How to Set Up A2X for Amazon VAT [UK & EU Seller Guide]

Written by: Elspeth Cordray

November 18, 2025

One of the biggest accounting mistakes that Amazon sellers make is recording their entire Amazon deposit as “income”. Amazon deposits are actually a combination of sales, fees, refunds, VAT, and other transactions – and all of these transaction types must be correctly accounted for.

Manually going through Amazon settlement reports and recording each transaction into your accounting software is a daunting and time-consuming task.

Fortunately, this is exactly what A2X was designed to do.

A2X can integrate Amazon Seller Central and Xero, or Amazon and QuickBooks Online, or Amazon and Sage. It securely pulls all of the data on your sales, shipping revenues, returns, seller fees, FBA fees, and reserve balances and sends it through to your accounting software, ready to reconcile with the total that hits your bank and submit your UK VAT return.

Setting up A2X for UK and EU sellers is easy, and A2X can even automate how you “map” your Amazon transactions to your Chart of Accounts.

It’s important to set up A2X according to your Amazon storefront’s unique requirements – e.g., considering your VAT registration status, the marketplaces you sell in, and more.

Follow the steps below to set up A2X for Amazon and VAT.

What information do I need to set up A2X for Amazon?

To prepare for setting up A2X for your Amazon Seller Central account, we recommend the following:

- Check your VAT registrations: Which ones are live, which ones are in progress? Check that all of the current registrations have been added into Amazon Seller Central.

- Check that Amazon’s VAT Calculation Service is switched on: This will give you the most detailed information on your transactions.

- Check your product types: Are all the products you sell standard rated (20% VAT)? Do you have any special product types that have a different rate of VAT? (Note: A number of items are charged at a lower or zero rate of VAT. These can include items such as car seats, books or some hygiene products.) Check that your product listings in Amazon have the correct VAT rate applied for the product.

- Check the VAT rates that have been applied to your Amazon fee invoices: The best place to look for these is in the Tax Document Library in Amazon Seller Central. This can be found at Amazon Seller Central → Reports → Tax Document Library. The invoices normally fall into three categories: Amazon FBA Fees, Amazon Merchant Seller Fees and Product Ads.

Initial A2X setup steps for all UK & EU sellers

All Amazon sellers will need to follow these 3 steps to get started with A2X.

Once these are completed, you’ll have a few more setup steps, but they’ll depend on your specific VAT requirements.

1. Sign up for an A2X account

Go to A2X’s website. In the top right, click ‘Try A2X for free’.

Follow the prompts to sign up for an A2X account. You do not need a credit card to sign up – your account will remain in “free trial mode”, which means you can set up and use A2X with limited functionality until you decide to subscribe.

2. Connect to your accounting system

Connect A2X to QuickBooks Online, Xero, or Sage.

On the A2X home page, select your accounting software, and follow the prompts to complete the connection. All you’ll need is your accounting software login information.

3. Connect to an Amazon marketplace

On the A2X home screen, follow the prompts to connect to Amazon.

All you’ll need is your Amazon Seller Central login information. Or, if you’re an accountant or bookkeeper working with an Amazon seller, you can request that they provide you with access to connect A2X.

What to do if you sell on multiple marketplaces

A2X will ask you to select your primary marketplace. If you sell on multiple marketplaces, choose the marketplace where your store is based or where you are registered for VAT. A2X will automatically detect and connect to all other marketplaces in that same region where you have sales. You’ll also be able to add additional marketplaces in your A2X settings later.

Amazon regions vs. marketplaces

Amazon is divided into regions, and each region has its own marketplaces.

A separate A2X account is required for each separate region you sell in.

Here are the majority of the Amazon regions and their marketplaces:

- North America Region: Amazon US/CA/MX/BR

- UK & Europe Region: Amazon UK/DE/IT/FR/ES/NL/SE/TR/PL

- Asia & Pacific Region: Amazon JP*/AU*/AE*/IN*

- Singapore: Amazon SG

Important note: There are instances where these marketplaces are managed via separate Amazon seller accounts.

Accounts & VAT mapping in A2X

Once you’ve signed up for A2X and connected to your accounting software and Amazon Seller Central, your next setup step is to categorize, or “map”, Amazon transactions to an account in your Chart of Accounts, and apply VAT rates as necessary.

