Managing US Sales Tax for Shopify

Managing US sales tax for a Shopify store can be incredibly complicated. Sales tax varies by state and product, and it can be challenging to understand nexus and where/when you need to register.

A2X does not provide tax advice. We strongly recommend that Shopify merchants selling in the US work with a sales tax professional to ensure that they’re compliant with any applicable US sales tax regulations.

To help you get started, we’ve put together the following guide, which covers basic information about managing US sales tax for a Shopify store.

Key takeaways:

- Shopify merchants must handle their own sales tax compliance. Shopify does not automatically collect, remit, or file sales tax on behalf of merchants. It is the merchant’s responsibility to determine where they have nexus (physical or economic presence in a state), register for sales tax, collect the correct amount, and file returns as required by each state.

- Understanding nexus is crucial for US sales tax compliance. Shopify sellers must assess physical nexus (e.g., offices, employees, inventory in a state) and economic nexus (e.g., sales exceeding a state’s threshold, typically $100,000 or 200 transactions). Some states require combined sales across platforms like Amazon and Shopify to determine economic nexus. Failure to register and comply can lead to penalties and audits.

- Sales tax should be accurately recorded to avoid over- or under-payment. Sales tax collected from customers is a liability and should not be counted as revenue. Shopify payouts include multiple components (sales, fees, refunds, and taxes), so accurate bookkeeping is essential. Tools like A2X help automate sales tax reporting by correctly categorizing transactions for accounting software like QuickBooks.

Special thanks to Nimbl for providing the information in this guide. Nimbl is a leading full-service ecommerce accounting firm that provides accounting, advisory, sales tax, financial modeling, and income tax services.

Table of Contents

Integrate Shopify and your accounting software for accurate accounting

A2X auto-categorizes your Shopify sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today

Shopify sales tax: An accounting expert shares what you need to know

If you’d prefer a video walkthrough of all of the information in this article, watch our webinar recording with Christy Cox, VP of Client Services at Nimbl.

In this webinar, Christy breaks down what Shopify merchants need to understand about US sales tax.

Introduction to US sales tax

How does sales tax work in the US, and when do Shopify merchants have to register? Let’s start with a basic overview.

- Sales tax is a state and local tax. Sales tax is not applied at the federal level but varies by state and locality.

- Sales tax varies by state and product. Some states don’t levy sales tax, and certain products, like groceries, often have lower rates (1-3%) compared to the general rate (5-8%).

- Sales tax can be charged based on destination or origin – Sales tax can be based on the destination (ship-to address) or origin (ship-from address), with most states using the destination-based approach.

- Sales tax registration is complex, and how merchants register with the state depends on the type of nexus they have established.

- There are two primary types of nexus that will impact Shopify merchants: Physical and economic nexus. Merchants typically must register and collect sales tax in a particular state if they have established physical or economic nexus in that state.

- Once you are registered for sales tax in a particular state, you are required to collect and remit sales tax, file tax returns, and maintain accurate records to remain compliant.

What Shopify merchants need to know about sales tax

There are a few specific things that Shopify merchants should keep in mind when it comes to managing sales tax.

- Shopify is not responsible for setting up, collecting, or remitting sales tax on behalf of merchants. Merchants must handle all aspects of sales tax compliance themselves. (More information about this later in this guide.)

- Sales tax setup may vary depending on a merchant’s subscription plan:

- Shopify Plus offers integration options with Avalara AvaTax for more streamlined sales tax management. Shopify Plus also includes a growing program called Shopify Tax, which has seen significant updates in recent months and is expected to continue evolving.

- Merchants on plans such as the Shopify Basic plan may need to manually manage sales tax calculations and payments. (Learn more about Shopify’s Basic Tax setup here, and Manual Tax setup here.)

Does Shopify collect and remit sales tax?

Shopify is not required to collect and remit sales tax.

While Shopify helps to automate charging sales tax from customers, it’s the responsibility of the Shopify merchant to ensure that they are collecting and remitting the correct amount of sales tax (if they are liable to do so).

Shopify vs. marketplace facilitators

For ecommerce sellers on multiple channels (e.g., Amazon and Shopify), understanding sales tax collection can be especially confusing.

In the US, marketplace facilitators, like Amazon and Etsy, are responsible for collecting and remitting sales tax on behalf of sellers. However, sellers must still include these sales in many states to determine if they meet economic thresholds for state filing.

