7 Times Accountants Turned Near Ecommerce Failures Into Success

If you’ve ever watched a scary movie, you’ve likely experienced that moment of smug disbelief when a character runs directly into danger against all better judgment. Yelling at the screen does nothing to deter them, and it’s no surprise when they meet their grisly end and become another cautionary tale.

While there aren’t too many crazed killers or nasty monsters in the world of ecommerce accounting, ask any accountant or bookkeeper, and you’ll discover plenty of horror stories. This Halloween, we spoke with seven specialist ecommerce accounting practices to hear some of their most shocking stories of near ecommerce failures. Read on to learn these seven cautionary tales so that when it comes time to take care of your ecommerce business finances, you’ll know exactly how to avoid a horror story of your own.

Table of Contents

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there

1. No Line of Credit = no inventory from new supplier

For one High Rock client—an Amazon seller doing over $1 million in sales—the arrival of the pandemic in March 2020 was a disaster they were totally unprepared for. The sudden shutdown of their China-based supplier left them scrambling to find a replacement. But, after they averted that crisis, there was a new problem. One which may have cost them everything.

As there was no existing relationship with the new supplier, they were required to pay a 50% down payment at the time of order and the remaining 50% before shipment, $100,000 in total.

The business had some cash available, but it wasn’t enough. Besides, this was before covid relief programs were available, so they worried they might need that cash for other expenses. No one knew how long the pandemic or lockdowns might last, and fear and uncertainty abounded.

The situation was clear: Secure a Line of Credit to acquire inventory or face the possibility of shutting down.

But with neglected books and no cash flow forecasting, the business owner quickly realized no lender would ever give them the funds they needed.

Stressed beyond belief that their livelihood was on the line, the business owner turned to their tax accountant, High Rock Accounting’s Jay Kimelman, to see if he could offer services to help their situation.

Thanks to High Rock’s expertise and Jay’s background as a former manufacturing business owner, he knew the business needed cash flow forecasting to secure a working capital line of credit. The client agreed to upgrade their services, and the hard work began.

After three weeks, Jay and the client had a financing packet of documents, including up-to-date financial statements, cash flow projections, personal financial statements, business and personal tax returns, and insurance policy details. The numbers showed that if the business received the funding, the forecast sales would ensure they could pay the line of credit.

Working with Jay, the business found mid-market lenders and secured funding that allowed them to order, receive, and sell the products they needed. After weathering the uncertainty of the pandemic—and with a renewed respect for prudent ecommerce bookkeeping and accounting practices—the business is going strong and tracking toward $1.5 million in revenue.

The takeaway:

If you leave it until tax season to get the books in order, you’re operating with an incomplete and out-of-date view of your business. If something unexpected happens, the business could quickly be in trouble. One unwise purchase could put the company in financial jeopardy, and your neglected books won’t do much to convince lenders to offer funding or loans.

A good cash flow forecast gives you a better overview of your business’s current financial health. This results in making educated spending decisions or giving potential lenders peace of mind so they can offer funding or loans.

Need help cleaning up your books and doing cash flow forecasting? High Rock Accounting can help— find them in our directory.

2. Profit First saves the day after haunting Amazon failures

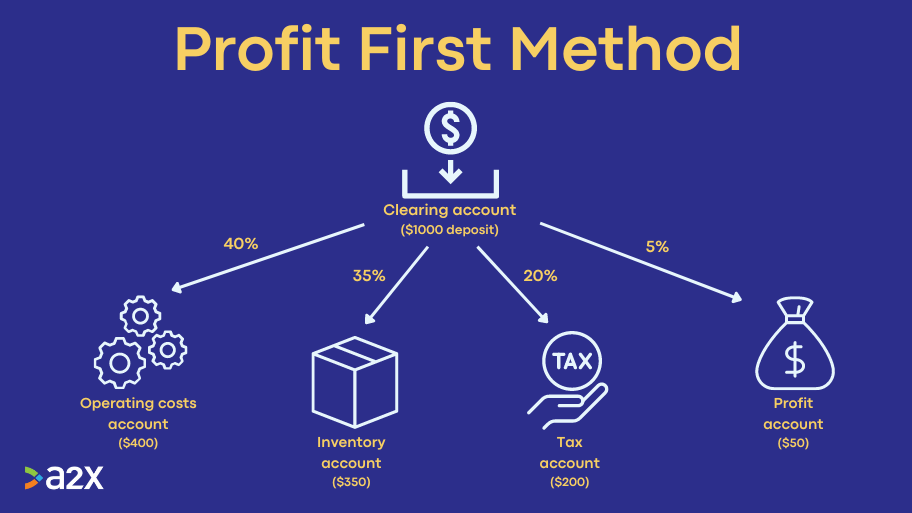

For Cyndi Thomason, founder and president of Bookskeep, implementing the Profit First method is one of the most important things an ecommerce business owner can do to safeguard the future of their company.