To complete accounts and VAT mapping, you’ll need to go to the ‘Accounts and Taxes’ page in A2X. The first time you land there, you’ll be presented with a series of questions that will help A2X automate this process.

Important note: Your accounts and VAT mapping setup will depend on your Amazon storefront’s specific needs.

We’ll cover the exact steps for how to answer the questionnaire and complete accounts and VAT mapping for the following scenarios – choose the one that best applies to you and follow the steps below:

- You are an Amazon seller with no VAT registration

- You are an Amazon seller with 1 UK VAT registration

- You are an Amazon seller with a UK VAT registration plus one or more EU VAT registrations

- You are an Amazon seller with a UK VAT registration plus all EU VAT registrations (OSS/IOSS)

VAT setup configurations for each stage of the UK/EU Amazon seller

Setup 1: Seller with no VAT registration

If you’re an Amazon seller with no VAT registrations, both your expenses and sales will be set up as NO VAT when you push them through from A2X to Xero.

Ensure you are meeting your obligations by not registering – the rules as of January 2021 may require you to.

Here’s how to answer the A2X setup questionnaire if you have no VAT registrations:

Select the main country your business operates in: United Kingdom

Is this business registered and collecting or remitting VAT? No

Assisted Setup or Custom Setup? Select ‘Review’ under Assisted Setup for A2X to automatically apply best practice tax mappings. You can change these, if necessary.

When using A2X’s Assisted Setup, here’s an example of how accounts should be mapped for a seller with no VAT registrations.

Setup 2: Seller with one UK VAT registration

This setup applies if you are an Amazon seller who has only one UK VAT registration – i.e., you are registered for VAT and sell on the UK Amazon marketplace.

Here’s how to answer the A2X setup questionnaire if you have only one VAT registration:

Select the main country your business operates in: United Kingdom

Is this business registered and collecting or remitting VAT? Yes

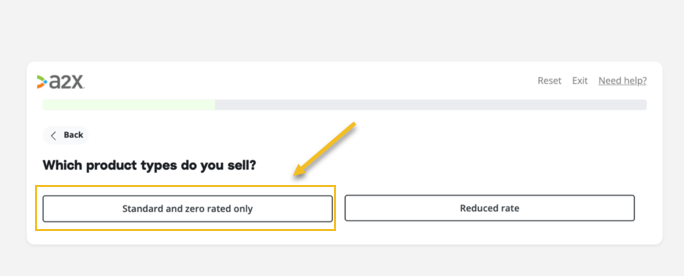

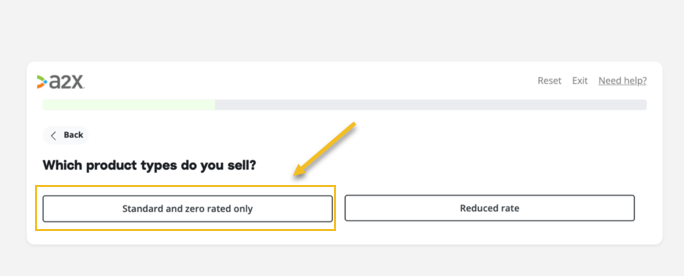

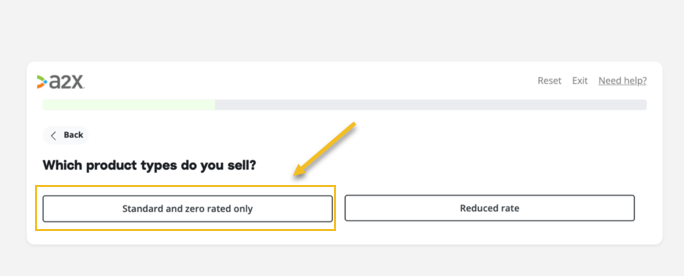

What product types do you sell? Select whichever option best applies to you.

Please select additional countries your business is registered in: None

Assisted Setup or Custom Setup? Select ‘Review’ under Assisted Setup for A2X to automatically apply best practice tax mappings. You can change these, if necessary.

When using A2X’s Assisted Setup, here’s an example of accounts should be mapped for a seller with one VAT registration.

Setup 3: Seller with a UK VAT registration plus one or more EU VAT registrations

In this scenario, you are an Amazon seller who has a UK VAT registration and in addition, one or more EU VAT registrations. For this example, we will look at the mapping on the Accounts and Taxes page for a seller with a UK and a DE (German) registration that is live in Amazon Seller Central.