Shopify, unlike Amazon, is not a marketplace facilitator. Sellers on Shopify must manage their own sales tax obligations, registering, collecting, and remitting sales tax directly to the state, either manually or using third-party services.

Note: Ensure proper recording of sales tax if selling on a marketplace facilitator for accurate record-keeping.

Understanding nexus

As mentioned, Shopify does not collect and remit sales tax, and it’s the seller’s responsibility to determine if, when, and where they must register for sales tax.

Sales tax is a state tax, and to determine if you need to pay sales tax in a particular state, you need to understand if you have established nexus there.

You also need to understand nexus to understand the taxability of the products you sell. Sales tax applicability varies by state and product type (e.g., groceries may be taxed differently across states).

For multi-channel sellers, It’s also important to note that some states require combined sales from multiple platforms (e.g., sales from both Shopify and Amazon) to determine economic nexus. Other states may only consider sales from a single platform.

There are two primary types of nexus that impact Shopify merchants: Physical nexus and economic nexus.

Physical nexus

Physical nexus occurs when a business has a physical presence in a state, such as an office, employee, business partner, or inventory stored in the state. Inventory held by third-party fulfillment centers can also establish physical nexus.

Having a physical nexus often requires the business to register as a foreign qualified entity in that state. This usually means the business must report and file income tax in addition to sales tax.

Economic nexus

Economic nexus is based on the amount of sales or the number of transactions within a state, regardless of physical presence. Economic nexus compliance is generally simpler and less costly than physical nexus.

Economic nexus is determined by sales volume or number of transactions within a state. Thresholds vary by state, typically ranging from $100,000 to $500,000 in sales or 100 to 250 transactions. Surpassing these thresholds means the business must register and file for sales tax in that state.

Note – Two additional types of nexus also exist, but they typically don’t apply to small-to-medium Shopify merchants:

- Affiliate nexus occurs when a business has a relationship with another entity in a state, such as a subsidiary or a related company, which helps the business establish a presence in that state.

- Click-through nexus is established when an out-of-state retailer pays a commission to an in-state entity (like a website or blogger) for referrals that lead to sales, through links or advertisements on the in-state entity’s site.

Compliance resources

Businesses must continuously monitor their sales and transaction volumes to ensure compliance with nexus thresholds.

Sales Tax Institute has a ‘State by State’ chart that outlines state-specific thresholds and requirements.

Third-party services and software providers can assist in monitoring and complying with nexus regulations.

How much sales tax do I need to collect and remit?

Sales tax varies by state, and also by product type. Some states don’t levy sales tax, and certain products (such as groceries) are often taxed at lower rates (1-3%) compared to a state’s general sales tax rate (usually between 5-8%).

Once you understand if you have established physical or economic nexus in a particular state, it’s time to determine how much sales tax you need to collect and remit based on your product type(s).

Helpful resources:

- This guide from Avalara outlines tax rates by each US state

- Shopify also has a reference guide to help you understand tax rates and tax sourcing

