The Fundamentals of Ecommerce Accounting: A Comprehensive Guide

Most sellers don’t start their online businesses with ecommerce accounting in mind, but understanding your numbers is essential to achieve success and maintaining a profitable, healthy business. Financial issues—such as running out of cash or price and costing problems— are some of the main reasons ecommerce businesses fail. This comprehensive guide is the perfect starting point if you want to avoid those common pitfalls.

The reality is that ecommerce accounting is tricky, with many added complexities compared with accounting for a brick-and-mortar retail business. So, even if you’re a capable bookkeeper, there’s plenty more to learn in order to have clean, precise books for an online store.

Below we’ve covered the basics of accounting for ecommerce, including why it’s so complex, bookkeeping methods, financial reports you need, and essential metrics to track for your business. Read on to learn more and find links to dig deeper and master your company’s finances.

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

What is ecommerce accounting, and how is it different?

Ecommerce accounting sits under the umbrella of business accounting, where a bookkeeper or accountant records, enters, and organizes an online store’s financial data, so there is a clear and accurate record of the flow of money into and out of the business.

While ecommerce accounting shares many tasks with accounting for other businesses, there are added complexities and differences due to the involvement of sales platforms like Amazon or Shopify, which disrupt the direct flow of cash from customers to retailers. Here’s a comparison:

Tradition commerce: A customer goes into a brick-and-mortar store, purchases a product, and pays the store directly.