With this setup, you will need to create two extra accounts on the Chart of Accounts in your accounting software before we begin the mapping page.

The accounts you will create will be:

- DE Sales: this will be account type REVENUE and tax rate NO VAT in your accounting software.

- DE VAT Liability: this will be account type CURRENT LIABILITY and tax rate NO VAT in your accounting software.

If you are not familiar with setting up new accounts in your accounting software’s Chart of Accounts, please see the following articles:

- Add, edit, or delete an account in Xero

- Add an account to your chart of accounts in QuickBooks Online

The next step is to pull these new accounts through to A2X. You can do this in A2X by going to ‘Settings’ > ‘Connections’ > [Your Accounting Software] > ‘Refresh Cache’. This will bring those new accounts through to the mapping page.

Now you are ready to begin the mapping on the Accounts and Taxes page.

Here’s how to answer the A2X setup questionnaire if you have one UK VAT registration, plus one or more EU VAT registrations:

Select the main country your business operates in: United Kingdom

Is this business registered and collecting or remitting VAT? Yes

What product types do you sell? Select whichever option best applies to you.

Please select additional countries your business is registered in: Select the countries that you are registered in

Assisted Setup or Custom Setup? Select ‘Review’ under Assisted Setup for A2X to automatically apply best practice tax mappings. You can change these, if necessary.

Below is an example of how accounts should be mapped for a seller with one UK VAT registration and a DE VAT registration. Where a transaction line appears with the information Jurisdiction DE, that line should be separated out to either the new DE Sales account or the DE VAT Liability account.

We will use a NO VAT tax code for these DE transactions. This will allow you to track them on your books for third party submission in Germany, without putting them through the UK VAT return.

Setup 4: Seller with one UK VAT registration plus OSS

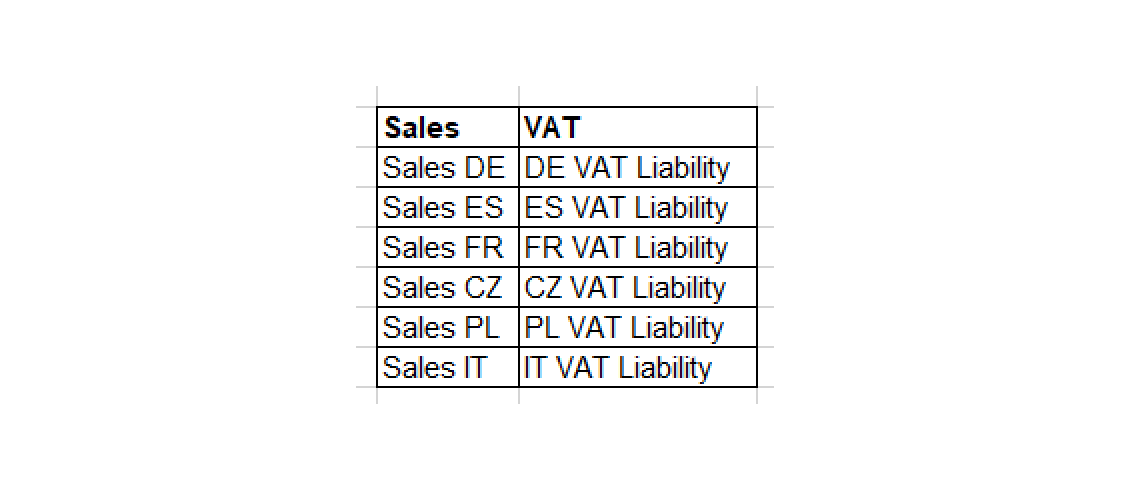

Note: If you sell higher value items and/or Marketplace Facilitator VAT rules don’t apply to your store, to complete this setup, you may need to set up an individual sales account and VAT liability account in Xero for every live VAT jurisdiction registered in Amazon Seller Central.

For example, for a seller registered in the seven main countries, the new accounts would look something like this:

Here’s how to answer the A2X setup questionnaire if you have one UK VAT registration, and all EU VAT registrations (OSS/IOSS):

Select the main country your business operates in: United Kingdom

Is this business registered and collecting or remitting VAT? Yes

What product types do you sell? Select whichever option best applies to you.