The Profit First method involves the following:

- Ecommerce business owners receive settlements in a clearing account

- They split the amount by different percentages into their own individual bank accounts

- Each account has a specific purpose. For example, operating expenses, inventory, tax, and profit

Profit First allows business owners to use bank accounts as a quick financial dashboard.

It also gives a solid system if unexpected events occur, which is exactly what happened to a client of Cyndi’s a few years ago.

Cyndi’s client was busy running a successful six-figure business in the wellness niche when she sent a $12,000 order of inventory to Amazon. She still had stock available but would need more soon. It was business as usual until she received a notification all Amazon sellers dread: they had not received the order.

Amazon had lost her inventory.

The business owner was frustrated and confused —how does $12,000 worth of product go missing!—but she was also prepared. Because she was using Profit First, she had cash in a dedicated inventory account and a profit account that could provide an additional cushion if needed. With enough money to weather this rainy day, she placed a second order of inventory. But then she got a second notification.

Amazon had lost her inventory. Again.

Thankfully, throughout this nightmare, the client never ran out of inventory available for customers. And as they were preparing to place a third order, Amazon finally found the lost product. Things were looking up, but the storm wasn’t over yet.

After locating the missing inventory orders, Amazon suspended the client’s account. Despite being stocked with $24,000 worth of inventory, she couldn’t sell anything for 11 days.

Once again, the client’s use of the Profit First method saved the day. The funds in her profit account meant she could pay herself and make it through the next 11 days until she could resume selling again and get back to business as usual.

A few years later, Cyndi’s client is still doing well as an ecommerce owner using the Profit First method. She even managed to sell the original wellness business for a fantastic price, thanks to her tidy books and use of Profit First.

The takeaway:

Although the ordeal with Amazon was fraught with frustration, because of her preparedness, Cyndi’s client was never in danger of losing the business and could overcome each obstacle, including keeping herself paid.

Even if they are profitable, many ecommerce businesses haven’t equipped themselves to survive outlay for two rounds of inventory orders and wait for an 11-day business shutdown. This is where having up-to-date books and using systems like Profit First allows a company to make it unscathed. Not to mention having a great view over the state of the business when things are running smoothly.

Want to know more about Profit First or need help with accounting for your ecommerce store? Bookskeep can help— find them in our directory.

3. Working with a non-ecommerce accountant led to a horrific £100k tax bill

A couple of years ago, Steve Blackmore, founder and Director of UK-based Elver E-Commerce Accountants, met a new client who was distressed after making a chance discovery that he feared might cost him significantly.

The business owner was primarily selling on Amazon in the EU and UK and doing close to £1 million in revenue. While he took care of VAT returns, he had an accountant (that didn’t specialize in ecommerce) handling year-end and corporation tax returns. The owner and accountant had discussed how he should be accounting for income on his VAT returns, and the accountant reassured the owner that he was happy with how the business was doing things.

It wasn’t until the owner came across something online by chance that he realized he was most likely doing things incorrectly and might have significant VAT liabilities.

He then came to Elver E-Commerce Accountants for a second opinion, and they confirmed what he dreaded: he had under-declared his income over a few years and had therefore underpaid his VAT by around £100k.

Unfortunately for Steve’s client, there was no way around the bill, and he had to find a way to pay the £100,000, which was an understandably stressful experience. The good news is that he could do so without shutting the business, and it remains open and profitable. However, he’s now moved his books to the specialist ecommerce accounting team at Elver to ensure there are no more costly surprises in store for him.

The takeaway:

Although this owner did the right thing by engaging the services of their initial accountant, this story highlights the very real risks and costly repercussions of using an accountant unfamiliar with the unique needs and requirements of an ecommerce business.