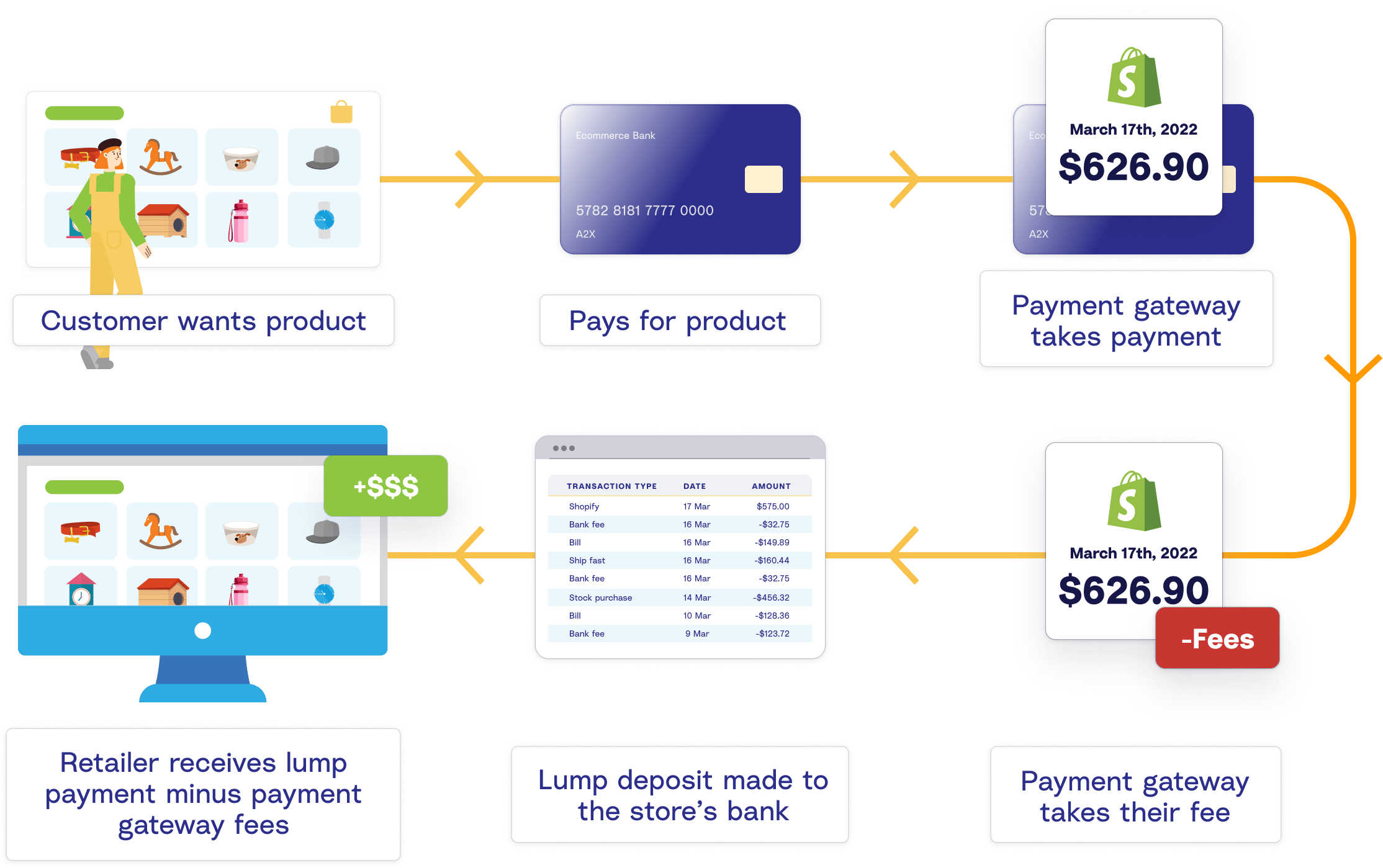

Ecommerce: A customer buys a product, and the store’s payment gateway processes the payment. The payment gateway takes a percentage of the purchase price as a fee for facilitating the sale. Instead of depositing the remaining amount into the retailer’s bank account immediately, it holds the funds and makes a delayed lump sum payment. These lump sum payments often comprise money from multiple sales and could be deposited days or weeks after the transactions occurred.

Because the money from the sales channels is deposited in a lump sum, looking at an ecommerce retailer’s bank account won’t give you detailed information about what took place, e.g., sales, returns, fees, and shipping costs. All of that information is on Amazon, Shopify, or your sales channel of choice. Skills and knowledge are needed to categorize and correctly reconcile what’s in the bank account with the transaction types on the sales channel.

What does ecommerce accounting involve?

When you think of accounting, your mind probably goes straight to taxes, but that’s only part of what ecommerce business accounting entails. Let’s take a closer look.

Bookkeeping

Bookkeeping and accounting are often used interchangeably, but they cover different tasks that feed to common goal. There are numerous bookkeeping-only practices if you’re looking to outsource these tasks. However, many accounting firms will also offer bookkeeping services.

Bookkeeping involves tracking and categorizing business transactions, such as sales, purchases, receipts, invoices, and payments. This means bookkeepers handle tasks like balance sheet preparation, payroll, and accounts payable and receivable.

Keeping good books means organized, accurate financial records, which accountants can use for their tasks.

Tax management and compliance

With changes to sales tax obligations since the 2018 Wayfair decision, understanding your tax responsibilities as an ecommerce business can be difficult. Tax management and compliance is a core service offered by ecommerce accountants.

Managing taxes for an ecommerce business involves:

- Registering for sales tax in states and localities where a company has tax obligations.

- Calculating and filing quarterly and year-end taxes.

- Collecting, tracking, and remitting state and local taxes.

- Managing any international tax obligations, such as VAT and GST.

- Staying informed on any updates to tax law and regulations.

- Handling tax audits or disputes.

Financial analysis and growth planning

Good financial records, ensuring compliance, and meeting tax obligations are all essential tasks for an online business, regardless of size and stage. However, another part of ecommerce accounting is analyzing financial data to plan for expansion and growth.

This aspect of ecommerce accounting involves looking at product profitability, finding opportunities to increase profits, setting and evaluating growth-related metrics, and forecasting cash flow. This analysis helps businesses make better financial decisions, like when to purchase inventory and if they can afford to hire employees. It also ensures preparedness for periods of slow business, as well as when it needs funding or is seeking external investment.