Note: If you choose “Other rates”, A2X will not provide auto-mapping by country.

Please select additional countries your business is registered in: Select Europe

Are you filing via OSS (One-Stop-Shop)? Yes

Assisted Setup or Custom Setup? Select ‘Review’ under Assisted Setup for A2X to automatically apply best practice tax mappings. You can change these, if necessary.

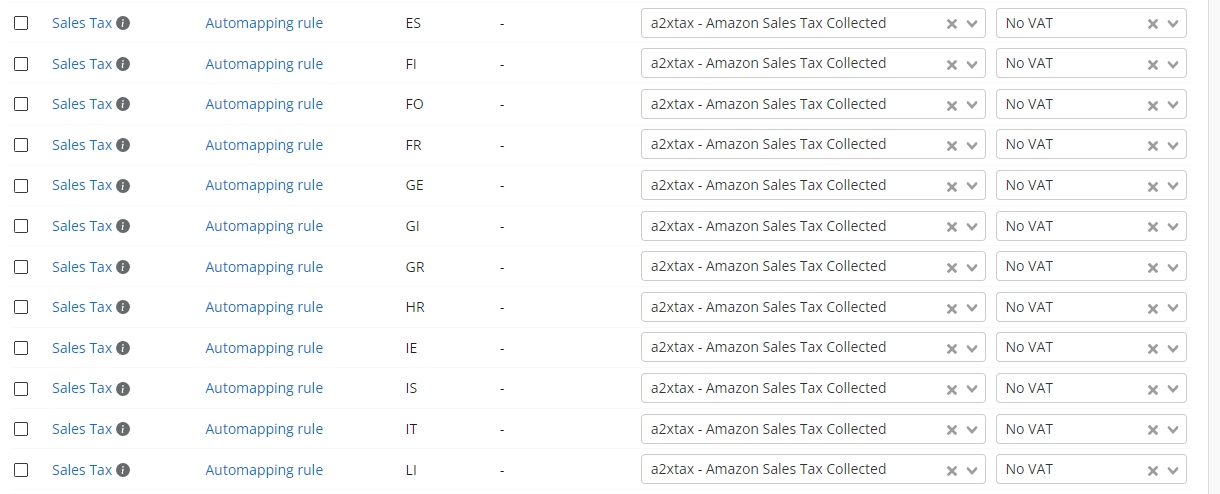

Below is an example of how A2X will map accounts and taxes for sellers filing with OSS.

For customers splitting by multiple EU countries, you can choose to group all of your EU VAT transactions into their own customer EU VAT Liability Account, or into individual liability accounts by country, depending on your own internal reporting requirements.

Using A2X: Review settlements and send to your accounting software for reconciliation

The next step for all types of sellers once they are happy with their accounts and VAT setup in A2X is to send settlement data from A2X to their accounting software for reconciliation.

This process is the same for all types of sellers, regardless of VAT configuration.

