![Why You Should Be Using Shopify Payments [9 Benefits]](/img/content/shopify.jpg)

Why You Should Be Using Shopify Payments [9 Benefits]

Shopify Payments is the integrated payment gateway for Shopify sellers.

Powered by Stripe, Shopify Payments is quick to activate when you open your store and immediately gives your buyers choices when it comes to their payment method at checkout.

With hundreds of payment gateways on the market offering you different things, is Shopify’s native the obvious choice? Or should you be giving others a look-in too?

Well, in this blog we’re going to tell you why sticking with Shopify Payments is probably your best bet. We’ll also clear up the difference between Shopify Payments, Shopify Pay and Shop Pay. Because they’re all things, and that’s a little confusing.

In this article on Shopify Payments:

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

Ready? Let’s get into it.

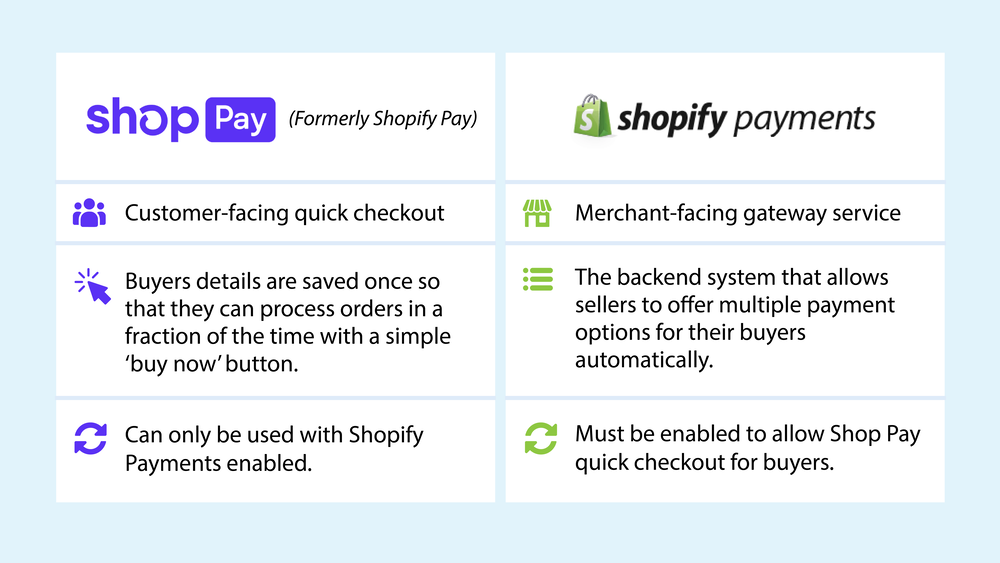

Shopify Payments vs. Shopify Pay vs. Shop Pay

Ok, these all sound the same and look similar too. But they are different things.

In a nutshell, Shopify Payments is the backend that you see, as the merchant. Shop Pay (which used to be called Shopify Pay) is the easy “buy it now” button that your customers see on the frontend.

Now that’s cleared up, let’s get a bit of context around Shopify Payments and why it could be the best option for most Shopify sellers.

A Little Background on Shopify Payments

In 2013, Shopify partnered with Stripe to bring their users an integrated payments solution, eliminating the need to pay for a third-party integration. All sellers would need to do to activate Shopify Payments is click a few buttons in their admin Settings page - easy.

In our own analysis of the most popular Shopify payment gateways, we found that Shop Pay (powered by Shopify Payments) came out on top. This tells us that customers prefer it above other gateways.

Shopify’s own reports and research have had similar results too. They found that conversion for merchants using Shop Pay was 1.72x higher than for merchants not using Shop Pay. It is also highly efficient on mobile devices, with Shop Pay checkouts almost twice as high in conversion as regular checkouts.

Shop Pay makes the checkout process around four times quicker, and that’s not the only benefit of opting for the integrated solution.

9 Benefits of Using Shopify Payments

Shopify was the first ecommerce platform to offer its own gateway solution.

Not every seller may be eligible to use it, but for those that are, there are numerous advantages to using it over a third-party provider.

-

It’s integrated for quick and easy activation

You don’t need another account, another set of fees to calculate, or another app to integrate. It’s all part of the same ecosystem.

-

It’s designed for the platform, by the platform

This one shouldn’t be underestimated. Shopify are experts on their own platform, their merchants and buyers. For this reason, they are constantly looking for ways to make everyone’s lives easier.

A great example of this was a change made to help merchants deal with backlogs caused by COVID-19. They extended authorization periods for merchants to capture credit card payments before orders would expire, helping take the pressure off their users.

-

Shop Pay is quick and popular

As mentioned above, Shop Pay is the top choice for Shopify buyers. It’s buyer behavior that drives your store, so listen to what the stats are telling you.

-

Using it reduces your fees

If you disable Shopify Payments in favor of other gateways, Shopify will charge you a fee on top of any fees you might be paying that external provider. That adds up, so make sure you’re getting added value from that provider to make it worth it.

-

Your buyers have plenty of options

Shopify Payments gives your buyers access to the major payment methods that they’re used to, including: Visa, Mastercard, American Express, Apple Pay and Google Pay.

-

Your buyers have access to a Buy Now Pay Later option

You don’t have to do your research to know that Afterpay and Klarna are dominating the ecommerce space at the moment. Buyers like to spread costs and it might tempt them to spend more. Shopify released Shop Pay Installments to help merchants meet the demands of today’s customers and stay competitive.

-

You can localize pricing for overseas buyers

You can control pricing by region through either automatic percentage adjustments based on location, or specific prices unique to each product which you upload via a csv file. Your customers see pricing relevant to their location for a seamless, personalized experience.

-

Some localized payment providers accepted

For Shopify users based in Canada, Discover and Diners Club cards are now accepted as payment methods. This shows Shopify’s commitment to localized solutions to help merchants reach more customers.

-

Track your money in real-time with a centralized dashboard

Everything is in one place for easy, real-time viewing. No need to transfer data, it’s ready for you.

The Gap Left by Payment Gateways and Accounting Software

If you currently use Shopify Payments without an accounting connector app, you probably have your accounting system directly connected to your Shopify store. This means that every single transaction made in your store is directly uploaded to your accounting system.

Whether you make ten sales a day, or ten thousand, this quantity of transactional data can quickly overwhelm you – and your accounting system.

A2X for Shopify imports all your Shopify transactions, including Shopify Payments pay-outs, summarizes the amounts and posts the summaries to your accounting system. A2X then reconciles these summaries to your Shopify Payments bank deposits so you know everything has been accounted for accurately.

You’ll save hours of reconciling each month by automating an otherwise manual process.

Its job is to bridge the data gap between your accounting system and Shopify to ensure reliable and accurate bookkeeping.

Start your free trial of A2X for Shopify today!

Also on the blog

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here