A Chief Financial Officer (CFO) typically handles these responsibilities in large companies, but many accounting firms also offer virtual CFO services as part of their offerings.

What things do you need to start ecommerce accounting?

Setting up your finances should be a top priority for an ecommerce business owner, and it’s good to do at the same time as establishing your business. Here are a few key things to get sorted so that it’s easier to do your ecommerce accounting:

Business tax ID number: if you run a partnership or corporation, you’ll need an Employer Identification Number (EIN) from the IRS. This unique nine-digit number is used to identify your business in tax documents, when opening business bank accounts, hiring employers, establishing credit, and obtaining permits, among other things.You can use your Social Security Number (SSN) instead if you’re a sole proprietor.

Business bank account: One of the biggest mistakes new businesses make is mixing personal and business finances. It can be tempting to use an account you already have, but you’ll live to regret that decision when it comes to untangling your finances. Instead, set up a dedicated business account. Solutions like PayPal for Business or Shopify Balance can set you up in minutes.

Accounting software: If you’re just getting started, you may get by using Excel or Google Sheets, but as your online business grows, accounting software will help save time as you track sales, expenses, inventory, and taxes and will generate the necessary financial reports for you. Among small businesses and experts, Xero and QuickBooks Online are two of the most popular cloud accounting software. You can also consider adding accounting automation apps like A2X to your tech stack. A2X sits between your sales channel and accounting software, automatically summarizing your transactions, saving time and effort.

9 ecommerce accounting tasks to regularly complete

Now that you know what accounting for ecommerce entails and why it’s important to do it properly, the next step is figuring out the regular accounting tasks for an ecommerce business.

Many newer business owners find it handy to use an ecommerce bookkeeping checklist to ensure they remember to do everything. Or, refer to the list below for a brief overview of the tasks needed to maintain a financially healthy and compliant business:

- Track and categorize sales transactions: Ensure all sales transactions are recorded accurately, including sales revenue, sales tax, shipping fees, and discounts.

- Track and categorize expenses: Monitor and categorize all business-related expenses, such as advertising, shipping, inventory costs, software subscriptions, and web hosting or sales platform fees.

- Track and categorize returns, refunds, and chargebacks: Be sure to properly account for these types of transactions so your balance sheets are accurate.

- Reconcile bank and credit card accounts: Do a high-level review of your data, including comparing your accounting records with your bank statements to ensure everything matches. If it doesn’t, then identify the discrepancies and solve them.

- Prepare financial statements: Generate your financial statements using the information you recorded. You will need income statements, balance sheets, and cash flow statements.

- Analyze financial performance: Spend time looking over essential financial metrics. Check gross profit margin, net profit margin, and inventory turnover to identify trends, areas for improvement, and opportunities.

- Stay on top of taxes: Ecommerce businesses need to plan for and file income tax returns while also determining the appropriate sales tax to collect and remit to the relevant tax authorities.

- Keep a business budget: A budget lets you plan for upcoming costs and make it through seasonal lows.

- Keep organized, accurate records: Have accurate and organized records of all financial transactions, receipts, and invoices to facilitate future audits or reviews.

Ecommerce accounting methods: cash, accrual, and modified cash

A bookkeeping method refers to the practices and procedures used to record financial transactions, maintain records, and generate financial statements. Choosing the right bookkeeping method is crucial for making informed decisions about your business’s finances, as it impacts the accuracy of financial forecasting and the data available for analysis.

In ecommerce, different bookkeeping methods may be more suitable depending on various factors such as the size and complexity of the business, the volume of transactions, and regulatory requirements.

Let’s explore the most common bookkeeping methods. These methods use double-entry accounting, where each transaction must have at least two general ledger accounts assigned, which balance and offset each other.

Cash Accounting

Cash accounting is similar to how we manage our personal finances. Income is recognized when you receive money from a sale, and expenses are recorded when money goes out. With this method, you only account for income or expenses when the cash is exchanged, which makes it easier to understand your cash flow.