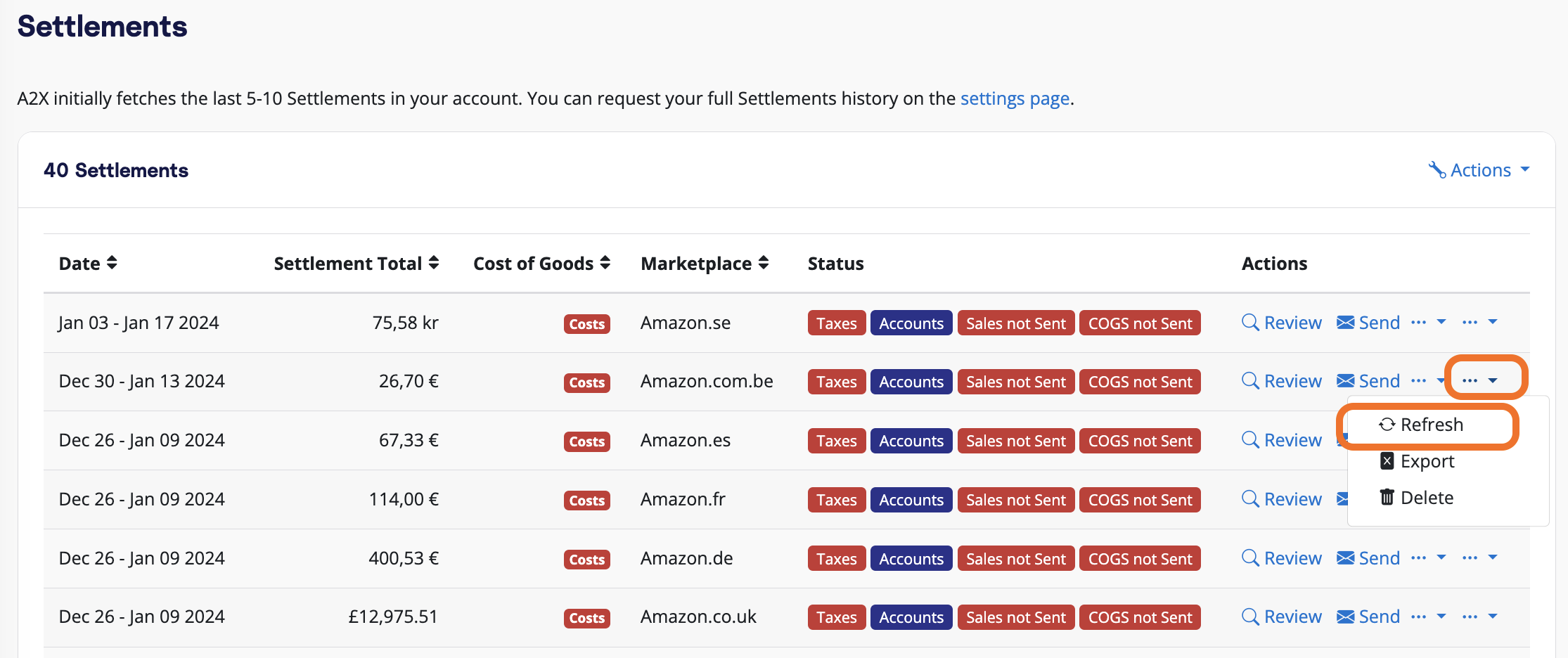

Go to the ‘Settlements’ page in A2X.

Beside each settlement, you’ll see two “…” icons. Click on the one on the far right, then select ‘Refresh’. (Refreshing the settlement before sending will apply all your new tax settings to the period.)