Compliance vs. risk of non-compliance

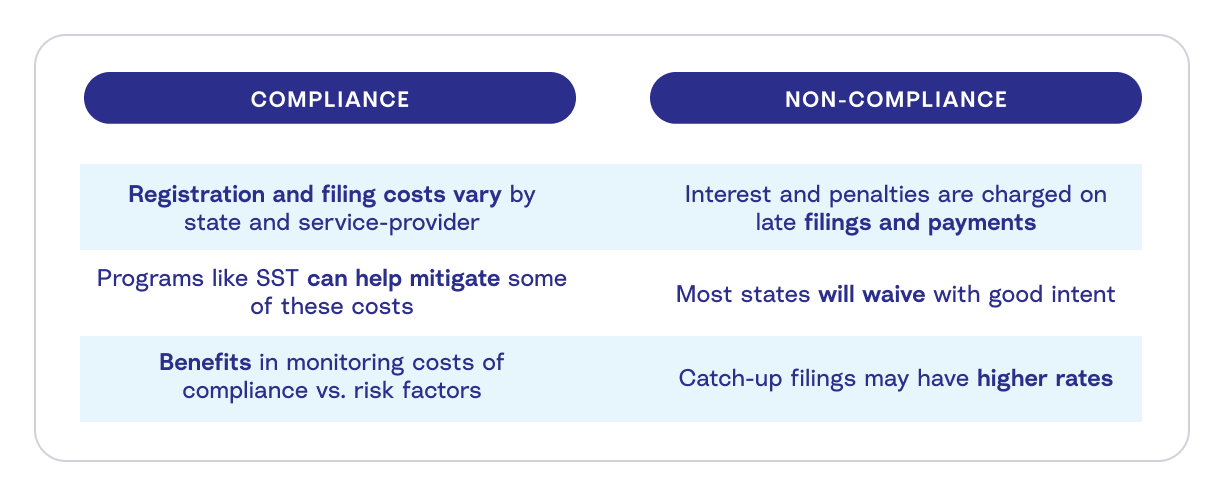

Many Shopify merchants will likely have an internal debate about the costs associated with compliance with sales tax laws vs. the risks of non-compliance.

On the one hand, compliance can be expensive, with costs varying by state and service provider. It’s also important to consider that different states have different deadlines for when you must register, ranging from immediately to up to 90 days.

On the other hand, failure to register and file on time can lead to penalties and interest on uncollected sales tax. Although some states may waive penalties and interest if you show intent to comply and work with them proactively, this can be costly to your Shopify business. Audits can also be costly and time-consuming.

Merchants must weigh the costs and risks based on their specific circumstances and products. Some products, like groceries, may not be taxable in certain states, reducing the compliance risk.

Simplify US sales tax compliance with Streamlined Sales Tax

Streamlined Sales Tax (SST) is an initiative to simplify and reduce the costs associated with sales tax compliance for businesses.

24 out of the 50 US states currently participate in the SST program.

Some of the benefits of SST include:

- Simplified tax rates – SST states typically offer one sales tax rate per state and one per jurisdiction, avoiding the complexity of multiple local rates.

- Cost coverage – Participating states cover the costs of registration and filing for businesses, which can significantly reduce expenses. (Fees can range from $50 to $100 per state, depending on complexity.)

- Risk mitigation – SST helps limit the risks associated with sales tax compliance for small businesses by simplifying the process.

To participate in SST, you’ll need to find a Certified Service Provider (CSP). Accounting practices like Nimbl can help businesses navigate the SST process and connect with appropriate CSPs.

How to set up sales tax on Shopify

Shopify has features that can help you calculate sales tax, and they have several resources designed to help merchants set up US sales tax. Find them on the Shopify Help Center.

In Shopify, you can set up sales tax collection by navigating to ‘Settings’, then ‘Taxes and duties’.

How to record sales tax correctly

Recording sales tax correctly in your books is another aspect that makes managing US sales tax complicated. (The good news? Using tools such as A2X can make this easy!)

If you’re registered for sales tax, you must keep accurate records of how much tax has been collected and paid. It’s also best practice to keep accurate records so that you can get an accurate idea of how your Shopify store is performing.

Sales tax is often included in Shopify lump sum payments

Shopify merchants will be familiar with the fact that they get paid in a lump sum amount. However, what you might not know is that that amount is not made up of just sales. It’s actually a combination of sales, fees, refunds, tax, and other transactions.

If you record this entire amount as “sales” or “income”, you risk over or under-reporting your actual sales or income – which can cause you to over or under-pay sales tax (and provide incorrect numbers, which causes incorrect financial reporting).

Sales tax on the balance sheet

Sales tax is a liability owed to the state and should be accounted for on the balance sheet.

Sales tax is collected from customers on behalf of the state or local government. It is not revenue for the business, but a payable amount that the business owes to the tax authorities.

Recording sales tax as a liability will help to ensure that it is not mistakenly included in the company’s revenue, providing a clear and accurate picture of the business’s financial position.

Use A2X to get accurate numbers

Shopify provides reports that can help you understand the transactions that make up a payout (including any sales tax amounts you’ve collected from customers). However, manually going through these reports and adding these transactions to your accounting software for Shopify can be time consuming and error-prone.

A2X is an accounting automation tool that connects Shopify with your accounting software. It will automatically categorize your Shopify payouts into accurate summaries that reconcile perfectly with the corresponding amount in your bank account. Each transaction – including sales tax – will be coded to the correct account in your general ledger.

Connect A2X to your Shopify store and your accounting software to help you better manage your bookkeeping. Start a free trial!

Integrate Shopify and your accounting software for accurate accounting

A2X auto-categorizes your Shopify sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today