When looking for potential accounting or bookkeeping professionals, it’s crucial to ask about their experience and knowledge of dealing with ecommerce businesses. If they admit they have minimal experience or something about their answer gives you cause for concern, look elsewhere—learn all the tips and tricks in our full guide on the matter.

If you’re a UK-based business owner or need help with your UK VAT obligations, Elver can help— find them in our directory.

4. Discounted products causing a near-fatal cash flow problem

Two years ago Jason Andrew, Co-Founder of Australia-based SBO Financial took on a client that, at face value, looked incredibly successful.

The business had been launched through a successful crowdfunding effort, which also drove massive initial demand, seeing over $3 million in sales in their first 12 months. Then, through the ecommerce boom of the pandemic, the product, which was in the home and living niche, continued to enjoy success.

Despite this, the business had constant cash flow problems, often struggling to have enough cash for payroll or the next inventory order. The owners, primarily marketing and product experts, chalked this up to their spending on marketing.

Given their cash flow issues, when the business started attracting cold calls from investors keen to invest due to the buzz around the product, the owners were more than interested in entertaining offers.

With the books in disarray, SBO came onboard to help clean things up so they could present their books to the investors. However, it was then that SBO discovered the root of the cash flow issue. The problems weren’t due to marketing spending at all, but discounting.

The business relied on discounting its products to entice buyers. While this had worked, sales volume hadn’t increased in step with the generous discounts, so the discounting had eroded its gross profit margin, leaving them with a cash flow problem.

After identifying the issue, Jason’s client realized they didn’t need investment if they changed their approach. With the root cause identified, they were able to turn things around and break even.

These days, Jason’s client still has the business, which is now thriving. After realizing they didn’t need investment two years ago, they are now at the stage where they have a legitimate need for investors. And thanks to SBO, they have tidy books to show off the business’s potential.

The takeaway:

When business is booming, it’s easy to assume profits are booming too. But, without taking the time to dive deep into the numbers, you could easily miss the things that are cutting into your margins. Getting your books sorted will either confirm your money is going where you suspect or, as was the case with Jason’s client, reveal that something else is eating your profits.

If you want to build a profitable business and are using discounts to drive sales, be sure you’re not discounting below your gross profit margins. Use a discount calculator to determine how much you need to sell to maintain your margins. Keep an eye on your finances over time to ensure discounts benefit your bottom line.

Australia-based and need help getting books in order and want solid advice for improving your ecommerce business’s cash flow? SBO Financial can help— find them in our directory.

5. A ‘quick review’ that led to a ghastly amount in under-reported sales

It was a little inkling that things weren’t right that brought a high-end coat retailer to Teresa Slack, CEO and owner of Canada-based Financly Bookkeeping Solutions. As it turned out, that inkling would save the company a lot of stress and headaches.

The business was doing well at the time, selling internationally on multiple sales channels and bringing in around $1.5 million. While using QuickBooks Online to do their books, they approached Financly for a consultation and review of the integration they had set up between their inventory app and bookkeeping software to ensure everything was in orders.

Unfortunately, what Financly uncovered was a disaster.

The company had massive gaps due to the integration failing to bring data into the books and other instances of duplication. The values shown in the inventory app versus the ecommerce platform versus the books were all different. Teresa’s client couldn’t rely on any of the information and had a huge mess on their hands.

The worst part was that the company’s sales had been understated by around $600,000, meaning their collected sales tax was also understated. So, if the company had been audited, it would have had to pay significantly more in income and sales tax.

The business owner was in a complete panic.

Realizing they needed to remedy this situation, the business owner asked Financly to get to work. Teresa and the team cleaned up the books and created a new integration system using A2X and Cin7, which meant the business knew they could rely on the data they were collecting in their accounting system.

A few months after the shocking discovery, Teresa’s client had clean books, a functional integration, and accurate financials. And, with a renewed respect for ecommerce bookkeeping, they have become an ongoing client for Financly, allowing them more time to focus on getting their coats in the hands of shoppers worldwide.

The takeaway:

While you may be able to do your own bookkeeping to a satisfactory level for a while, as your business scales and becomes more complex, engaging a qualified ecommerce bookkeeper will undoubtedly save you time, money, and stress.

By using qualified professionals, you’ll have peace of mind that your finances are in order and that your tax returns have been filed correctly. And should your business be audited, it will be a straightforward experience with no surprise tax bills at the end.