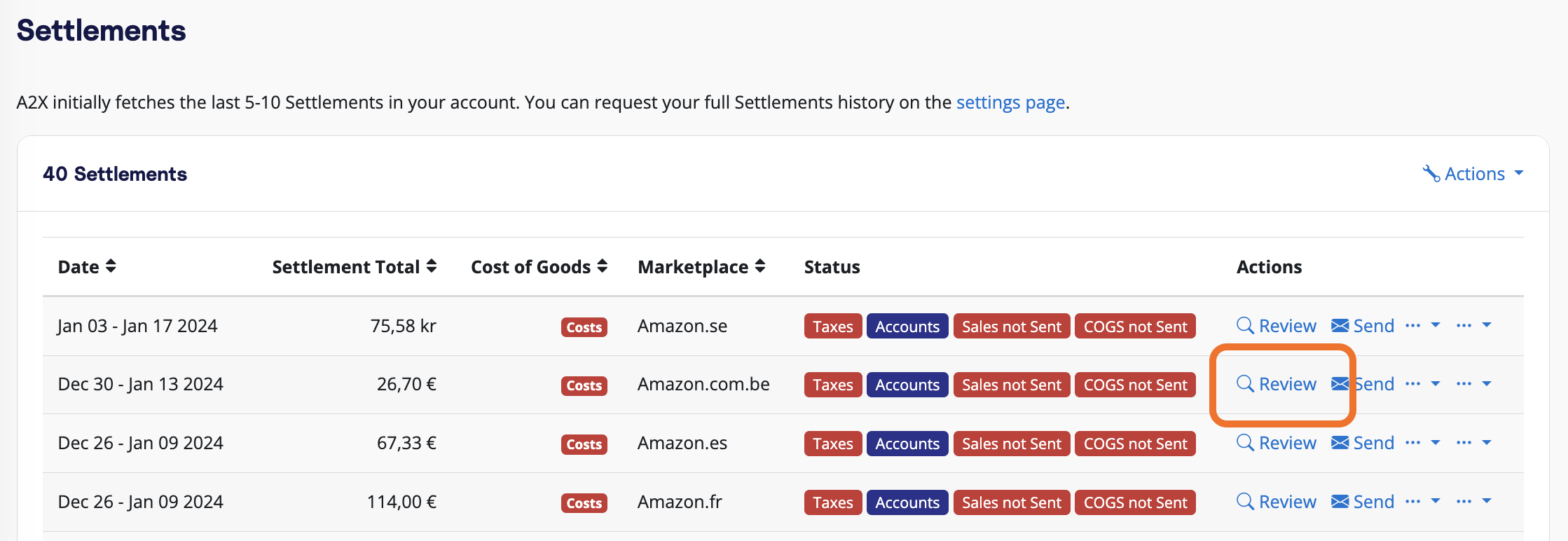

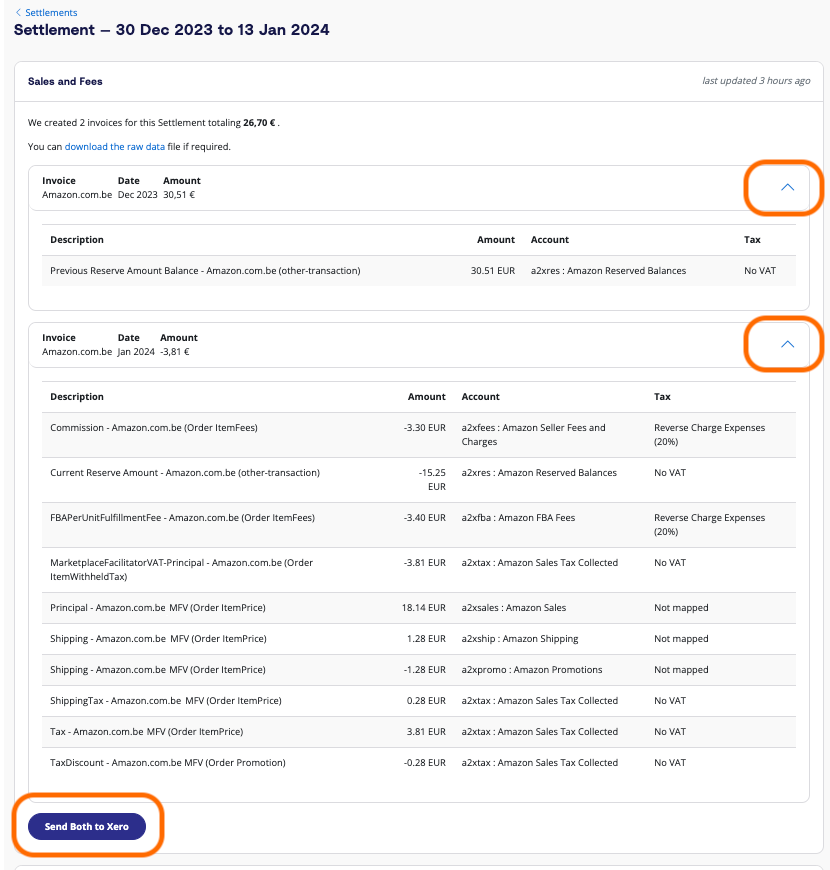

Then, click ‘Review’ beside the settlement.

Review the settlement to make sure A2X has coded each transaction correctly. If all looks good, scroll down and click ‘Send to [Your Accounting Software]’

Note: You can automate this step using A2X’s auto-posting feature.

To reconcile:

Log in to your accounting software and go to the bank feed. You should see the transaction you have just sent from A2X beside the corresponding deposit in the bank feed, ready to be reconciled.

- Learn more about reconciling A2X settlements in Xero here

- Learn more about reconciling A2X settlements in QBO here

Each time you receive a payout from Amazon, make it a habit to log in to A2X to send the transaction data over to your accounting software for reconciliation.

Or, you can save even more time by setting up A2X’s Auto-Posting feature, which will automatically send A2X settlements to your accounting software.

Are you ready for effortless Amazon accounting?

One of the most common areas where Amazon sellers get stuck is ensuring that their accounts are done right, without spending untold amounts of time manually entering data or fixing mistakes.

A2X can help make Amazon accounting easy – and, perhaps more importantly, accurate.

Frequently Asked Questions

FAQs about A2X for Amazon VAT for UK and EU Sellers

Integrate Amazon and your accounting software for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today