Example: Your store receives an order for 500 pairs of summer sandals. The shoes are manufactured and shipped to the customer who pays the invoice 30 days later. With the cash accounting method, you record the income for these sandals when the customer’s payment is in your account, despite being a month since they received the sandals and more than a month since you received and prepared the order.

Accrual Accounting

Accrual accounting is more suitable for businesses dealing with inventory. This method requires you to record revenue from sales when they occur, not when the cash is received. A similar process applies to expenses. Accrual accounting helps you understand the long-term impact of inventory purchases and sales on your financial performance.

Example: Your store receives an order for 500 pairs of summer sandals. The shoes are manufactured and shipped to the customer who pays the invoice 30 days later. With the accrual method, the income for the sandals is recorded as the day the sandals were shipped to the customer, as this was the completion of the sale. The income is recorded as an account receivable and will be settled when the customer pays 30 days later. This payment is recorded as a cash inflow.

Modified cash accounting

Modified cash accounting—also called the hybrid method—lets bookkeepers use both the cash and accrual method for different types of transactions. With modified cash, you would handle operating expense transitions using the cash basis and revenue and Cost of Goods Sold (COGS) using accrual basis. The modified cash method gives you a more accurate view of profitability than cash basis and is less time-consuming and complex than accrual basis. It’s most suited to businesses in the $1-25 million revenue range.

What accounting methods should sellers use?

As an ecommerce seller, using accrual or modified cash accounting is recommended, which provides a more accurate picture of your cash flow and enables better financial forecasting. Most accounting software, including A2X, organizes your books using accrual accounting by default, making it easier to prepare for your business’s financial ups and downs.

Additionally, once a business is doing more than $25 million in annual revenue, it is required by the IRS to use the accrual method.

Essential financial metrics for accounting for ecommerce

To make informed decisions about your ecommerce business, you need to understand and track various financial metrics.

Cost of Goods Sold (COGS)

COGS is a crucial metric for ecommerce sellers, as it refers to the direct costs of producing the goods sold by your business. This includes the cost of materials and labor used to create the product but excludes indirect expenses like distribution and marketing costs. Understanding COGS is essential for determining the profitability of your products.

The formula for Cost of Goods Sold (COGS) is: COGS = Beginning Inventory + Purchases - Ending Inventory.

Gross profit

This is the difference between a company’s total revenue and its cost of goods sold. It represents the initial profit before other expenses such as taxes, marketing, rent, etc.

The formula for gross profit is: gross profit = revenue - cost of goods sold.

Gross margins

We use the same data we used for gross profit to determine gross margins. However, this time we’re looking for a percentage of total revenue. The formula for gross margin is: Gross Margin = (Total Revenue - Cost of Goods Sold) / Total Revenue × 100%.

The higher the gross margin, the more capital a company retains on each dollar of sales, which can be used to cover other costs or pay debts. Keep in mind that margins can vary across sellers and products, but in general, aim for higher margins on slower-moving products.

A common observation from A2X’s accounting partners is that ecommerce sellers need to pay more attention to their expenses, making it difficult to calculate and optimize their margins accurately. Here’s an example of a business that wasn’t correctly tracking its heavy discounting, affecting its gross margins and leading to cash flow problems:

Generally speaking, you should understand and track your gross margins, plan and strategize to optimize your margins and focus on minimizing expenses to maximize margins.

Understanding Key Financial Statements for Ecommerce Sellers

Understanding and using key financial statements to manage your ecommerce business effectively is essential, including profit and loss (P&L) statements, balance sheets, and cash flow statements. These reports provide valuable insights into your business’s financial performance and help guide decision-making.

Income statements/profit and loss (P&L) statements

An income statement, also called a profit and loss statement, is a standard business accounting report. It summarizes a company’s revenue, expenses, and costs over a specific period, typically a financial quarter or year. These statements help you evaluate your business’s profitability and compare performance over time.