Need a consult or help getting your books in order?*Financly Bookkeeping Solutions can help—f ind them in our directory.*

6. $1 million in under-reported income due to a rogue employee

When Kamilie Billingsley, service delivery manager for LedgeGurus, took on an online clothing retailer as a client in August this year, they were in dire need of specialist ecommerce accounting help—and fast.

On the outside, business seemed to be booming—they were doing $35 million in revenue selling clothing primarily on their Shopify store. However, a new CFO quickly discovered the company had a big problem.

Keen to get up to speed on the state of the business, the CFO requested financial information from the company’s accountant. But, it turned out the accountant was not confident in how they had been recognizing revenue. Faced with the new CFO seeing the imperfect books, she deleted three years of financials and quit.

The deadline to file their 2021 taxes was fast approaching, and the CFO had no way of anticipating this mess when she joined the company. And there was also an additional inventory-related challenge. The company had moved warehouses several times and had limited visibility into inventory, including how much they had and where.

Keen to get things back on track, the CFO turned to LedgerGurus to get their expert ecommerce accounting help. Over six weeks, Kamilie and the LedgerGurus team expedited and rebuilt the company’s 2021 and 2022 financials in time for the business to file its 2021 taxes. Meanwhile, the company had been working on getting all its inventory to one location.

But just when they thought they were out of the dark, there was one more discovery: their 2020 tax returns were wrong. The former accountant had misfiled to the tune of $1 million.

With the mistake recently uncovered, Kamilie and the team are currently rebuilding the company’s 2020 financials so it can file a tax amendment. Meanwhile, LedgerGurus is also helping implement a new inventory management tool, giving the company greater insight into its inventory levels and location at any given time. Although it’s been a messy situation, they can now see the light at the end of the tunnel.

The takeaway:

Having an in-house accountant can be incredibly valuable, but it’s important to get them up to speed on the complexities of ecommerce accounting. Luckily, there are courses available and you can always engage the services of an external practice for training or review. And if you’re not working with an in-house team, consider outsourcing to an expert ecommerce accounting practice that understands the complexities of selling online.

In situations where you’re unsure if your accountant has the expertise necessary, it could be safer to outsource to practices with a proven track record and a history of carrying out ecommerce-specific accounting and bookkeeping.

Need help with your ecommerce business’s finances or inventory? LedgerGurus can help— find them in our directory.

7. A successful family-run side hustle with disastrous books lurking in the shadows

It’s not uncommon for ecommerce stores to become overnight successes. One endorsement, trend, or viral social post could be the catalyst for a business taking off. It can sometimes leave owners scrambling to hold things together as they scale.

Acuity operations manager Melissa Melbye helped one such business where the owner, a busy mom, started a side hustle that ballooned into a multi-channel business doing over $10 million a year in sales.

As the business took off, the owner brought in other family members to help manage the growth. This included the owner’s mom, who assisted with the business’s accounting and bookkeeping until it became too complicated for her and her daughter to handle.

With the business quickly growing, its objectives changed, and the owner decided to sell off one store and acquire a loan to purchase more inventory. However, as they dug into the books to present them to a potential buyer, they realized the financials were a mess.

Seeing that the situation had gone beyond their capabilities—and with the potential buyer impatient to see the books he believed were already in order— they came to Acuity for help.

As it turned out, the company had over 20 bank and credit cards that were a mix of business and personal accounts and were unreconciled. In addition, a PayPal account was almost $1 million negative in their accounting system. And they had over $20,000 in petty cash that was unreconciled and not accounted for every month.

After some hard work, Acuity put together clean financials, allowing the company to sell their store and acquire a loan, meaning they have finances ready to go as needed while they continue to grow.

The takeaway:

Although the books were in bad shape, this business owner’s story is far from uncommon for those focussed so heavily on growth. In the rush to scale, accounting and bookkeeping became an afterthought, something the owner grew to regret once they changed focus and needed clean books ASAP.

Once a company starts to grow, having a company like Acuity take care of financials means you have rock-solid books when situations change, including selling the business, accessing loans, or taking on investment. Business can move fast, and taking weeks to clean up books could mean missing out on opportunities your company could benefit from. Opting for professional help will give you peace of mind.

Want your ecommerce business’s finances right from the start? Acuity can help— find them in our directory.

Need an ecommerce accountant or bookkeeper for your online store? Find one now.

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there