IRS makes no secret of who they audit and the likelihood of auditing one group over another.

This study published trends in income tax audits by the IRS. In general, the audit rate is decreasing across the board - likely due to staffing shortages and the time it takes to perform an audit.

But that’s no reason to avoid filing in the first place.

When did they file?

Unsurprisingly over 90% of our respondents filed on time.

But what about those that didn’t—was it a strategic move?

It could be. Here’s why.

“You are subject to penalties with interest if you don’t file on time. But sometimes, that extra time that you’re making money and not paying your taxes, even with penalties, can leave you with more money in your pocket. It’s a risky strategy but it can pay off.

Alternatively, some people will pay what they think is correct on time, and then go back and check the process later on. Any differences they’ll either pay up or get refunded anyway. That’s the best way to avoid penalties.”

Who filed for them?

Over half of our respondents use a professional to file their income tax returns.

When it comes to deciding whether to do this yourself, in-house, or through a professional, Jeremy’s advice is clear:

“The only question you need to ask yourself is: do you know what you’re doing? If you have the expertise to manage your taxes, or this is available to you in-house, then the risk of getting them wrong is low.

But if you aren’t a tax expert, and don’t have experts in your company, then it’s about how comfortable you are with that risk.

I’d say most companies outsource it still, just because it’s such a specialized body of knowledge. And filing might only happen once a year.”

And Jeremy had one more benefit to using a professional that might sway many business owners hesitant to pay for a professional.

“You they could be leaving money on the table with missed credits and overpayment of taxes.”

So what happens in an audit?

Regardless of whether the state or the IRS is auditing you, the experience of an audit varies.

You might be audited in person (at your business or the auditor’s offices) or via mail. This will depend on the complexity of your tax return.

“You can try to manage an audit yourself, but we don’t recommend it. Auditors are trained to extract information, so it’s best to get professional help with how you respond.”

Audits can be time-consuming. But if your accounts are thoroughly documented and organized, it shouldn’t be too bad.

“You want to find an experienced CPA, tax attorney or enrolled agent to manage the audit for you. Depending on the size of your business, this could cost anywhere from $5,000 to $50,000. A great way to reduce that cost is by having clean, bulletproof books!”

IRS audits are typically triggered by missing information and bad reporting, and are concerned with filling these gaps or correcting errors. But states also often look at residency status and whether you should be paying tax there.

“It’s difficult to make a sweeping statement about state vs federal auditors, but we’ve noticed the former are typically more aggressive than the latter.”

Summary

Here’s an overview of the key insights and advice in this report:

- You can be audited by the IRS and by individual states. The reasons for these audits can vary, sometimes the IRS will want one thing from one seller, and something else entirely from another seller.

- Most problems that cause audits can be solved by using a specialist and keeping clean books throughout the year. A professional tax advisor can flag under-reporting income, calculation errors, inventory accounting issues, and nexus non-compliance before it’s too late.

- Managing an audit yourself can be a time-consuming, stressful process. If you aren’t using an accountant or tax attorney already, it’s best to get professional help.

Looking for help with your ecommerce business accounting? Chat to the team at EcomCPA today.

Learn how to set up your ecommerce accounting foundations like a pro

Accounting for ecommerce sales presents a unique set of challenges. Discover the key concepts, software, terminoloy and knowledge you need to simplify your business.

Download our free guide