Cash flow statement

A cash flow statement gives a detailed overview of a company’s cash inflows and outflows over a specific period, categorizing transactions into operating, investing, and financing activities to give a comprehensive understanding of the company’s liquidity and cash management. Cash flow statements work with income statements and balance sheets to reveal a full picture of a company’s financial health. Potential investors or buyers also use them to evaluate whether or not a business is a worthwhile investment.

Balance Sheets

Balance sheets provide a snapshot of a business’s financial position at a specific point in time. They track three key components:

- Assets (including cash and inventory)

- Liabilities (including loans or purchases)

- Equity of all shareholders

The balance sheetfollows the fundamental accounting equation: Assets = Liabilities + Equity.

To summarize all three financial statements:

- Income statements show a company’s revenues and expenses over a given period of time, reflecting its profitability during that period. It helps you understand how much money a company has earned or lost.

- Balance sheets provide a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and equity, giving you an overall view of its financial health.

- Cash flow statements show the inflows and outflows of cash within a company over a given period of time. It helps you understand how a company generates and uses cash in its operations, investing, and financing activities.

Is ecommerce accounting the same for all sales channels?

Accounting for ecommerce is different for all sales channels. It’s common for businesses to sell on multiple channels, and multi-channel sellers must be aware of the differences between them.

For example, Amazon has a variety of fees to account for, such as seller fees or Fulfillment By Amazon (FBA) fees, depending on the services you use.

On the other hand, Shopify is a platform, not a marketplace, so you need to be mindful of taxes, including managing the remittance of your sales tax.

Depending on your channels, whether it’s Amazon, Shopify, or other popular marketplaces like Etsy or eBay, you should educate yourself on the specific fees, transaction types, and any other information needed to maintain accurate records.

Getting help from a professional ecommerce accountant

As detailed in this guide, ecommerce accounting can be challenging, so many online business owners opt for professional assistance. Here are some of the different levels of support you can get from the experts for all levels of ecommerce:

New business with few orders: Your business is small, and money is tight at this stage. Rather than investing in professional services, find some leading voices in the ecommerce business accounting world and make the most of free articles and guides, video tutorials, templates, and checklists to get you started.

Small business with increasing orders: You would benefit from using software and tools to simplify bookkeeping and accounting. If you don’t already have cloud accounting software, start using it and look into automations like A2X that will integrate your sales channel with your accounting software to reduce time spent on data entry and categorization from hours to minutes. Many ecommerce accounting practices offer services to set up your software and provide training to shore up your bookkeeping skills.

Established business with 1000+ orders a month: At this point, accounting is taking up more of your time than you would like, and it’s time to find an ecommerce accountant or hire someone in-house. Look into a regular bookkeeper and an accountant to help with taxes. An easy way to find the service you need is using the A2X Directory.

Growing business with sales in the 7-figure range: With your bookkeeping and accounting taken care of, at this point, you need an accountant who will help you analyze your financial data and work on a solid growth plan. Some ecommerce accounting practices work solely with seven and 8-figure businesses that can help you set and reach your goals.

Wrapping up

Establishing good accounting and bookkeeping practices is critical to run a stable, profitable business. The financial statements produced by recording and categorizing your transactions let you take care of your tax obligations, make predictions, and plan for future growth.

By setting these practices early on, your books will stay neat and accurate and be a solid foundation as the business grows and becomes more complicated.

Using accounting software and automations like A2X will help you keep organized records and reduce the amount of time you spend on your accounting, leaving you to get on with other parts of the business.

Next in the Series

This blog is the first in our ecommerce accounting fundamentals series.

From the core accounting concepts ecommerce sellers need to know about through to cash flow management, bookkeeping best practices and what software to use, we cover everything you need to know.

Next up: what makes ecommerce accounting unique and sometimes, much more challenging ➡️ Read now.

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here